Decoding Live Nation Entertainment (LYV): Options For Smart Investors

Table of Contents

Live Nation operates through a multifaceted business model encompassing ticketing (Ticketmaster), venues, artist management, and sponsorship. Our goal is to illuminate the pathways to potentially profitable investment in LYV stock.

Understanding Live Nation's (LYV) Business Model and Financial Performance

Live Nation's success hinges on its diverse revenue streams and market-leading position. Let's delve into the specifics.

Revenue Streams and Market Dominance

Live Nation boasts a diversified revenue model, minimizing reliance on any single segment:

- Ticketing (Ticketmaster): This segment dominates the primary ticketing market, generating substantial revenue through fees on ticket sales for countless concerts and events globally.

- Venues: Live Nation owns and operates a vast network of amphitheaters, clubs, and festivals worldwide, providing consistent revenue streams from rentals, concessions, and merchandise sales.

- Artist Management: Representing prominent artists allows Live Nation to control significant aspects of their tours, enhancing profitability.

- Sponsorship: Securing sponsorships from various brands provides additional revenue streams and marketing opportunities.

This diversification contributes to robust overall revenue. Key financial metrics, including revenue growth, profitability (profit margins), and debt levels, should be carefully monitored through sources like the company's financial reports and reputable financial news outlets. While direct competitors are relatively few, analyzing the market share of smaller players and emerging technologies is crucial for understanding potential future challenges.

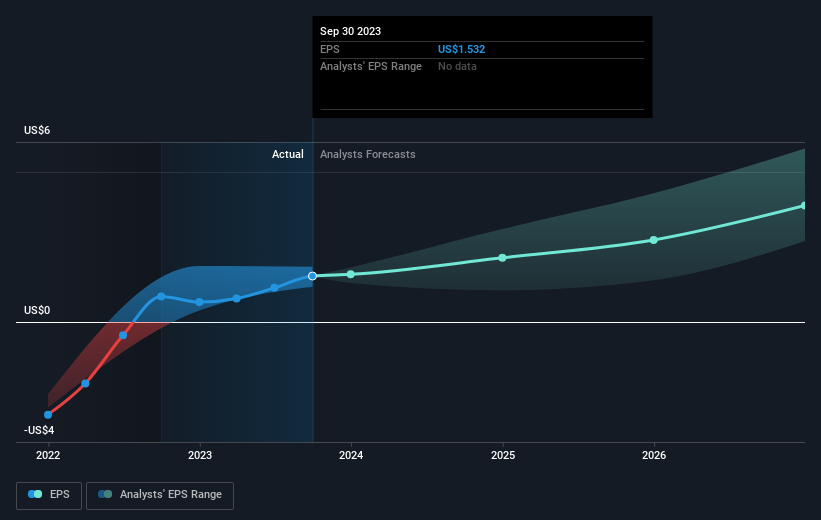

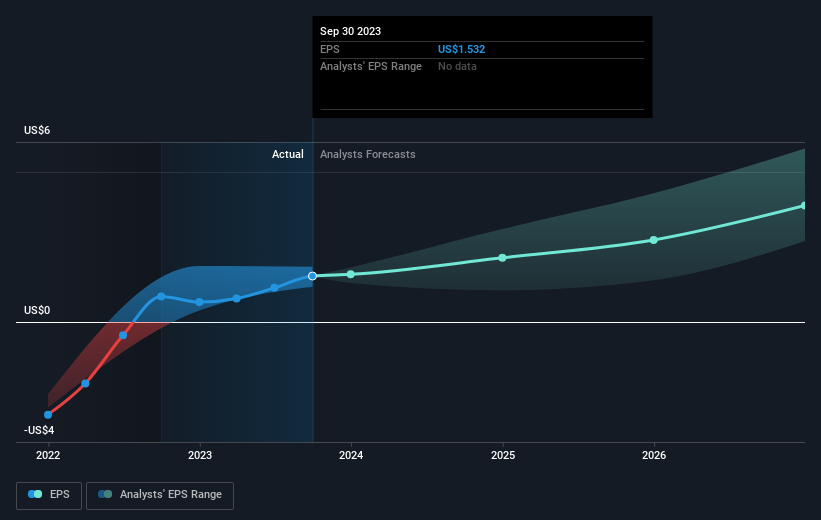

Analyzing LYV's Financial Health

A thorough evaluation of LYV's financial health requires examining key financial statements and ratios:

- Debt-to-Equity Ratio: This ratio reveals the company's leverage and its ability to manage debt. A high ratio could indicate increased financial risk.

- Profit Margins: Analyzing gross profit margin and net profit margin provides insights into the efficiency of Live Nation's operations and its ability to translate revenue into profit.

- Revenue Growth: Consistent year-over-year revenue growth is a positive indicator of a healthy and expanding business.

Regularly reviewing Live Nation's quarterly and annual reports (accessible through the investor relations section of their website and SEC filings) is essential. Any recent financial news or announcements, including earnings calls, press releases, and analyst reports, should be carefully considered. Remember to always scrutinize the risks and challenges – economic downturns or unforeseen events can impact the company's financial performance. Links to reliable sources like the SEC's EDGAR database and reputable financial news websites will provide further insight.

