ETFs To Consider: Riding The Wave Of Uber's Autonomous Vehicle Development

Table of Contents

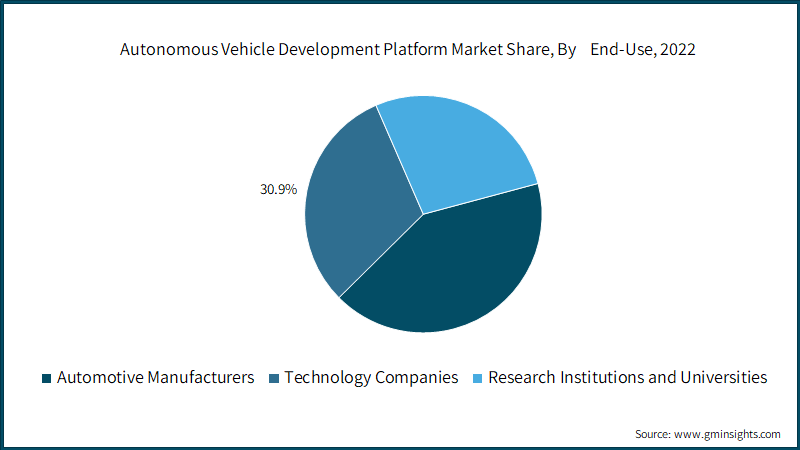

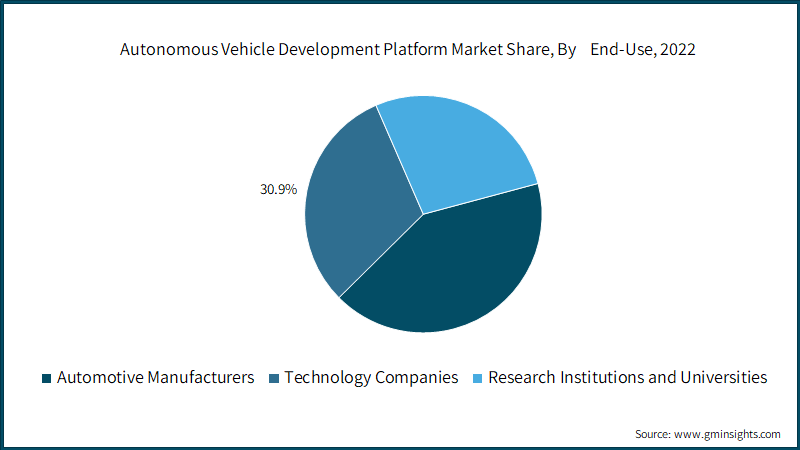

Understanding the Autonomous Vehicle Market and its Growth Potential

The autonomous vehicle market is poised for explosive growth, driven by rapid advancements in technology and a growing demand for safer, more efficient transportation.

The Technological Landscape

The autonomous driving technology landscape is dynamic and rapidly evolving. Key players, beyond Uber, include Waymo, Tesla, and Cruise, all pushing the boundaries of self-driving cars and robotaxis.

- Key Technologies: LiDAR (Light Detection and Ranging), advanced sensor fusion, sophisticated AI algorithms, and high-precision mapping are driving innovation in autonomous driving technology.

- Market Projections: Industry analysts predict substantial growth. Reports suggest the global market for autonomous vehicles could reach hundreds of billions of dollars within the next decade, significantly impacting market capitalization across related sectors. This growth is fueled by increasing investments in research and development and the expansion of autonomous driving technology into various applications beyond passenger vehicles, such as logistics and delivery.

Uber's Role in the Autonomous Vehicle Revolution

Uber, through its Advanced Technologies Group (ATG), is a major player in the autonomous vehicle revolution. Uber ATG's investments in research and development, coupled with its existing ride-sharing platform, position it to be a significant beneficiary of the autonomous ride-sharing market.

- Uber ATG Progress: Uber ATG has made significant strides in developing self-driving technology, conducting extensive testing and piloting programs. Their progress, though facing challenges, positions them to potentially become a leading provider of autonomous ride-sharing services.

- Key Collaborations: Uber has engaged in strategic partnerships and acquisitions to bolster its technological capabilities and expand its reach within the autonomous vehicle ecosystem. These alliances accelerate development and access to crucial resources.

Identifying Relevant ETFs for Exposure to Autonomous Vehicle Technology

While a dedicated "autonomous vehicle ETF" might be limited, investors can gain exposure through various avenues.

ETFs Focused on Technology and Innovation

Investing in broader technology ETFs offers indirect exposure to the autonomous vehicle sector. Companies developing crucial components like semiconductors, AI software, and robotics are integral to autonomous driving systems.

- Relevant Tech ETFs: Many ETFs focused on technology, semiconductors, AI, and robotics indirectly benefit from the growth of autonomous vehicles. Examples include those tracking the Nasdaq 100 or specific technology indices. Consider ETFs with a strong focus on innovation and emerging technologies.

