Did US Economic Shifts Affect Elon Musk's Net Worth?

Table of Contents

Inflation's Bite: How Rising Prices Affected Musk's Assets

Inflation, the persistent increase in the general price level of goods and services, significantly impacts asset valuations. For Elon Musk, this means the value of his primary asset, Tesla stock, is directly affected. Rising inflation erodes purchasing power, impacting consumer spending and, consequently, the demand for Tesla vehicles.

- Increased production costs for Tesla vehicles: Higher prices for raw materials and components directly translate into increased production costs, squeezing Tesla's profit margins.

- Decreased consumer demand due to higher prices: As inflation rises, consumers become more price-sensitive, potentially reducing demand for luxury electric vehicles like Tesla's.

- Impact on Tesla's profit margins: The combined effect of increased production costs and potentially reduced sales volume significantly impacts Tesla's profitability, which, in turn, affects its stock price and Elon Musk's net worth.

- Effect on the overall valuation of Tesla: A decline in Tesla's profitability directly translates into a lower market valuation, impacting Musk's overall wealth. This highlights the sensitivity of his net worth to inflationary pressures.

Interest Rate Hikes and Their Ripple Effect on Musk's Investments

The Federal Reserve's actions regarding interest rates have a profound impact on the stock market. There's an inverse relationship between interest rates and stock valuations; as interest rates rise, stock prices tend to fall. This is because investors shift towards safer, higher-yielding investments like bonds, reducing demand for stocks.

- Increased borrowing costs for Tesla and SpaceX: Higher interest rates increase the cost of borrowing for Tesla and SpaceX, impacting their expansion plans and potentially slowing down growth.

- Investor shift towards safer investments (bonds): Investors often seek the safety of bonds during periods of rising interest rates, leading to a reduction in investment in riskier assets like Tesla stock.

- Decreased investment in innovative technologies: Higher interest rates can curb investment in high-growth, innovative technologies, particularly impacting companies like Tesla and SpaceX that rely on continuous investment for research and development.

- Impact on Tesla's expansion plans: Increased borrowing costs may force Tesla to reconsider or postpone expansion projects, potentially hindering future growth and, subsequently, impacting Musk's net worth.

Recessionary Fears and Their Influence on the Tech Sector (and Musk)

Recessionary fears trigger significant uncertainty in the market, particularly impacting the tech sector, where Tesla operates. Investor sentiment plummets, leading to a sell-off in tech stocks, including Tesla.

- Reduced consumer confidence leading to decreased demand: The fear of an economic downturn reduces consumer confidence, leading to less discretionary spending and decreased demand for luxury goods like Tesla vehicles.

- Increased investor risk aversion: During recessionary periods, investors become more risk-averse, opting for safer investments and selling off more volatile assets like Tesla stock.

- Potential impact on future Tesla projects and funding: Recessionary anxieties can make it harder for Tesla to secure funding for new projects, potentially slowing down its growth trajectory.

- Correlation between market downturn and Musk's net worth fluctuations: A significant correlation exists between market downturns and fluctuations in Musk's net worth, underscoring the vulnerability of his fortune to broader economic conditions.

The Diversification Factor: How Musk's Holdings Mitigate Economic Risks

While heavily reliant on Tesla's success, Elon Musk's vast holdings extend beyond Tesla, including SpaceX and Twitter/X. This diversification plays a crucial role in mitigating the impact of economic downturns on his overall net worth.

- The performance of SpaceX independent of market fluctuations: SpaceX, unlike Tesla, is less directly tied to the volatile stock market, offering some insulation against economic downturns.

- The role of Twitter/X in his overall portfolio: Twitter/X's performance, though influenced by the economy, adds another layer of diversification to Musk's portfolio.

- The impact of other investments on mitigating economic risks: While specifics are less public, Musk's other investments further contribute to diversification, reducing the reliance on any single asset class.

- Overall resilience of his portfolio against economic shifts: The diversified nature of his holdings offers a degree of resilience against negative economic impacts, though it cannot entirely eliminate the influence of economic shifts on his net worth.

