Delinquent Student Loans: Facing The Consequences Of Non-Payment

Table of Contents

Understanding Delinquency and its Stages

Delinquent student loans are defined as missed payments. The severity of the delinquency escalates with the length of time payments are missed. Lenders typically classify delinquency in stages:

- 30-day delinquency: This is usually the first stage and often triggers a late payment notice from your lender. While it doesn't immediately impact your credit score, it's a crucial warning sign. Take action immediately to avoid further problems.

- 90-day delinquency: After three missed payments (or 90 days), your lender is likely to report the delinquency to the major credit bureaus (Equifax, Experian, and TransUnion). This will significantly damage your credit score, making it harder to obtain future credit.

- 180-day delinquency: At this point, the consequences become more serious. Your lender might begin more aggressive collection efforts, including contacting you repeatedly. Your credit score will suffer even more, hindering your ability to secure loans, mortgages, or even rent an apartment.

- Default: Defaulting on your student loans is the most severe stage of delinquency. It typically occurs after 270 days of nonpayment. Defaulting results in immediate and severe consequences, potentially including wage garnishment, tax refund offset, and even legal action. Your credit score will be severely damaged, and it will be extremely difficult to rehabilitate your credit.

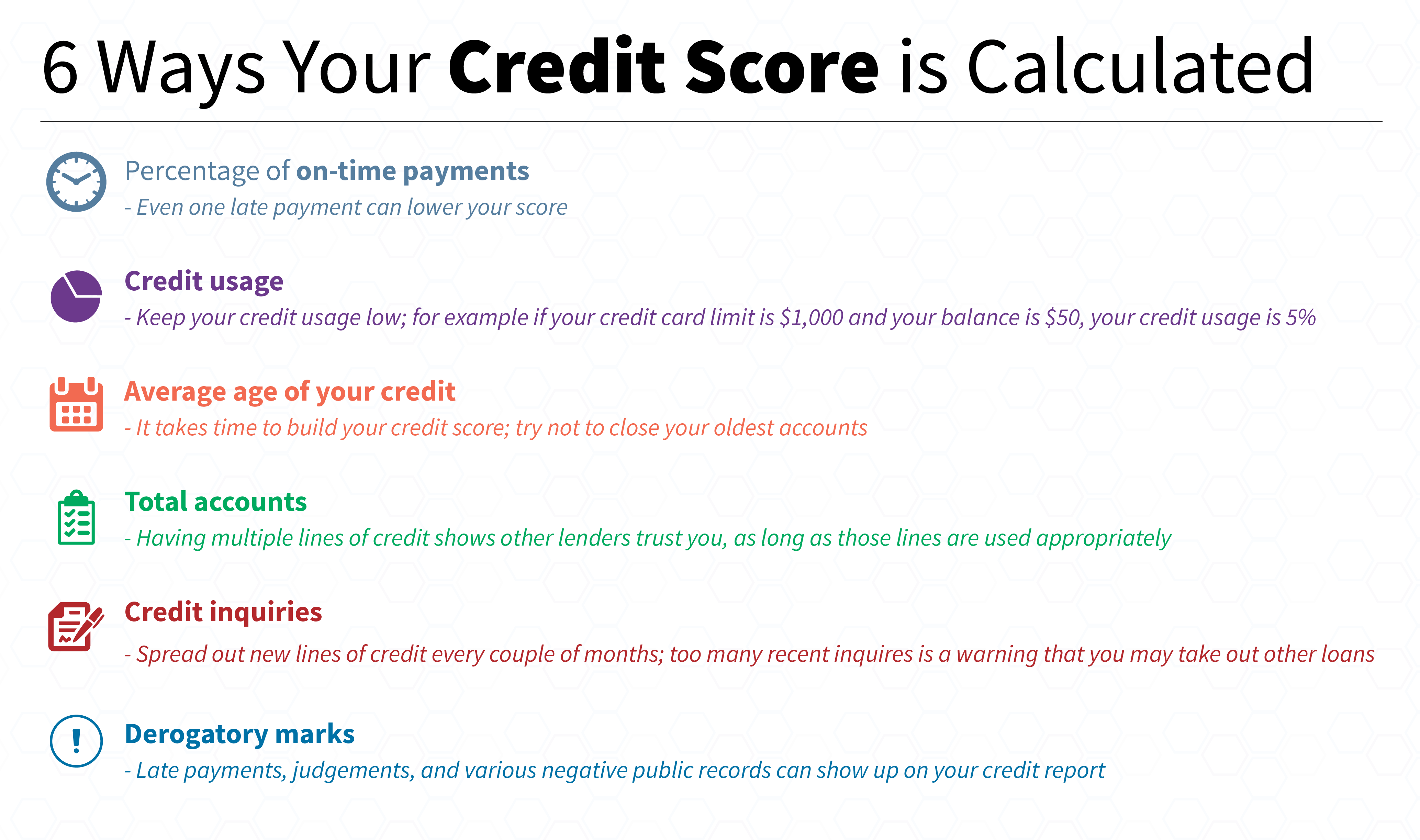

The Impact on Your Credit Score

Delinquent student loans have a devastating impact on your credit score. A significant drop in your score can make obtaining future credit incredibly difficult and expensive.

