Bitcoin's Future: Analyzing The $100,000 Prediction After Trump's Speech

Table of Contents

Trump's Influence on Bitcoin's Price

Analyzing Trump's Statements

Trump's pronouncements on Bitcoin have historically proven to be market-moving events. Analyzing his specific statements is crucial to understanding their impact.

- Example 1: (Insert specific quote from Trump about Bitcoin). This statement could be interpreted as [insert interpretation and its likely impact on the market – positive, negative, or neutral].

- Example 2: (Insert another quote). This seemingly [positive/negative/neutral] comment might have resonated with investors based on [reasoning].

- Example 3: (Insert a third quote if available). The ambiguity in this statement could lead to [explain the various market reactions it might cause].

His past comments on cryptocurrencies have shown a mixed effect on prices. While some statements have led to short-term price surges, others have had little noticeable impact. Understanding the context and the overall sentiment expressed is critical to discerning the long-term effects of his latest remarks.

Market Reaction to Trump's Speech

The immediate market reaction to Trump's recent speech was [describe the immediate price movement – e.g., a sharp increase, a slight dip, no significant change]. The following days saw [describe subsequent price movements and volatility].

- Chart 1: [Insert a chart showing Bitcoin's price movement around the time of Trump's speech].

- Trading Volume: Trading volume [increased/decreased/remained stable], indicating [interpret the implications of the trading volume change].

- Social Media Sentiment: Social media sentiment analysis reveals [positive/negative/mixed] feelings towards Bitcoin following Trump's comments.

Comparing this reaction to previous instances where Trump commented on Bitcoin is essential for establishing a pattern and predicting future responses. Prior instances saw [briefly describe past reactions]. This suggests that [conclusion based on the comparison].

Technical Analysis and Price Predictions

Chart Patterns and Indicators

Technical analysis provides valuable insights into Bitcoin's potential price movements. Analyzing chart patterns using various indicators can help us predict future price trends.

- Moving Averages: The [short-term/long-term] moving average is currently [above/below] the [short-term/long-term] moving average, suggesting [bullish/bearish] momentum.

- RSI (Relative Strength Index): An RSI of [value] suggests [overbought/oversold/neutral] conditions, potentially indicating a [reversal/continuation] of the current trend.

- MACD (Moving Average Convergence Divergence): The MACD histogram is currently [positive/negative], indicating [bullish/bearish] momentum.

- Support and Resistance Levels: Key support levels are located at [prices], while resistance levels are at [prices].

Chart 2: [Insert a chart showing Bitcoin's price with overlaid technical indicators].

On-Chain Metrics and Adoption Rates

Examining on-chain data provides a more fundamental perspective on Bitcoin's long-term health and potential.

- Transaction Volume: Increasing transaction volume signals growing adoption and potentially higher demand.

- Mining Difficulty: The rising difficulty reflects the growing computational power securing the network.

- Hash Rate: A high hash rate is a sign of network security and decentralization.

- Institutional Adoption: The influx of institutional investment significantly impacts Bitcoin's price and stability.

The correlation between these on-chain metrics and price predictions remains a subject of ongoing research. However, generally, healthy on-chain metrics tend to support a bullish outlook for Bitcoin's price in the long term.

Regulatory Landscape and Its Impact

Global Regulatory Scrutiny

The regulatory landscape for Bitcoin varies significantly across different jurisdictions. This creates uncertainty and potential challenges to the $100,000 Bitcoin prediction.

- United States: The regulatory environment in the US remains relatively unclear, with ongoing debates about how to classify and regulate cryptocurrencies.

- Europe: The EU is developing a comprehensive regulatory framework for crypto assets, aiming to balance innovation with consumer protection.

- China: China's crackdown on cryptocurrency mining and trading has significantly impacted the global market.

Different regulatory approaches influence Bitcoin adoption rates and investor sentiment, impacting its price. Clear and favorable regulations are generally considered positive for price appreciation.

The Role of Central Banks and Governments

Central banks and governments play a significant role in shaping the macroeconomic environment, which in turn affects Bitcoin's value.

- CBDCs (Central Bank Digital Currencies): The emergence of CBDCs could potentially compete with Bitcoin, impacting its dominance as a store of value.

- Macroeconomic Factors: Inflation, interest rates, and economic growth directly influence investor behavior and investment allocation towards Bitcoin.

- Government Intervention: Direct government intervention, such as bans or restrictions, can negatively impact Bitcoin's price.

The interplay between these factors creates a complex dynamic that makes precise price prediction challenging.

Potential Catalysts for Reaching $100,000

Technological Advancements

Technological advancements in the Bitcoin ecosystem are crucial for enhancing its scalability, efficiency, and usability.

- The Lightning Network: This second-layer scaling solution improves transaction speeds and reduces fees.

- Taproot Upgrade: This upgrade enhances privacy and smart contract capabilities.

These improvements can attract more users and businesses, leading to increased demand and potential price appreciation.

Increased Institutional Adoption

The growing interest from institutional investors is a significant catalyst for Bitcoin's price growth.

- Grayscale Bitcoin Trust (GBTC): This investment vehicle provides a regulated way for institutional investors to gain exposure to Bitcoin.

- MicroStrategy and Tesla: The adoption of Bitcoin by major corporations demonstrates increased confidence and legitimacy.

Continued institutional adoption can drive significant price increases as large investors allocate substantial capital to Bitcoin.

