Evaluating Uber (UBER) As An Investment Opportunity

Table of Contents

Financial Performance and Valuation of UBER Stock

Understanding Uber's financial health is paramount before considering an investment. Analyzing key metrics provides a clearer picture of its current standing and future prospects.

Revenue Growth and Profitability

Uber's revenue streams are diverse, encompassing ride-hailing, Uber Eats (food delivery), and freight services. While the company has shown significant revenue growth historically, achieving consistent profitability remains a challenge. Several factors contribute to this:

- Historical revenue growth: Uber has demonstrated strong historical revenue growth, though the rate has fluctuated. Analyzing year-over-year and quarter-over-quarter changes is crucial.

- Current profit margins: Currently, Uber operates with relatively low profit margins, squeezed by high driver costs, operational expenses, and intense competition.

- Projected future revenue: Analysts' projections for future revenue growth should be considered, acknowledging inherent uncertainties.

- Key financial ratios: Examining key financial ratios like the Price-to-Earnings (P/E) ratio is essential for valuation and comparison against industry peers. A high P/E ratio might suggest the market anticipates strong future growth, while a low P/E ratio might indicate undervaluation or lower growth expectations.

Debt and Cash Flow

Assessing Uber's debt levels and cash flow generation provides insights into its financial stability and ability to meet its obligations.

- Debt-to-equity ratio: A high debt-to-equity ratio could signal higher financial risk. Investors should analyze this ratio to understand Uber's leverage.

- Free cash flow: Free cash flow (FCF) represents the cash generated after accounting for capital expenditures. Strong FCF indicates a company's ability to reinvest in its business, pay down debt, or return value to shareholders.

- Operating cash flow: Operating cash flow (OCF) measures the cash generated from a company's core operations. Healthy OCF is essential for sustainable growth.

- Capital expenditures: Capital expenditures (CAPEX) represent investments in property, plant, and equipment. High CAPEX might suggest significant future growth potential, but it also reduces near-term cash flow.

Market Position and Competitive Landscape

Uber's market position and the competitive landscape significantly influence its investment potential.

