Definity's $3.3 Billion Acquisition Of Travelers Canada: A Closer Look

Table of Contents

Strategic Rationale Behind Definity's Acquisition

Definity's acquisition of Travelers Canada wasn't a random move; it's a strategic play designed to significantly bolster its position in the Canadian insurance market.

Expanding Market Share in Canada

This acquisition provides Definity with several key strategic advantages:

- Increased Canadian insurance market penetration: Travelers Canada boasts a substantial customer base and established distribution network, instantly expanding Definity's reach across Canada. This move propels Definity further up the rankings of major Canadian insurers.

- Diversification of Definity's product portfolio: The acquisition adds Travelers Canada's existing product lines to Definity's offerings, creating a more comprehensive and diverse portfolio to cater to a wider range of customer needs. This diversification mitigates risk and strengthens the company's overall market position.

- Synergies and cost savings opportunities: Combining operations, technology, and back-office functions can generate substantial cost savings and efficiencies for Definity. Economies of scale and streamlined processes are key outcomes expected from this merger.

- Strengthened competitive positioning against other major players: By absorbing a significant competitor, Definity strengthens its competitive standing against other prominent insurers in Canada. This significantly improves its bargaining power and market dominance.

Synergies and Integration Challenges

While the synergies are considerable, integrating two large insurance companies is never without challenges:

- Potential for combining technology platforms and operational efficiencies: Streamlining IT systems and operational processes can lead to major efficiency gains but requires significant investment and careful planning. This includes data migration, system integration, and employee training.

- Challenges related to merging different company cultures and employee integration: Combining two distinct corporate cultures requires sensitive management to avoid employee dissatisfaction and maintain productivity during the transition. Effective communication and change management strategies are crucial.

- Regulatory hurdles and approvals: The Competition Bureau of Canada and other relevant regulatory bodies will scrutinize the acquisition to ensure it doesn't harm competition. Securing all necessary approvals is crucial for the deal's completion.

- Potential disruptions to customer service during transition: Integration processes can cause temporary disruptions to customer service. Proactive communication with customers and robust contingency plans are vital to minimizing negative impact.

Financial Implications of the $3.3 Billion Deal

The $3.3 billion price tag raises important questions about Definity's financing and the overall financial impact.

Funding and Financing

Definity likely used a combination of financing methods to fund this substantial acquisition:

- Details about the funding structure (debt, equity, etc.): A mix of debt financing (loans and bonds) and equity financing (issuing new shares) was probably employed to balance risk and maintain financial stability.

- Impact on Definity's debt-to-equity ratio: The acquisition will increase Definity's debt load, affecting its debt-to-equity ratio. Careful management of this ratio is essential for maintaining investor confidence.

- Expected return on investment (ROI) for Definity: Definity's financial projections will include detailed forecasts of the expected return on this substantial investment. Synergies and market share growth are key elements of this ROI calculation.

- Potential impact on Definity's credit rating: Credit rating agencies will assess the acquisition's impact on Definity's financial health and may adjust its credit rating accordingly. Maintaining a strong credit rating is critical for future borrowing capabilities.

Valuation and Deal Structure

The valuation of Travelers Canada and the deal's structure are vital aspects to analyze:

- Discussion of the deal's multiples (e.g., Price-to-earnings ratio): The acquisition price was likely determined based on various valuation multiples, comparing it to similar transactions in the insurance sector.

- Explanation of any contingent payments or earn-outs: Parts of the purchase price may be contingent on Travelers Canada meeting certain performance targets in the coming years. This adds complexity but can align incentives.

- Comparison to similar acquisitions in the insurance sector: Benchmarking this acquisition against comparable deals provides insights into its relative valuation and overall market trends.

Impact on the Canadian Insurance Market

The acquisition significantly alters the competitive landscape of the Canadian insurance market.

Competitive Landscape

This insurance acquisition creates ripple effects throughout the industry:

- Increased concentration in the market: The merger reduces the number of major players, leading to a more concentrated market. This raises concerns about potential reduced competition.

- Potential impact on insurance premiums and rates for consumers: While difficult to predict, the deal's effect on premiums will be closely watched by consumers and regulatory bodies. Economies of scale could lead to lower prices, but increased market power could also lead to price increases.