Conclusion

Predicting whether Bitcoin will reach $100,000 is speculative. However, analyzing Trump's influence, along with technical indicators, on-chain metrics, regulatory developments, and potential catalysts provides a more informed perspective. While Trump's comments can create short-term volatility, the long-term trajectory of Bitcoin hinges on factors like technological advancements, increased institutional adoption, and the evolving regulatory environment. A balanced view considers both bullish and bearish scenarios. While uncertainty remains, understanding these influencing factors is crucial for informed decision-making. Continue your research on Bitcoin price prediction and stay updated on market trends to make your own informed assessment of whether Bitcoin will reach $100,000. Learn more about Bitcoin investment strategies and manage your risk effectively.

Featured Posts

-

Victoria Del Flamengo Arrascaeta Marca Un Gollazo En La Final De La Taca Guanabara

May 08, 2025

Victoria Del Flamengo Arrascaeta Marca Un Gollazo En La Final De La Taca Guanabara

May 08, 2025 -

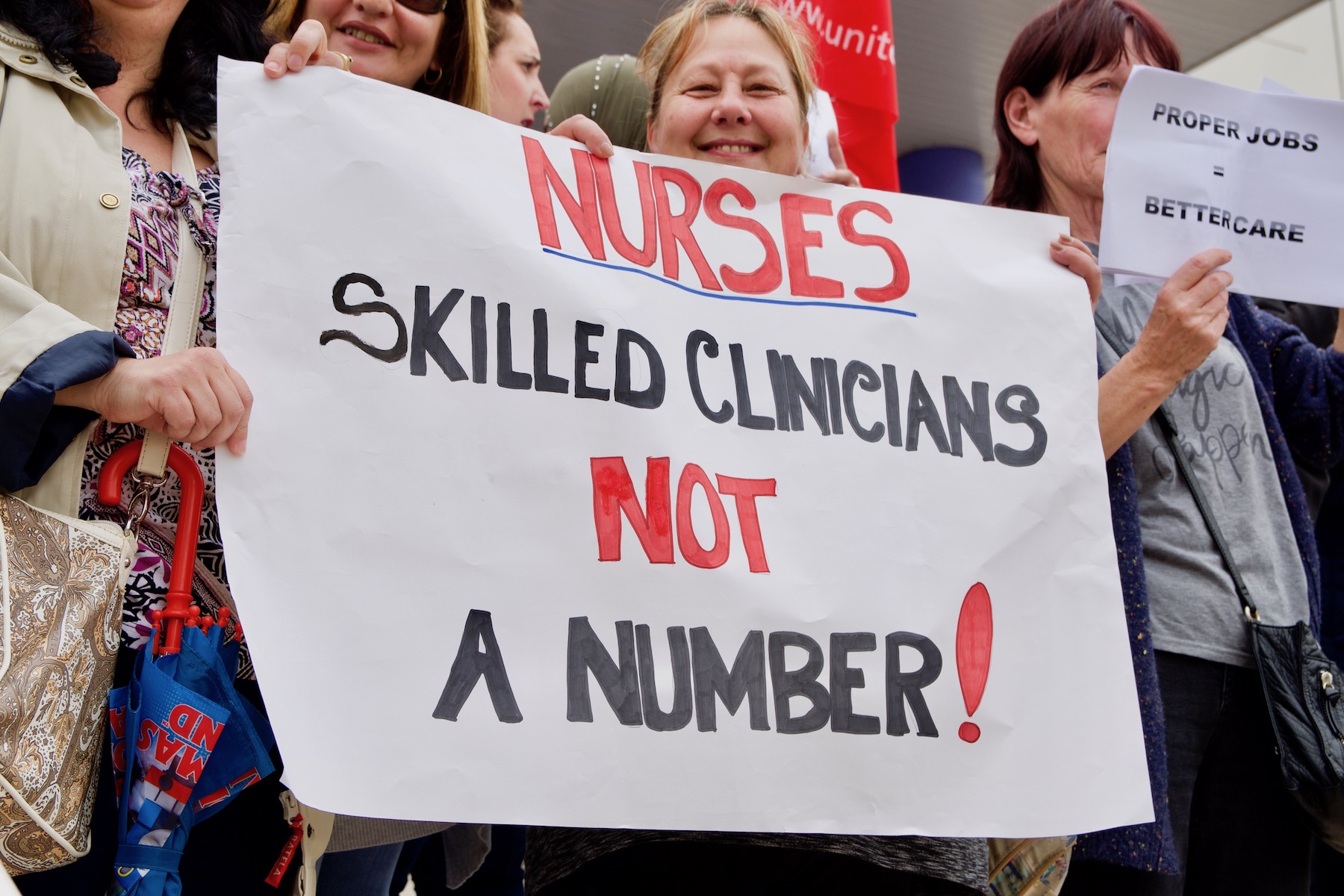

Governments Jhl Privatisation Plan Faces Gha Backlash

May 08, 2025

Governments Jhl Privatisation Plan Faces Gha Backlash

May 08, 2025 -

Papal Conclave 2023 Preparing For The Election Of A New Pope

May 08, 2025

Papal Conclave 2023 Preparing For The Election Of A New Pope

May 08, 2025 -

Ps 5 Pro Sales Underperform A Comparison With The Ps 4 Pro

May 08, 2025

Ps 5 Pro Sales Underperform A Comparison With The Ps 4 Pro

May 08, 2025 -

Bitcoin Fiyat Endeksi Canli Veriler Ve Grafikler

May 08, 2025

Bitcoin Fiyat Endeksi Canli Veriler Ve Grafikler

May 08, 2025