Understanding The Credit Score Effects Of Delinquent Student Loans

Table of Contents

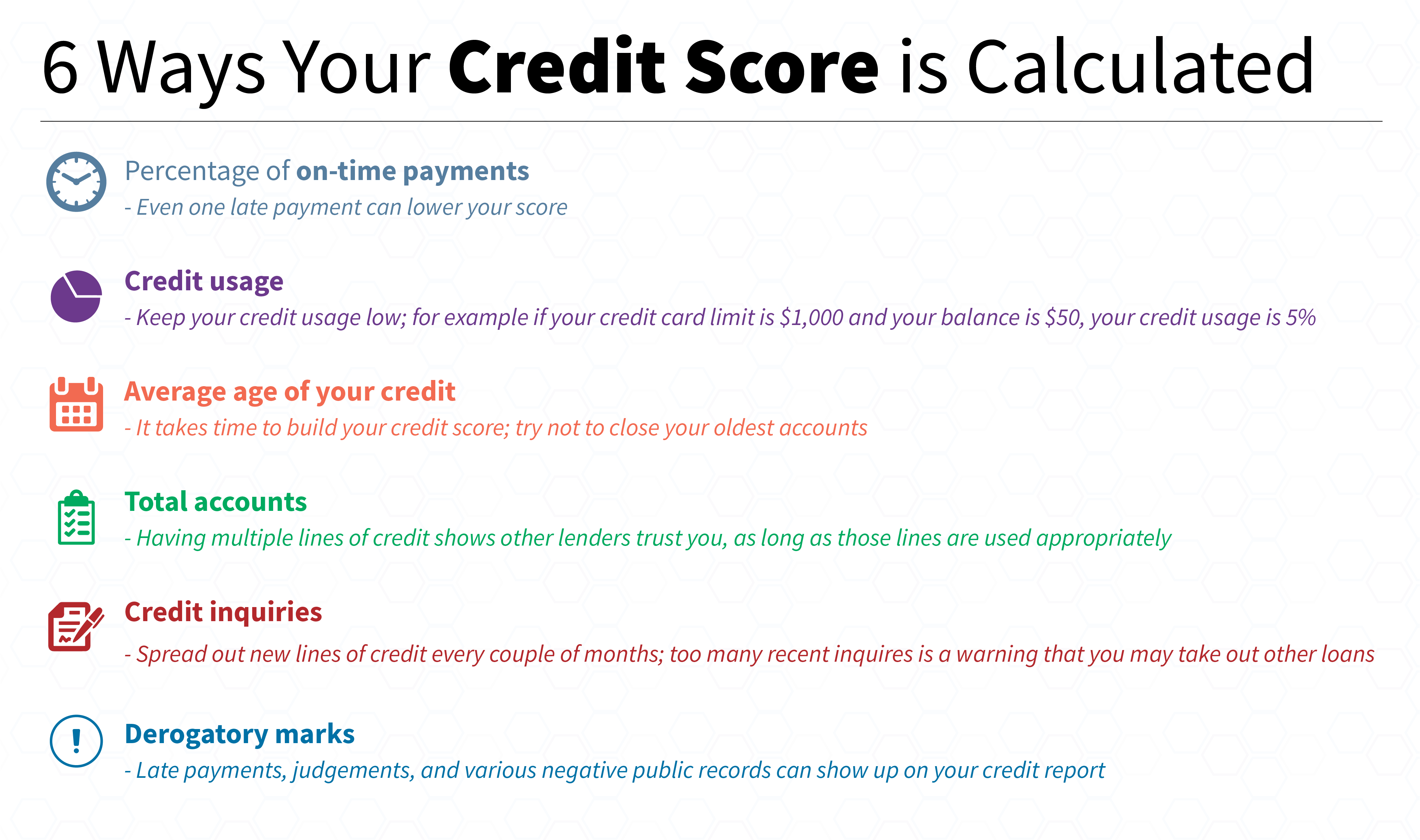

How Delinquent Student Loans Impact Your Credit Score

When you miss a student loan payment, your loan servicer reports this delinquency to the three major credit bureaus: Equifax, Experian, and TransUnion. This negative information becomes part of your credit report, significantly impacting your credit score calculation. The effect is substantial; even a single missed payment can lead to a significant drop in your FICO score, potentially impacting your ability to secure future loans or credit.

The impact of federal and private student loans on your credit score differs slightly. While both negatively affect your score if delinquent, the collection practices and reporting mechanisms might vary. Private lenders may be quicker to pursue aggressive collection methods, further impacting your credit.

