European Market Update: Tariff Hopes And LVMH's Decline

Table of Contents

Tariff Hopes and Fears in the European Union

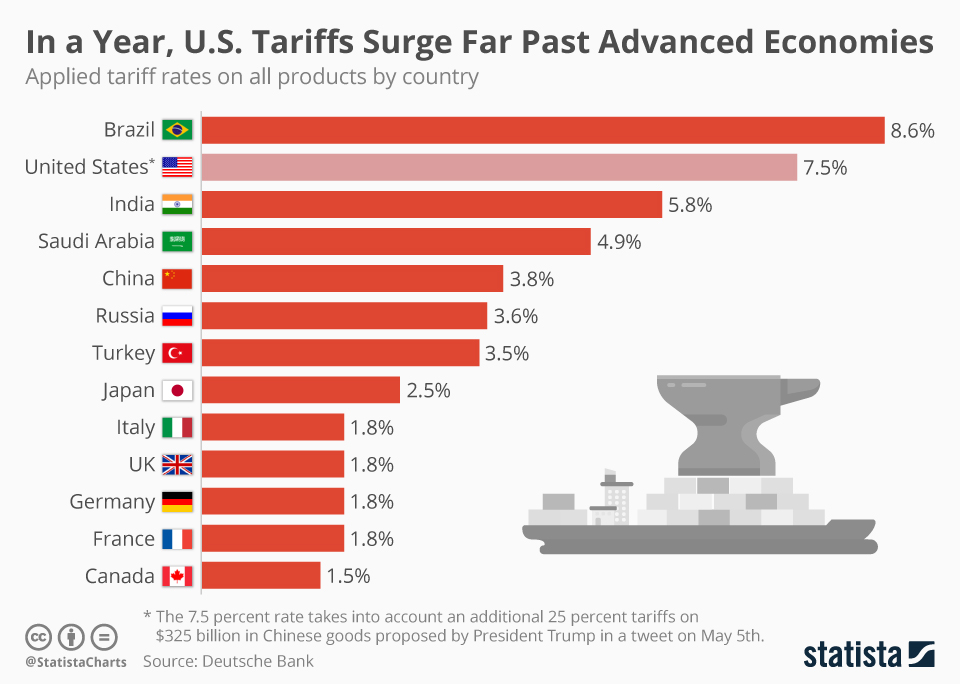

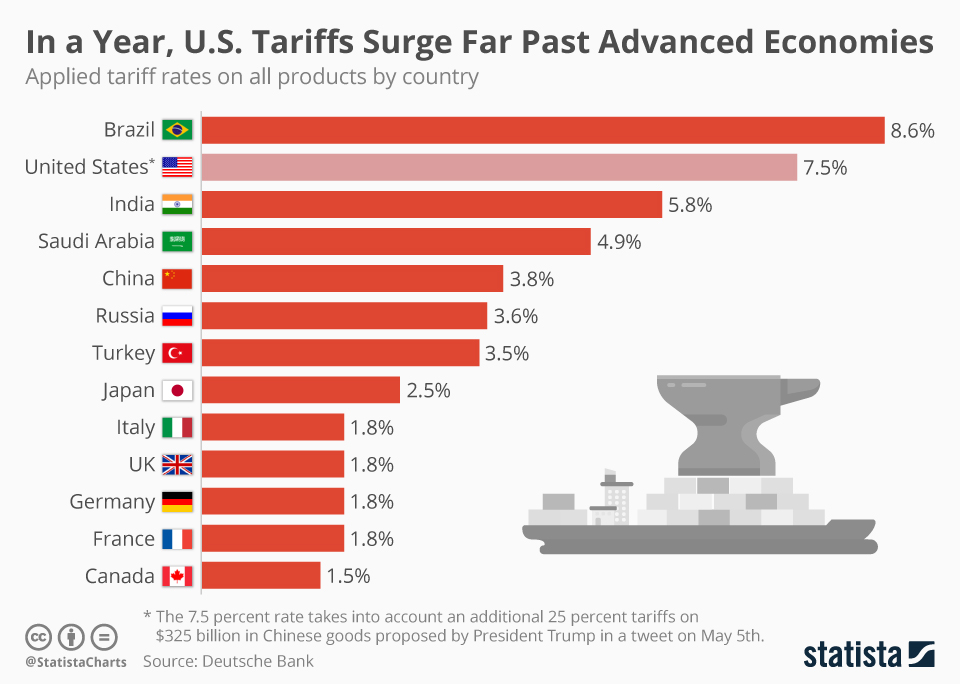

The European Union faces a complex web of potential trade wars and shifting trade policies, creating significant uncertainty for businesses. The impact of these potential tariff changes ripples across various sectors, demanding careful navigation.

Impact of Potential Trade Wars

New or escalating tariffs could severely impact European businesses. Specific sectors like automotive and luxury goods are particularly vulnerable.

- Automotive: Increased tariffs on imported car parts could significantly raise production costs, reducing competitiveness and potentially leading to job losses. The ongoing trade dispute between the EU and the US serves as a prime example.

- Luxury Goods: Tariffs on imported materials or finished goods could dramatically increase prices for luxury brands, impacting consumer demand and profitability. This is especially relevant given the global nature of luxury goods supply chains.

- Retaliatory Measures: The imposition of tariffs often triggers retaliatory measures from affected countries, leading to a cycle of escalating trade barriers and harming overall economic growth. The EU's response to US tariffs is a case in point.

