Decoding Bitcoin's Golden Cross: Is A Bull Run Imminent?

Table of Contents

Understanding the Bitcoin Golden Cross

The Bitcoin Golden Cross is a bullish signal in technical analysis that occurs when the 50-day moving average (MA) crosses above the 200-day MA. These moving averages smooth out price fluctuations, providing a clearer picture of the underlying trend. The 50-day MA reflects short-term price movements, while the 200-day MA indicates long-term trends. When the shorter-term average crosses above the longer-term average, it suggests a shift from bearish to bullish sentiment.

[Insert chart illustrating a Bitcoin Golden Cross here]

Historically, the Bitcoin Golden Cross has often preceded periods of significant price appreciation. However, it's crucial to remember that it's not a foolproof predictor. There have been instances where a Golden Cross occurred, yet the subsequent price action failed to produce a sustained bull run. This highlights the importance of considering other factors alongside the Golden Cross when making investment decisions.

- Technical Definition: The 50-day MA crossing above the 200-day MA.

- Historical Performance: Mixed results; sometimes precedes bull runs, sometimes not.

- Limitations: Not a self-sufficient prediction tool; requires contextual analysis.

Factors Influencing a Post-Golden Cross Bull Run

Several factors beyond the Golden Cross itself influence the likelihood of a sustained Bitcoin bull run. These factors can be categorized into macroeconomic conditions, adoption and institutional investment, and market sentiment.

Macroeconomic Conditions

Global economic conditions play a crucial role in Bitcoin's price. High inflation, rising interest rates, and negative economic sentiment can negatively impact Bitcoin, often leading to decreased investor appetite for riskier assets like cryptocurrencies. Conversely, periods of economic uncertainty can sometimes drive investors towards Bitcoin as a hedge against inflation. The correlation between traditional markets and the cryptocurrency market is complex and often unpredictable. Regulatory developments, both positive and negative, can significantly influence investor confidence and market volatility.

- Inflation: High inflation can boost Bitcoin's appeal as a store of value.

- Interest Rates: Rising rates can decrease investment in riskier assets.

- Regulation: Clearer regulations can increase institutional participation.

Adoption and Institutional Investment

The growing adoption of Bitcoin by institutional investors and large corporations is a crucial factor driving its long-term value. Increased institutional participation brings greater stability and liquidity to the market. The development of Bitcoin-related financial products, such as ETFs, enhances accessibility and makes it easier for institutional investors to participate. Bitcoin's inherent scarcity, with a limited supply of 21 million coins, further strengthens its potential as a long-term store of value.

- Institutional Investment: Increased investment brings stability and liquidity.

- Regulatory Clarity: Clearer regulations encourage more institutional involvement.

- Scarcity: Limited supply increases long-term value potential.

Market Sentiment and Social Media Trends

Public sentiment and social media hype significantly influence Bitcoin's price volatility. Positive sentiment and widespread media coverage can fuel price rallies, while negative news or regulatory concerns can trigger sharp declines. Analyzing Google Trends data and social media sentiment analysis can provide valuable insights into the prevailing market mood. Major news events and media coverage often have a disproportionate effect on the volatile cryptocurrency market.

- Social Media Sentiment: Positive sentiment can drive price increases.

- News Events: Significant news can trigger volatility.

- Google Trends: Analyzing search data provides insights into market interest.

Analyzing the Current Bitcoin Market

[Insert chart showing recent Bitcoin price action and relevant moving averages here]

Currently, Bitcoin's price, volume, and market capitalization show [Insert current market data here]. On-chain metrics, such as the MVRV ratio and the Puell Multiple, [Insert analysis of current on-chain metrics here]. Recent significant events, including [Mention recent relevant events], have [Explain their impact on the market]. This data provides a snapshot of the current market environment and can be used to assess the potential for a bull run following the Golden Cross.

Alternative Perspectives and Risks

While the Golden Cross can be a useful indicator, it's not infallible. Some analysts argue that it's a lagging indicator, meaning it confirms a trend rather than predicting one. Others point out that past performance is not indicative of future results. There are inherent risks associated with Bitcoin and cryptocurrency investments, including market corrections and unexpected regulatory actions. The cryptocurrency market is highly volatile, and significant price swings are common. Diversification and prudent risk management are crucial for mitigating potential losses.

- Counterarguments: The Golden Cross is a lagging indicator; past performance is not guaranteed.

- Risks: Market corrections, regulatory uncertainty, and inherent volatility.

- Risk Management: Diversification and careful risk assessment are essential.

Decoding Bitcoin's Golden Cross – The Verdict and Call to Action

The Bitcoin Golden Cross, while a potentially bullish signal, is not a guarantee of a sustained bull run. Its effectiveness depends heavily on macroeconomic conditions, institutional adoption, market sentiment, and the overall risk appetite of investors. While the current market conditions [Insert cautiously optimistic or pessimistic outlook based on your analysis], thorough research and due diligence are paramount before investing in Bitcoin.

