Economists Warn: Canada Needs To Address Overvalued Loonie Quickly

Table of Contents

The Overvalued Loonie's Impact on Canadian Exports

A strong Canadian dollar, while seemingly beneficial for consumers through cheaper imports, significantly undermines the competitiveness of Canadian exports. When the loonie is overvalued, Canadian goods and services become more expensive in international markets, making them less attractive to foreign buyers. This directly impacts crucial export sectors, hindering economic growth and potentially leading to job losses.

- Reduced competitiveness in global markets: Canadian businesses face a steeper uphill battle against competitors from countries with weaker currencies. Their products are simply priced out of many markets.

- Decreased export volumes and revenues: The higher cost of Canadian goods leads to a decline in demand and, consequently, lower export volumes and reduced revenues for businesses.

- Potential job losses in export-oriented industries: As businesses struggle with reduced competitiveness, they may be forced to cut costs, including laying off workers, particularly in sectors heavily reliant on exports.

- Negative impact on GDP growth: The overall decline in exports directly translates to a slower rate of GDP growth for the Canadian economy as a whole.

This situation affects various sectors, including manufacturing, agriculture, and resource extraction. For example, the Canadian lumber industry, a major exporter, has faced significant challenges due to the strong Canadian dollar, impacting employment and investment in the sector. The resulting trade deficit further exacerbates the issue, requiring careful monitoring and strategic intervention.

The Overvalued Loonie and Inflation

The relationship between a strong currency and inflation is complex and paradoxical. While a strong Canadian dollar can lower import prices, potentially reducing inflation in the short term, its negative impact on domestic industries and employment can lead to inflationary pressures in the long run.

- Lower import costs, potentially reducing inflation: Cheaper imports can ease inflationary pressures by lowering the cost of goods and services for consumers.

- Reduced domestic production & increased reliance on imports: As Canadian-made goods become more expensive, consumers may opt for cheaper imports, leading to a decline in domestic production and a greater reliance on foreign goods.

- Potential for wage stagnation in affected sectors: Industries struggling with export competitiveness might find it difficult to increase wages, leading to wage stagnation in affected sectors.

- Supply chain disruptions impacting inflation: Increased reliance on imports can also make the Canadian economy more vulnerable to global supply chain disruptions, further impacting inflation.

Therefore, policymakers need a nuanced understanding of this intricate interplay to implement effective strategies to maintain price stability without jeopardizing domestic industries.

Policy Responses to Address the Overvalued Loonie

Addressing the challenges posed by the overvalued loonie requires a multifaceted approach involving both monetary and fiscal policies. Several options are available to the Bank of Canada and the federal government, each with its own set of advantages and disadvantages.

- Interest rate adjustments by the Bank of Canada: Lowering interest rates can make the Canadian dollar less attractive to foreign investors, potentially weakening the currency. However, this approach carries the risk of fueling inflation.

- Government intervention in foreign exchange markets: The government could intervene directly in the foreign exchange markets to sell Canadian dollars and buy foreign currencies, thereby weakening the loonie. However, this is a delicate strategy with potential drawbacks.

- Trade policy adjustments to improve competitiveness: Trade agreements and other policy measures can help improve the competitiveness of Canadian exports and reduce reliance on a weak currency.

- Diversification of the Canadian economy: Reducing over-reliance on specific export sectors can make the Canadian economy less vulnerable to fluctuations in the exchange rate.

The challenge lies in finding a balanced approach that manages the exchange rate without creating other economic imbalances.

Long-Term Economic Implications of an Overvalued Loonie

Failure to address the overvalued loonie could have severe long-term consequences for the Canadian economy. Inaction risks undermining economic growth, employment, and overall prosperity.

- Sustained decline in export-oriented industries: Continued overvaluation could lead to the permanent decline of several export-oriented industries, leading to job losses and reduced economic activity.

- Increased reliance on resource-based economy: The Canadian economy could become overly reliant on resource extraction, increasing vulnerability to commodity price fluctuations.

- Slower economic growth compared to global peers: The persistent overvaluation of the loonie could lead to slower economic growth compared to other developed nations.

- Potential for regional economic disparities: Regions heavily reliant on specific export sectors might experience disproportionately higher unemployment and economic hardship.

Addressing the issue proactively is crucial to ensure sustainable long-term economic growth and prosperity for all Canadians.

Addressing the Overvalued Loonie – A Call to Action

The overvalued loonie presents a significant challenge to the Canadian economy, impacting exports, inflation, and long-term economic growth. The negative impacts on Canadian businesses, workers, and the overall economy are substantial and require urgent attention. Policymakers must act decisively and strategically to implement effective solutions to manage the exchange rate and mitigate the adverse consequences of this strong Canadian dollar. Understanding the complexities of the overvalued loonie and advocating for balanced economic policies is crucial. Learn more about the issue and encourage your representatives to prioritize policies that address the overvalued loonie and promote sustainable economic growth for Canada.

Featured Posts

-

Is The 12 Inch Surface Pro Worth Buying

May 08, 2025

Is The 12 Inch Surface Pro Worth Buying

May 08, 2025 -

Gambling On Tragedy Analyzing The Los Angeles Wildfire Betting Market

May 08, 2025

Gambling On Tragedy Analyzing The Los Angeles Wildfire Betting Market

May 08, 2025 -

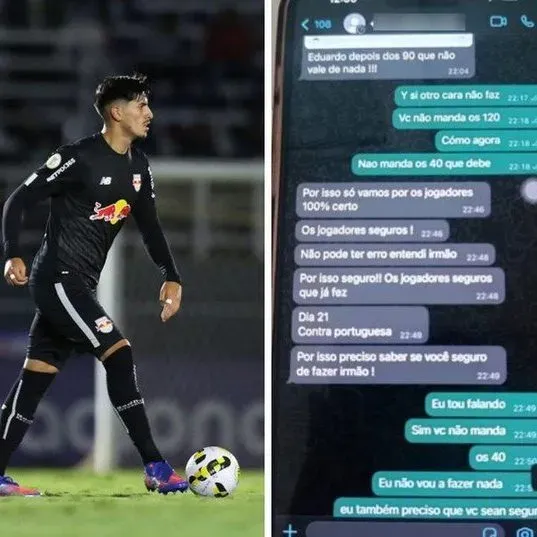

Brasileirao Jugador Argentino Recibe Sancion De Un Mes

May 08, 2025

Brasileirao Jugador Argentino Recibe Sancion De Un Mes

May 08, 2025 -

2 Day Lahore Weather Forecast Eid Ul Fitr Celebrations In Punjab

May 08, 2025

2 Day Lahore Weather Forecast Eid Ul Fitr Celebrations In Punjab

May 08, 2025 -

Antisemitism Allegations Prompt Investigation At Boeings Seattle Campus

May 08, 2025

Antisemitism Allegations Prompt Investigation At Boeings Seattle Campus

May 08, 2025