- Negative impact on FICO scores: A drop of 50-100 points or more is possible with even one missed payment.

- Increased difficulty securing loans: Obtaining auto loans, mortgages, or other significant loans becomes exponentially harder.

- Higher interest rates on future borrowing: Lenders perceive you as a higher risk, leading to significantly higher interest rates.

- Potential rejection for credit cards and other financial products: Credit card applications and other financial products may be denied due to poor credit history.

Types of Delinquency and Severity of Impact

Delinquency is categorized by the number of days your payment is past due. The longer you're delinquent, the more severe the impact on your credit score.

- 30 days late: While the initial impact might be relatively small, it's a warning sign.

- 60 days late: The negative mark on your credit report becomes more pronounced.

- 90 days late: This indicates a serious problem and significantly lowers your credit score.

- Default: Defaulting on a student loan has the most catastrophic consequences. Your credit score plummets, and you face serious financial repercussions.

The consequences of default extend beyond a damaged credit score:

- Wage garnishment: A portion of your wages can be legally seized to repay the debt.

- Tax refund offset: The government can withhold your tax refund to pay towards your defaulted loan.

- Difficulty obtaining government benefits: Securing certain government benefits might become challenging.

Strategies to Protect Your Credit Score with Student Loans

Proactive strategies are crucial to avoid delinquency and protect your credit score. Careful financial planning is paramount.

- Budgeting and financial planning: Create a realistic budget that includes your student loan payments.

- Exploring deferment or forbearance options: These options can temporarily postpone payments, but they typically don't eliminate the debt and may have negative long-term implications. Understand the terms carefully before opting for them.

- Contacting your loan servicer proactively: If facing financial hardship, contact your loan servicer immediately to explore possible repayment options.

- Utilizing student loan repayment calculators: These tools help you understand your repayment options and plan effectively.

- Income-driven repayment plans: These plans adjust your monthly payments based on your income, making them more manageable.

- Loan consolidation and refinancing: Consolidating multiple loans into one or refinancing at a lower interest rate can simplify payments and potentially reduce your monthly burden.

- Seeking professional financial advice: A financial advisor can provide personalized guidance on managing your student loans and improving your financial situation.

Rebuilding Your Credit After Delinquent Student Loans

Rebuilding your credit after delinquency takes time and consistent effort. It's a marathon, not a sprint.

- Dispute inaccuracies on credit reports: Review your credit reports regularly and dispute any inaccuracies.

- Consistent on-time payments on all accounts: Make all your payments on time to demonstrate responsible financial behavior.

- Credit monitoring services: These services help you track your credit report and identify potential problems early.

- Seeking credit counseling: A credit counselor can provide valuable guidance and support during the rebuilding process.

The process can take several years, but consistent responsible financial behavior is key.

Conclusion:

Delinquent student loans have a significant and lasting negative impact on your credit score, affecting your ability to secure loans, credit cards, and other financial products. The severity of the impact depends on the type of loan, length of delinquency, and ultimately, whether the loan defaults. Proactive management of your student loan debt, including exploring available repayment options and seeking professional help when needed, is crucial to protecting your credit score and financial future. Don't let delinquent student loans damage your financial future. Take control of your student loan debt today by exploring your options and protecting your credit score.

