European Central Bank: Economists' Warning On Rate Cut Delays

Table of Contents

Rising Inflation and the ECB's Response

Inflation in the Eurozone remains a significant concern. Consumer prices are rising at a pace not seen in decades, impacting household budgets and business profitability. This persistent inflation forces businesses to increase prices, creating a challenging environment for consumers and potentially stifling economic growth. The ECB's current monetary policy, while aiming for price stability, has prioritized a cautious approach, delaying significant rate cuts. This strategy reflects the ECB's concern about potentially fueling inflation further.

- Current Inflation Figures and Projections: Eurostat recently reported inflation at [Insert latest Eurozone inflation figure]%, exceeding the ECB's target of 2%. Projections vary, but several institutions forecast inflation to remain above target for [mention timeframe].

- Analysis of the ECB's Previous Rate Decisions: The ECB has gradually increased interest rates over the past year in an attempt to curb inflation. However, the impact of these rate hikes on inflation has been slower than anticipated.

- Potential Risks Associated with Prolonged High Inflation: Prolonged high inflation erodes purchasing power, reduces consumer confidence, and can lead to wage-price spirals, further destabilizing the economy.

Economists' Concerns Regarding Delayed Rate Cuts

Not all economists agree with the ECB's cautious approach. Many prominent figures are advocating for more immediate and decisive rate cuts, arguing that the current strategy risks exacerbating the economic slowdown. The fear is that delaying rate cuts could lead to a deeper recession and prolonged economic stagnation.

- Potential Negative Impacts of Delayed Rate Cuts on Economic Growth: Delayed rate cuts can stifle investment, reduce consumer spending, and ultimately hinder economic growth. Businesses may postpone expansion plans, and consumers may delay purchases due to uncertainty.

- Risks of Exacerbating Recessionary Pressures: Maintaining high interest rates for an extended period can increase borrowing costs for businesses and households, potentially tipping the economy into a deeper recession.

- Concerns about the Effectiveness of the Current Monetary Policy: Some economists argue that the current monetary policy is not adequately addressing the underlying causes of inflation and may be ineffective in achieving the ECB's objectives.

"[Quote from a prominent economist expressing concern about the ECB's delay in rate cuts]," states [Economist's Name], highlighting the potential for significant economic damage.

Potential Consequences of Delayed Action

The continued delay in implementing rate cuts carries significant risks for the Eurozone economy. The potential consequences extend across various sectors, impacting investment, employment, and overall economic stability.

- Impact on Investment and Consumer Spending: High interest rates discourage investment and reduce consumer spending, leading to slower economic growth and potentially a deeper recession.

- Potential Implications for Unemployment Rates: A prolonged economic slowdown could result in job losses and increased unemployment rates, further depressing consumer confidence and economic activity.

- Risks of a Deeper Recession or Prolonged Economic Stagnation: The most severe consequence could be a deeper and more prolonged recession, with lasting negative impacts on the Eurozone's economic trajectory.

Several leading economic institutions, including [mention institutions], have projected [mention specific projections] if the ECB fails to act decisively.

Alternative Monetary Policy Strategies

The ECB could explore alternative monetary policy strategies to address the current challenges while mitigating the risks associated with drastic rate cuts.

- Targeted Support for Specific Sectors: Targeted support for struggling sectors could help alleviate economic hardship without excessively stimulating inflation.

- Quantitative Easing Measures: Reintroducing quantitative easing (QE) could inject liquidity into the market and lower borrowing costs, supporting investment and growth.

- Other Non-Conventional Monetary Policy Tools: The ECB could consider other non-conventional tools, such as negative interest rates or forward guidance, to influence market expectations and guide economic activity.

The feasibility and effectiveness of these alternatives require careful consideration and analysis. The ECB needs to weigh the potential benefits against the risks associated with each approach.

European Central Bank Rate Cut Delays: A Call for Action

In conclusion, the economists' warnings regarding European Central Bank rate cut delays are serious and deserve careful consideration. The potential consequences of inaction—a deeper recession, higher unemployment, and prolonged economic stagnation—are significant. The ECB needs to act decisively to address the current economic challenges, balancing the need to control inflation with the urgency of supporting economic growth. It's crucial to stay informed about the ECB's future decisions and their impact on the Eurozone economy. Follow reputable financial news sources and engage in further research on European Central Bank rate cut delays and their implications. Let's discuss this critical issue using #ECBRateCuts #EurozoneEconomy #Inflation. Your informed participation is vital.

