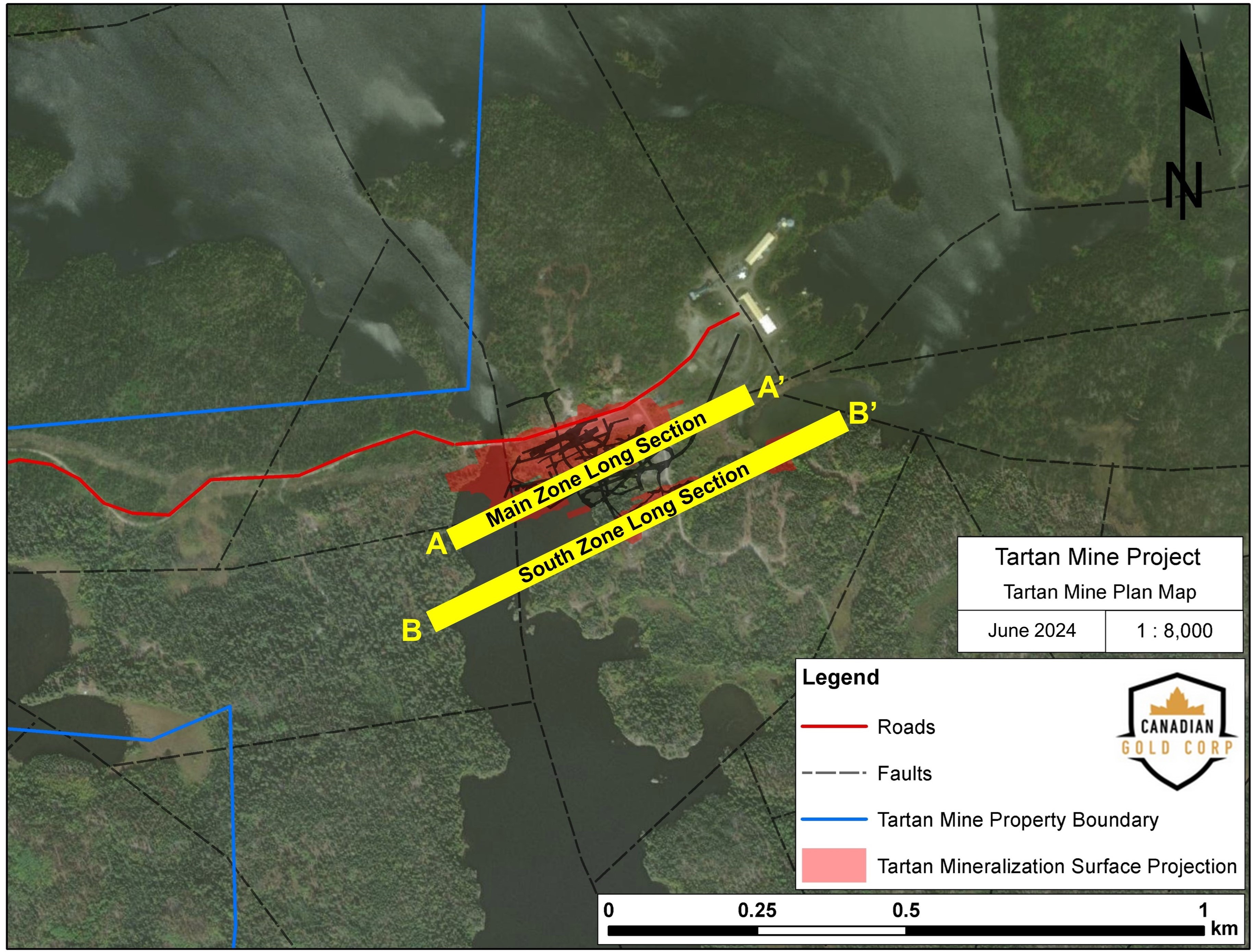

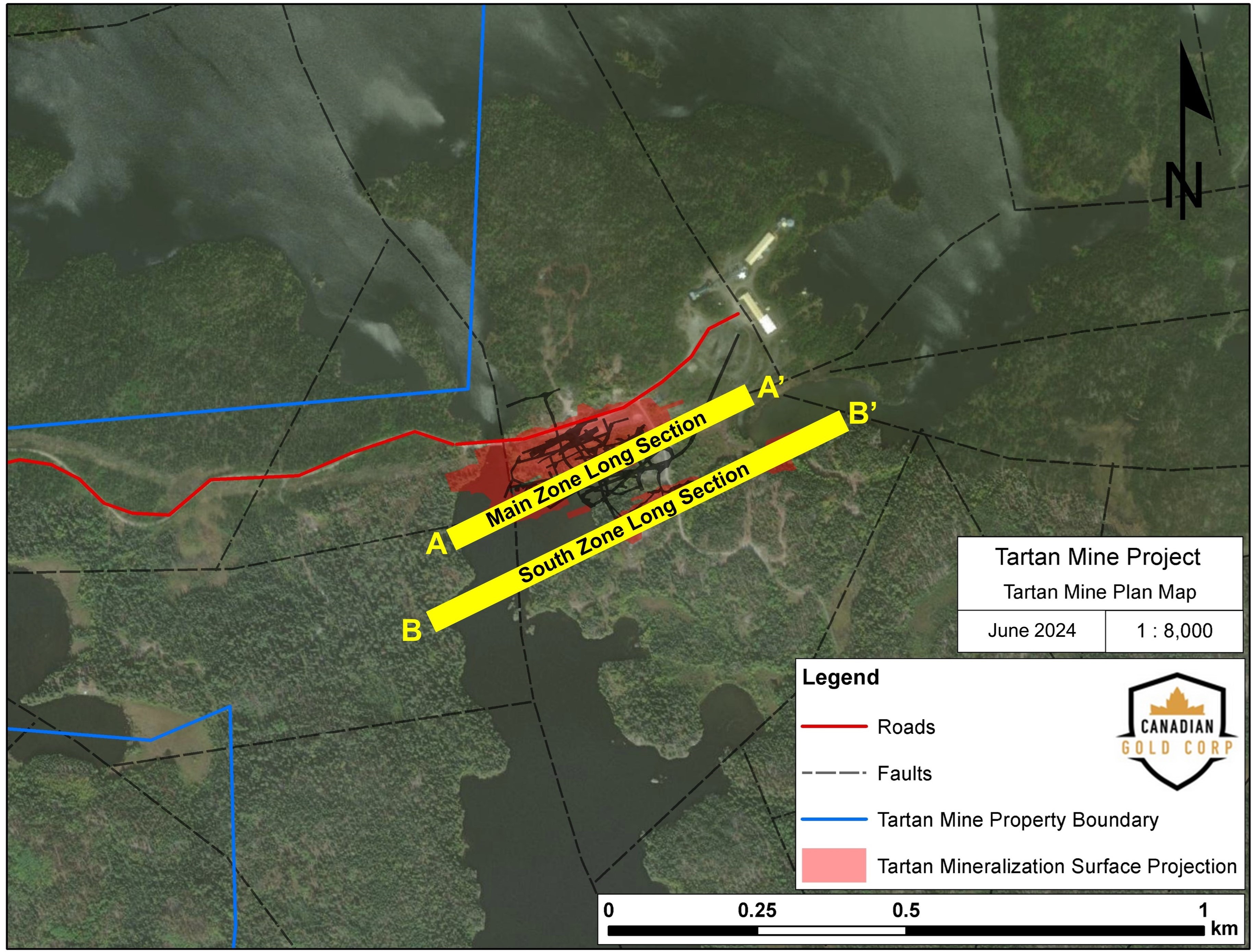

Canadian Gold Corp Secures Funding For Tartan Mine NI 43-101 & PEA

Table of Contents

Securing the Funding: Details and Implications

Canadian Gold Corp has secured $[Insert Funding Amount] CAD in funding to propel the Tartan Mine project to the next stage. This financing comprises a combination of [Specify Funding Sources, e.g., private equity investment from [Investor Names, if disclosed], and a secured loan from [Lender Name, if disclosed]]. The terms of the funding agreement include [briefly describe key terms, if publicly available, e.g., milestone payments, equity participation]. This strategic investment is crucial for accelerating the project's development, enabling the company to progress through key milestones and ultimately bring the Tartan Mine into production.

- Funding Amount: $[Insert Funding Amount] CAD

- Investors: [List Investor Names, if disclosed]

- Use of Funds: Exploration drilling, resource expansion, environmental studies, permitting, and preliminary engineering design.

- Expected Timeline: Completion of a Feasibility Study within [ timeframe], permitting applications submitted by [date], and anticipated start of construction by [date].

NI 43-101 Compliant Resource Estimate: Significance and Details

In Canada, NI 43-101 compliance is mandatory for all public reporting of mineral projects. This stringent standard ensures transparency, accuracy, and reliability of resource estimates. The NI 43-101 compliant resource estimate for the Tartan Mine demonstrates a significant gold deposit. Key findings reveal [Insert Gold Ounces] ounces of gold, with an average grade of [Insert Average Gold Grade] g/t. This estimate provides a high level of confidence in the project's resource base, paving the way for more detailed studies and economic evaluations.

