Elon Musk's Net Worth Falls Below $300 Billion: Tesla's Troubles Take A Toll

Table of Contents

Tesla Stock Performance and its Impact on Musk's Net Worth

Tesla's stock (TSLA) performance is intrinsically linked to Elon Musk's net worth. A substantial portion of his wealth is directly tied to his ownership stake in the electric vehicle giant. Recent market data reveals a significant decline in Tesla's share price. For example, between [Start Date] and [End Date], TSLA experienced a [Percentage]% drop, impacting its overall market capitalization.

-

The reasons behind this stock price decline are multifaceted:

- Increased Competition: The electric vehicle market is becoming increasingly crowded, with established automakers and new entrants vying for market share. This intensified competition puts pressure on Tesla's sales and profitability.

- Production Challenges: Tesla has faced occasional production bottlenecks and delays, impacting its ability to meet the growing demand for its vehicles.

- Economic Downturn: Concerns about a potential recession and rising inflation have negatively affected investor sentiment towards growth stocks like Tesla.

- Investor Sentiment: Negative news cycles, including concerns about Musk's management of Twitter (now X), have also contributed to a decline in investor confidence in Tesla.

-

Direct Impact on Musk's Net Worth: As a significant shareholder, Musk's wealth is directly tied to Tesla's market capitalization. Any drop in the company's valuation translates to a proportional reduction in his net worth. A [Percentage]% decrease in Tesla's market cap directly correlates to a significant decrease in Musk's personal wealth.

-

Analyst Predictions: Analysts offer varying predictions for Tesla's future stock performance. Some remain bullish, citing the long-term growth potential of the electric vehicle market. However, others express concerns about Tesla's ability to maintain its market dominance amidst increasing competition and economic uncertainty.

Beyond Tesla: Diversification and Other Investments

While Tesla significantly contributes to Elon Musk's net worth, his wealth isn't solely dependent on it. His other ventures, including SpaceX, X (formerly Twitter), and The Boring Company, play a role, albeit a smaller one compared to Tesla.

-

Performance of Other Ventures: SpaceX, with its ambitious space exploration goals, is considered a valuable asset, although its valuation isn't publicly traded in the same way as Tesla. X, after significant changes and restructuring, faces its own financial challenges and uncertainty. The Boring Company's progress, while promising, remains in a relatively early stage of development.

-

Diversification: Despite his multiple ventures, Musk's portfolio remains relatively concentrated, with a significant portion of his net worth directly linked to Tesla's success. This lack of substantial diversification increases the vulnerability of his overall wealth to the fluctuations of the electric vehicle market.

-

Future Investments and Divestments: Future investment strategies and decisions regarding asset divestments will undoubtedly influence Musk’s net worth. Any major acquisitions or sales could significantly impact his overall wealth, potentially mitigating or exacerbating losses.

The Impact of Market Volatility and Economic Uncertainty

The recent decline in Elon Musk's net worth isn't solely attributable to Tesla's performance; broader economic factors also play a crucial role.

-

Macroeconomic Context: Global economic uncertainty, including inflation, rising interest rates, and the threat of a recession, has created a volatile market environment that negatively impacts many high-growth technology companies.

-

Impact of Inflation and Recessionary Pressures: Inflation and a potential recession impact consumer spending, making it more challenging for companies like Tesla to maintain high sales growth. This decreased consumer spending can directly affect Tesla's revenue and, therefore, its stock price.

-

Risk of Concentrated Investments: The decline highlights the inherent risk associated with heavily concentrating wealth in a single company, especially in a volatile market. Diversification is key to mitigating such risks.

Public Perception and Musk's Business Practices

Elon Musk's public image and business decisions significantly influence investor sentiment toward Tesla and, consequently, his net worth.

-

Influence of Public Statements and Actions: Musk's often controversial statements and actions on social media and in business dealings can negatively impact investor confidence in Tesla. His leadership style, while often lauded for its ambition, is also a source of uncertainty for some investors.