- Credit score reduction: A single delinquent student loan can drop your credit score by 100 points or more. The longer the delinquency persists, the greater the damage.

- Difficulty securing future credit: Lenders view delinquent student loans as a major risk. With a damaged credit score, you'll likely face higher interest rates, lower credit limits, and potential rejection for loans, mortgages, and even credit cards.

- Higher interest rates: Even if you can secure credit, you'll likely pay significantly higher interest rates due to your poor credit history. This can cost you thousands of dollars over the life of a loan.

Legal and Financial Ramifications

The legal and financial consequences of delinquent student loans are substantial. Lenders are persistent in their pursuit of repayment, often resorting to aggressive collection methods.

- Wage garnishment: Your lender can legally garnish a portion of your wages to repay the delinquent loan. The amount garnished varies by state and the size of your debt.

- Tax refund offset: The IRS can intercept and seize your tax refund to pay off your delinquent student loans. This can leave you with no refund to cover other expenses.

- Legal fees and court costs: If the lender takes you to court, you'll face significant additional costs, including legal fees and court judgments, further increasing your debt.

Available Solutions for Delinquent Student Loans

If you're struggling with delinquent student loans, several options might help you avoid the severe consequences outlined above:

- Income-driven repayment (IDR) plans: IDR plans adjust your monthly payments based on your income and family size. Several IDR plans exist, including Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR). Eligibility requirements vary.

- Deferment and forbearance: These options temporarily suspend or reduce your monthly payments. Deferment typically requires demonstrating financial hardship, while forbearance may be granted for other reasons. Interest may still accrue during deferment or forbearance, depending on the loan type.

- Loan consolidation: Combining multiple student loans into a single loan can simplify payments and potentially lower your monthly payments. However, careful consideration of interest rates and overall loan term is crucial.

- Seeking professional help: Contacting a non-profit credit counselor can provide valuable guidance and support in navigating your options and creating a repayment plan. They can help you understand your rights and negotiate with your lenders.

Preventing Delinquent Student Loans

Proactive steps can prevent you from falling behind on your student loan payments:

- Creating a realistic budget: Track your income and expenses to understand your financial situation and determine how much you can afford to pay towards your student loans.

- Choosing the right repayment plan: Select a repayment plan that aligns with your current financial circumstances and long-term goals.

- Automating payments: Set up automatic payments to avoid missed deadlines and late fees.

- Regularly checking loan status and statements: Stay informed about your loan balance, payment due dates, and any changes in your repayment plan.

Conclusion

Delinquent student loans carry severe consequences, ranging from damaged credit scores to legal action and significant financial burdens. Understanding the stages of delinquency and the potential ramifications is crucial. However, various solutions exist to help you manage your student loan debt effectively. Don't let delinquent student loans ruin your financial future. Take control today by exploring repayment options such as income-driven repayment plans, deferment, forbearance, or loan consolidation and seeking professional guidance. Understanding your rights and responsibilities regarding your delinquent student loans is the first step towards a solution.

Featured Posts

-

Understanding The Credit Score Effects Of Delinquent Student Loans

May 17, 2025

Understanding The Credit Score Effects Of Delinquent Student Loans

May 17, 2025 -

Nba Officials Acknowledge Crucial Missed Foul Call In Knicks Pistons Game

May 17, 2025

Nba Officials Acknowledge Crucial Missed Foul Call In Knicks Pistons Game

May 17, 2025 -

Knicks Jalen Brunson Injury Latest Update And Return Timeline

May 17, 2025

Knicks Jalen Brunson Injury Latest Update And Return Timeline

May 17, 2025 -

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025 -

Student Loan Debt A Financial Planner Offers Expert Advice

May 17, 2025

Student Loan Debt A Financial Planner Offers Expert Advice

May 17, 2025

Latest Posts

-

10 Fantastic Tv Shows Cut Short A Shameful Waste

May 17, 2025

10 Fantastic Tv Shows Cut Short A Shameful Waste

May 17, 2025 -

Erdogan Al Nahyan Telefon Goeruesmesi Detaylar Ve Analiz

May 17, 2025

Erdogan Al Nahyan Telefon Goeruesmesi Detaylar Ve Analiz

May 17, 2025 -

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025 -

Cumhurbaskani Erdogan Ve Birlesik Arap Emirlikleri Devlet Baskani Nin Telefon Goeruesmesi

May 17, 2025

Cumhurbaskani Erdogan Ve Birlesik Arap Emirlikleri Devlet Baskani Nin Telefon Goeruesmesi

May 17, 2025 -

The 10 Best Tv Shows Cancelled Before Their Time A Critical Overview

May 17, 2025

The 10 Best Tv Shows Cancelled Before Their Time A Critical Overview

May 17, 2025