Dubai Holding's REIT IPO: A $584 Million Boost

Table of Contents

The Significance of the $584 Million IPO

The Dubai Holding REIT IPO's success is more than just a financial figure; it's a powerful statement about the confidence in Dubai's real estate market. The $584 million raised represents a substantial influx of capital for Dubai Holding, allowing for further investment in developing and expanding its already impressive portfolio of properties. This is particularly significant when compared to other REIT offerings in the region, many of which have raised considerably less capital. This Dubai Holding REIT IPO positions Dubai as a leading player in the global REIT market.

The impact extends beyond Dubai Holding itself. The IPO has several crucial implications for the broader economy:

- Increased capital for Dubai Holding's future projects: This substantial capital injection will enable Dubai Holding to pursue ambitious development projects, contributing to the city's ongoing transformation.

- Attraction of foreign investment into Dubai's real estate market: The successful IPO serves as a powerful magnet for international investors, further diversifying the sources of capital flowing into the Dubai real estate sector. This influx of foreign investment strengthens the market’s resilience.

- Boost to Dubai's overall financial standing: The Dubai Holding REIT IPO demonstrates the robustness of Dubai's financial system and its ability to attract substantial investment, bolstering its global standing.

- Potential for job creation and economic growth: The increased investment and development activity spurred by the IPO are expected to lead to significant job creation across various sectors, contributing to overall economic growth.

Attractiveness of Dubai's Real Estate Market

The success of the Dubai Holding REIT IPO is a testament to the enduring appeal of Dubai's real estate market. Several key factors contributed to this success:

- Dubai's stable political and economic environment: Dubai's reputation for political stability and a robust, business-friendly economic environment is a major draw for investors seeking long-term growth opportunities. This stability significantly reduces investment risk.

- Strategic location and robust infrastructure: Dubai's strategic location as a global hub, combined with its world-class infrastructure, makes it an attractive destination for businesses and individuals alike, underpinning the demand for real estate.

- Strong tourism sector driving demand: The thriving tourism sector in Dubai contributes significantly to the demand for both residential and commercial properties, making real estate a sound investment.

Further underpinning the attractiveness of this particular REIT offering are:

- Government initiatives supporting real estate development: The Dubai government actively supports the real estate sector through various initiatives, encouraging investment and development.

- High rental yields and capital appreciation potential: Dubai's real estate market offers investors the potential for strong rental income and significant capital appreciation, making it an appealing investment option.

- Diversified portfolio of high-quality assets within the REIT: The REIT's portfolio includes a diverse range of high-quality assets across various sectors, mitigating risk and enhancing returns for investors.

Implications for Future Investment in Dubai Real Estate

The successful Dubai Holding REIT IPO is likely to have a significant impact on future investment in Dubai's real estate sector. We can expect:

- Increased liquidity in the Dubai real estate market: The IPO's success introduces greater liquidity, making it easier for investors to buy and sell properties.

- Potential for higher property valuations: Increased investor interest driven by the IPO may lead to higher property valuations across the market.

- Attraction of more international investors: The successful IPO will likely attract further international investment, boosting the sector's growth.

- Development of more sophisticated investment products in the region: This successful IPO could pave the way for the development of more sophisticated and innovative investment products in the region.

Risks and Challenges

While the outlook is positive, it's crucial to acknowledge potential risks associated with investment in Dubai real estate:

- Potential impact of global economic downturns: Global economic fluctuations can impact the real estate market, affecting demand and prices.

- Regulatory changes affecting the real estate sector: Changes in government regulations could impact investment strategies and returns.

- Competition from other regional markets: Competition from other emerging markets in the region could affect the relative attractiveness of Dubai's real estate market.

Conclusion

The Dubai Holding REIT IPO, generating $584 million, signifies a major boost for Dubai's real estate market and its economy. The success of this IPO reflects the strength and attractiveness of Dubai's property sector, driven by strong fundamentals and supportive government policies. This landmark event is likely to stimulate further investment and development, paving the way for a more robust and sophisticated real estate market. To stay informed about the latest developments in this dynamic sector, and learn more about investment opportunities in the wake of the successful Dubai Holding REIT IPO, keep following our updates on the Dubai real estate market. Interested in learning more about similar opportunities in the future? Stay tuned for news on future Dubai Holding REIT IPOs and other promising investment options.