Conclusion: Understanding the Complex Relationship Between US Economy and Elon Musk's Net Worth

The analysis clearly demonstrates a significant correlation between US economic shifts and Elon Musk's net worth. Inflation, interest rate hikes, and recessionary fears all impact Tesla's valuation and, consequently, Musk's fortune. However, his diversified investments offer a buffer against the full impact of these economic pressures. Understanding this complex relationship underscores the importance of diversification in mitigating economic risk for high-net-worth individuals. To further understand this dynamic, we encourage readers to research the impact of US economic shifts on other high-net-worth individuals and the broader economy, further exploring "Elon Musk's net worth and the US economy" and the "US economic influence on Elon Musk's wealth."

Featured Posts

-

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process

May 09, 2025

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process

May 09, 2025 -

R3

May 09, 2025

R3

May 09, 2025 -

Dijon Vehicule Lance Contre Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 09, 2025

Dijon Vehicule Lance Contre Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 09, 2025 -

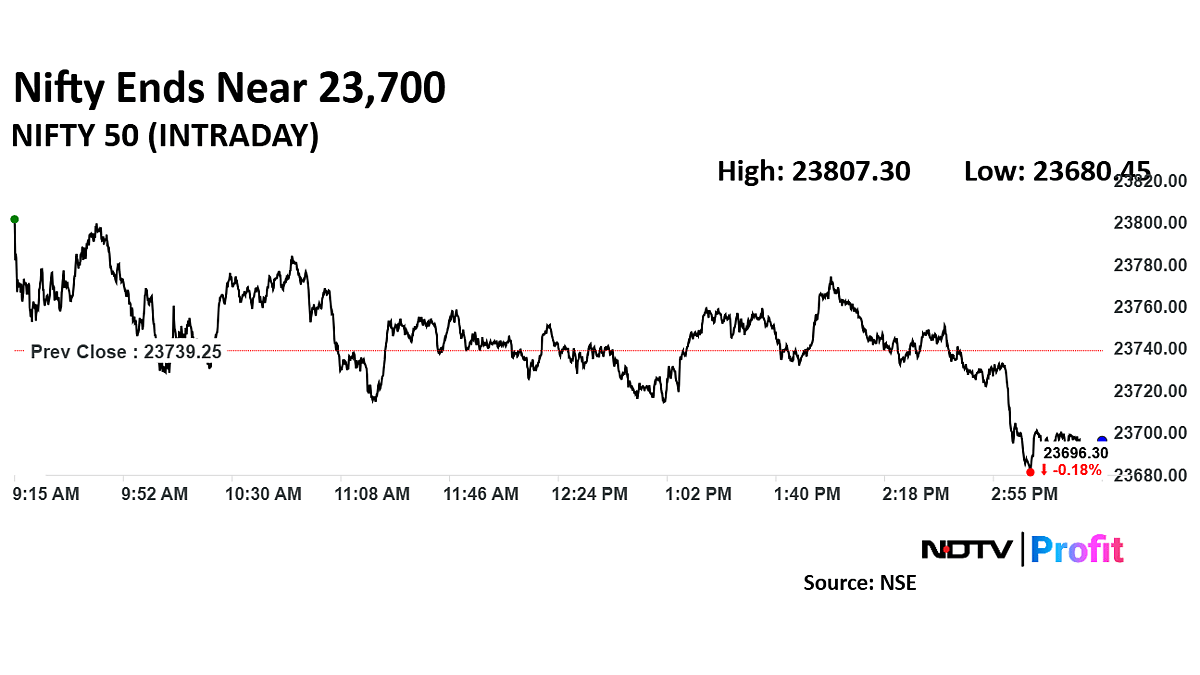

Bajaj Twins Weigh On Indian Markets Sensex Nifty 50 End Flat

May 09, 2025

Bajaj Twins Weigh On Indian Markets Sensex Nifty 50 End Flat

May 09, 2025 -

High Potential Season 2 Release Date Episode Count And Renewal Status

May 09, 2025

High Potential Season 2 Release Date Episode Count And Renewal Status

May 09, 2025