Decoding Uber's Double-Digit Stock Rally In April

Table of Contents

Improved Financial Performance and Profitability

Uber's impressive April stock performance was largely driven by a significant improvement in its financial results. This positive shift stems from both stronger-than-expected earnings and demonstrable cost-cutting measures.

Stronger-than-Expected Q1 Earnings

Uber's Q1 2024 earnings report significantly exceeded analyst expectations. Key metrics showcased impressive growth:

- Revenue Growth: A substantial increase in revenue, exceeding projections by a considerable margin. Specific figures illustrating this growth, once released, should be inserted here.

- Adjusted EBITDA: A positive and growing adjusted EBITDA demonstrated improved operational efficiency and profitability. Again, precise figures are needed here for optimal SEO impact.

- Net Income: A positive net income, possibly the first in several quarters, signaling a major turnaround in Uber's financial health.

These positive results were driven by strong performances across multiple segments:

- Rides: Increased ridership and higher fares contributed significantly to revenue growth.

- Delivery: The food delivery segment continued to perform well, showing resilience and consistent demand.

- Freight: This emerging segment likely also contributed positively to overall revenue.

These positive numbers significantly impacted the overall narrative around Uber's financial health, contributing heavily to the Uber stock price increase and the positive Uber investor sentiment. Keywords like Uber Q1 earnings, Uber revenue growth, Uber profitability, and Uber EBITDA are crucial for search engine optimization.

Cost-Cutting Measures and Operational Efficiency

Simultaneously, Uber implemented various cost-cutting measures and focused on enhancing operational efficiency:

- Streamlined Operations: Internal restructuring and process improvements led to significant cost reductions.

- Optimized Driver Compensation Models: While details remain confidential, adjustments to driver compensation likely played a role in improving margins without significantly impacting driver supply.

- Technological Efficiency: Investments in technology and AI likely improved logistics, reduced operational costs, and optimized resource allocation.

These measures, coupled with the strong revenue growth, resulted in improved profitability, bolstering investor confidence and driving the Uber stock rally. Keywords like Uber cost-cutting, Uber operational efficiency, and Uber driver compensation are strategically important.

Strategic Initiatives and Growth Strategies

Beyond improved financials, Uber's strategic initiatives contributed to the April stock surge. These initiatives demonstrate a clear path to future growth and expansion.

Expansion into New Markets and Services

Uber's continuous expansion into new markets and the introduction of new services fuel expectations of further growth.

- Geographical Expansion: Entering new geographical areas taps into previously untapped markets, increasing potential customer base and revenue streams. Specific examples of new market entries should be added here, if available.

- New Service Launches: Introducing new delivery options, such as grocery delivery partnerships or expansion into specialized delivery services, broadens Uber's service offerings and attracts a wider customer base. Specific examples of new services are vital.

These expansions contribute to long-term revenue growth, increasing investor confidence in Uber's future potential. Keywords such as Uber expansion, Uber new services, and Uber autonomous driving (if applicable) should be used organically.

Technological Advancements and Innovation

Uber's commitment to technological innovation is a key driver of its success and its increased stock value.

- App Improvements: Regular updates to the Uber app, enhancing user experience and driver convenience, improve customer satisfaction and retention.

- New Features: Introduction of features like improved payment options, integrated loyalty programs, or enhanced safety features contribute to a more seamless and enjoyable experience for both riders and drivers.

- AI-Driven Optimizations: Implementation of AI for route optimization, dynamic pricing, and improved matching algorithms leads to greater efficiency and profitability.

Continuous technological advancements are key to Uber maintaining its competitive edge and achieving sustainable growth. Using keywords like Uber technology, Uber app improvements, and Uber AI helps optimize search engine ranking.

Market Sentiment and Investor Confidence

The April stock rally was fueled not only by Uber's performance but also by the positive market sentiment surrounding the company.

Positive Market Reaction to Earnings and Strategy

The market reacted positively to Uber's strong Q1 earnings and its strategic initiatives.

- Analyst Upgrades: Financial analysts and investment firms issued positive ratings and upgrades, reflecting a renewed confidence in Uber's future prospects.

- Positive Media Coverage: Favorable media coverage further fueled the positive sentiment, contributing to increased investor interest.

- Increased Investor Confidence: Overall, investor confidence in Uber significantly improved, leading to a surge in demand for Uber stock.

This positive market sentiment played a crucial role in driving the double-digit stock rally. Including keywords like Uber stock price, Uber investor sentiment, and Uber analyst ratings strengthens the article's SEO.

Impact of Macroeconomic Factors

Broader macroeconomic factors also played a role in shaping Uber's stock performance.

- Easing Inflation: Easing inflationary pressures potentially improved consumer spending, positively impacting demand for Uber's services.

- Changing Interest Rates: Changes in interest rates may have influenced investor sentiment towards growth stocks like Uber.

These macroeconomic factors, combined with Uber's strong performance, created a favorable investment environment. Keywords such as Macroeconomic factors, Uber stock market performance, and interest rates enhance the article's SEO.

