Elon Musk's Return To Form: A Positive Sign For Tesla Investors?

Table of Contents

Improved Operational Efficiency at Tesla

Tesla's recent success isn't solely down to innovative products; it's also about significantly improved operational efficiency. The company has implemented several strategies to streamline production, reduce costs, and enhance its supply chain management. This improved efficiency directly impacts profitability and, consequently, the Tesla stock price.

- Increased Production Output at Gigafactories: Tesla's Gigafactories are producing vehicles at an unprecedented rate, meeting growing global demand and minimizing production bottlenecks. This increased output translates to higher revenue and improved profitability.

- Reduced Manufacturing Costs per Vehicle: Through process optimization and economies of scale, Tesla has managed to lower the manufacturing cost per vehicle, enhancing its profit margins and making its vehicles more competitive in the market.

- Improved Delivery Times: Reduced wait times for Tesla vehicles demonstrate improved logistics and supply chain management, leading to increased customer satisfaction and potentially boosting future sales.

- Successful New Product Launches or Updates: The successful launch of new models and software updates showcases Tesla's ability to adapt to market trends and maintain its position as a leader in the electric vehicle industry.

The correlation between Tesla production efficiency and its stock price is undeniable. Increased output, lower costs, and faster delivery times all contribute to a stronger financial outlook, influencing investor confidence and driving stock prices upward. This improved operational efficiency, driven by a more focused Musk, is a key component of his "return to form."

Renewed Focus on Innovation and Product Development

Beyond operational improvements, Tesla's continued focus on innovation remains a critical driver of its success and investor confidence. Recent advancements in several key areas highlight the company's commitment to pushing the boundaries of electric vehicle technology.

- Progress in Full Self-Driving (FSD) technology: While still under development, advancements in FSD technology remain a significant attraction for investors. The potential for fully autonomous driving represents a massive market opportunity for Tesla.

- New Battery Technology Improvements (range, charging speed): Improvements in battery technology, focusing on extended range and faster charging times, are crucial for enhancing the overall consumer appeal of Tesla vehicles and maintaining a competitive edge.

- Development of new electric vehicle models (Cybertruck, Roadster): The anticipated launch of new models like the Cybertruck and Roadster signifies Tesla’s ambition to expand its market reach and cater to a wider range of customer preferences. The anticipation surrounding these launches directly impacts investor sentiment and stock valuation.

These innovations directly contribute to Tesla's long-term growth potential, significantly influencing investor confidence and making Tesla stock a potentially attractive investment for those with a long-term outlook.

Stabilized Public Image and Leadership

Elon Musk's public image and leadership style have significantly impacted Tesla's stock performance in the past. Recent evidence suggests a more measured and focused approach from Musk, leading to a more stable public perception of both him and the company.

- Reduced controversial statements on social media: A less erratic social media presence contributes to a more stable public image, reducing negative headlines and uncertainty surrounding the company's leadership.

- Increased focus on company performance and goals: A clearer emphasis on operational excellence and achieving company targets signals a more responsible leadership style.

- Improved communication with investors and the public: More transparent and consistent communication builds trust with investors and the public, reducing uncertainty and positively impacting stock prices.

This shift towards a more stable public image and leadership style is crucial for maintaining investor confidence and attracting new investments, ultimately impacting Tesla's stock valuation positively.

Market Sentiment and Tesla Stock Performance

Analyzing Tesla's recent stock performance alongside Elon Musk's actions reveals a clear correlation. While broader market factors undoubtedly influence Tesla's valuation, positive changes in Musk's leadership and Tesla's operational efficiency have generally been met with positive market sentiment and stock price increases. (Include a relevant chart or graph here visually demonstrating this correlation). However, it's crucial to note that Tesla's stock remains volatile and subject to rapid changes based on various market forces.

Conclusion: Is Elon Musk's Return to Form Good News for Tesla Investors?

