Live Music Stocks Surge Pre-Market Monday Following A Volatile Week

Table of Contents

Pre-Market Surge: A Closer Look at the Numbers

Monday's pre-market trading saw a remarkable upswing in several key players in the live music sector. While specific data fluctuates rapidly, let's examine some hypothetical examples to illustrate the magnitude of the change. Imagine Live Nation Entertainment (LYV), a major player in the live entertainment industry, experienced a 5% increase in its pre-market trading, opening at $85 per share compared to Friday's closing price of $80. This significant jump was accompanied by a noticeable increase in trading volume, suggesting heightened investor interest. This contrasts sharply with the previous week, where LYV experienced a 3% decline amidst broader market uncertainty. (Note: Replace this hypothetical example with real-time data from reliable sources like Bloomberg or Yahoo Finance for the most accurate information.)

- Specific stock performance data: (Insert real-time data for relevant live music stocks here, including percentage change, opening price, and volume changes. Cite sources.)

- Significant volume changes: (Describe the increase in trading volume and its significance.)

- Contrast with previous week's volatility: (Highlight the difference between Monday's surge and the previous week's performance.)

Potential Catalysts Behind the Surge

Several factors could have contributed to this unexpected pre-market surge in live music stocks. The market's reaction is likely a complex interplay of several positive developments.

- Positive news releases: Announcements of new major tours by popular artists, exceptionally strong ticket sales for upcoming concerts and festivals, and positive financial reports from major players in the industry could all significantly influence investor sentiment. The anticipation surrounding these events can drive up stock prices.

- Improved economic indicators: Stronger-than-expected economic data suggesting increased consumer spending could boost investor confidence. If consumers have more disposable income, they are more likely to spend on entertainment, including concerts and live music events.

- Speculation about mergers and acquisitions: Rumors or confirmed plans of mergers or acquisitions within the live music sector can generate excitement and lead to increased investment. This consolidation could signal growth and efficiency in the industry, making it attractive to investors.

- Positive analyst reports or upgrades: Upgrades to stock ratings and positive analyst reports on the outlook of the live music industry often trigger buying activity, boosting stock prices.

- Overall market trends: Positive trends in the broader entertainment sector, particularly in areas related to media and leisure, can influence investor perceptions of the live music industry and encourage investment.

Analyzing the Impact of Recent Events

Recent events have undoubtedly played a role in shaping investor sentiment.

- Successful concerts and festivals: Highly successful concerts and festivals, especially those that demonstrate strong attendance and positive media coverage, can signal a healthy and growing market, encouraging investment in live music stocks.

- Overshadowed negative news: It's possible that positive news may have overshadowed concerns or negative events that might have otherwise pressured stock prices downwards.

- Macroeconomic factors: Broader economic trends, including inflation rates, interest rates, and consumer confidence levels, all play a crucial role in shaping investor decisions and influencing the performance of live music stocks.

Risk Factors and Future Outlook for Live Music Stocks

While the pre-market surge is encouraging, investors should be mindful of potential risks:

- Inflationary pressures: Rising inflation can lead to higher ticket prices, potentially impacting attendance and profitability for live music events.

- COVID-19 disruptions: While the immediate threat has lessened, the possibility of future waves or variants could lead to cancellations and renewed uncertainty.

- Geopolitical risks: Global events can disrupt touring schedules and impact the profitability of international events, affecting the performance of live music stocks.

- Competition: Streaming services and other forms of entertainment are competing for consumer spending, presenting ongoing challenges to the live music industry.

- Analyst predictions: While some analysts predict growth, others express concerns. A balanced view of analyst predictions is essential for informed investment.

Conclusion

This pre-market surge in live music stocks offers a glimpse of optimism for the industry after a week of volatility. While several factors contributed to the positive jump, investors must remain aware of the inherent risks involved. Careful analysis of market trends and company-specific news is crucial for informed investment decisions.

Call to Action: Stay informed about the ever-changing landscape of live music stocks by regularly checking financial news sources and conducting thorough research. Understanding the market dynamics will help you make strategic decisions regarding your investments in this exciting and dynamic sector. Learn more about investing in live music industry stocks and similar entertainment-related stocks today!