- Indicated Resources: [Insert Ounces and Grade]

- Inferred Resources: [Insert Ounces and Grade]

- Average Gold Grade: [Insert Average Gold Grade] g/t

- Potential for Resource Expansion: Significant potential exists for further resource expansion through ongoing exploration programs.

Preliminary Economic Assessment (PEA): Key Findings and Projections

The PEA provides a preliminary assessment of the economic viability of the Tartan Mine project. It encompasses various aspects, including capital costs, operating expenses, production rates, and revenue projections. Key findings indicate a positive net present value (NPV) of [Insert NPV] at a discount rate of [Insert Discount Rate]%, an internal rate of return (IRR) of [Insert IRR]%, and a payback period of [Insert Payback Period] years. This positive economic outlook strengthens the investment case for the Tartan Mine, highlighting its potential for profitability. The PEA also addresses potential environmental and social impacts, outlining mitigation strategies to ensure responsible and sustainable mining practices.

- NPV: [Insert NPV]

- IRR: [Insert IRR]

- Payback Period: [Insert Payback Period] years

- Capital Expenditure: [Insert Capital Expenditure]

- Annual Production Rate: [Insert Annual Production Rate] ounces of gold

Next Steps and Future Outlook for Canadian Gold Corp and the Tartan Mine

The next steps for the Tartan Mine project include conducting a comprehensive feasibility study, obtaining necessary permits, and securing financing for construction. Successful completion of these stages will position the company for construction and ultimately, production. The Tartan Mine project is expected to create [Number] jobs during the construction phase and [Number] ongoing jobs during operations, contributing significantly to the local economy. Canadian Gold Corp anticipates a strong future driven by the potential success of the Tartan Mine, along with other exploration projects in its portfolio. However, inherent risks in mining must be considered, including fluctuations in gold prices, permitting delays, and unforeseen geological challenges.

- Feasibility Study Completion: [Timeframe]

- Permitting Timeline: [Timeframe]

- Construction Start: [Date]

- Job Creation: [Number] jobs (construction) and [Number] jobs (operations).

- Environmental Mitigation: [Outline key mitigation strategies]

Conclusion: Investing in the Future with Canadian Gold Corp Tartan Mine NI 43-101 & PEA

Canadian Gold Corp's successful securing of funding for the Tartan Mine project, coupled with the completion of the NI 43-101 compliant resource estimate and the positive PEA results, paints a promising picture for the company’s future. The project's economic viability, coupled with responsible environmental practices, positions Canadian Gold Corp for significant growth. This is a compelling opportunity for investors interested in Canadian gold mining investments. To learn more about Canadian Gold Corp investment opportunities related to the Tartan Mine project, and explore other exciting ventures, visit the company website at [Insert Website Address]. Consider exploring "Canadian Gold Corp investment," "Tartan Mine investment," and other related keywords for more information.

Featured Posts

-

Ticketmaster Mayor Transparencia En Los Precios De Las Entradas

May 30, 2025

Ticketmaster Mayor Transparencia En Los Precios De Las Entradas

May 30, 2025 -

Problemas Ticketmaster 8 De Abril Informacion Grupo Milenio

May 30, 2025

Problemas Ticketmaster 8 De Abril Informacion Grupo Milenio

May 30, 2025 -

2 37 23

May 30, 2025

2 37 23

May 30, 2025 -

Tiga Jet Ski Premium Kawasaki Resmi Diluncurkan Kemewahan Di Atas Air

May 30, 2025

Tiga Jet Ski Premium Kawasaki Resmi Diluncurkan Kemewahan Di Atas Air

May 30, 2025 -

Setlist Fm Y Ticketmaster Una Integracion Para Mejorar La Experiencia Del Fan

May 30, 2025

Setlist Fm Y Ticketmaster Una Integracion Para Mejorar La Experiencia Del Fan

May 30, 2025

Latest Posts

-

Posthaste Decoding The Tariff Rulings Impact On Canada

May 31, 2025

Posthaste Decoding The Tariff Rulings Impact On Canada

May 31, 2025 -

Updated Birmingham Supercross Round 10 Race Results 2025

May 31, 2025

Updated Birmingham Supercross Round 10 Race Results 2025

May 31, 2025 -

Braintree And Witham Times Local Man Convicted On Animal Pornography Charges

May 31, 2025

Braintree And Witham Times Local Man Convicted On Animal Pornography Charges

May 31, 2025 -

Official 2025 Birmingham Supercross Round 10 Results

May 31, 2025

Official 2025 Birmingham Supercross Round 10 Results

May 31, 2025 -

Essex Man Sentenced For Animal Pornography Offences

May 31, 2025

Essex Man Sentenced For Animal Pornography Offences

May 31, 2025