-

Impact of Controversies: The controversies surrounding Twitter/X, including significant layoffs and policy changes, have negatively affected investor perceptions of Musk's leadership and the long-term stability of his businesses. This, in turn, impacts the valuation of all his assets.

-

Public Perception and Market Valuation: Positive public perception and strong brand reputation are essential for maintaining high company valuations. Negative publicity and controversy can lead to reduced consumer confidence and ultimately, a decrease in market capitalization.

Conclusion

Elon Musk's net worth dropping below $300 billion underscores the inherent vulnerability of immense fortunes tied to volatile market conditions and the performance of a single company, even one as innovative as Tesla. This decline demonstrates the intricate interplay between company performance, macroeconomic factors, and public perception in shaping a billionaire's wealth. The complexities of business leadership within a rapidly shifting economic landscape are vividly illustrated. Factors beyond direct company control, such as public image and prevailing economic trends, exert significant influence on a billionaire's net worth.

Call to Action: Stay informed about the fluctuations in Elon Musk's net worth and the factors impacting Tesla's performance. Continue to follow this space for updates on Elon Musk's net worth and the ongoing challenges and triumphs of Tesla.

Featured Posts

-

How The Fentanyl Crisis Reshaped The Landscape Of Us China Trade Discussions

May 10, 2025

How The Fentanyl Crisis Reshaped The Landscape Of Us China Trade Discussions

May 10, 2025 -

Imf To Review Pakistans 1 3 Billion Loan Package Amidst India Tensions

May 10, 2025

Imf To Review Pakistans 1 3 Billion Loan Package Amidst India Tensions

May 10, 2025 -

The Trump Factor How Threats Reshaped Greenland Denmark Relations

May 10, 2025

The Trump Factor How Threats Reshaped Greenland Denmark Relations

May 10, 2025 -

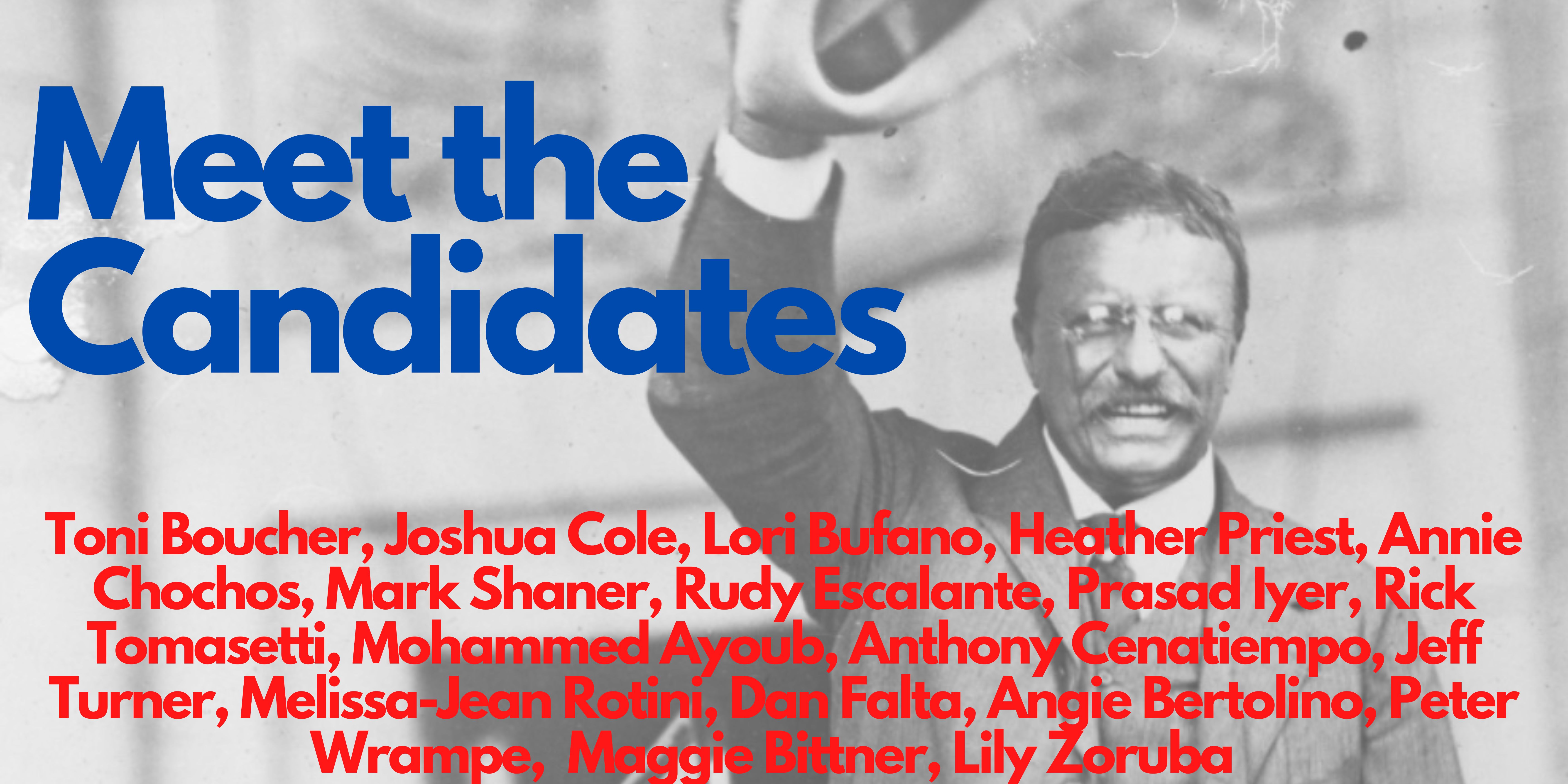

Understanding The Candidates In Your Nl Federal Riding

May 10, 2025

Understanding The Candidates In Your Nl Federal Riding

May 10, 2025 -

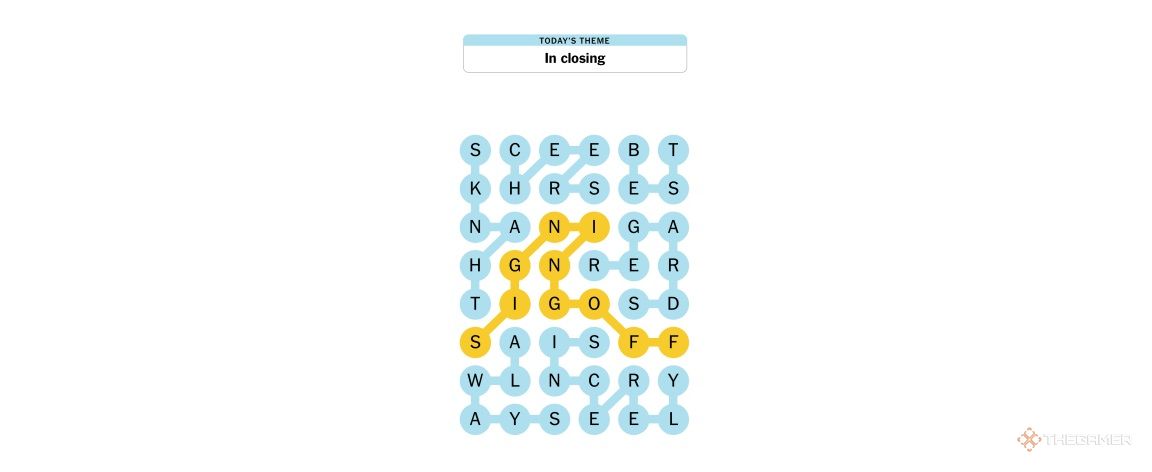

Nyt Spelling Bee Strands April 9th 2025 Complete Gameplay Guide

May 10, 2025

Nyt Spelling Bee Strands April 9th 2025 Complete Gameplay Guide

May 10, 2025