The Bank Of Canada And The Tariffs: Analyzing The Potential For Further Rate Cuts

Table of Contents

The Impact of Tariffs on the Canadian Economy

Tariffs, essentially taxes on imported goods, have far-reaching consequences for the Canadian economy. These trade barriers disrupt established trade relationships, leading to reduced competitiveness and impacting various sectors. The effects are felt across the board:

-

Manufacturing: Canadian manufacturers, particularly those reliant on imported components or exporting to tariff-affected markets, face higher input costs and reduced export demand. This can lead to decreased production, job losses, and reduced investment.

-

Agriculture: The agricultural sector is particularly vulnerable, with tariffs on Canadian agricultural exports to key trading partners directly impacting farmers' incomes and the viability of agricultural businesses.

-

Exports: The overall volume of Canadian exports is negatively impacted by retaliatory tariffs imposed by other countries in response to Canadian tariffs or those imposed by other nations. This decline in exports dampens economic growth.

The uncertainty surrounding tariffs also discourages investment and consumer spending. Businesses postpone expansion plans, and consumers become hesitant to make large purchases, fearing further economic downturn. Statistics Canada data on GDP growth, inflation, and unemployment will be crucial in assessing the overall effect of tariffs on the Canadian economy. For instance, a slowdown in GDP growth coupled with rising unemployment may signal the need for BoC intervention.

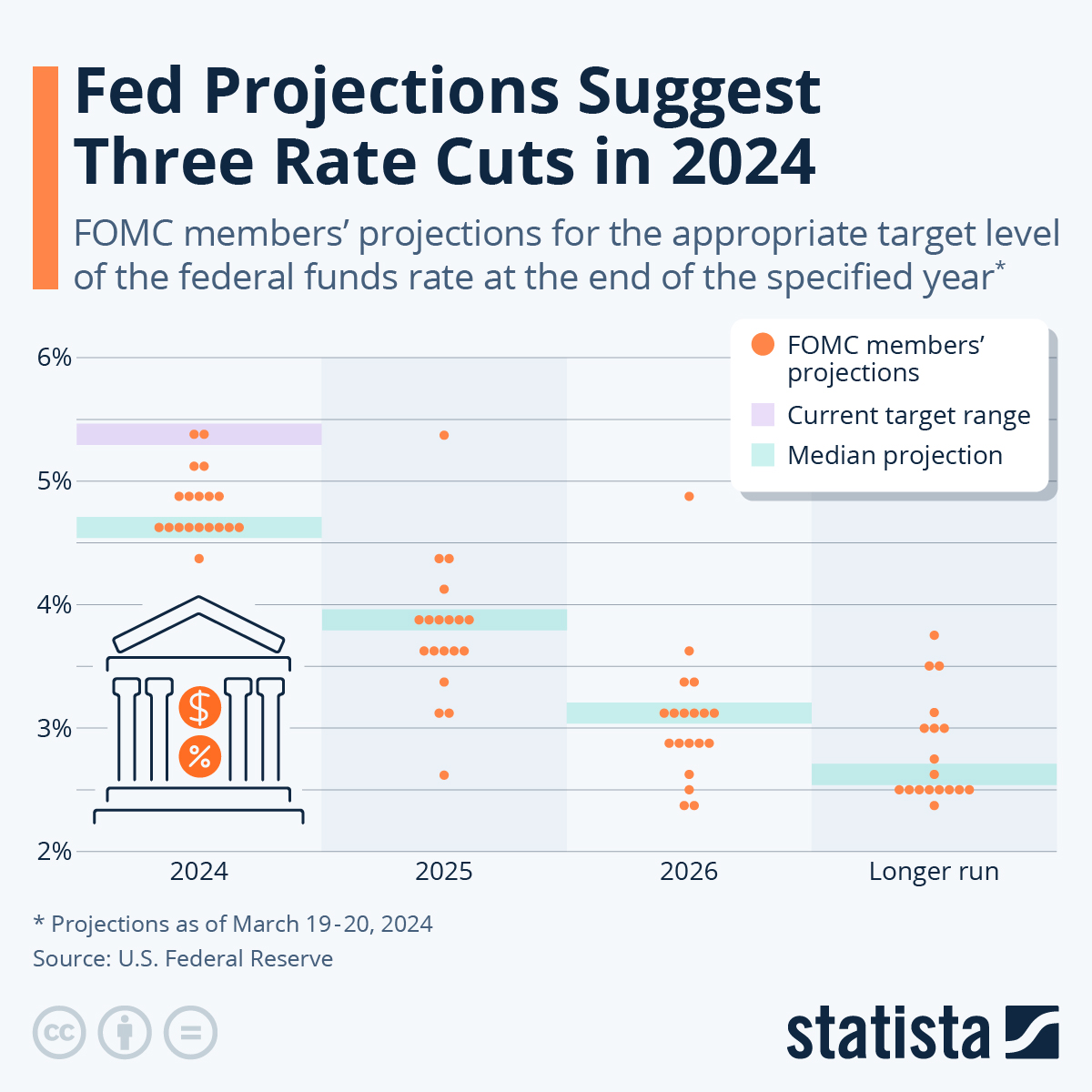

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's primary mandate is to maintain price stability and full employment. To achieve this, the BoC uses monetary policy tools, primarily adjusting the policy interest rate – the overnight rate – which influences borrowing costs across the economy. Currently, the BoC's policy interest rate stands at [Insert current BoC interest rate here]. The rationale behind this rate is [Insert BoC's stated rationale for the current rate – reference their latest announcements].