- Opportunities and challenges for competitors: Other insurers now face a more formidable competitor in Definity, creating new challenges while also presenting opportunities for those who can effectively differentiate their offerings.

Regulatory Scrutiny

The acquisition will face thorough regulatory review:

- Review by the Competition Bureau of Canada: The Competition Bureau will assess whether the deal substantially lessens competition and harms consumers. Addressing antitrust concerns is paramount.

- Potential antitrust concerns: The merger's potential to stifle competition will be a central focus of regulatory review. Addressing these concerns proactively is crucial for successful approval.

- Other regulatory bodies involved in the approval process: Depending on the specific lines of insurance involved, other regulatory bodies may be involved in the approval process. This adds to the complexity of securing approvals.

Conclusion: The Future of Definity After the Travelers Canada Acquisition

Definity's acquisition of Travelers Canada is a bold move with far-reaching implications. The strategic rationale is clear: expansion of market share, diversification, and enhanced competitive positioning in the Canadian insurance market. However, the financial implications require careful management, and the integration process presents significant challenges. The deal's impact on the Canadian insurance market is substantial, raising questions about competition and consumer pricing. The long-term success of this acquisition hinges on Definity's ability to effectively integrate Travelers Canada, manage the associated financial risks, and navigate the regulatory landscape. Stay informed about further developments in Definity's acquisition of Travelers Canada and similar major insurance acquisitions to understand their evolving impact on the industry.

Featured Posts

-

Jon Jones Unresolved Rivalry With Daniel Cormier Analysis From A Former Ufc Competitor

May 30, 2025

Jon Jones Unresolved Rivalry With Daniel Cormier Analysis From A Former Ufc Competitor

May 30, 2025 -

Killer Seaweed The Extermination Of Marine Life In Australia

May 30, 2025

Killer Seaweed The Extermination Of Marine Life In Australia

May 30, 2025 -

Oasis Tour Ticket Fiasco Investigating Ticketmasters Compliance With Consumer Protection Laws

May 30, 2025

Oasis Tour Ticket Fiasco Investigating Ticketmasters Compliance With Consumer Protection Laws

May 30, 2025 -

Assessing Trumps Repeated Two Week Timeline For Ukraine Peace

May 30, 2025

Assessing Trumps Repeated Two Week Timeline For Ukraine Peace

May 30, 2025 -

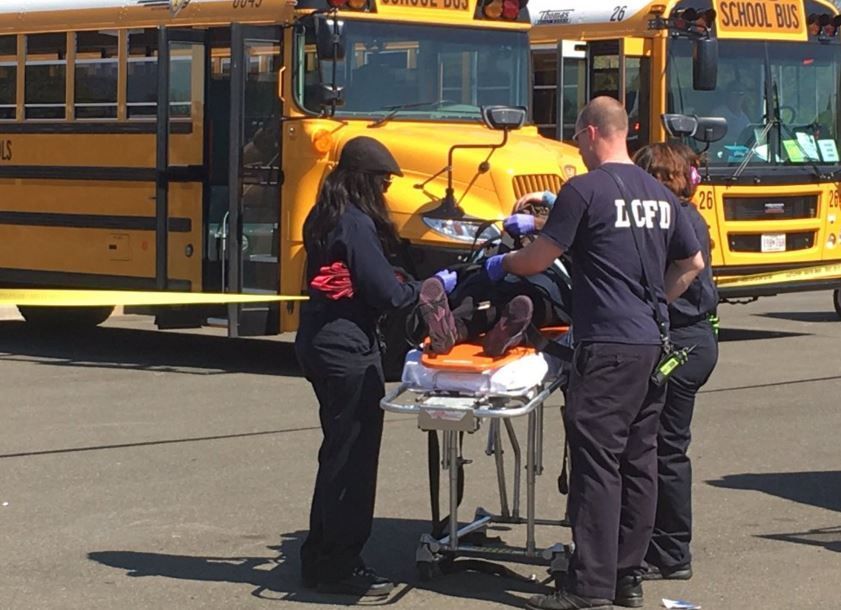

Pella School Bus Accident Leaves Two With Injuries

May 30, 2025

Pella School Bus Accident Leaves Two With Injuries

May 30, 2025