Ensuring A Smooth Wealth Transfer: Succession Planning For The Super Rich

Table of Contents

Legal Structures for Wealth Preservation

Establishing appropriate legal structures is paramount in succession planning for the super-rich. These structures act as shields, protecting assets from various risks and minimizing tax burdens across generations. Effective wealth preservation hinges on choosing the right vehicle for your unique circumstances.

-

Types of Trusts and Their Benefits: Dynasty trusts, for instance, can perpetuate wealth across multiple generations, offering significant tax advantages. Charitable trusts allow for philanthropic contributions while minimizing estate taxes. Understanding the nuances of each trust type—including grantor retained annuity trusts (GRATs) and qualified personal residence trusts (QPRTs)—is crucial.

-

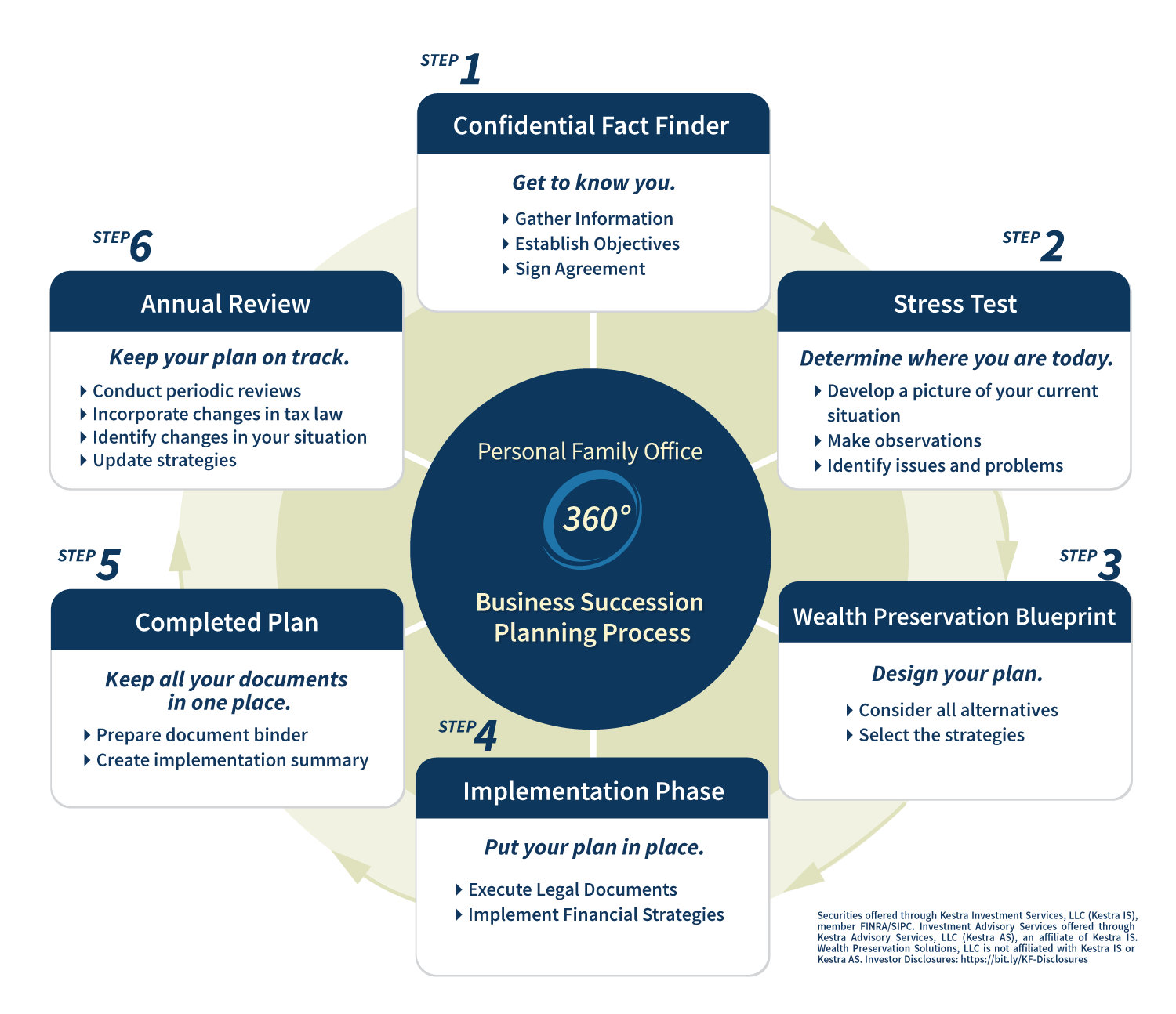

Setting up a Family Office: A family office provides centralized management of assets, offering sophisticated investment strategies, tax planning, and administrative support. Considerations include the cost of establishing and maintaining a family office versus outsourcing certain functions.

-

International Tax Implications and Estate Planning Strategies: For high-net-worth individuals with global assets, navigating international tax laws is critical. Strategies such as utilizing offshore trusts or specific tax treaties can help mitigate international tax liabilities.

-

Protecting Assets from Creditors and Potential Legal Challenges: Properly structured legal entities offer protection from creditors and potential lawsuits, ensuring the long-term security of your assets. This involves understanding asset protection trusts and other legal mechanisms designed to safeguard your wealth.

Tax Optimization Strategies

Tax optimization is a crucial component of effective succession planning for the super-rich. The complexities of domestic and international tax laws require strategic planning to minimize tax burdens during wealth transfer. Failing to account for these complexities can lead to significant financial losses.

