BigBear.ai Holdings (BBAI): Evaluating Its Potential As An AI Penny Stock

Table of Contents

Understanding BigBear.ai Holdings (BBAI) and its Business Model

BigBear.ai Holdings (BBAI) provides AI-powered solutions and services primarily to government and commercial clients. Its core business revolves around leveraging advanced analytics and artificial intelligence to solve complex problems across various sectors. The company boasts a diverse portfolio of offerings, making it a potentially attractive investment in the AI sector.

-

Key Technologies and Offerings: BBAI's AI capabilities include:

- Data Analytics: Processing and interpreting vast datasets to extract actionable insights.

- AI-Driven Decision Support: Providing intelligent recommendations and predictions to aid decision-making processes.

- Cybersecurity Solutions: Utilizing AI to enhance threat detection and response capabilities.

- Geospatial Intelligence: Leveraging AI to analyze geographic data for various applications.

-

Target Market: BBAI focuses on two key markets with significant growth potential:

- Government: Providing crucial AI solutions for national security, defense, and intelligence agencies. This often involves securing large government contracts.

- Commercial: Offering AI-driven solutions to businesses across various sectors, such as finance, healthcare, and energy.

Keywords: BigBear.ai business model, BBAI services, AI solutions, government contracts, commercial AI, data analytics, cybersecurity AI, geospatial intelligence.

Analyzing BBAI's Financial Performance and Growth Prospects

Analyzing BBAI's financial performance requires a careful review of its recent financial statements. While revenue growth is a key indicator, profitability and debt levels must also be considered to gain a holistic view. Investors should examine key financial ratios such as revenue growth rate, gross margin, and debt-to-equity ratio. (Note: Specific financial data should be sourced from reputable financial websites and reports at the time of analysis).

-

Growth Trajectory: BBAI’s growth trajectory depends heavily on securing new contracts and expanding its service offerings. Industry trends, such as the increasing adoption of AI across various sectors, suggest potential for future expansion. However, potential investors need to critically assess the company’s projections and carefully consider potential challenges and limitations.

-

Risks and Challenges: Investing in BBAI involves inherent risks:

- Competition: The AI market is highly competitive, with numerous established players and emerging startups.

- Dependence on Government Contracts: Reliance on government contracts can lead to revenue instability.

- Financial Volatility: As a penny stock, BBAI's share price is subject to significant fluctuations.

Keywords: BBAI financial performance, BBAI stock growth, revenue growth, profitability, AI stock valuation, financial risk, investment risk, gross margin, debt-to-equity ratio.

Evaluating BBAI's Competitive Landscape and Market Position

BBAI operates in a crowded AI market. Major players like IBM, Google, and Microsoft command significant market share. However, BBAI differentiates itself through its specialized focus on government and commercial sectors and its unique suite of AI-powered solutions.

-

Competitive Analysis: A SWOT analysis is crucial here. BBAI’s strengths include its specialized expertise and focus on niche markets. Weaknesses might include limited brand recognition compared to larger players and potential scalability challenges. Opportunities lie in expanding into new sectors and forming strategic partnerships. Threats come from intense competition and the ever-evolving landscape of AI technology.

-

Market Share and Penetration: BBAI's current market share is relatively small. Growth will depend on its ability to secure more contracts, effectively market its services, and build strong brand recognition.

Keywords: BBAI competitors, AI market competition, market share, competitive advantage, AI industry landscape, SWOT analysis.

Assessing the Risks and Rewards of Investing in BBAI as an AI Penny Stock

Investing in BBAI, as with any penny stock, carries significant risks and rewards. The high-risk, high-reward nature of this type of investment necessitates careful consideration.

-

Potential Risks:

- Market Volatility: Penny stocks are highly volatile, meaning prices can fluctuate dramatically.

- Financial Instability: BBAI's financial health is critical. A downturn could lead to significant share price drops.

- Competitive Pressures: Intense competition can hinder growth and profitability.

- Regulatory Changes: Changes in regulations could impact the business.

-

Potential Rewards:

- High Growth Potential: Successful execution of BBAI’s strategy could lead to substantial growth.

- Significant Returns: If the company performs exceptionally well, investors could see large returns on their investment.