- ETF Considerations: When selecting an ETF, analyze its investment strategy, expense ratio (lower is better), and historical performance. Consider both passive investing (index funds) and actively managed funds, weighing their potential benefits and drawbacks.

ETFs with Specific Exposure to Autonomous Vehicle Companies

While dedicated autonomous vehicle ETFs are less common, some broader technology ETFs may hold significant positions in companies directly involved in autonomous driving development. It's crucial to examine the ETF's portfolio composition carefully.

- Identifying Direct Holdings: Scrutinize the ETF's holdings to identify companies significantly involved in autonomous vehicle technology. The weighting of these companies within the ETF’s portfolio will determine the level of exposure you receive.

- Portfolio Analysis: A thorough understanding of the ETF's investment strategy and portfolio composition is vital to assess the level of exposure to autonomous driving technology. Look for ETFs that include companies developing essential technologies like LiDAR, AI, or sensor systems.

Assessing Risk and Diversification Strategies

Investing in autonomous vehicle technology, like any emerging sector, carries inherent risks.

Understanding the Risks Involved

The autonomous vehicle industry is subject to significant uncertainties.

- Potential Downsides: Regulatory hurdles, technological challenges (e.g., unexpected software glitches, safety concerns), intense competition, and market volatility pose significant risks. The development and rollout of self-driving technology are complex and subject to delays.

- Due Diligence and Risk Tolerance: Thorough research and a realistic assessment of your risk tolerance are crucial before investing. Understand the potential for losses as well as the potential for substantial returns.

Building a Diversified Portfolio

Diversification is paramount to mitigating risks.

- Diversification Strategies: Don't put all your eggs in one basket. Diversify investments across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio risk.

- Balanced Portfolio Approach: A balanced portfolio approach, incorporating a mix of low-risk and high-risk investments, can help you manage risk while still participating in the potential rewards of the autonomous vehicle market.

Conclusion: Investing in the Future of Transportation with Autonomous Vehicle ETFs

The autonomous vehicle market presents substantial growth potential. Uber's significant investment in autonomous driving technology, along with the broader technological advancements in this sector, creates an attractive investment opportunity. While dedicated autonomous vehicle ETFs may be limited, investors can gain exposure through carefully selected technology ETFs with holdings in companies developing crucial components and technologies. Remember to conduct thorough research, understand the inherent risks, and implement a robust diversification strategy for optimal risk management. Consider researching the ETFs mentioned in this article and incorporating them into your investment strategy to capitalize on the long-term growth potential of autonomous vehicle technology and Uber-related investments. The future of transportation is autonomous, and strategic ETF investments offer a compelling way to participate in this transformative trend.

Featured Posts

-

Quebec Labour Tribunal Hears Amazon Union Case On Warehouse Shutdowns

May 18, 2025

Quebec Labour Tribunal Hears Amazon Union Case On Warehouse Shutdowns

May 18, 2025 -

Cops Investigate Homicide In Brooklyn Bridge Park

May 18, 2025

Cops Investigate Homicide In Brooklyn Bridge Park

May 18, 2025 -

Analyzing Red Carpet Protocol Violations A Cnn Perspective

May 18, 2025

Analyzing Red Carpet Protocol Violations A Cnn Perspective

May 18, 2025 -

Cnn Releases Video Of New Orleans Jail Escape

May 18, 2025

Cnn Releases Video Of New Orleans Jail Escape

May 18, 2025 -

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Detailed Analysis

May 18, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Detailed Analysis

May 18, 2025

Latest Posts

-

Infografis Konflik Israel Palestina Apakah Solusi Dua Negara Masih Mungkin Peran Dan Sikap Indonesia

May 18, 2025

Infografis Konflik Israel Palestina Apakah Solusi Dua Negara Masih Mungkin Peran Dan Sikap Indonesia

May 18, 2025 -

Film No Other Land Raih Oscar Cerminan Konflik Palestina Israel

May 18, 2025

Film No Other Land Raih Oscar Cerminan Konflik Palestina Israel

May 18, 2025 -

Infografis Solusi Dua Negara Pandangan Pesimis Dan Peran Indonesia Dalam Konflik Israel Palestina

May 18, 2025

Infografis Solusi Dua Negara Pandangan Pesimis Dan Peran Indonesia Dalam Konflik Israel Palestina

May 18, 2025 -

Abd Li Dergi Tuerkiye Israil Catismasi Ve Erdogan Netanyahu Karsilasmasi

May 18, 2025

Abd Li Dergi Tuerkiye Israil Catismasi Ve Erdogan Netanyahu Karsilasmasi

May 18, 2025 -

No Other Land Analisis Film Pemenang Oscar Tentang Konflik Palestina Israel

May 18, 2025

No Other Land Analisis Film Pemenang Oscar Tentang Konflik Palestina Israel

May 18, 2025