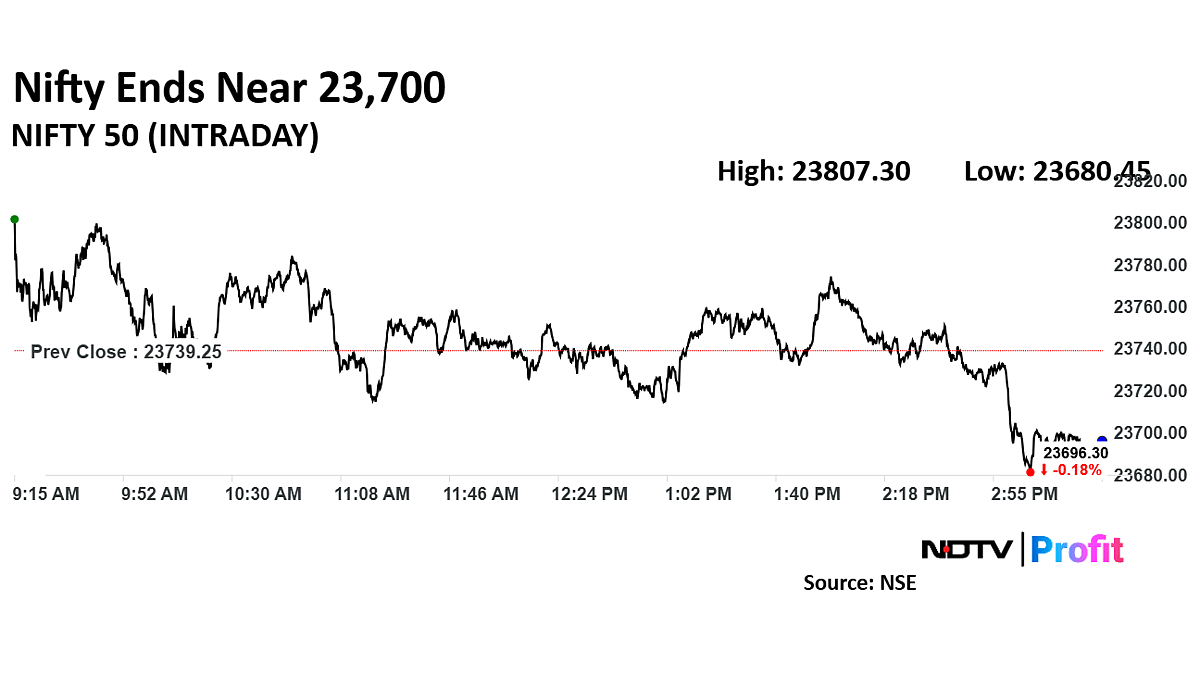

Bajaj Twins Weigh On Indian Markets: Sensex, Nifty 50 End Flat

Table of Contents

Bajaj Twins' Performance and its Impact

The performance of Bajaj Finance and Bajaj Finserv played a crucial role in the Sensex and Nifty 50's flat closure. While specific daily percentage changes would need to be inserted here based on the actual data for a particular day (e.g., "Bajaj Finance saw a 1.2% dip, while Bajaj Finserv closed 0.5% higher"), their combined influence on the market was undeniable. Both companies hold significant weightings in the indices, meaning even small fluctuations in their stock prices can have a considerable impact on the overall index performance. Their substantial market capitalization, combined with their role as bellwethers for the Indian financial sector, makes their daily performance a key indicator of market health. For instance, any significant news regarding lending rates or regulatory changes affecting these companies would directly impact their stock prices and consequently the broader market.

- Bajaj Finance: [Insert specific percentage change and details on the day's performance].

- Bajaj Finserv: [Insert specific percentage change and details on the day's performance].

- Market Capitalization Impact: [Insert data on the market capitalization of both companies and explain their relative impact on the Sensex and Nifty 50].

- Significant News: [Mention any relevant news or announcements affecting either company on that specific day].

Broader Market Trends and Contributing Factors

While the Bajaj twins undoubtedly played a role, the flat closure of the Sensex and Nifty 50 was also influenced by several other factors. Global market trends, particularly those in the US and European markets, often have a ripple effect on the Indian stock market. Macroeconomic indicators, such as inflation rates, interest rate changes implemented by the Reserve Bank of India (RBI), and fluctuations in the Indian Rupee against other major currencies, also impact investor sentiment and market movements.

- Global Events: [Mention significant global events impacting Indian markets on that day, e.g., changes in US interest rates, geopolitical tensions].

- Macroeconomic Data: [Include specific data points, e.g., inflation figures, interest rate announcements, foreign exchange reserves].

- Other Sectoral News: [Mention any significant news from other sectors like IT, Banking, or Manufacturing which might have influenced the market].

