Decoding Warren Buffett's Apple Sale: Insights For Investors

Table of Contents

The Magnitude of the Sale and Market Reaction

The sheer scale of Warren Buffett's Apple Sale is noteworthy. Berkshire Hathaway reduced its Apple stake by approximately [Insert Number] shares, representing a [Insert Percentage]% decrease in its overall Apple holdings. This translated to a dollar value of roughly [Insert Dollar Amount]. The immediate market reaction was swift and palpable. Apple's stock price experienced a [Insert Percentage]% drop in the [Timeframe] following the announcement, accompanied by a significant surge in trading volume.

- Shares Sold: Approximately [Insert Number] shares.

- Percentage Change in Apple's Stock Price: [Insert Percentage]% decrease.

- Comparison to Previous Transactions: This sale represents a [Describe the significance] departure from Berkshire Hathaway's previous consistent holding and gradual increases in Apple stock.

Potential Reasons Behind Buffett's Decision

Several plausible explanations exist for Warren Buffett's Apple Sale. Let's explore the most prominent theories:

Rebalancing the Berkshire Hathaway Portfolio

Berkshire Hathaway, with its vast and diverse portfolio, regularly engages in portfolio rebalancing. The sale could reflect a strategic decision to reallocate capital to other sectors considered undervalued or poised for higher growth. This aligns with Buffett's long-held principles of diversification and risk management.

- Data Point: Berkshire Hathaway's recent investments in [Mention specific sectors or companies].

- Expert Opinion: [Quote from a financial analyst regarding portfolio rebalancing].

Market Timing and Valuation Concerns

It's possible that Buffett perceived a temporary overvaluation in Apple's stock price, prompting a strategic decision to secure profits. Concerns about slowing iPhone sales, increasing competition, and macroeconomic uncertainties might have influenced this assessment.

- Data Point: Apple's recent financial reports showing [Mention relevant financial indicators].

- Expert Opinion: [Quote from an expert analyzing Apple's valuation].

Investment in Other Opportunities

Buffett is renowned for his ability to identify undervalued assets. The sale could signal the emergence of more attractive investment opportunities elsewhere, leading to a shift in capital allocation.

- Data Point: Recent market trends suggesting potential growth in [Mention specific sectors].

- Speculation: Potential investment targets could include [Mention potential investment areas].

Lessons for Investors from Buffett's Apple Sale

Warren Buffett's Apple Sale offers several invaluable lessons for investors of all levels:

Diversification

The sale underscores the critical importance of diversification. Even a seemingly stable investment, like Apple, can experience volatility. Diversifying your portfolio across various asset classes mitigates risk.

- Tip: Allocate your investments across different sectors, geographies, and asset types.

- Warning: Avoid over-concentration in any single stock or sector.

Long-Term Investing

While market fluctuations are inevitable, the long-term perspective remains crucial. Short-term market movements shouldn't dictate long-term investment strategies.

- Tip: Focus on the fundamental strength and long-term prospects of companies before investing.

- Warning: Avoid impulsive trading decisions based on short-term market noise.

Fundamental Analysis

Thorough research and fundamental analysis are essential before making any investment decision. Understanding a company's financials, competitive landscape, and growth potential is vital.

- Tip: Analyze a company's financial statements, competitive advantages, and management team.

- Warning: Don't solely rely on market sentiment or speculation.

Future Implications for Apple and Berkshire Hathaway

The long-term consequences of Warren Buffett's Apple Sale remain to be seen. For Apple, it might signal a period of slight market uncertainty until future performance demonstrates continued strength. Berkshire Hathaway's move could reflect a shift in investment priorities, potentially influencing their future portfolio allocations.

- Prediction: Apple's stock price might experience further short-term volatility.

- Scenario: Berkshire Hathaway may increase investments in other technology companies or explore alternative sectors.