-

Tax Implications of Inheritance and Gift Taxes: Understanding the inheritance and gift tax laws in various jurisdictions is crucial. Strategic gifting during your lifetime can help reduce your estate tax liability.

-

Utilizing Tax-Efficient Investment Vehicles: Employing tax-advantaged investment vehicles, such as municipal bonds or certain types of investment trusts, can significantly reduce your overall tax burden.

-

Estate Tax Planning and Minimizing Estate Tax Liability: Proactive estate tax planning, including the use of trusts and other tax-efficient strategies, is essential to minimize the tax burden on your heirs.

-

The Role of Tax Advisors and Financial Planners: Engaging experienced tax advisors and financial planners is paramount. Their expertise ensures that your strategy complies with current laws and remains optimized for future changes in tax regulations.

Minimizing Estate Disputes

Family conflicts over inheritance can severely undermine the intended legacy. Clear communication and meticulous documentation are crucial in preventing these disputes.

-

Drafting Comprehensive and Legally Sound Wills and Testamentary Documents: A well-drafted will, coupled with other testamentary documents, leaves no room for ambiguity and reduces the likelihood of disputes.

-

Establishing Clear Distribution Guidelines: Clearly defining distribution guidelines within the chosen legal structure prevents confusion and potential conflicts among heirs.

-

Utilizing Mediation or Arbitration: Pre-emptive agreements specifying mediation or arbitration processes can resolve potential disputes efficiently and amicably, avoiding costly litigation.

-

The Role of Family Governance Structures: Formal family governance structures, such as family councils or family constitutions, can provide a framework for communication and decision-making, minimizing conflict.

Asset Management and Investment Strategies

The success of your succession plan extends beyond the initial wealth transfer. Ongoing asset management and sound investment strategies ensure the long-term preservation and growth of your assets.

-

Developing a Long-Term Investment Strategy: A well-defined, long-term investment strategy tailored to your beneficiaries' needs and risk tolerance is essential for sustained wealth growth.

-

Selecting and Overseeing Professional Asset Managers: Engaging experienced and reputable asset managers ensures professional management of your assets and adherence to the established investment strategy.

-

Ensuring the Preservation and Growth of Wealth: Diversification across various asset classes and a focus on long-term value creation are critical for preserving and growing wealth across generations.

-

Diversification of Assets: Diversifying across various asset classes—stocks, bonds, real estate, private equity, etc.—mitigates risk and enhances the resilience of the portfolio.

Philanthropic Planning

Incorporating philanthropic goals into your succession plan can be both personally rewarding and tax-advantageous. It allows you to leave a lasting legacy beyond financial wealth.

-

Establishing Charitable Foundations or Trusts: Setting up a charitable foundation or trust allows for organized and ongoing philanthropic activity, often with significant tax benefits.

-

Tax Benefits of Philanthropic Giving: Donating to charity often offers significant tax deductions, minimizing your overall tax burden.

-

Aligning Philanthropic Goals with Family Values: Integrating charitable giving with your family’s values ensures that your philanthropic efforts resonate with your legacy and family beliefs.

-

The Role of Impact Investing: Impact investing—investing in ventures that generate positive social and environmental impact alongside financial returns—aligns financial goals with your philanthropic objectives.

Conclusion

Succession planning for the super-rich is a multifaceted process requiring proactive and strategic planning. By carefully considering the legal, tax, and asset management aspects, and by fostering open communication within the family, you can ensure a smooth and effective wealth transfer. Don't leave your legacy to chance. Invest in comprehensive succession planning for the super-rich today to protect your family's future. Contact a qualified wealth management professional to discuss your specific needs and develop a customized plan for securing your family’s financial future.

Featured Posts

-

16 Million Fine For T Mobile A Three Year Data Breach Settlement

May 22, 2025

16 Million Fine For T Mobile A Three Year Data Breach Settlement

May 22, 2025 -

Peppa Pig Family Announces Babys Gender In A Sweet Celebration

May 22, 2025

Peppa Pig Family Announces Babys Gender In A Sweet Celebration

May 22, 2025 -

Athena Calderone Celebrates A Milestone In Extravagant Roman Style

May 22, 2025

Athena Calderone Celebrates A Milestone In Extravagant Roman Style

May 22, 2025 -

Turning Poop Into Podcast Gold How Ai Digests Repetitive Documents

May 22, 2025

Turning Poop Into Podcast Gold How Ai Digests Repetitive Documents

May 22, 2025 -

Trans Australia Run The Race To Break The World Record

May 22, 2025

Trans Australia Run The Race To Break The World Record

May 22, 2025

Latest Posts

-

Taylor Swift And Blake Lively Friendship Fracture Amid Legal Dispute

May 22, 2025

Taylor Swift And Blake Lively Friendship Fracture Amid Legal Dispute

May 22, 2025 -

Rossiya I Nato Ugroza Kaliningradu I Slova Patrusheva

May 22, 2025

Rossiya I Nato Ugroza Kaliningradu I Slova Patrusheva

May 22, 2025 -

Taylor Swift And Selena Gomez Feud The Blake Lively Factor

May 22, 2025

Taylor Swift And Selena Gomez Feud The Blake Lively Factor

May 22, 2025 -

Shlyakh Ukrayini Do Nato Rezultati Peregovoriv Ta Vikliki

May 22, 2025

Shlyakh Ukrayini Do Nato Rezultati Peregovoriv Ta Vikliki

May 22, 2025 -

Vid Nato Do Neytralitetu Chi Bezpechna Dlya Ukrayini Taka Politika

May 22, 2025

Vid Nato Do Neytralitetu Chi Bezpechna Dlya Ukrayini Taka Politika

May 22, 2025