Stay informed about Bitcoin's price action and the Golden Cross indicator by continuing your research. Understanding Bitcoin's potential requires careful analysis. Learn more about effective strategies for navigating the Bitcoin market and making informed investment decisions. Remember to conduct thorough research and seek professional financial advice before making any investment decisions.

Featured Posts

-

Celtics Tatum Suffers Apparent Ankle Injury Updates And Analysis

May 08, 2025

Celtics Tatum Suffers Apparent Ankle Injury Updates And Analysis

May 08, 2025 -

Gjranwalh Myn Wlyme Ke Mwqe Pr Dl Ka Dwrh Dlhn Ka Ghm

May 08, 2025

Gjranwalh Myn Wlyme Ke Mwqe Pr Dl Ka Dwrh Dlhn Ka Ghm

May 08, 2025 -

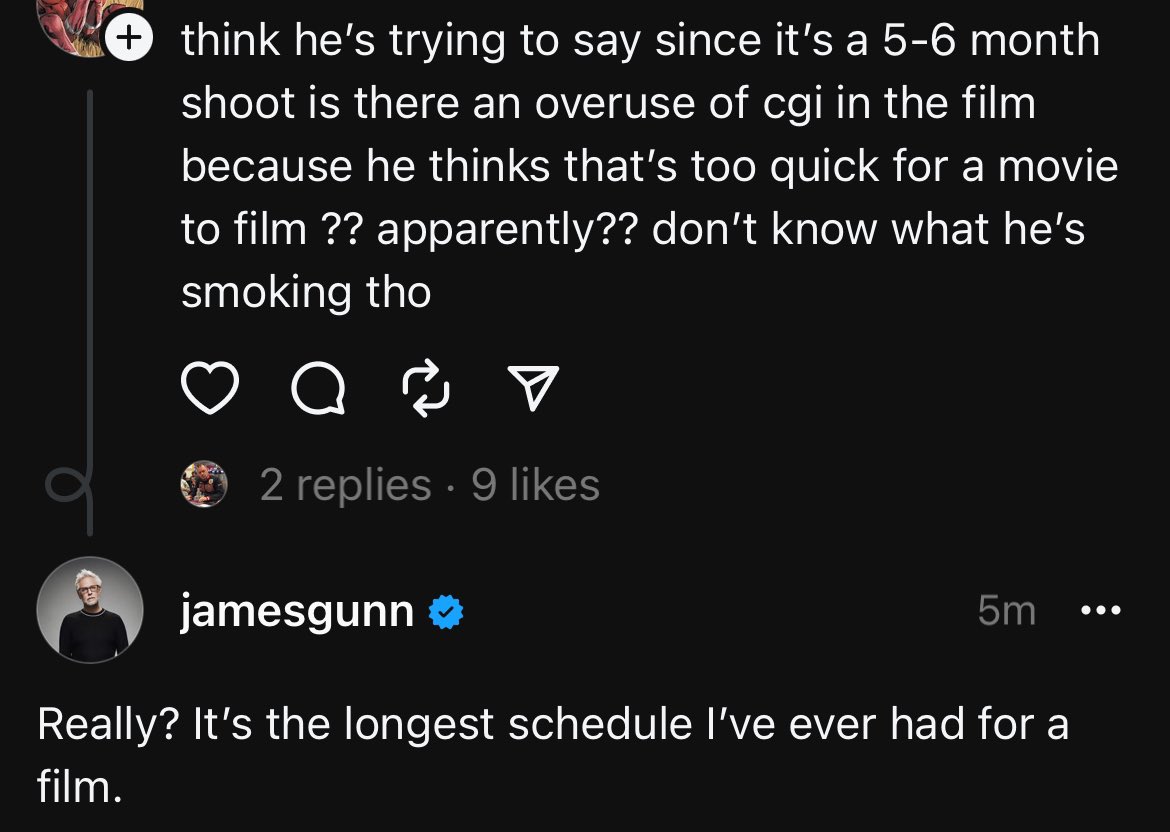

A Potential Superman Easter Egg Hidden In James Gunns Jimmy Olsen Anniversary Photo

May 08, 2025

A Potential Superman Easter Egg Hidden In James Gunns Jimmy Olsen Anniversary Photo

May 08, 2025 -

Mike Trouts Knee Soreness Angels Lose Fifth Straight Game

May 08, 2025

Mike Trouts Knee Soreness Angels Lose Fifth Straight Game

May 08, 2025 -

Liberation Day Tariffs A Deep Dive Into Their Effects On Various Stock Sectors

May 08, 2025

Liberation Day Tariffs A Deep Dive Into Their Effects On Various Stock Sectors

May 08, 2025