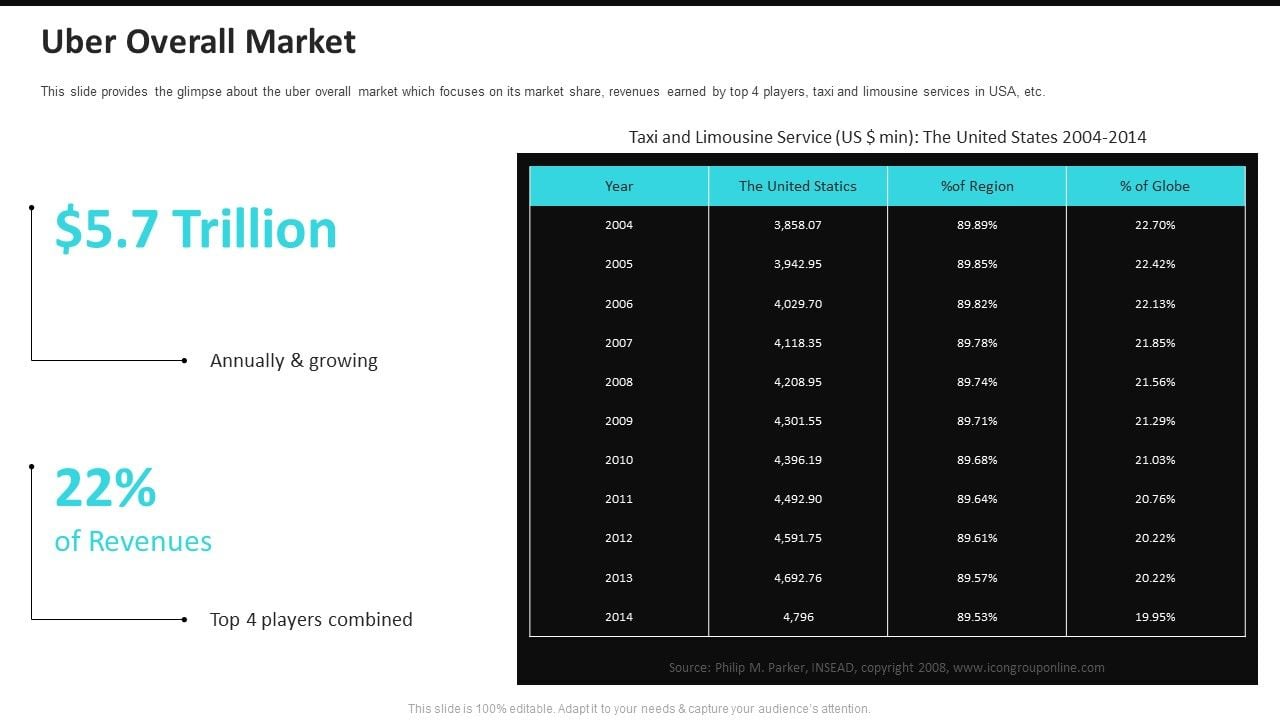

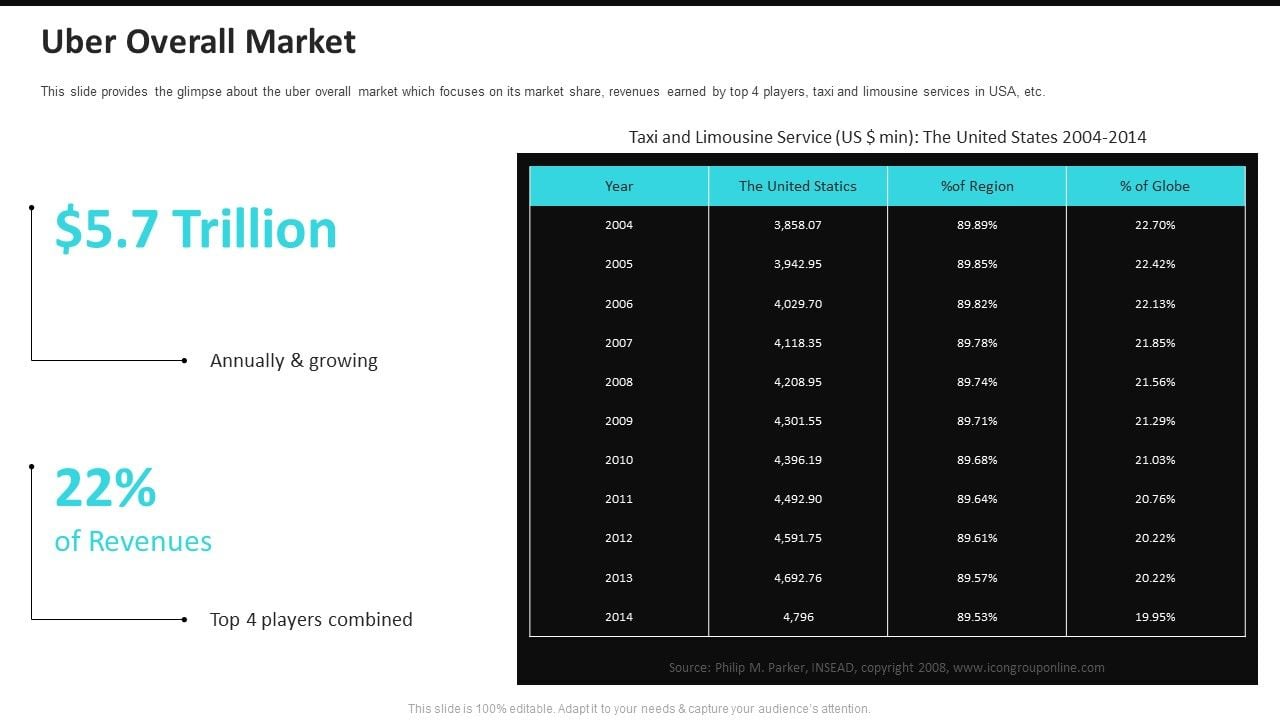

Market Share and Dominance

Uber holds a substantial market share globally in the ride-sharing and food delivery sectors. However, competition is fierce:

- Market share data: Analyzing Uber's market share against competitors like Lyft (ride-sharing) and DoorDash (food delivery) provides context for its competitive strength.