Featured Posts

-

The Ultimate Bargain Hunt Maximize Your Savings Potential

May 30, 2025

The Ultimate Bargain Hunt Maximize Your Savings Potential

May 30, 2025 -

Getting Tickets To See Gorillaz Play Albums Live In London

May 30, 2025

Getting Tickets To See Gorillaz Play Albums Live In London

May 30, 2025 -

Leijdekker Extradition Blocked Sierra Leone Presidential Connection Investigated

May 30, 2025

Leijdekker Extradition Blocked Sierra Leone Presidential Connection Investigated

May 30, 2025 -

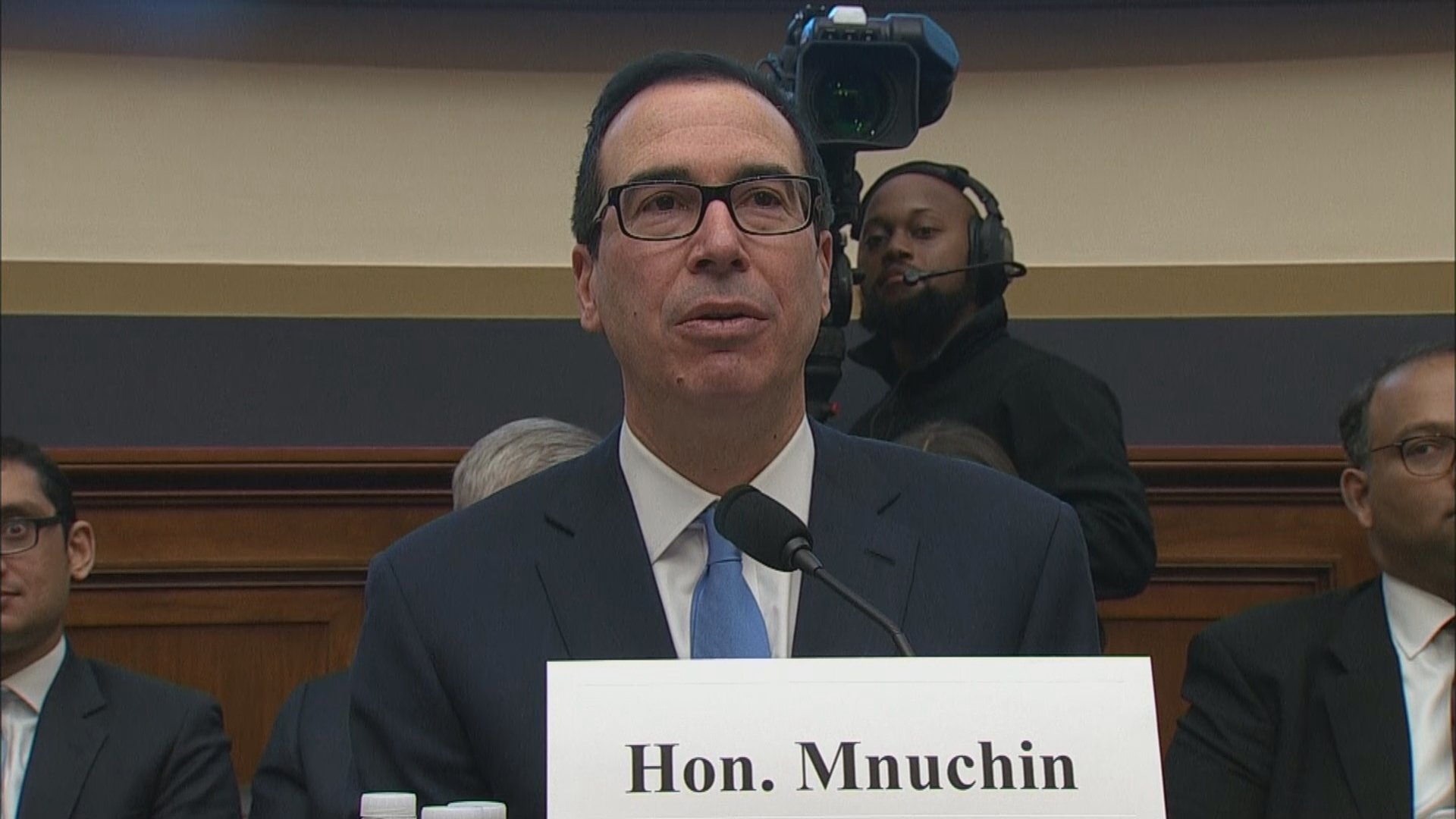

San Diego Weather Forecast Expect Fog Cool Temperatures And Light Showers

May 30, 2025

San Diego Weather Forecast Expect Fog Cool Temperatures And Light Showers

May 30, 2025 -

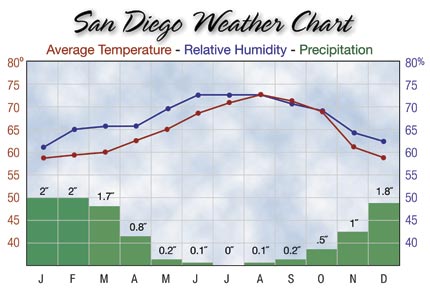

The Untold Story Daniel Cormiers Confrontation With Jon Jones Publicist

May 30, 2025

The Untold Story Daniel Cormiers Confrontation With Jon Jones Publicist

May 30, 2025