The evidence suggests that Elon Musk's perceived "return to form," marked by improved operational efficiency, a renewed focus on innovation, and a more stable public image, has positively impacted Tesla's stock performance. The improved production efficiency, exciting technological advancements, and stabilized public relations all point to a stronger and more sustainable future for the company. However, it's essential to acknowledge that the electric vehicle market is highly competitive, and unforeseen challenges could still significantly impact Tesla's future. This makes thorough due diligence crucial before making any investment decisions.

Learn more about Elon Musk's influence on Tesla's stock, and consider whether now is the time to invest in Tesla. Assess the risks and rewards of Tesla investments based on Elon Musk's recent performance. The future of Tesla, and the potential for significant returns, is intrinsically linked to the continued success of Elon Musk's leadership.

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025 -

Florentino Perez 20 Anos Al Frente Del Real Madrid Logros Y Controversias

May 25, 2025

Florentino Perez 20 Anos Al Frente Del Real Madrid Logros Y Controversias

May 25, 2025 -

Rassel Prinyos Mercedes 300 Y Podium Analiz Dostizheniy

May 25, 2025

Rassel Prinyos Mercedes 300 Y Podium Analiz Dostizheniy

May 25, 2025 -

Atletico Madrid In 3 Maclik Karanligi Bitti

May 25, 2025

Atletico Madrid In 3 Maclik Karanligi Bitti

May 25, 2025 -

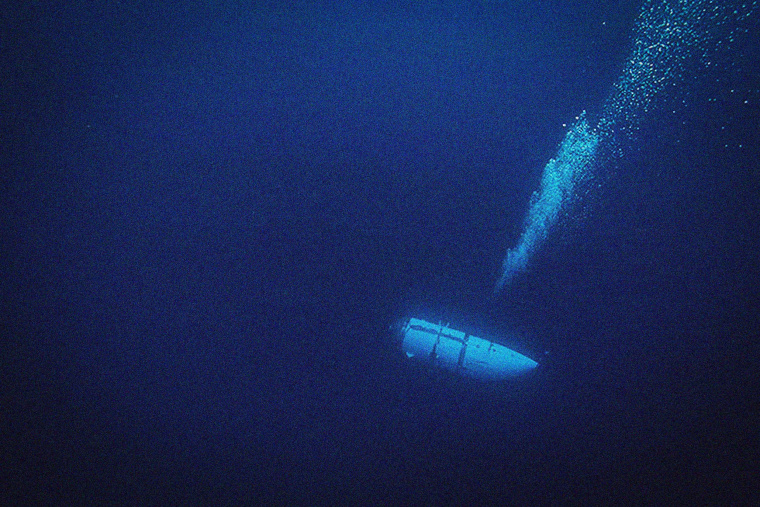

Footage Of Titan Subs Implosion The Distinctive Bang Explained

May 25, 2025

Footage Of Titan Subs Implosion The Distinctive Bang Explained

May 25, 2025

Latest Posts

-

L Ascension De Melanie Thierry De Ses Debuts A Aujourd Hui

May 25, 2025

L Ascension De Melanie Thierry De Ses Debuts A Aujourd Hui

May 25, 2025 -

Polemique Ardisson Accuse Baffie De Cracher Dans La Soupe

May 25, 2025

Polemique Ardisson Accuse Baffie De Cracher Dans La Soupe

May 25, 2025 -

Melanie Thierry Roles Films Et Recompenses

May 25, 2025

Melanie Thierry Roles Films Et Recompenses

May 25, 2025 -

Il Vient Cracher Dans La Soupe La Dispute Explosive Entre Ardisson Et Baffie

May 25, 2025

Il Vient Cracher Dans La Soupe La Dispute Explosive Entre Ardisson Et Baffie

May 25, 2025 -

Decouvrez La Vie Et L Uvre De Melanie Thierry

May 25, 2025

Decouvrez La Vie Et L Uvre De Melanie Thierry

May 25, 2025