Dow Jones's Gradual Rise: Positive PMI Data Provides Support

Table of Contents

The Significance of PMI Data in Predicting Market Trends

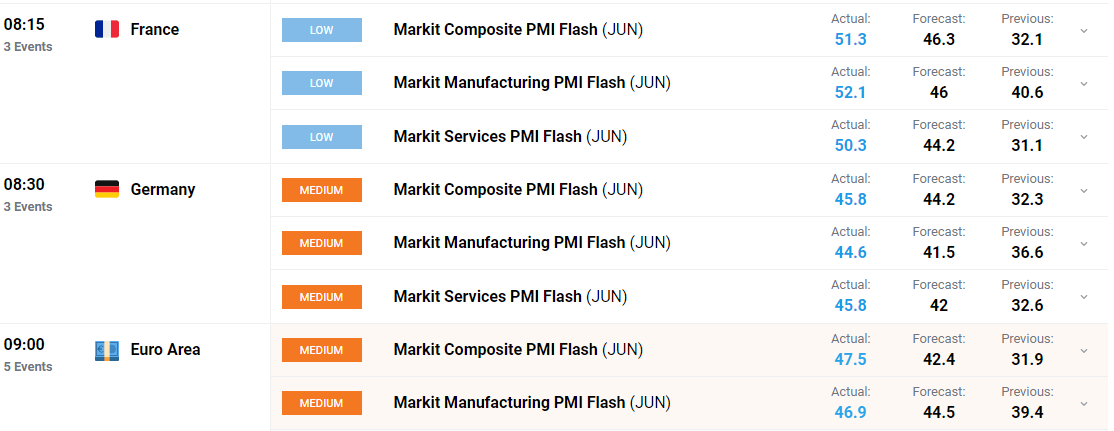

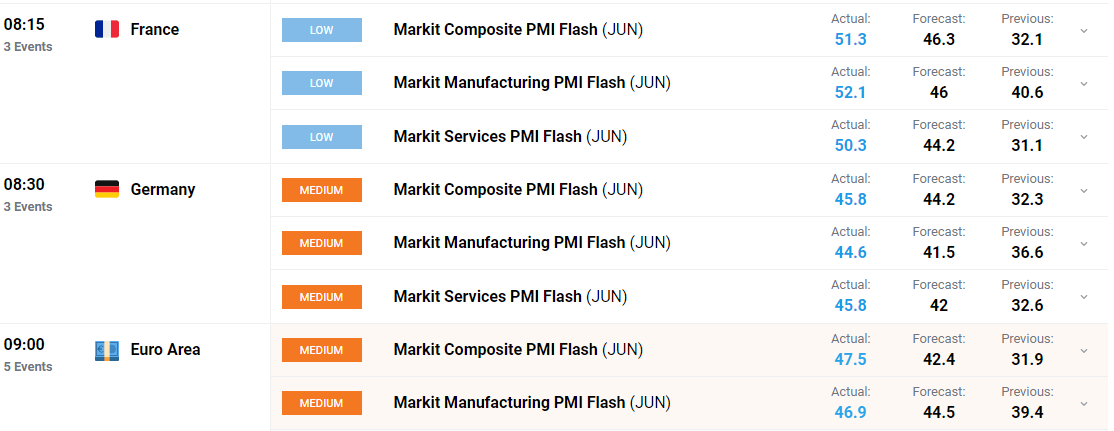

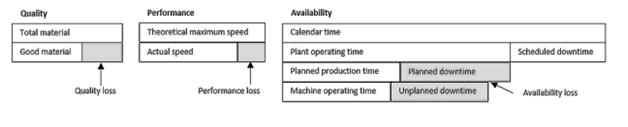

The Purchasing Managers' Index (PMI) is a crucial economic indicator that gauges the health of the manufacturing and services sectors. It's calculated by surveying purchasing managers at companies across various industries, asking them about key aspects of their businesses, such as production levels, new orders, employment, supplier deliveries, and inventory levels. A PMI reading above 50 generally indicates expansion, while a reading below 50 suggests contraction.

There are different types of PMI data:

- Manufacturing PMI: Focuses specifically on the manufacturing sector.

- Services PMI: Concentrates on the services sector, encompassing a vast range of industries.

- Composite PMI: A combined measure of both manufacturing and services PMIs, providing a broader view of the overall economy.

A high PMI reading is generally considered bullish for the stock market. This is because:

- Strong PMI suggests increased business activity and investment. Companies are producing more, indicating strong demand and economic growth.

- High PMI often correlates with positive corporate earnings. Increased business activity usually translates to higher profits for companies.

- Investors often react positively to strong PMI readings, boosting stock prices. Positive economic news generally leads to increased investor confidence.