Featured Posts

-

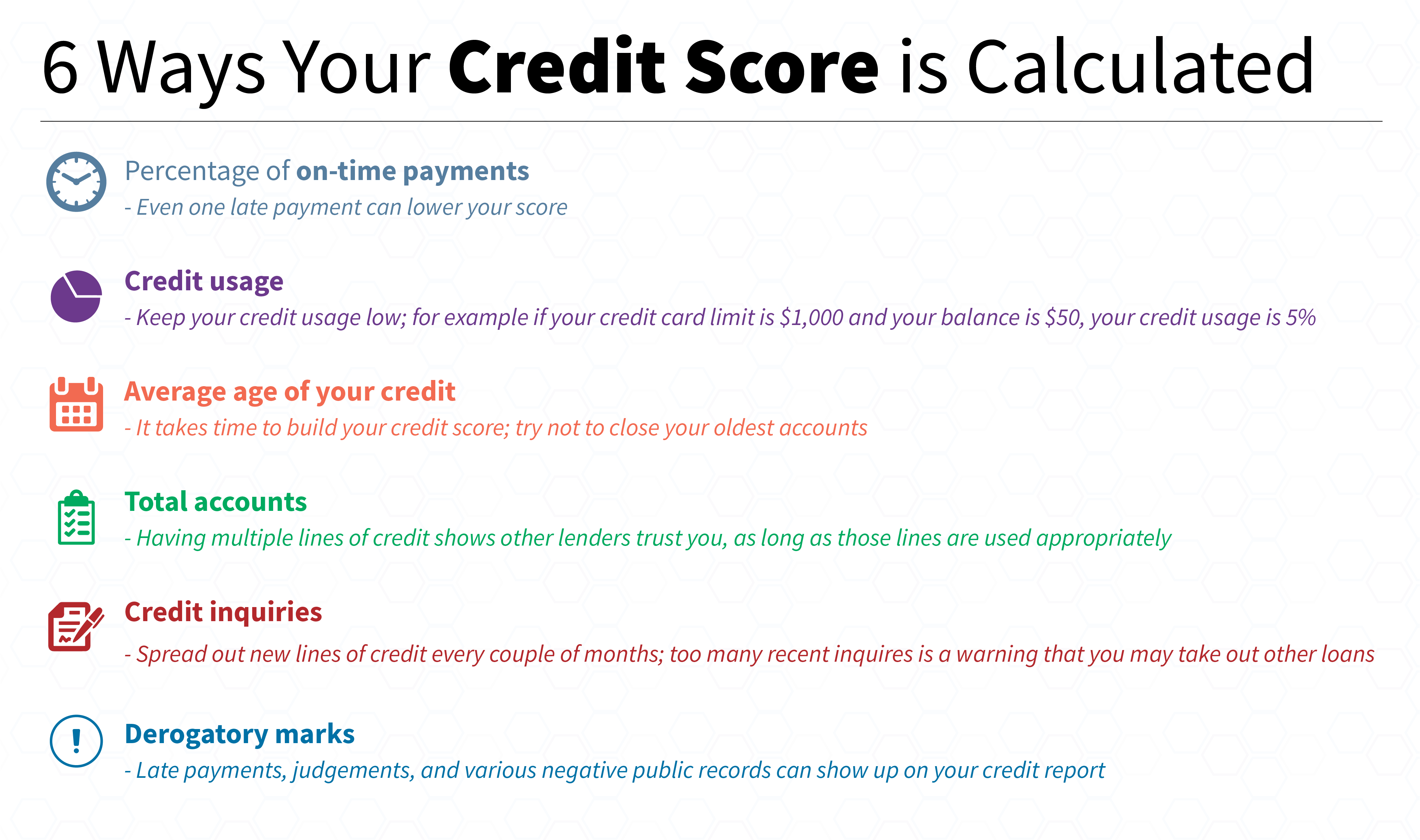

Reebok X Angel Reese A Powerful Collaboration

May 17, 2025

Reebok X Angel Reese A Powerful Collaboration

May 17, 2025 -

Subat 2024 Tuerkiye Uluslararasi Yatirim Pozisyonu Oenemli Rakamlar Ve Degerlendirme

May 17, 2025

Subat 2024 Tuerkiye Uluslararasi Yatirim Pozisyonu Oenemli Rakamlar Ve Degerlendirme

May 17, 2025 -

Canadas Best Online Casino Why 7 Bit Casino Ranks 1

May 17, 2025

Canadas Best Online Casino Why 7 Bit Casino Ranks 1

May 17, 2025 -

Simplified Surface Portfolio Analyzing Microsofts Latest Move

May 17, 2025

Simplified Surface Portfolio Analyzing Microsofts Latest Move

May 17, 2025 -

Razvitie Biznesa V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov

May 17, 2025

Razvitie Biznesa V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov

May 17, 2025

Latest Posts

-

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025 -

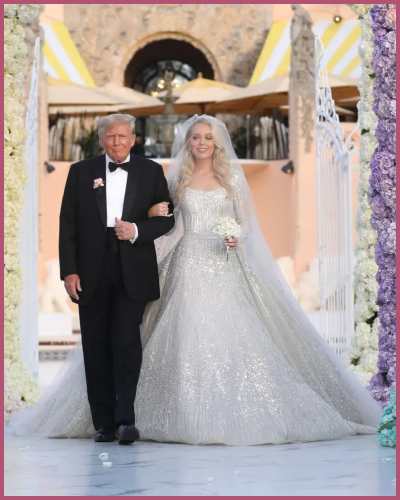

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025