Conclusion: Decoding the Rally – Investing in Uber's Future

Uber's double-digit stock rally in April was a result of a confluence of factors: significantly improved financial performance, driven by stronger-than-expected Q1 earnings and cost-cutting measures; strategic initiatives focused on expansion and technological innovation; and positive market sentiment reflecting increased investor confidence. Understanding these factors provides valuable insights into Uber's evolving position in the market.

Key takeaways highlight the importance of strong financial performance, strategic planning, and positive market sentiment in driving stock price appreciation. Uber's ability to navigate challenges and capitalize on opportunities positions it for continued growth. Stay tuned for further updates on Uber's performance and potential future stock rallies. Learn more about investing in Uber stock and capitalizing on future growth opportunities.

Featured Posts

-

Pre 19 Godina Podatak O Novaku Koji Ce Vas Iznenaditi

May 18, 2025

Pre 19 Godina Podatak O Novaku Koji Ce Vas Iznenaditi

May 18, 2025 -

Kanye Wests Super Bowl Ban Taylor Swift Feud Explained

May 18, 2025

Kanye Wests Super Bowl Ban Taylor Swift Feud Explained

May 18, 2025 -

37 Yasinda Bile Zirvede Novak Djokovic In Suerdueruelebilir Basarisi

May 18, 2025

37 Yasinda Bile Zirvede Novak Djokovic In Suerdueruelebilir Basarisi

May 18, 2025 -

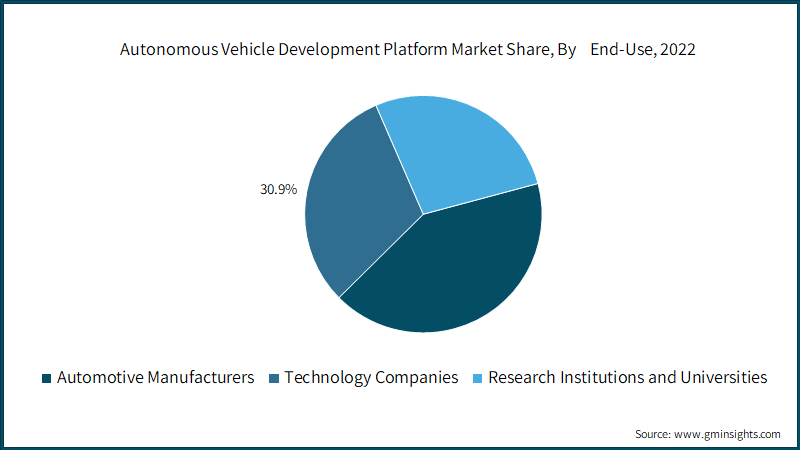

Etfs To Consider Riding The Wave Of Ubers Autonomous Vehicle Development

May 18, 2025

Etfs To Consider Riding The Wave Of Ubers Autonomous Vehicle Development

May 18, 2025 -

Russias Failed Peace Initiative Analyzing Putins Diplomatic Defeat

May 18, 2025

Russias Failed Peace Initiative Analyzing Putins Diplomatic Defeat

May 18, 2025

Latest Posts

-

Infografis Pesimisme Yang Meningkat Jalan Buntu Solusi Dua Negara Israel Palestina And Peran Indonesia

May 18, 2025

Infografis Pesimisme Yang Meningkat Jalan Buntu Solusi Dua Negara Israel Palestina And Peran Indonesia

May 18, 2025 -

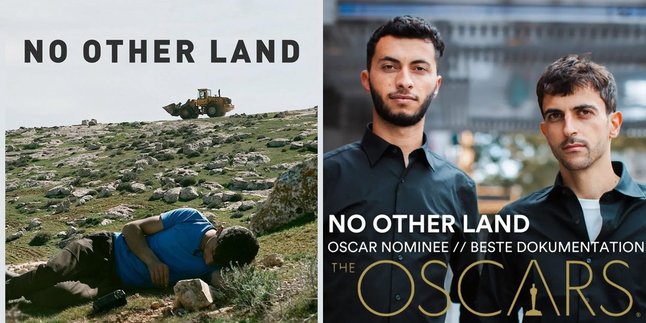

No Other Land Film Pemenang Oscar Yang Mengungkap Konflik Palestina Israel

May 18, 2025

No Other Land Film Pemenang Oscar Yang Mengungkap Konflik Palestina Israel

May 18, 2025 -

Infografis Menipisnya Harapan Solusi Dua Negara And Sikap Indonesia Terhadap Konflik Israel Palestina

May 18, 2025

Infografis Menipisnya Harapan Solusi Dua Negara And Sikap Indonesia Terhadap Konflik Israel Palestina

May 18, 2025 -

Film No Other Land Kemenangan Oscar Dan Realita Konflik Palestina Israel

May 18, 2025

Film No Other Land Kemenangan Oscar Dan Realita Konflik Palestina Israel

May 18, 2025 -

28 April 2025 Daily Lotto Results

May 18, 2025

28 April 2025 Daily Lotto Results

May 18, 2025