Featured Posts

-

Top Deals Hugo Boss Perfumes In Amazons Spring 2025 Sale

May 20, 2025

Top Deals Hugo Boss Perfumes In Amazons Spring 2025 Sale

May 20, 2025 -

Will Tariffs Reverse The Buy Canadian Trend In Beauty

May 20, 2025

Will Tariffs Reverse The Buy Canadian Trend In Beauty

May 20, 2025 -

Michael Strahan And Good Morning America Understanding His Decision To Depart

May 20, 2025

Michael Strahan And Good Morning America Understanding His Decision To Depart

May 20, 2025 -

New Hmrc Tax Codes For Savers What You Need To Know

May 20, 2025

New Hmrc Tax Codes For Savers What You Need To Know

May 20, 2025 -

Cote D Ivoire Port Autonome D Abidjan Paa Trafic Record En 2022

May 20, 2025

Cote D Ivoire Port Autonome D Abidjan Paa Trafic Record En 2022

May 20, 2025

Latest Posts

-

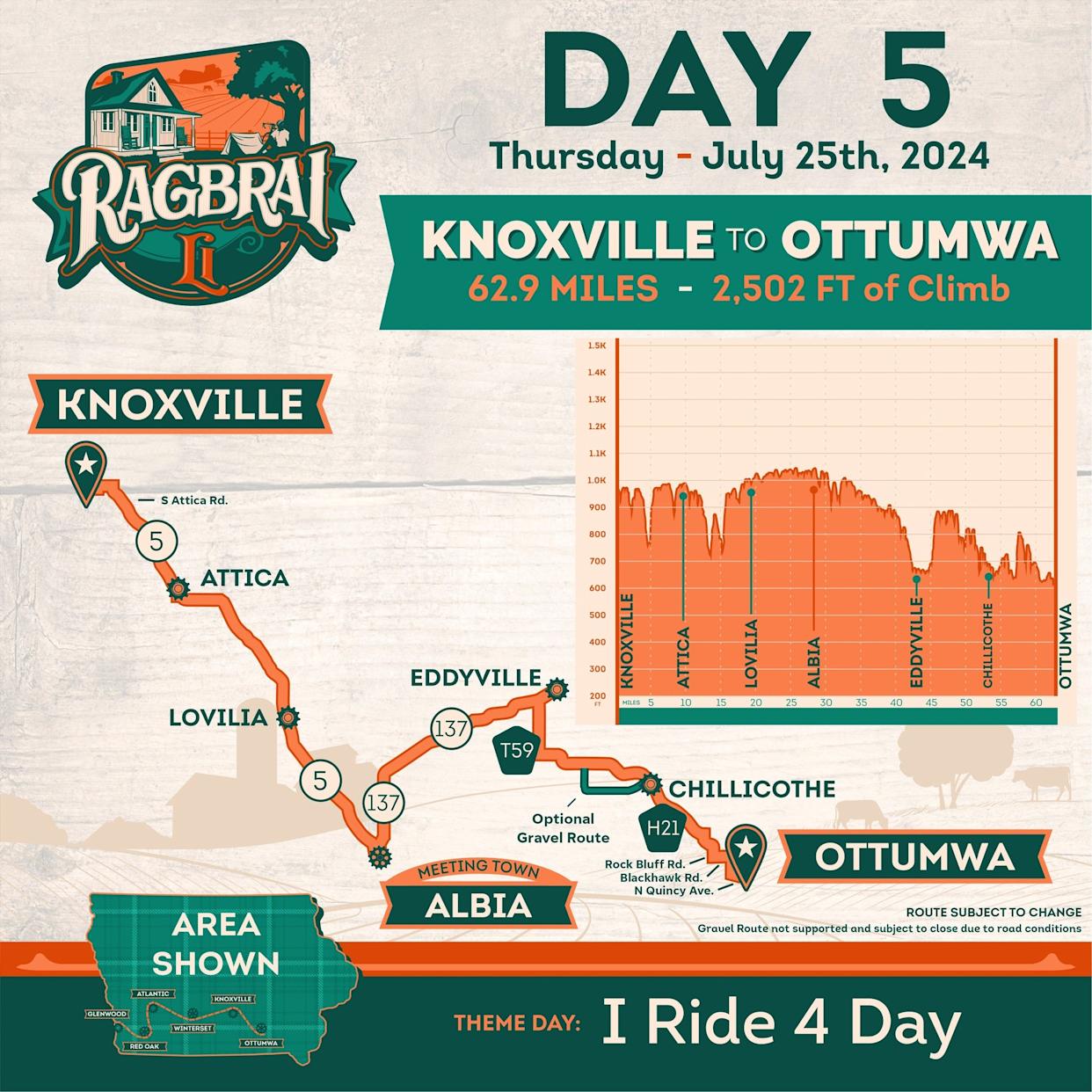

From Ragbrai To Daily Rides Scott Savilles Passion For Biking

May 20, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Biking

May 20, 2025 -

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025 -

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025 -

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025 -

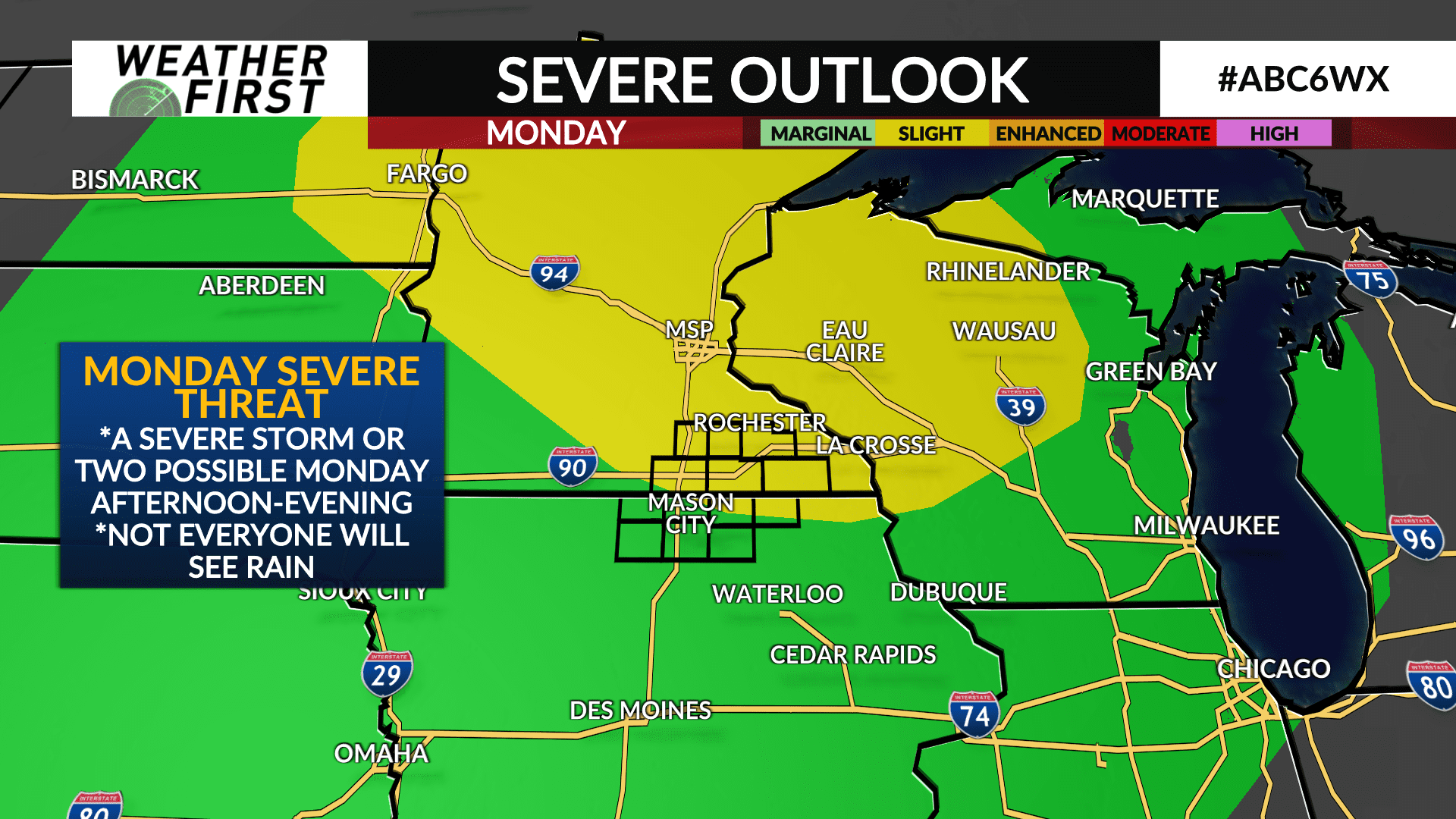

Increased Storm Chance Overnight Severe Weather Possible Monday

May 20, 2025

Increased Storm Chance Overnight Severe Weather Possible Monday

May 20, 2025