Apple Stock Performance: Q2 Earnings Exceed Expectations

Table of Contents

Key Highlights from Apple's Q2 Earnings Report

Apple's Q2 earnings report showcased impressive growth across multiple key metrics. The figures surpassed analyst predictions, reinforcing investor confidence in the company's future. Let's break down the key highlights:

-

Revenue Growth: Apple reported a revenue increase of 2.5% year-over-year, reaching $94.8 billion. This exceeded the anticipated 1.8% growth, demonstrating resilience despite global economic uncertainties.

-

Net Income and Earnings Per Share (EPS): Net income surged to $24.17 billion, translating to an EPS of $1.52. This marked a significant improvement compared to the same period last year and beat analyst estimates.

-

Product Category Performance: While the iPhone remains a major revenue driver, the Services segment showed particularly strong growth.

-

iPhone Sales: iPhone sales demonstrated healthy growth, up by 1.5% year-over-year. Although growth was modest, it exceeded expectations given the current global economic environment. Strong demand for the iPhone 14 Pro models contributed significantly to this performance.

-

Services Revenue: Apple's Services revenue continued its upward trajectory, growing by 5.5% year-over-year to $21.2 billion. This segment’s consistent performance underlines the recurring revenue model's strength and the increasing engagement with Apple's ecosystem.

-

Mac Sales: Mac sales experienced a slight decline compared to last year, reflecting the impact of a slowing PC market. However, the decline was less severe than anticipated by many analysts.

-

iPad and Wearables Sales: Both the iPad and Wearables, Home, and Accessories categories showed moderate growth, contributing positively to the overall financial results.

-

-

Challenges: Despite the strong overall performance, Apple did mention increased competition and some minor supply chain issues in specific regions. However, these challenges were successfully managed and did not significantly impact the overall positive results.

Factors Contributing to Apple's Strong Q2 Performance

Several factors contributed to Apple's exceptional Q2 performance, highlighting the company's strategic prowess and market position:

-

Sustained iPhone Demand: Despite the mature smartphone market, demand for iPhones remained strong, particularly for the premium iPhone 14 Pro and Pro Max models. This demonstrates Apple's ability to maintain brand loyalty and command premium pricing.

-

Robust Services Growth: The continued expansion of Apple's Services segment is a critical driver of consistent revenue. The growth stems from increased subscriptions to Apple Music, iCloud, Apple TV+, and the App Store. This demonstrates a move towards a more diversified revenue stream, reducing reliance on hardware sales alone.

-

Successful Product Launches and Marketing: Apple's marketing campaigns, coupled with the successful launch of new products and features (such as the latest iPhones and the Vision Pro headset, although the latter is not yet released, hype contributed to the overall positive market sentiment), fueled positive consumer sentiment and purchasing behavior.

-

Supply Chain Improvements: Apple has made significant strides in improving its supply chain resilience. Although some minor disruptions still exist, the company has better managed these challenges than in previous years.

-

Favorable Market Trends: Despite global economic headwinds, consumer spending in key markets remained relatively strong, particularly in certain geographic regions. This trend benefited Apple, as consumers continued purchasing its premium products.

Impact on Apple Stock Price and Investor Sentiment

The strong Q2 earnings announcement had an immediate and positive impact on Apple stock price and investor sentiment.

-

Market Reaction: The AAPL stock price surged following the earnings release, indicating strong market confidence in Apple's future prospects. Trading volume also increased substantially, reflecting the heightened interest from investors.

-

Analyst Ratings and Price Targets: Following the earnings announcement, several analysts upgraded their ratings for Apple stock, reflecting a positive outlook on the company’s performance and its ability to deliver strong results in future quarters. Price targets also increased, suggesting a bullish outlook on the AAPL stock price.

-

Investor Sentiment: Investor sentiment significantly improved after the Q2 results. The impressive growth and the positive outlook signaled strong confidence in Apple's future, making the AAPL stock a desirable investment option.

-

Stock Forecast: Many analysts have released positive forecasts for Apple's stock price, projecting continued growth based on the strong Q2 performance and the expected success of future product launches.

Risks and Potential Challenges

While the outlook for Apple is currently positive, several risks and potential challenges could impact future performance:

-

Economic Slowdown: A global economic slowdown could impact consumer spending and affect demand for Apple's products, particularly in the premium segment.

-

Intense Competition: The tech industry is highly competitive, and Apple faces strong competition from other major players in smartphones, tablets, and other product categories.

-

Inflation and Supply Chain Disruptions: Persistently high inflation could negatively impact consumer purchasing power and supply chain issues remain a potential source of risk.