Conclusion: Key Takeaways and Call to Action

Warren Buffett's Apple Sale highlights the dynamic nature of the investment world, emphasizing the importance of diversification, long-term perspectives, and meticulous fundamental analysis. The sale serves as a potent reminder that even the most successful investors adjust their strategies based on market conditions and evolving opportunities. By analyzing Warren Buffett's investment decisions and understanding the implications of the Apple sale, investors can refine their own approaches. Conduct your own thorough research on Warren Buffett's Apple Sale, and develop informed investment strategies based on these insights. Further reading on value investing and portfolio management techniques can enhance your understanding. Don't hesitate to analyze Warren Buffett’s investment philosophy to further refine your approach to investing.

Featured Posts

-

Facebook Under Trump Zuckerbergs Challenges And Opportunities

Apr 23, 2025

Facebook Under Trump Zuckerbergs Challenges And Opportunities

Apr 23, 2025 -

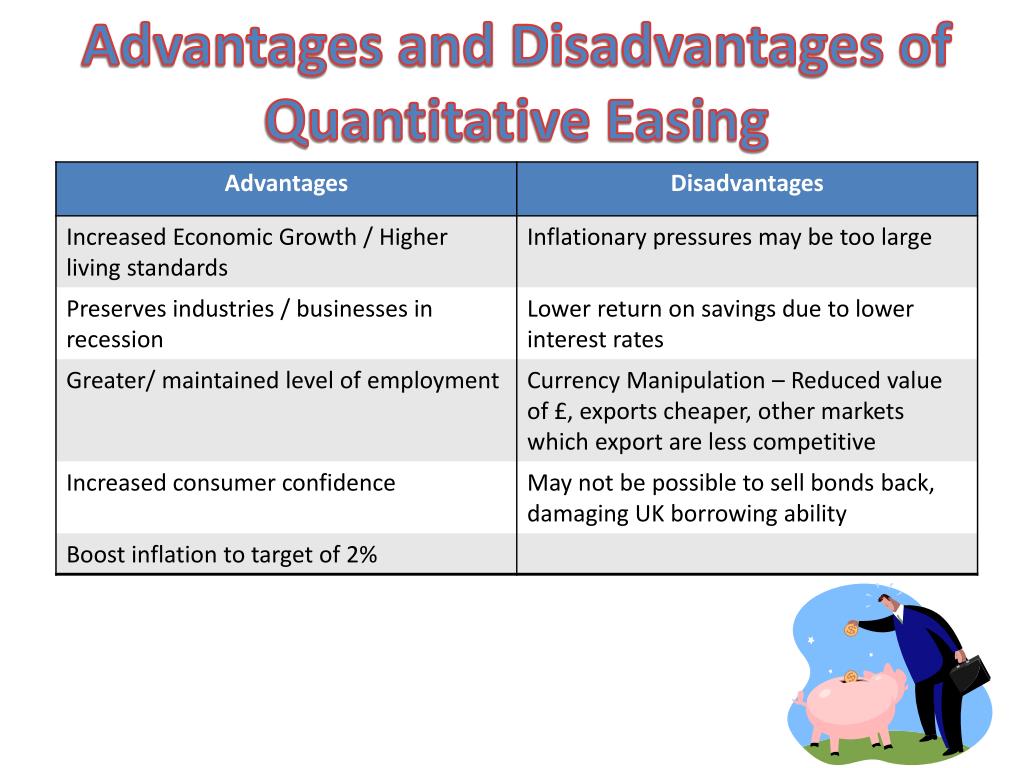

Quantitative Easing Greene Suggests A Revised Boe Strategy For Future Economic Crises

Apr 23, 2025

Quantitative Easing Greene Suggests A Revised Boe Strategy For Future Economic Crises

Apr 23, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 23, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 23, 2025 -

Lab Owners Guilty Plea In Covid 19 Test Falsification Case

Apr 23, 2025

Lab Owners Guilty Plea In Covid 19 Test Falsification Case

Apr 23, 2025 -

Yankees Big Win A Testament To Team Strength Not Just Powerful Bats

Apr 23, 2025

Yankees Big Win A Testament To Team Strength Not Just Powerful Bats

Apr 23, 2025