Keywords: Penny stock risks, BBAI investment risks, high-risk high-reward investment, AI stock volatility, potential returns.

Conclusion: Should You Invest in BigBear.ai Holdings (BBAI) Penny Stock?

Investing in BigBear.ai Holdings (BBAI) presents a complex investment proposition. While the company operates in a rapidly growing sector with significant potential, the inherent risks associated with AI penny stocks cannot be ignored. Our analysis highlights BBAI's strengths in specialized AI solutions and its focus on lucrative markets. However, challenges like intense competition and financial volatility remain. A thorough understanding of BBAI’s financials, competitive landscape, and business strategy is crucial.

Therefore, before investing in BBAI or any AI penny stock, conduct extensive due diligence, including independent research and consultation with a qualified financial advisor. Remember, the decision to invest in BigBear.ai (BBAI) should be aligned with your individual risk tolerance and investment goals. Don't treat this as financial advice – carefully consider the risks involved before investing in this or any AI penny stock. Keywords: BigBear.ai investment decision, BBAI stock outlook, AI penny stock investment strategy, due diligence, invest in AI, AI penny stocks.

Featured Posts

-

Huuhkajat Mm Karsinnoissa Uusi Valmennus Ja Tavoitteet

May 20, 2025

Huuhkajat Mm Karsinnoissa Uusi Valmennus Ja Tavoitteet

May 20, 2025 -

Investigating The Rise In Femicide Understanding The Underlying Issues

May 20, 2025

Investigating The Rise In Femicide Understanding The Underlying Issues

May 20, 2025 -

Latest Man United Transfer News Matheus Cunha Update

May 20, 2025

Latest Man United Transfer News Matheus Cunha Update

May 20, 2025 -

Analyzing Suki Waterhouses Full Circle Met Gala Style

May 20, 2025

Analyzing Suki Waterhouses Full Circle Met Gala Style

May 20, 2025 -

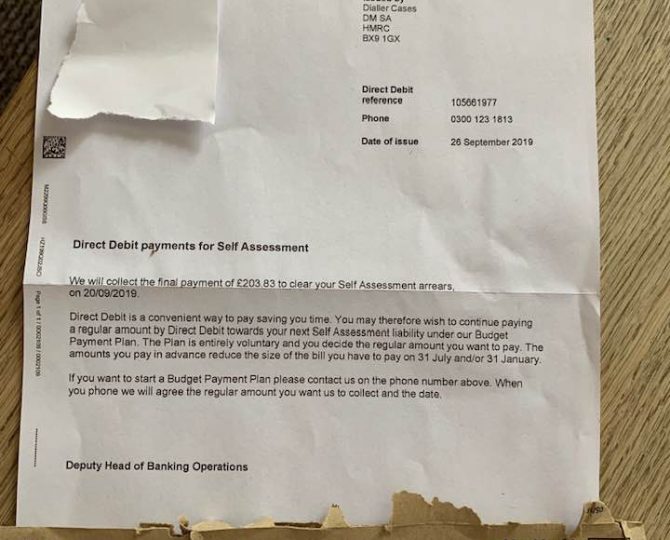

Ignoring Hmrc Letters Potential Consequences For Uk Households

May 20, 2025

Ignoring Hmrc Letters Potential Consequences For Uk Households

May 20, 2025

Latest Posts

-

New Images From Echo Valley Starring Sydney Sweeney And Julianne Moore

May 21, 2025

New Images From Echo Valley Starring Sydney Sweeney And Julianne Moore

May 21, 2025 -

El Regreso De Javier Baez Salud Y Exito En La Mlb

May 21, 2025

El Regreso De Javier Baez Salud Y Exito En La Mlb

May 21, 2025 -

Echo Valley Images Offer First Look At Sweeney And Moores New Film

May 21, 2025

Echo Valley Images Offer First Look At Sweeney And Moores New Film

May 21, 2025 -

Puede Javier Baez Recuperar Su Productividad

May 21, 2025

Puede Javier Baez Recuperar Su Productividad

May 21, 2025 -

Irish Actor Barry Ward A Candid Interview On Roles And Stereotypes

May 21, 2025

Irish Actor Barry Ward A Candid Interview On Roles And Stereotypes

May 21, 2025