Economists Forecast Bank Of Canada Interest Rate Cuts Due To Tariff Impacts

Table of Contents

H2: The Impact of Tariffs on the Canadian Economy

Tariffs, essentially taxes on imported goods, create ripple effects throughout an economy. In Canada, the imposition of tariffs has led to significant challenges for businesses, consumers, and overall economic growth. Industries heavily reliant on international trade, such as the automotive and agricultural sectors, have been particularly hard hit.

-

Reduced Consumer Spending: Increased prices on imported goods, resulting from tariffs, directly reduce consumer purchasing power. This leads to decreased consumer spending, a key driver of economic growth. Consumers are forced to cut back on discretionary spending, impacting various sectors.

-

Decreased Business Investment: The uncertainty surrounding future trade policies and the increased cost of inputs creates hesitancy among businesses to invest in expansion or new projects. This dampens economic activity and job creation.

-

Slowdown in Economic Growth: The combined effects of reduced consumer spending and decreased business investment inevitably lead to a slowdown in overall economic growth. GDP growth forecasts are often revised downwards in response to significant tariff increases.

-

Potential Job Losses: Industries facing increased competition due to tariffs may be forced to reduce their workforce or even close down entirely, leading to job losses in affected sectors. This can have devastating social and economic repercussions.

For example, the automotive industry in Canada has felt the pinch of tariffs on imported parts, leading to reduced production and potential job losses. Similarly, Canadian farmers have faced challenges due to tariffs imposed on their exports. Data from Statistics Canada shows a clear correlation between tariff increases and decreased economic activity in key sectors.

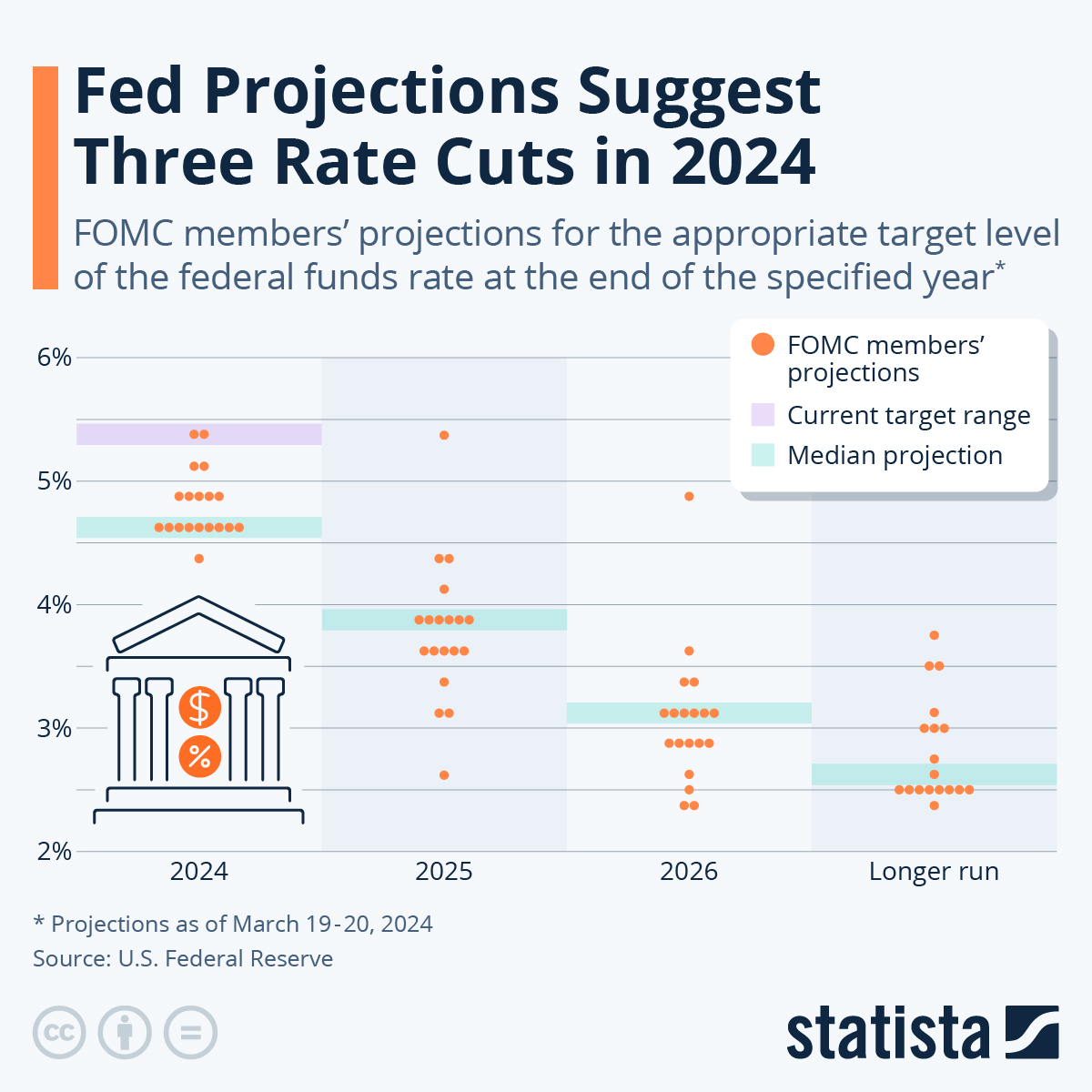

H2: Economists' Predictions and Rationale for Interest Rate Cuts

Faced with these negative economic consequences, many economists believe that interest rate cuts by the Bank of Canada are a necessary measure to stimulate the economy. The rationale behind this prediction is rooted in several key economic theories and models. Lowering interest rates makes borrowing cheaper for businesses and consumers, thereby encouraging investment and spending.