- Competitive advantages: Uber's brand recognition, technological capabilities, and economies of scale provide competitive advantages, but these are not insurmountable.

- Key competitors: Understanding the strategies and market share of key competitors is crucial for assessing Uber's long-term prospects.

Regulatory and Legal Challenges

The ride-sharing industry faces ongoing regulatory hurdles that impact Uber's operations:

- Legal challenges: Uber has faced numerous legal challenges regarding driver classification, labor laws, and data privacy.

- Regulatory changes: Changes in regulations, licensing requirements, and safety standards can significantly impact profitability and operations.

- Driver classification disputes: The classification of drivers as independent contractors versus employees is a major ongoing legal and regulatory battleground.

Growth Potential and Future Outlook for Uber

Uber's future growth hinges on its expansion strategies and technological advancements.

Expansion into New Markets and Services

Uber continues to expand geographically and diversify its service offerings:

- New market entry plans: Expansion into new markets offers significant growth opportunities, but also carries risks related to local regulations and competition.

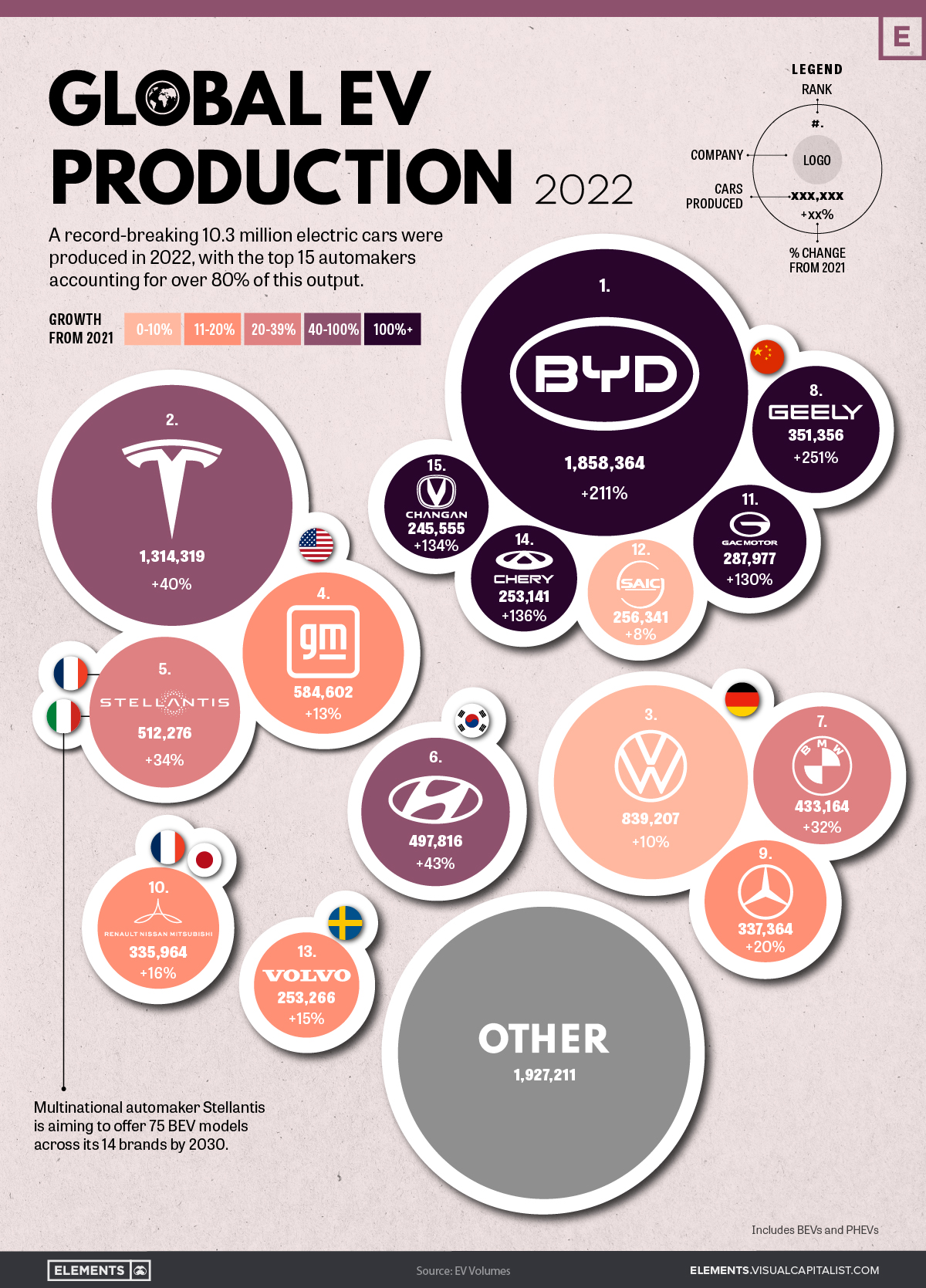

- Potential growth areas: Exploring new service areas, such as autonomous vehicles and logistics, could create new revenue streams.

- Technological advancements: Investments in technology are crucial for maintaining a competitive edge.

- Strategic partnerships: Strategic alliances can facilitate expansion and access to new technologies.

Technological Innovation and Disruption

Uber's investment in technology positions it for continued disruption:

- Investment in self-driving technology: Autonomous vehicles could significantly reduce operational costs and enhance efficiency.

- Use of AI and machine learning: AI and machine learning are used to optimize pricing, routing, and driver dispatch, improving efficiency.

- Technological competitive advantages: Maintaining technological leadership is critical for retaining a competitive advantage.

Risks Associated with Investing in UBER Stock

Investing in Uber stock carries several risks that investors must carefully consider.

Economic and Market Risks

Macroeconomic factors significantly impact Uber's performance:

- Sensitivity to economic downturns: During recessions, demand for ride-sharing and food delivery services may decrease.

- Impact of inflation on operating costs: Rising inflation impacts fuel costs, driver wages, and other operational expenses.

- Fuel price volatility: Fluctuations in fuel prices directly affect operational costs.

Competition and Market Saturation

Intense competition and potential market saturation pose risks:

- Intensity of competition: The ride-sharing and food delivery markets are highly competitive, with new entrants continually emerging.

- Potential for market saturation: Market saturation could limit future growth opportunities.

- Competitive pricing pressures: Intense competition puts downward pressure on prices, reducing profitability.

Conclusion

Evaluating Uber (UBER) as an investment opportunity requires a comprehensive analysis of its financial performance, competitive landscape, growth potential, and inherent risks. While Uber has demonstrated significant growth and innovation, investors must consider the challenges related to profitability, regulatory hurdles, and intense competition. Thorough due diligence is essential before investing in UBER stock. Consider your risk tolerance, conduct your own research, and seek advice from a qualified financial advisor before making any investment decisions. This article is for informational purposes only and does not constitute financial advice. Further research into UBER stock and other related investment opportunities is recommended before committing your capital.

Featured Posts

-

True Blue A Look At Play Station Podcast Episode 512

May 08, 2025

True Blue A Look At Play Station Podcast Episode 512

May 08, 2025 -

Arsenal News Collymores Strong Criticism Of Artetas Performance

May 08, 2025

Arsenal News Collymores Strong Criticism Of Artetas Performance

May 08, 2025 -

Economists Warn Canada Needs To Address Overvalued Loonie Quickly

May 08, 2025

Economists Warn Canada Needs To Address Overvalued Loonie Quickly

May 08, 2025 -

Pakistans Global Trade Ahsans Plea For Tech Adoption In Manufacturing

May 08, 2025

Pakistans Global Trade Ahsans Plea For Tech Adoption In Manufacturing

May 08, 2025 -

New Superman Film First Glimpse Of Kryptos Heroic Deeds

May 08, 2025

New Superman Film First Glimpse Of Kryptos Heroic Deeds

May 08, 2025