Evaluating Investment Strategies for Live Nation (LYV)

Choosing the right investment strategy depends on your risk tolerance and investment horizon.

Long-Term Investment Approach

A long-term investment strategy in LYV leverages the potential for continued growth in the live entertainment sector.

- Advantages: Potential for significant capital appreciation over the long term, riding the wave of growth in the industry.

- Disadvantages: Higher risk associated with longer holding periods, susceptibility to market downturns.

Factors like economic conditions, technological advancements (e.g., virtual concerts), and changing consumer preferences can impact long-term growth. Thorough research and diversification within your portfolio are critical.

Short-Term Trading Strategies

Short-term trading aims to capitalize on short-term price fluctuations.

- Potential Strategies: Day trading (buying and selling within a single day) and swing trading (holding for a few days or weeks) can be employed.

- Risks: Short-term trading is inherently riskier; significant losses are possible due to market volatility. Effective risk management techniques are vital.

News events (e.g., artist cancellations, new partnerships) and market sentiment can significantly influence LYV's short-term price movements.

Dividend Investing in LYV

While not a high-yield dividend stock, analyzing Live Nation's dividend history provides valuable insight for income-seeking investors.

- Dividend Yield and Payout Ratio: These metrics demonstrate the company's ability to distribute dividends and the sustainability of future payouts.

- Dividend Growth History: Examining past dividend growth provides clues about the company's commitment to returning value to shareholders.

Factors like profitability, financial health, and future investment needs influence the company's dividend policy.

Risks and Considerations for Investing in Live Nation (LYV)

Investing in LYV carries inherent risks that need careful consideration.

Macroeconomic Factors

Economic downturns, inflation, and recessionary periods significantly affect consumer spending on entertainment. This directly impacts ticket sales, venue attendance, and overall revenue.

- Potential Risks: Reduced consumer discretionary spending, decreased event attendance, and potential revenue decline.

Industry-Specific Risks

Competition, changing consumer preferences (e.g., streaming services impacting live event attendance), and technological disruptions pose significant challenges.

- Potential Risks: Loss of market share to competitors, decreased demand for live events, and the need for adaptation to new technologies.

Geopolitical Risks

Global events and geopolitical instability can negatively affect operations, particularly international tours and events.

- Potential Risks: Travel restrictions, safety concerns, and disruptions to supply chains can impact revenue and profitability.

Conclusion: Making Informed Investment Decisions with Live Nation Entertainment (LYV)

Investing in Live Nation Entertainment (LYV) requires a comprehensive understanding of its business model, financial health, and the various investment strategies available. This analysis highlights the potential for growth but also emphasizes the risks associated with investing in this dynamic sector. Remember to conduct thorough due diligence, assessing your risk tolerance and investment objectives before making any investment decisions. Understanding macroeconomic factors, industry-specific challenges, and geopolitical risks is critical for informed decision-making.

Ready to make informed investment decisions regarding Live Nation Entertainment (LYV)? Start your research today! Consult with a financial advisor and utilize reputable resources like the SEC's EDGAR database and financial news websites to gain a complete understanding before investing.

Featured Posts

-

Gyujtoi Markak A Lidl Ben Itt A Toekeletes Alkalom A Vasarlasra

May 29, 2025

Gyujtoi Markak A Lidl Ben Itt A Toekeletes Alkalom A Vasarlasra

May 29, 2025 -

Real Madrid Golazo Reaccion Inmediata A La Victoria 2 0 Sobre Sevilla

May 29, 2025

Real Madrid Golazo Reaccion Inmediata A La Victoria 2 0 Sobre Sevilla

May 29, 2025 -

Pakistans Crypto Diplomacy Pccs Impact In 50 Days

May 29, 2025

Pakistans Crypto Diplomacy Pccs Impact In 50 Days

May 29, 2025 -

Ipa O Ilon Mask Apoxorei Apo Tin Kyvernisi Tramp Kritiki Sto Megalo Omorfo Nomosxedio

May 29, 2025

Ipa O Ilon Mask Apoxorei Apo Tin Kyvernisi Tramp Kritiki Sto Megalo Omorfo Nomosxedio

May 29, 2025 -

Droge Omstandigheden Massale Annulering Paasvuren Drenthe

May 29, 2025

Droge Omstandigheden Massale Annulering Paasvuren Drenthe

May 29, 2025

Latest Posts

-

Live Music Stock Market Rebound Mondays Pre Market Jump

May 30, 2025

Live Music Stock Market Rebound Mondays Pre Market Jump

May 30, 2025 -

Fernando Cabral De Mello Assume Lideranca Na Sony Music Entertainment Brasil

May 30, 2025

Fernando Cabral De Mello Assume Lideranca Na Sony Music Entertainment Brasil

May 30, 2025 -

Live Music Stocks Surge Pre Market Monday Following A Volatile Week

May 30, 2025

Live Music Stocks Surge Pre Market Monday Following A Volatile Week

May 30, 2025 -

Eventims Positive Financial Performance A Strong Start To 2024

May 30, 2025

Eventims Positive Financial Performance A Strong Start To 2024

May 30, 2025 -

Ilaiyaraajas London Symphony Rajinikanths Acknowledgement

May 30, 2025

Ilaiyaraajas London Symphony Rajinikanths Acknowledgement

May 30, 2025