Positive PMI Data and its Impact on the Dow Jones

Recent positive PMI data releases have demonstrably coincided with upward movements in the Dow Jones. For example, the strong Manufacturing PMI reading of 52.8 in [Insert Month, Year] was followed by a significant increase in the Dow Jones within the subsequent week. Similarly, the robust Services PMI of [Insert Number] in [Insert Month, Year] further bolstered investor sentiment, contributing to the continued rise of the Dow. (Note: Insert actual data and dates for accuracy. Consider adding a chart or graph visually representing this correlation if data is available.)

Specific examples of this positive correlation include:

- The surge in technology stocks following a strong PMI reading in the tech sector.

- Increased investment in consumer discretionary goods after a positive Services PMI report.

- Improved outlook for industrial companies after a strong Manufacturing PMI release.

While the correlation is apparent, it's crucial to acknowledge potential caveats. Other factors influence market performance, and attributing the Dow's rise solely to PMI data would be an oversimplification.

Other Factors Contributing to the Dow Jones's Rise

While positive PMI data has played a significant role, several other factors have contributed to the Dow Jones's recent rise:

- Interest rate decisions by the Federal Reserve: The Federal Reserve's monetary policy significantly impacts investor sentiment and market movements. Lower interest rates generally stimulate economic activity and boost stock prices.

- Geopolitical events and their impact on investor sentiment: Global events can influence investor confidence. Positive developments often lead to market increases.

- Corporate earnings reports and announcements: Strong corporate earnings reports demonstrate company health and often translate into higher stock prices.

Analyzing the Sustainability of the Dow Jones's Upward Trend

The sustainability of the Dow Jones's upward trend depends on several factors. While positive PMI data provides a strong foundation, potential risks exist:

- Potential risks to consider: Inflationary pressures, looming recession fears, and geopolitical instability could dampen investor sentiment and trigger a market correction.

- Factors that could sustain the upward trend: Continued strong corporate earnings, robust consumer spending, and further positive PMI data releases could support the ongoing growth.

- Expert opinions on the future outlook for the Dow Jones: [Insert quotes or summaries of expert opinions on the future of the Dow Jones, citing credible sources].

Conclusion: Sustaining the Momentum: The Future of the Dow Jones's Gradual Rise

In summary, the recent upward trend in the Dow Jones exhibits a strong correlation with positive PMI data. While other factors contribute to market performance, the significance of PMI as a leading economic indicator cannot be overstated. Understanding the impact of positive PMI data on the Dow Jones's gradual rise is crucial for long-term investment strategies. Stay tuned for updates on PMI data and continue to monitor the Dow Jones's performance to make informed investment decisions. Understanding the interplay between PMI and the Dow Jones is key to navigating market fluctuations and potentially capitalizing on future opportunities.

Featured Posts

-

South Florida Hosts Thrilling Ferrari Challenge Racing Days

May 25, 2025

South Florida Hosts Thrilling Ferrari Challenge Racing Days

May 25, 2025 -

18 Brazilian Nationals Charged Major Gun Trafficking Bust In Massachusetts

May 25, 2025

18 Brazilian Nationals Charged Major Gun Trafficking Bust In Massachusetts

May 25, 2025 -

Gucci Supply Chain Shake Up Chief Industrial Officers Departure

May 25, 2025

Gucci Supply Chain Shake Up Chief Industrial Officers Departure

May 25, 2025 -

Apple Stock Performance Q2 Earnings Exceed Expectations

May 25, 2025

Apple Stock Performance Q2 Earnings Exceed Expectations

May 25, 2025 -

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025

Latest Posts

-

Traders Pare Bets On Boe Cuts Pound Strengthens After Uk Inflation Data

May 25, 2025

Traders Pare Bets On Boe Cuts Pound Strengthens After Uk Inflation Data

May 25, 2025 -

2002 Submarine Bribery Scandal French Prosecutors Name Malaysias Ex Pm Najib

May 25, 2025

2002 Submarine Bribery Scandal French Prosecutors Name Malaysias Ex Pm Najib

May 25, 2025 -

Wildfire Betting A Disturbing Reflection Of Our Times Los Angeles Focus

May 25, 2025

Wildfire Betting A Disturbing Reflection Of Our Times Los Angeles Focus

May 25, 2025 -

How Middle Managers Drive Productivity And Employee Engagement

May 25, 2025

How Middle Managers Drive Productivity And Employee Engagement

May 25, 2025 -

Najib Razak French Investigation Links Former Malaysian Pm To Submarine Bribery

May 25, 2025

Najib Razak French Investigation Links Former Malaysian Pm To Submarine Bribery

May 25, 2025