-

Stimulating Economic Growth: Lower borrowing costs incentivize businesses to invest in expansion, creating jobs and boosting economic activity. Consumers are also more likely to borrow money for major purchases like homes and cars, stimulating demand.

-

Encouraging Investment and Consumer Spending: Reduced interest rates make it more attractive for businesses to take out loans for expansion and investment, while consumers are more likely to borrow for purchases, boosting overall spending.

-

Preventing a Deeper Economic Slowdown or Recession: By acting proactively with interest rate reductions, the Bank of Canada aims to prevent a more significant economic downturn. A timely interest rate reduction can mitigate the negative impact of tariffs and avoid a recession.

-

Supporting Businesses Impacted by Tariffs: Lower borrowing costs provide a lifeline for businesses struggling under the weight of increased input costs due to tariffs, helping them to stay afloat and maintain employment.

Several prominent economists have publicly stated their belief that interest rate cuts are necessary given the current economic climate. [Insert links to relevant research or statements here, if available].

H2: Alternative Economic Policies and their Potential Effectiveness

While interest rate cuts are a primary tool, the Bank of Canada could also consider other policy options to address the negative impacts of tariffs. These include:

-

Quantitative Easing (QE): This involves the Bank of Canada injecting liquidity into the financial system by purchasing government bonds. QE can help lower long-term interest rates and increase the money supply. However, it carries risks like inflation.

-

Fiscal Stimulus: This involves the government increasing spending or cutting taxes to boost aggregate demand. Fiscal stimulus can be highly effective, but it requires political will and can lead to increased government debt.

A comparison of these options reveals that while each has potential benefits, interest rate cuts are often considered the most direct and immediate method for addressing a slowdown in economic activity caused by external factors like tariffs.

H2: The Bank of Canada's Response and Potential Future Actions

The Bank of Canada has been closely monitoring the economic situation and has issued statements acknowledging the challenges posed by tariffs. [Insert recent statements or actions from the Bank of Canada here]. While the exact timing and magnitude of any future interest rate cuts remain uncertain, analysts predict [insert predictions regarding timing and magnitude of potential cuts here]. Various scenarios are possible, depending on the evolution of trade tensions and the overall economic climate.

-

Scenario 1: A significant interest rate cut to counteract the negative impact of tariffs and prevent a recession.

-

Scenario 2: A more gradual approach with smaller interest rate reductions to assess the effectiveness of each move and avoid excessive inflation risks.

-

Scenario 3: A combination of interest rate cuts and other policy measures like quantitative easing to provide a comprehensive response.

3. Conclusion: The Future of Interest Rates and Tariff Impacts on the Canadian Economy

In conclusion, economists' forecasts point towards Bank of Canada interest rate cuts as a necessary response to the negative economic consequences of escalating tariffs. The significant impact of these tariffs on various sectors, including automotive and agriculture, necessitates proactive measures to prevent a deeper economic slowdown. The Bank of Canada's response will likely involve a careful consideration of various factors and a strategic approach to monetary policy, potentially including interest rate reduction alongside other policy tools. It is crucial to monitor the situation closely. Stay updated on the latest developments regarding Bank of Canada interest rate cuts and their connection to the ongoing tariff impacts by regularly checking reputable financial news sources such as the Bank of Canada's website and leading financial publications. Understanding these dynamics is vital for navigating the evolving economic landscape and making informed financial decisions in the face of uncertainty surrounding future interest rate changes and tariff impacts on the Canadian economy.

Featured Posts

-

Resistance Mounts Car Dealers Reiterate Opposition To Ev Mandates

May 12, 2025

Resistance Mounts Car Dealers Reiterate Opposition To Ev Mandates

May 12, 2025 -

From Scatological Data To Engaging Podcast An Ai Powered Solution

May 12, 2025

From Scatological Data To Engaging Podcast An Ai Powered Solution

May 12, 2025 -

How Many Fans Will Attend The Bristol Speedway Classic Manfred Watches On

May 12, 2025

How Many Fans Will Attend The Bristol Speedway Classic Manfred Watches On

May 12, 2025 -

Ice Arrest Public Intervention Causes Scene Of Disorder

May 12, 2025

Ice Arrest Public Intervention Causes Scene Of Disorder

May 12, 2025 -

The Bank Of Canada And The Tariffs Analyzing The Potential For Further Rate Cuts

May 12, 2025

The Bank Of Canada And The Tariffs Analyzing The Potential For Further Rate Cuts

May 12, 2025

Latest Posts

-

Kyle Tucker Trade A Look At The Cubs Fan Reaction

May 13, 2025

Kyle Tucker Trade A Look At The Cubs Fan Reaction

May 13, 2025 -

Analyzing The Fan Response To The Kyle Tucker Trade Rumors

May 13, 2025

Analyzing The Fan Response To The Kyle Tucker Trade Rumors

May 13, 2025 -

11 10 Loss Highlights Dodgers Offensive Struggle

May 13, 2025

11 10 Loss Highlights Dodgers Offensive Struggle

May 13, 2025 -

The Kyle Tucker Report And Its Impact On Cubs Fandom

May 13, 2025

The Kyle Tucker Report And Its Impact On Cubs Fandom

May 13, 2025 -

Is A Kyle Tucker Trade Realistic For The Cubs Fan Perspective

May 13, 2025

Is A Kyle Tucker Trade Realistic For The Cubs Fan Perspective

May 13, 2025