Delaying ECB Rate Cuts: Economists Sound The Alarm

Table of Contents

The Risks of Delaying ECB Rate Cuts

The potential downsides of prolonging high interest rates are significant and far-reaching, potentially jeopardizing the Eurozone's economic stability.

Increased Recessionary Pressure

Prolonged high interest rates stifle economic growth by increasing borrowing costs for businesses and consumers. This leads to a decrease in investment and consumer spending, ultimately impacting employment levels.

- Impact on Investment: Higher borrowing costs discourage businesses from investing in expansion, modernization, and new projects.

- Reduced Consumer Spending: Increased mortgage rates and loan interest negatively affect household budgets, reducing disposable income and consumer confidence.

- Potential Job Losses: Reduced investment and consumer spending lead to lower production and potentially significant job losses across various sectors. Current GDP growth forecasts already paint a bleak picture, and delaying ECB rate cuts could worsen this significantly. For example, recent forecasts suggest a potential contraction of the Eurozone GDP by X% in [Year].

Exacerbated Debt Crisis

Many Eurozone countries and businesses carry significant levels of debt. High interest rates exacerbate this problem, increasing the burden of repayments and potentially triggering a debt crisis.

- Impact on Sovereign Debt: Increased interest payments strain government budgets, potentially limiting their ability to fund essential public services.

- Potential Defaults: Highly indebted entities, both public and private, may face increased risk of defaulting on their loans.

- Strain on Government Budgets: Governments may need to implement austerity measures, further impacting economic growth and social welfare programs. This could lead to social unrest and political instability.

Deflationary Spiral Concerns

Maintaining excessively high interest rates despite weak growth could trigger a deflationary spiral. This is a scenario where falling prices lead to reduced consumer spending, further weakening demand and pushing prices down in a vicious cycle.

- Deflationary Pressures: Reduced demand and falling prices create a downward spiral, making it harder for businesses to profit and potentially leading to further job losses.

- Reinforcing Recessionary Tendencies: Deflation exacerbates the recessionary pressures caused by high interest rates, creating a double-edged sword for the Eurozone economy. The longer the ECB delays action, the greater the risk of this spiral.

Counterarguments: The Case for Continued Cautious Approach

While the risks of delaying ECB rate cuts are substantial, some argue that a cautious approach is still necessary.

Persistent Inflationary Pressures

Advocates for maintaining high rates emphasize that underlying inflationary pressures remain significant. Core inflation – excluding volatile food and energy prices – remains above the ECB's target of 2%.

- Underlying Inflationary Factors: Supply chain disruptions, energy price volatility, and strong wage growth all contribute to persistent inflation.

- Core Inflation Rates: Monitoring core inflation is crucial to assess the underlying strength of inflationary pressures.

- ECB's Inflation Target: The ECB's mandate is to maintain price stability, and premature rate cuts could undermine this objective.

The Risk of Premature Rate Cuts

Lowering interest rates too soon risks reigniting inflation and jeopardizing the ECB's hard-won credibility. A premature easing of monetary policy could undo months of efforts to combat inflation.

- Resurgence of Inflation: If inflation isn't sufficiently tamed before rate cuts, it could rebound rapidly, potentially requiring even more drastic measures in the future.

- Undermining ECB Credibility: Premature cuts could damage the ECB's reputation for managing inflation effectively.

Geopolitical Uncertainty

The current geopolitical landscape, particularly the war in Ukraine and the resulting energy crisis, adds significant uncertainty to economic forecasting.

- Impact on Inflation: The war has driven up energy prices, directly impacting inflation across the Eurozone.

- Economic Uncertainty: Geopolitical instability makes it difficult to accurately predict economic outcomes, complicating the ECB's decision-making process.

Conclusion: Delaying ECB Rate Cuts: A Delicate Balancing Act

The debate surrounding delaying ECB rate cuts highlights the incredibly complex economic situation facing the Eurozone. There are significant risks associated with both delaying and prematurely cutting rates. Delaying cuts risks exacerbating a recession and triggering a debt crisis, while premature cuts could reignite inflation. The ECB must carefully weigh these risks and navigate a delicate balancing act to achieve its primary mandate of price stability while safeguarding economic growth and financial stability. The debate surrounding delaying ECB rate cuts will continue to unfold. Stay informed and engage in constructive dialogue to better understand the potential ramifications for the Eurozone economy. Continue to follow the ECB's announcements and engage in further research on ECB interest rate policy and its impact.

Featured Posts

-

Jannik Sinner Tai Rome Masters Co Hoi Doi Dau Alcaraz

May 31, 2025

Jannik Sinner Tai Rome Masters Co Hoi Doi Dau Alcaraz

May 31, 2025 -

Cleveland Browns Draft Mel Kiper Jr S Top Pick At No 2 Overall

May 31, 2025

Cleveland Browns Draft Mel Kiper Jr S Top Pick At No 2 Overall

May 31, 2025 -

Carnaval D Ouistreham Ouverture De La Saison Estivale

May 31, 2025

Carnaval D Ouistreham Ouverture De La Saison Estivale

May 31, 2025 -

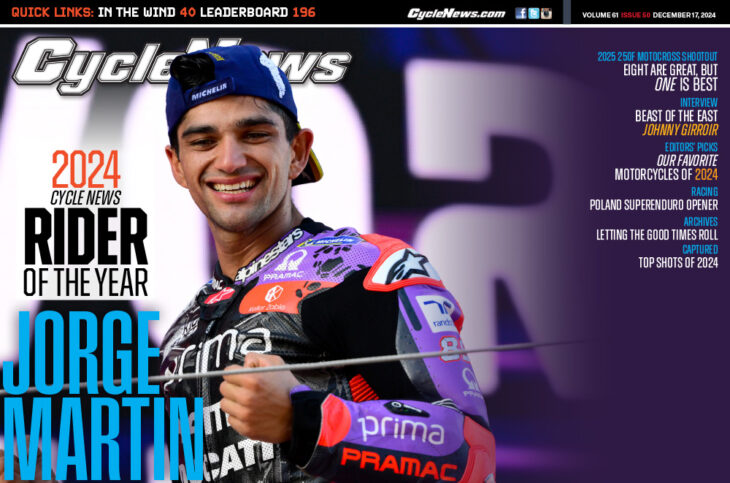

Cycle News Magazine 2025 Issue 12 Your Guide To The Latest Cycling Trends

May 31, 2025

Cycle News Magazine 2025 Issue 12 Your Guide To The Latest Cycling Trends

May 31, 2025 -

Suge Knight Wants Diddy To Testify A Plea For Humanization

May 31, 2025

Suge Knight Wants Diddy To Testify A Plea For Humanization

May 31, 2025