Investor Sentiment and Market Volatility

The overall investor sentiment on the day reflected a degree of cautious optimism, given the mixed signals from the Bajaj twins and the broader market. Market volatility, as measured by the VIX (Volatility Index), [insert VIX data for the day], indicated a [describe the level of volatility—e.g., moderate level of uncertainty]. The trading volumes for Bajaj Finance and Bajaj Finserv [insert data on trading volumes—e.g., showed increased activity, suggesting heightened investor interest].

- VIX (Volatility Index): [Insert VIX data for the specific day and provide context].

- Trading Volumes: [Insert and analyze trading volumes for Bajaj Finance and Bajaj Finserv].

- Expert Opinions: [Include quotes from analysts or market experts commenting on the day's market performance].

Potential Future Implications for the Bajaj Twins and the Market

The short-term outlook for the Bajaj twins remains somewhat uncertain, depending on several factors, including overall economic growth, regulatory changes, and consumer spending patterns. In the longer term, the Bajaj twins are expected to continue to play a significant role in the Indian market, given their robust business models and expanding customer base. However, potential risks such as economic downturns or shifts in consumer behavior could influence their performance. For the broader Indian market, the day's events highlight the importance of diversifying investments and closely monitoring both domestic and global factors.

- Future Stock Price Predictions: [Offer cautious predictions about the future stock price movements of the Bajaj twins – include a disclaimer].

- Market Scenarios: [Outline potential scenarios for the Indian market based on various factors].

- Investment Advice (Disclaimer): [Provide a disclaimer stating that this is not financial advice and investors should conduct their own research].

Bajaj Twins Weigh on Indian Markets: Key Takeaways and Future Outlook

The flat closure of the Sensex and Nifty 50 was a result of a complex interplay of factors, with the Bajaj twins' performance playing a significant, though not solely determinative, role. Broader market trends, global events, and macroeconomic indicators all contributed to the day's market behavior. Monitoring the performance of the Bajaj twins and staying informed about broader market trends are crucial for making informed investment decisions in the dynamic Indian stock market. To stay updated on the latest developments concerning the Bajaj twins, Sensex, and Nifty 50 performance, subscribe to our newsletter or follow us on social media for regular updates and in-depth analysis of the Indian stock market. [Link to newsletter signup or social media].

Featured Posts

-

Elon Musk Jeff Bezos And Mark Zuckerberg Billions Lost Since Donald Trumps Inauguration

May 09, 2025

Elon Musk Jeff Bezos And Mark Zuckerberg Billions Lost Since Donald Trumps Inauguration

May 09, 2025 -

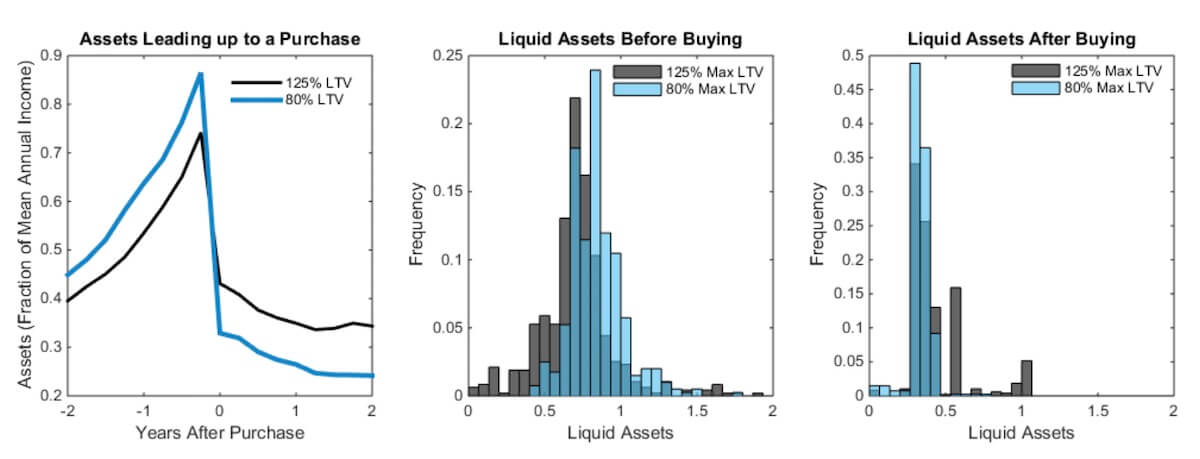

The Impact Of High Down Payments On Canadian Homeownership

May 09, 2025

The Impact Of High Down Payments On Canadian Homeownership

May 09, 2025 -

Stalking Charges Woman Who Claimed To Be Madeleine Mc Cann Arrested

May 09, 2025

Stalking Charges Woman Who Claimed To Be Madeleine Mc Cann Arrested

May 09, 2025 -

Incendie A La Mediatheque Champollion De Dijon Premieres Informations

May 09, 2025

Incendie A La Mediatheque Champollion De Dijon Premieres Informations

May 09, 2025 -

Elon Musks Path To Billions Key Milestones And Entrepreneurial Decisions

May 09, 2025

Elon Musks Path To Billions Key Milestones And Entrepreneurial Decisions

May 09, 2025