Dubai Holding REIT IPO Size Jumps To $584 Million

Table of Contents

Increased IPO Size and its Implications

The upward revision of the Dubai Holding REIT IPO size to $584 million speaks volumes about the current market sentiment. Several factors likely contributed to this increase. Initially, the projected size might have underestimated the substantial investor interest generated by Dubai Holding's impressive real estate portfolio. Stronger-than-expected market conditions, characterized by robust economic growth and increased capital inflows into the region, further fueled this upward trend. Furthermore, a reassessment of the underlying asset valuations, likely reflecting the continued appreciation of Dubai's prime real estate, could have also played a significant role.

This expanded IPO size directly impacts the valuation of Dubai Holding's real estate assets, placing them at a significantly higher premium than previously estimated. This reflects increased confidence in the long-term growth prospects of these assets and the overall Dubai real estate market. The potential for future growth and returns for investors is considerable, making the Dubai Holding REIT IPO an attractive proposition for both local and international investors.

- Specific figures: The IPO size increase represents a significant percentage jump from the initial projection (insert percentage if available).

- Key investors: While details may not be publicly available immediately, it is likely that a mix of institutional and high-net-worth individuals are participating.

- Strategic goals: The increased IPO size likely reflects Dubai Holding's strategic objectives of optimizing its real estate portfolio and unlocking further value for its shareholders.

Attractiveness of the Dubai Real Estate Market

The Dubai real estate market is currently experiencing a period of significant growth. This boom is fueled by several factors, including robust economic growth, government initiatives promoting real estate investment, and a steady influx of both residents and tourists. The emirate’s strategic location, world-class infrastructure, and favorable tax policies further enhance its appeal.

However, investing in any real estate market involves inherent risks. Potential challenges include fluctuations in global economic conditions, geopolitical instability, and potential changes in government regulations. A thorough due diligence process is essential before investing.

The Dubai Holding REIT differentiates itself from other REITs in the region through its strategic location, diverse portfolio of high-quality assets, and strong management team. This makes it a unique and competitive investment opportunity.

- Key market indicators: Occupancy rates in prime areas of Dubai remain high, and rental yields are comparatively strong compared to other international markets.

- Government initiatives: The Dubai government actively promotes real estate investment through various supportive policies and infrastructure development.

- KPI comparison: A comparison with competitor REITs in the region would highlight the Dubai Holding REIT's competitive advantages in terms of yield, occupancy, and asset quality (insert comparative data if available).

Investor Sentiment and Market Reaction

The initial market reaction to the increased Dubai Holding REIT IPO size has been largely positive. Early trading indicates strong demand, with the stock price experiencing a positive surge (insert data if available). This reflects investor confidence in the strength of the underlying assets and the long-term prospects of the Dubai real estate market.

The increased IPO size might also influence other real estate investment opportunities in Dubai. It could trigger a ripple effect, potentially leading to increased valuations and higher transaction volumes across the market. Overall, investor sentiment towards the Dubai Holding REIT is overwhelmingly optimistic, with many analysts forecasting robust growth in the coming years.

- Stock market performance: Track and report on the stock's performance following the IPO.

- Expert opinions: Include quotes from financial analysts and experts commenting on the IPO's success and future outlook.

- Media sentiment: Summarize the overall tone and coverage of the IPO in major news outlets.

Potential Risks and Challenges

While the prospects for the Dubai Holding REIT IPO are promising, investors should be aware of potential risks and challenges. Geopolitical uncertainties in the region could impact investor sentiment and market stability. Furthermore, global economic downturns could affect rental yields and property values. Competition from other real estate investment trusts (REITs) operating in Dubai also presents a challenge.

- Geopolitical risks: Mention any potential regional conflicts or political instability that might affect the market.

- Economic uncertainties: Discuss the impact of global economic fluctuations on the Dubai real estate market.

- Market competition: Analyze the competitive landscape and identify potential threats from other REITs.

Conclusion: Investing in the Booming Dubai Holding REIT IPO

The increased size of the Dubai Holding REIT IPO to $584 million signifies a strong vote of confidence in Dubai's dynamic real estate market and the potential for substantial returns. This development underscores the attractiveness of the Dubai real estate sector to both domestic and international investors. The potential for growth and the strategic positioning of Dubai Holding within the market make this a compelling investment opportunity. However, it's crucial to conduct thorough research and consider the inherent risks involved before making any investment decisions. To learn more about the Dubai Holding REIT investment opportunities and explore the detailed prospectus, visit [insert link to relevant resource]. Explore the potential of Dubai REIT IPO opportunities and secure your stake in this thriving market today.

