New HMRC Tax Codes For Savers: What You Need To Know

Table of Contents

Key Changes in HMRC Tax Codes for 2024 (and beyond)

The HMRC regularly updates tax codes to reflect changes in legislation and economic conditions. For 2024 and beyond, several key changes affect savers. While specifics are subject to annual budget announcements, be aware of potential adjustments to:

- Savings Allowance: The amount of savings income you can receive tax-free might be altered. This allowance varies depending on your overall income and other tax-relevant factors.

- Tax Rates on Savings Interest: The tax rates applied to savings interest earned above the personal savings allowance could change. This means a higher percentage of interest earned may be subject to income tax.

- Dividend Allowance: The amount of dividends you can receive tax-free might also see adjustments. This is relevant for those with dividend-paying savings accounts or investments.

These changes affect various savings vehicles differently. For example, the impact on a cash ISA will differ from the effect on a standard savings account or a pension.

| Savings Account Type | Potential Impact of New HMRC Tax Codes |

|---|---|

| ISA (Individual Savings Account) | Changes to tax-free allowances or eligibility. Specific allowances need to be checked annually. |

| Cash Savings Accounts | Changes to the tax rates applied to interest earned above the personal savings allowance. |

| Pension Savings | Potential changes to tax relief on contributions or tax implications on withdrawals. |

Keywords: HMRC tax code changes 2024, new tax codes, savings tax thresholds, ISA tax allowance.

How the New HMRC Tax Codes Impact Different Savings Accounts

Understanding how the new HMRC tax codes affect your specific savings accounts is crucial for effective financial planning.

Impact on ISAs (Individual Savings Accounts)

Generally, ISAs remain a tax-efficient way to save, as interest earned within an ISA remains tax-free. However, be aware of any changes to the annual ISA allowance. Staying informed about the annual allowance and subscription limits is vital to maximizing tax benefits. Keep track of changes to eligibility criteria.

Impact on Cash Savings Accounts

Interest earned on regular savings accounts above the personal savings allowance will be subject to income tax based on your individual tax rate. The new tax codes might alter this allowance or the applicable tax rates. Therefore, closely monitoring your interest income and its tax implications is crucial.

Impact on Pension Savings

Pension contributions typically receive tax relief, reducing your overall tax liability. Changes to the HMRC tax codes may alter the amount of relief you receive, or there might be alterations in the tax treatment of pension withdrawals. It's essential to understand how these changes will affect your retirement planning.

Keywords: ISA tax, cash savings tax, pension tax relief, tax-free savings.

Checking Your HMRC Tax Code and Understanding Your Tax Liability

Knowing your HMRC tax code is fundamental to managing your tax affairs.

- Access HMRC Online Services: Log in to your HMRC online account.

- Locate Your Tax Code: Your tax code is usually displayed prominently on your personal tax information.

- Understand Your Tax Liability: Use online HMRC tools or consult a tax advisor to calculate your tax liability based on your income and tax code.

If you have questions or believe there's an error, contact the HMRC helpline or visit a local tax office. Be prepared to provide your National Insurance number and other relevant personal information when contacting them.

Keywords: HMRC online services, check tax code, understand tax liability, tax calculation, HMRC helpline.

Planning Your Savings Strategy with the New HMRC Tax Codes

With the changes in HMRC tax codes, adapting your savings strategy is crucial.

- Diversify Your Savings: Explore different savings options to spread your risk and potentially benefit from varied tax treatments.

- Maximize Tax-Efficient Accounts: Fully utilize your ISA allowance to shield savings from tax.

- Seek Professional Advice: Consult a financial advisor for personalized tax planning tailored to your circumstances.

Remember, your savings strategy should align with your financial goals, risk tolerance, and tax implications.

Keywords: savings strategy, tax planning, financial planning, tax optimization, minimize tax.

Conclusion: Staying Informed About Your HMRC Tax Codes for Savers

Understanding the impact of the new HMRC tax codes on your savings is essential. Regularly review your tax code, monitor your savings income, and utilize the available resources from HMRC to stay informed. By strategically planning your savings, you can maximize your returns and minimize your tax liability. To effectively optimize your savings strategy with the new HMRC tax codes, visit the HMRC website or seek professional financial advice. Understand your HMRC tax liability and make informed decisions about your financial future. Review your HMRC tax code regularly to ensure accuracy and maximize your savings potential.

Featured Posts

-

Talisca Tadic Transferi Fenerbahce De Yeni Bir Doenem

May 20, 2025

Talisca Tadic Transferi Fenerbahce De Yeni Bir Doenem

May 20, 2025 -

Leclercs Future At Ferrari The Hamilton Factor

May 20, 2025

Leclercs Future At Ferrari The Hamilton Factor

May 20, 2025 -

Ferraris Chinese Gp Start Hamilton And Leclercs Contact

May 20, 2025

Ferraris Chinese Gp Start Hamilton And Leclercs Contact

May 20, 2025 -

Jennifer Lawrence Druhe Dieta Stastna Dvojnasobna Mama

May 20, 2025

Jennifer Lawrence Druhe Dieta Stastna Dvojnasobna Mama

May 20, 2025 -

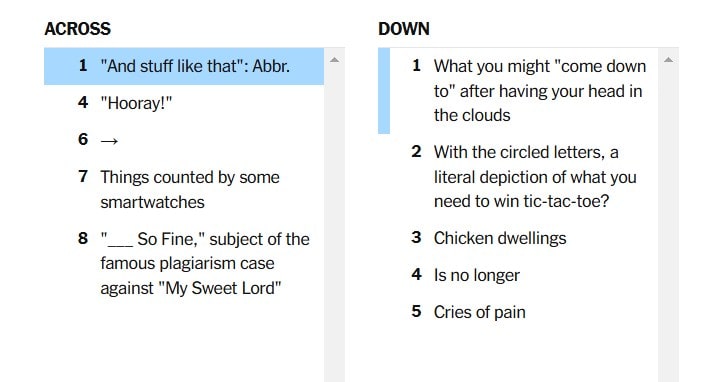

March 8 Nyt Mini Crossword Solutions And Clues

May 20, 2025

March 8 Nyt Mini Crossword Solutions And Clues

May 20, 2025

Latest Posts

-

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025 -

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025 -

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025