Keywords: EU tariffs, trade barriers, import duties, export restrictions, trade wars, global trade

Negotiations and Policy Changes

The EU is actively engaged in various trade negotiations and policy changes that could significantly influence tariff outcomes.

- Brexit Negotiations: The ongoing implications of Brexit continue to create uncertainty about future trade relations between the EU and the UK, impacting various sectors.

- WTO Disputes: The World Trade Organization (WTO) plays a critical role in resolving trade disputes, but its effectiveness is often challenged by political complexities.

- Bilateral Trade Agreements: The EU continues to negotiate bilateral trade agreements with various countries, aiming to reduce trade barriers and foster economic cooperation.

Keywords: EU trade policy, trade agreements, bilateral trade, WTO regulations, trade negotiations

Analyzing LVMH's Recent Stock Performance Decline

LVMH, a leading player in the luxury goods market, has experienced a recent dip in its stock performance. Understanding the contributing factors is crucial for assessing its future prospects.

Factors Contributing to LVMH's Dip

Several factors could be contributing to LVMH's recent stock market decline:

- Economic Slowdown: Global economic slowdown, particularly in key markets like China, can significantly reduce consumer spending on luxury goods.

- Geopolitical Instability: Geopolitical uncertainties, such as the ongoing war in Ukraine, impact consumer and investor confidence, influencing market performance.

- Currency Fluctuations: Changes in exchange rates can affect the profitability of international companies like LVMH, impacting their stock valuations.

- Changing Consumer Preferences: Evolving consumer preferences and the rise of sustainable and ethical luxury brands might be affecting LVMH’s market share.

Keywords: LVMH stock, luxury goods market, market capitalization, stock market volatility, investor sentiment

Long-Term Outlook for LVMH

Despite the recent dip, LVMH retains significant strengths:

- Brand Diversification: LVMH's diverse portfolio of luxury brands offers resilience against sector-specific challenges.

- Strong Brand Equity: Its powerful brands maintain high desirability and pricing power.

- Future Growth Potential: The long-term outlook for the luxury goods market remains positive, albeit with evolving consumer preferences.

Keywords: LVMH future, luxury brands, market share, brand strategy, long-term investment

Interrelation between Tariff Concerns and LVMH's Performance

The uncertainty surrounding tariffs poses unique challenges for luxury goods companies like LVMH.

Impact on Supply Chains

Increased tariffs on imported raw materials or components would directly impact LVMH's production costs.

- Raw Material Sourcing: Many luxury goods rely on specialized materials sourced globally, making them susceptible to tariff increases.

- Production Costs: Higher input costs inevitably translate into higher prices for finished goods, potentially affecting consumer demand.

Keywords: global supply chain, luxury goods supply, production costs, raw material prices

Impact on Consumer Spending

Tariff uncertainties can influence consumer confidence and spending habits, directly impacting LVMH's sales.

- Consumer Confidence: Economic uncertainty caused by trade wars can reduce consumer confidence, leading to decreased spending on luxury goods.

- Price Sensitivity: Higher prices due to tariffs might push price-sensitive consumers towards more affordable alternatives.

Keywords: consumer confidence, luxury consumer, spending habits, price elasticity, market demand

Conclusion: Staying Informed on the European Market Update

This European Market Update highlights the interconnectedness of tariff uncertainties and the performance of companies like LVMH within the volatile European market. Understanding these factors is crucial for investors and businesses operating in the region. Stay up-to-date on the European Market Update by following reputable financial news sources and economic analysis. Get the latest European Market Update to make informed decisions in this dynamic environment. The future of the European market will continue to depend on the ability of businesses to adapt to and navigate these ongoing challenges.

Featured Posts

-

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025 -

Porsche 911 80 Millio Forintba Keruelt Az Extrak

May 24, 2025

Porsche 911 80 Millio Forintba Keruelt Az Extrak

May 24, 2025 -

Years Later Tik Tok Connects Woman With Former Bishop Pope Leo

May 24, 2025

Years Later Tik Tok Connects Woman With Former Bishop Pope Leo

May 24, 2025 -

Apple Stock Key Levels Under Pressure Ahead Of Q2 Report

May 24, 2025

Apple Stock Key Levels Under Pressure Ahead Of Q2 Report

May 24, 2025 -

Trogatelniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025

Trogatelniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025

Latest Posts

-

Facing Closure How Trumps Cuts Threaten Vital Museum Programs

May 24, 2025

Facing Closure How Trumps Cuts Threaten Vital Museum Programs

May 24, 2025 -

Museum Programs In Crisis Examining The Consequences Of Trumps Budget Decisions

May 24, 2025

Museum Programs In Crisis Examining The Consequences Of Trumps Budget Decisions

May 24, 2025 -

Preserving History The Fight To Save Museum Programs After Trumps Cuts

May 24, 2025

Preserving History The Fight To Save Museum Programs After Trumps Cuts

May 24, 2025 -

Are Museum Programs History After Trumps Cuts A Look At The Impact

May 24, 2025

Are Museum Programs History After Trumps Cuts A Look At The Impact

May 24, 2025 -

Analysis Microsofts Decision To Block Emails With Palestine

May 24, 2025

Analysis Microsofts Decision To Block Emails With Palestine

May 24, 2025