The BoC's recent statements and announcements reflect its assessment of the economic outlook. Key considerations include:

-

Inflation: The BoC closely monitors inflation to ensure it remains within its target range. High inflation may necessitate a rate hike, while low inflation might encourage rate cuts.

-

Economic Growth: GDP growth figures are a critical indicator of the economy's health. Slowing growth may prompt the BoC to consider easing monetary policy.

-

Unemployment: High unemployment rates indicate slack in the economy, which could lead the BoC to lower interest rates to stimulate job creation.

Understanding the BoC's current stance is paramount in predicting the likelihood of future rate adjustments.

Analyzing the Likelihood of Further Rate Cuts

Predicting future Bank of Canada rate cuts requires analyzing various economic indicators and scenarios:

-

Scenario 1 (Strong Economy): If GDP growth remains robust, inflation remains within the target range, and unemployment stays low, the probability of further rate cuts is low. The BoC may maintain its current interest rate or even consider a gradual increase.

-

Scenario 2 (Moderate Slowdown): A moderate economic slowdown, characterized by slowing GDP growth and slightly rising unemployment, might prompt the BoC to implement one or two further rate cuts to stimulate economic activity.

-

Scenario 3 (Significant Slowdown): A significant economic contraction, possibly triggered by a prolonged trade war and persistent tariff uncertainty, could lead to more aggressive monetary easing, including several substantial Bank of Canada rate cuts.

However, the BoC must also consider the potential risks associated with aggressive rate cuts:

-

Inflation Risk: Excessive monetary easing can fuel inflation if the economy overheats.

-

Asset Bubbles: Low interest rates can inflate asset bubbles (e.g., in the housing market), creating future financial instability.

Alternative policy options might include targeted interventions to specific sectors most affected by tariffs, rather than broad-based rate cuts.

Market Reactions and Investor Sentiment

Financial markets react sensitively to the BoC's policy decisions and the overall economic climate. The Canadian dollar exchange rate is influenced by interest rate expectations; further rate cuts could weaken the Canadian dollar relative to other currencies. Investor sentiment reflects the overall market confidence in the Canadian economy. Negative sentiment due to tariff uncertainty could lead to capital flight and further pressure on the BoC to ease monetary policy. Bond yields, typically inversely correlated with interest rates, provide further insights into market expectations regarding future rate cuts. Analyzing these indicators provides a crucial understanding of the market's anticipations of future BoC actions.

Conclusion: The Future of Bank of Canada Rate Cuts in a Tariff-Affected Economy

The likelihood of further Bank of Canada rate cuts is contingent on the evolving economic landscape, particularly the impact of tariffs and trade uncertainty. While a strong economy might see the BoC maintain or even slightly increase interest rates, a significant economic slowdown fueled by trade tensions could necessitate several rate cuts to stimulate growth and employment. The BoC's careful balancing act between stimulating the economy and mitigating the risks of inflation and asset bubbles will ultimately determine the future trajectory of interest rates. The interplay between economic indicators, market reactions, and investor sentiment will inform the BoC's decisions. Stay updated on the latest developments in Bank of Canada rate cuts and their impact on your financial planning. Closely follow the BoC's announcements to understand the future trajectory of interest rates and how they may affect your investments.

Featured Posts

-

Plan Trampa Schodo Zavershennya Viyni Rizka Kritika Vid Borisa Dzhonsona

May 12, 2025

Plan Trampa Schodo Zavershennya Viyni Rizka Kritika Vid Borisa Dzhonsona

May 12, 2025 -

Ice Arrest Public Intervention Causes Scene Of Disorder

May 12, 2025

Ice Arrest Public Intervention Causes Scene Of Disorder

May 12, 2025 -

End Of Outings For Refugees Fabers Revised Program

May 12, 2025

End Of Outings For Refugees Fabers Revised Program

May 12, 2025 -

Tennessee Cruises To 12 1 Victory Over Indiana State

May 12, 2025

Tennessee Cruises To 12 1 Victory Over Indiana State

May 12, 2025 -

Celtics Impressive Victory Seals Division Championship

May 12, 2025

Celtics Impressive Victory Seals Division Championship

May 12, 2025

Latest Posts

-

Heatstroke Alert Delhi Government Issues Advisory Amid Rising Temperatures

May 13, 2025

Heatstroke Alert Delhi Government Issues Advisory Amid Rising Temperatures

May 13, 2025 -

Delhi Mercury Soars Government Issues Heatstroke Warning And Advisory

May 13, 2025

Delhi Mercury Soars Government Issues Heatstroke Warning And Advisory

May 13, 2025 -

Delhi Governments Heatwave Advisory Stay Safe From Soaring Temperatures

May 13, 2025

Delhi Governments Heatwave Advisory Stay Safe From Soaring Temperatures

May 13, 2025 -

Extreme Heat Alert Record Temperatures Bake La And Orange Counties

May 13, 2025

Extreme Heat Alert Record Temperatures Bake La And Orange Counties

May 13, 2025 -

Delhi Heatwave Government Issues Advisory Heatstroke Warning

May 13, 2025

Delhi Heatwave Government Issues Advisory Heatstroke Warning

May 13, 2025