Featured Posts

-

Mlb Return Chase Lee Pitches Scoreless Inning May 12 2025

May 31, 2025

Mlb Return Chase Lee Pitches Scoreless Inning May 12 2025

May 31, 2025 -

Plumbing Repair Leads To Strange Basement Discovery

May 31, 2025

Plumbing Repair Leads To Strange Basement Discovery

May 31, 2025 -

Cleveland Guardians Home Opener Weather Patterns Over The Years

May 31, 2025

Cleveland Guardians Home Opener Weather Patterns Over The Years

May 31, 2025 -

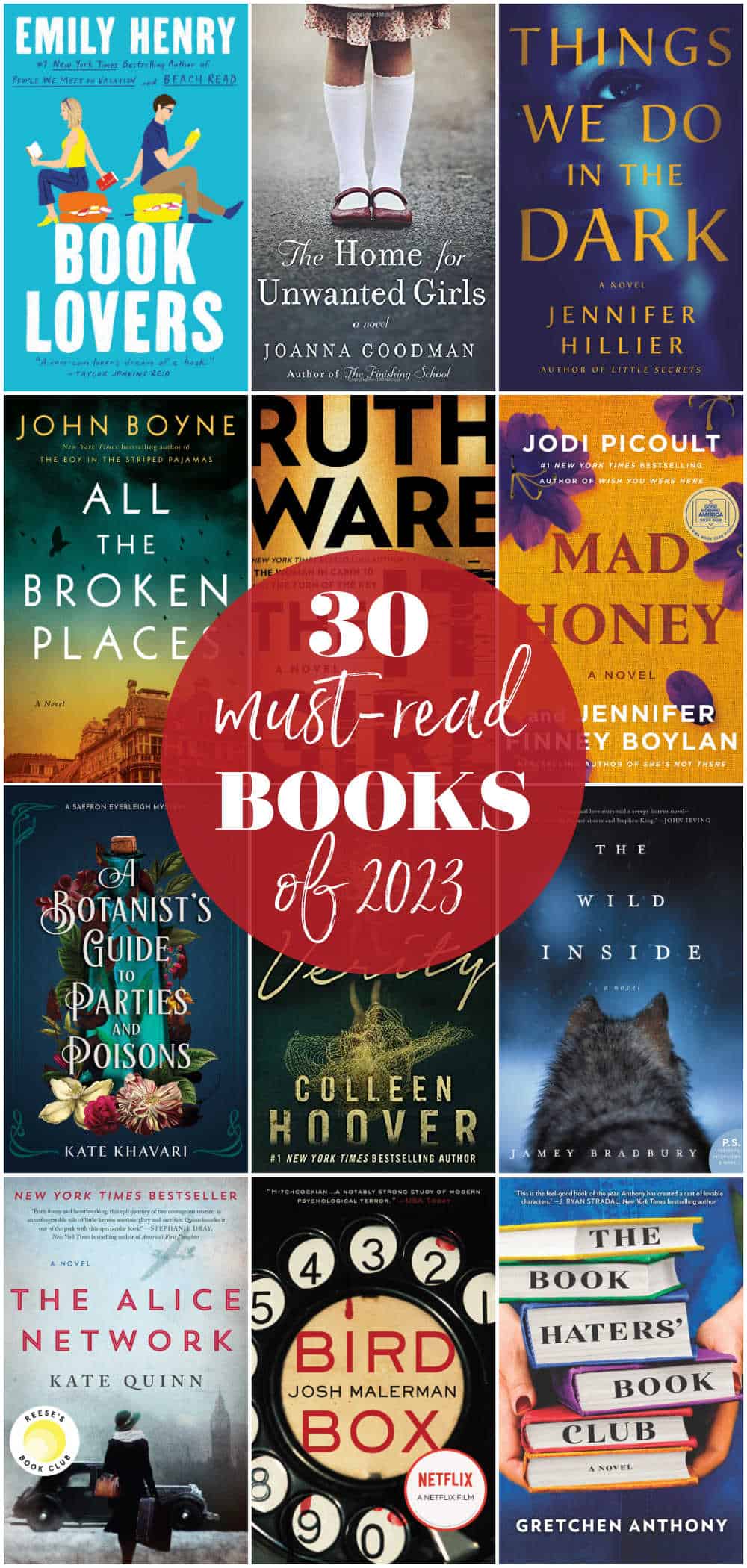

30 Best Books To Read This Summer Critic Recommendations

May 31, 2025

30 Best Books To Read This Summer Critic Recommendations

May 31, 2025 -

Cycle News Magazine Issue 17 2025 In Depth Coverage Of Cyclings Future

May 31, 2025

Cycle News Magazine Issue 17 2025 In Depth Coverage Of Cyclings Future

May 31, 2025