Featured Posts

-

L Ia Au Service De L Ecriture Reproduire Le Style D Agatha Christie Perspective Et Limites

May 20, 2025

L Ia Au Service De L Ecriture Reproduire Le Style D Agatha Christie Perspective Et Limites

May 20, 2025 -

Sostoyanie Mikhaelya Shumakhera Drug Podelilsya Pechalnoy Situatsiey

May 20, 2025

Sostoyanie Mikhaelya Shumakhera Drug Podelilsya Pechalnoy Situatsiey

May 20, 2025 -

Big Bear Ai Holdings Bbai Evaluating Its Potential As An Ai Penny Stock

May 20, 2025

Big Bear Ai Holdings Bbai Evaluating Its Potential As An Ai Penny Stock

May 20, 2025 -

Mega Tampoy Apokalypsi Gegonoton Sto Apopsino Epeisodio

May 20, 2025

Mega Tampoy Apokalypsi Gegonoton Sto Apopsino Epeisodio

May 20, 2025 -

Middle Management Their Crucial Role In Organizational Effectiveness And Employee Development

May 20, 2025

Middle Management Their Crucial Role In Organizational Effectiveness And Employee Development

May 20, 2025

Latest Posts

-

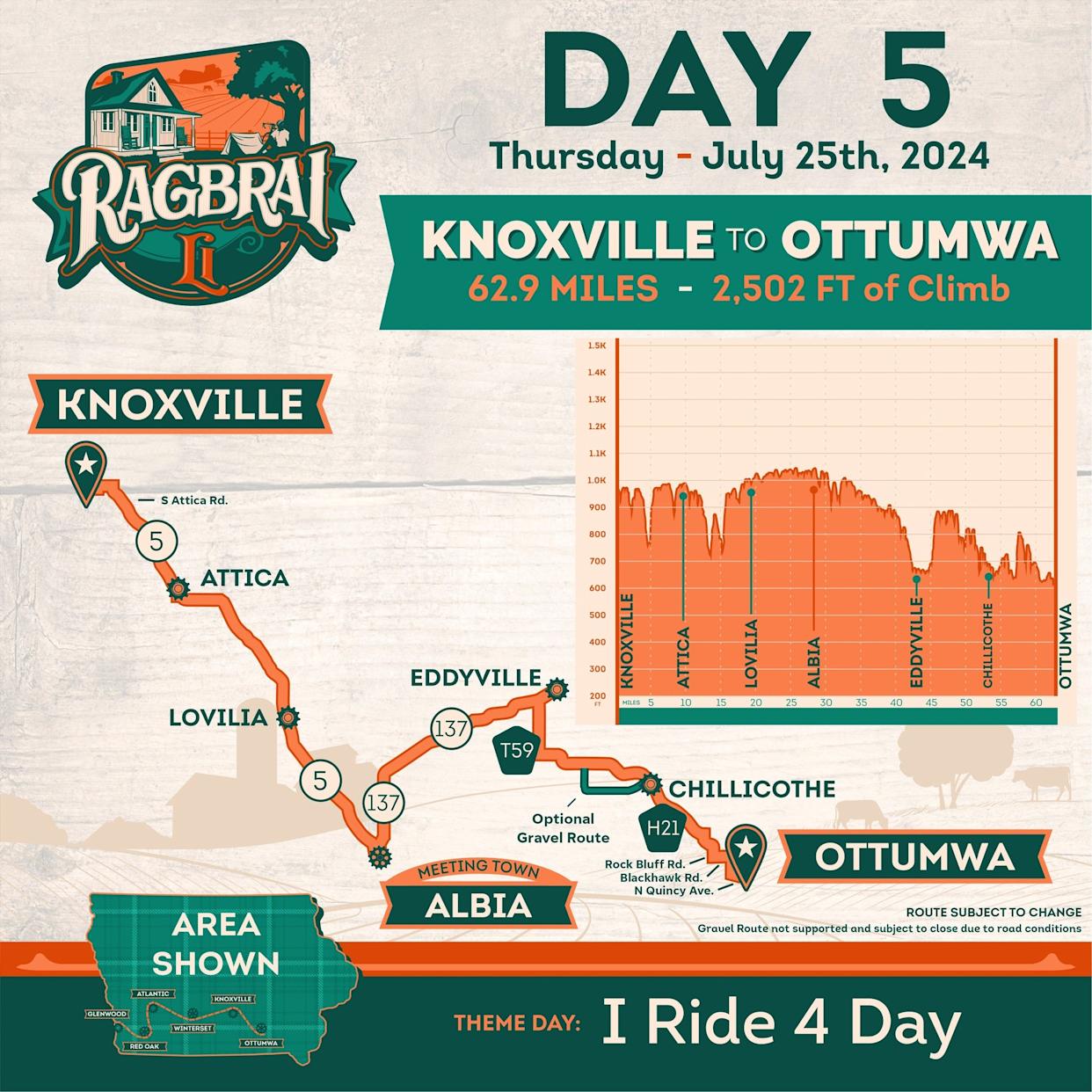

From Ragbrai To Daily Rides Scott Savilles Passion For Biking

May 20, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Biking

May 20, 2025 -

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025 -

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025 -

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025

Washington County Breeder Faces Action After 49 Dogs Removed

May 20, 2025 -

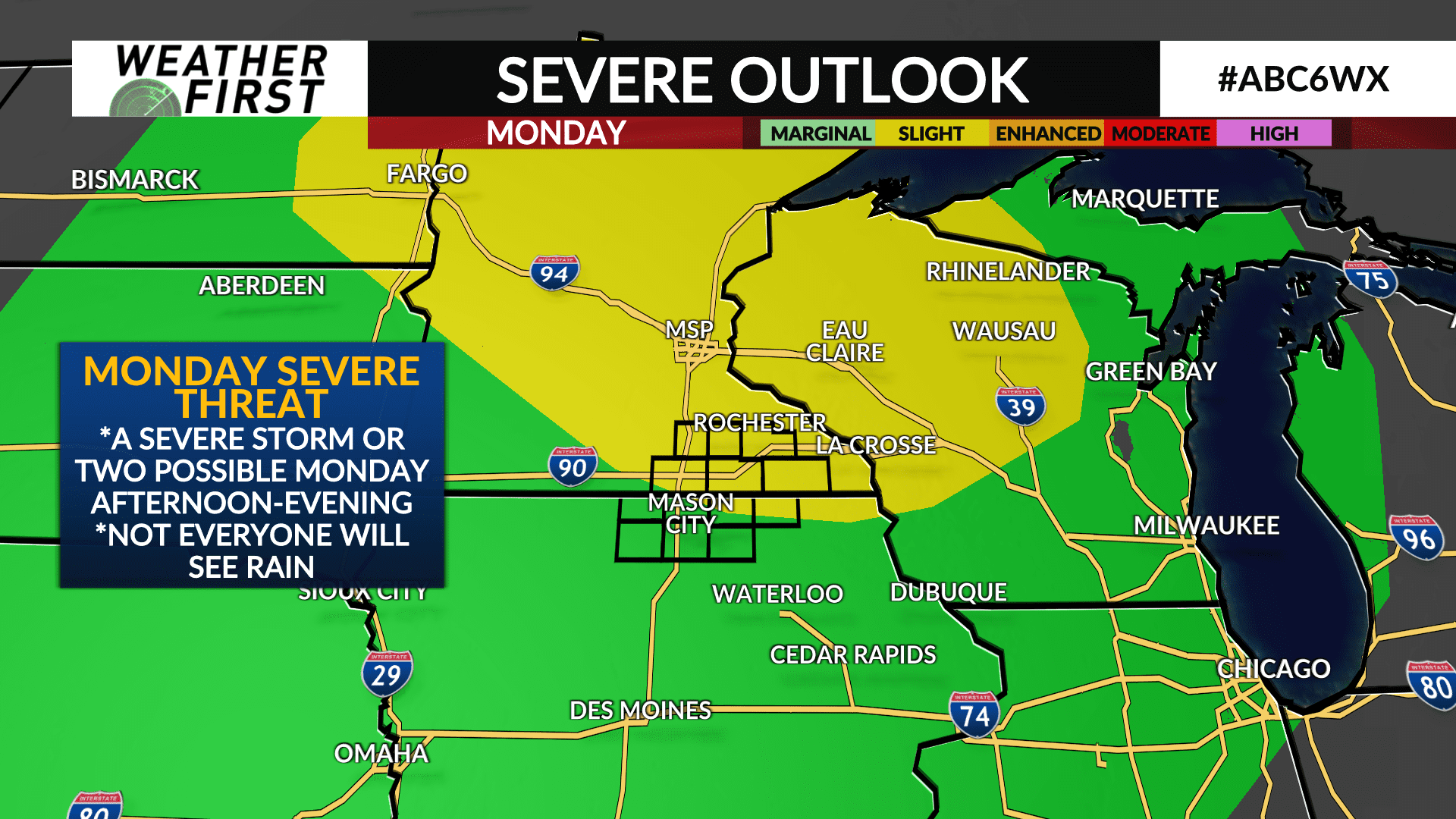

Increased Storm Chance Overnight Severe Weather Possible Monday

May 20, 2025

Increased Storm Chance Overnight Severe Weather Possible Monday

May 20, 2025