Conclusion

Apple's Q2 earnings exceeded expectations across multiple key metrics, demonstrating the company's continued strength and resilience. The robust growth in both hardware sales and the Services segment highlights a diversified and healthy business model. While external risks such as an economic slowdown and continued competition remain, the overall performance paints a positive picture for Apple's short-term and long-term prospects. The strong Q2 results reinforce Apple’s position as a leading tech company and suggest a continued upward trajectory for AAPL stock.

Call to Action: Stay informed on the latest developments in Apple stock performance and market trends. Follow our blog for continued analysis and insights into Apple's future earnings and stock price movement. Understanding the nuances of Apple stock performance is crucial for successful investment strategies.

Featured Posts

-

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 25, 2025

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 25, 2025 -

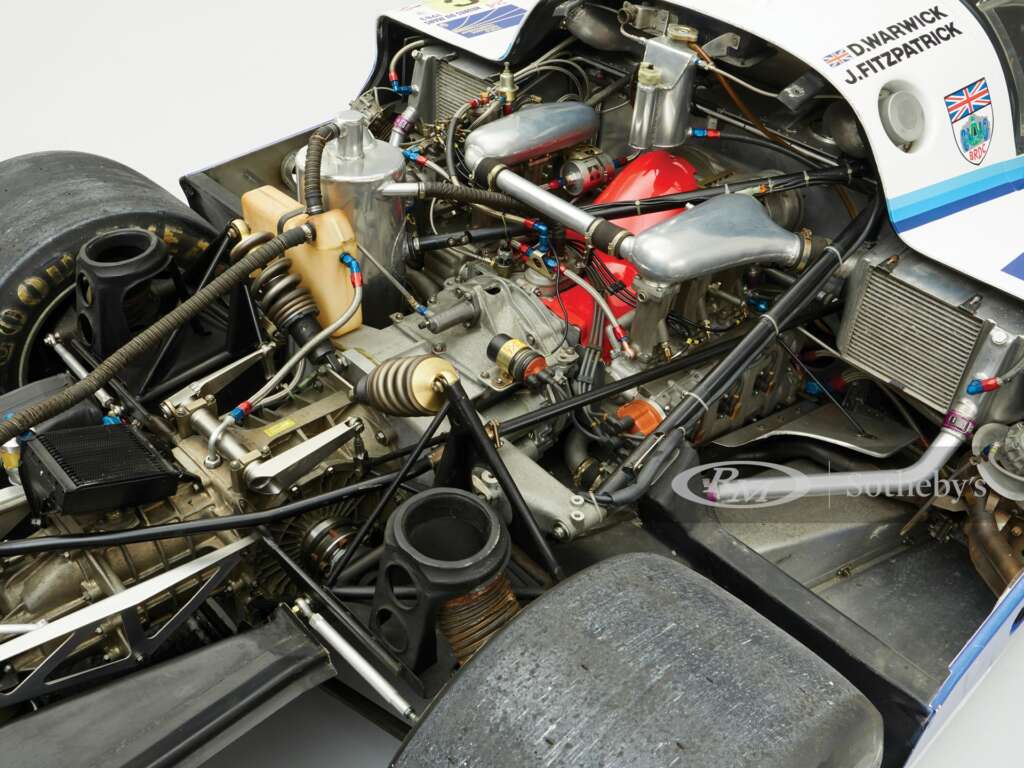

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 25, 2025

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 25, 2025 -

M6 Closed Real Time Updates On Crash And Traffic Delays

May 25, 2025

M6 Closed Real Time Updates On Crash And Traffic Delays

May 25, 2025 -

Apple Stock I Phone Sales Boost Q2 Financial Results

May 25, 2025

Apple Stock I Phone Sales Boost Q2 Financial Results

May 25, 2025 -

Monacos Royal Corruption Scandal The Prince And His Financial Advisor

May 25, 2025

Monacos Royal Corruption Scandal The Prince And His Financial Advisor

May 25, 2025

Latest Posts

-

Local News Triumph Myrtle Beach Newspaper Wins 59 Sc Press Association Awards

May 25, 2025

Local News Triumph Myrtle Beach Newspaper Wins 59 Sc Press Association Awards

May 25, 2025 -

Myrtle Beach Newspaper Garners 59 Sc Press Association Awards

May 25, 2025

Myrtle Beach Newspaper Garners 59 Sc Press Association Awards

May 25, 2025 -

Help Clean Up Myrtle Beach Volunteer Opportunity

May 25, 2025

Help Clean Up Myrtle Beach Volunteer Opportunity

May 25, 2025 -

Myrtle Beach Newspapers Sweep 59 Sc Press Association Awards For Local News And Photography

May 25, 2025

Myrtle Beach Newspapers Sweep 59 Sc Press Association Awards For Local News And Photography

May 25, 2025 -

Myrtle Beach Officer Involved Shooting 1 Dead 11 Injured Sled Investigating

May 25, 2025

Myrtle Beach Officer Involved Shooting 1 Dead 11 Injured Sled Investigating

May 25, 2025