DAX Rises Again: Frankfurt Equities Opening And Record Highs

Table of Contents

Key Factors Driving the DAX Surge

Several interconnected factors have contributed to the recent impressive performance of the DAX, pushing it to record highs and signifying a robust period for Frankfurt equities.

Strong Corporate Earnings

Many DAX-listed companies have recently reported significantly better-than-expected earnings, a key driver of the index's surge. This positive trend reflects a healthy German economy and strong performance across various sectors.

- Increased profits across various sectors: From automotive giants to industrial powerhouses and technology leaders, many DAX companies have seen substantial profit increases, exceeding analyst predictions. This indicates strong demand for German goods and services both domestically and internationally.

- Positive outlook for future growth forecasts: The positive earnings reports are not just about past performance; many companies are projecting continued growth in the coming quarters, further bolstering investor confidence and driving up share prices. This positive outlook is a crucial factor in the sustained DAX rise.

- Strong consumer spending contributing to revenue growth: Robust consumer spending within Germany, fueled by a stable job market and improving economic conditions, is significantly contributing to the revenue growth of DAX-listed companies. This domestic demand is a critical component of the overall positive trend.

Global Economic Optimism

Positive economic indicators from around the world have played a significant role in fueling investor confidence, leading to increased investment in European markets, including the DAX. This global optimism translates into increased foreign investment in German equities.

- Improved global trade relations: Easing trade tensions between major global economies have reduced uncertainty and boosted investor sentiment, encouraging greater investment in international markets, benefiting the DAX.

- Decreasing inflation in some key economies: A gradual decrease in inflation in some key economies has reduced concerns about interest rate hikes, creating a more favorable investment environment and supporting the DAX's upward trajectory.

- Increased foreign direct investment in Germany: Germany's strong economic fundamentals and strategic location continue to attract significant foreign direct investment, further bolstering the DAX and Frankfurt equities.

Technological Advancements

The strong performance of technology companies listed on the DAX has been a significant contributor to the overall index growth. Germany's commitment to technological innovation is clearly paying off.

- Innovation driving sector growth: German technology companies are at the forefront of innovation in various fields, driving sector growth and attracting substantial investment. This innovative strength is a critical aspect of the DAX's success.

- Strong demand for German technological expertise: Global demand for German engineering and technological expertise remains strong, driving revenue growth and contributing to the overall positive performance of the DAX.

- Government support for technological advancements: The German government's continued investment in research and development, coupled with supportive policies, is creating a fertile ground for technological innovation and contributing to the DAX's upward momentum.

Impact of the DAX Rise on the German Economy

The rise in the DAX has significant implications for the German economy, creating a positive ripple effect across various sectors.

Increased Investor Confidence

The surge in the DAX reflects growing confidence in the German economy and its future prospects. This increased confidence attracts both domestic and foreign investment.

- Attracting further foreign investment: The strong DAX performance signals a healthy and attractive investment environment, attracting more foreign capital into Germany. This influx of investment further stimulates economic growth.

- Boosting domestic investment and job creation: Increased investor confidence translates into greater domestic investment, leading to job creation and overall economic expansion within Germany.

- Strengthening the Euro: The strong DAX performance contributes positively to the value of the Euro, further benefiting the German economy in international trade.

Positive Spillover Effects

The success of the DAX has a positive spillover effect, boosting other sectors of the German economy.

- Increased consumer spending: Positive economic sentiment, fueled by the strong DAX performance, leads to increased consumer confidence and spending, driving economic activity.

- Growth in related industries and services: The growth in the stock market stimulates activity in related industries, such as financial services and consulting, creating a positive ripple effect across the economy.

- Overall improvement in economic indicators: The DAX rise serves as a strong indicator of overall economic health, improving confidence and driving further positive economic indicators.

Potential Risks and Challenges

While the current trend is undeniably positive, it's crucial to acknowledge potential risks and challenges.

- Geopolitical uncertainties: Global geopolitical instability can negatively impact investor sentiment and potentially affect the DAX.

- Inflationary pressures: Persistent inflationary pressures could dampen consumer spending and negatively affect corporate profits, potentially impacting the DAX.

- Supply chain disruptions: Ongoing supply chain disruptions could hinder the growth of some sectors, potentially impacting the DAX's performance.

Conclusion

The DAX's remarkable rise signifies a positive outlook for the German and broader European economies. Driven by strong corporate earnings, global economic optimism, and technological advancements, the Frankfurt equities market is experiencing a significant surge. While potential risks exist, the current trend indicates strong investor confidence. Stay informed about the DAX and its performance to make informed investment decisions. Continue monitoring the DAX index for future updates and analysis to capitalize on market opportunities. Understanding the intricacies of the Frankfurt equities market will be crucial in navigating this dynamic environment.

Featured Posts

-

Nemecka Ekonomika H Nonline Sk Prinasa Prehlad O Rozsiahlych Prepustaniach

May 24, 2025

Nemecka Ekonomika H Nonline Sk Prinasa Prehlad O Rozsiahlych Prepustaniach

May 24, 2025 -

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Guide

May 24, 2025

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Guide

May 24, 2025 -

M56 Collision Car Rollover Results In Motorway Casualty

May 24, 2025

M56 Collision Car Rollover Results In Motorway Casualty

May 24, 2025 -

Glastonbury Festival 2025 Lineup Details After Leak Ticket Availability

May 24, 2025

Glastonbury Festival 2025 Lineup Details After Leak Ticket Availability

May 24, 2025 -

Serious Crash On M56 Current Traffic And Road Closures

May 24, 2025

Serious Crash On M56 Current Traffic And Road Closures

May 24, 2025

Latest Posts

-

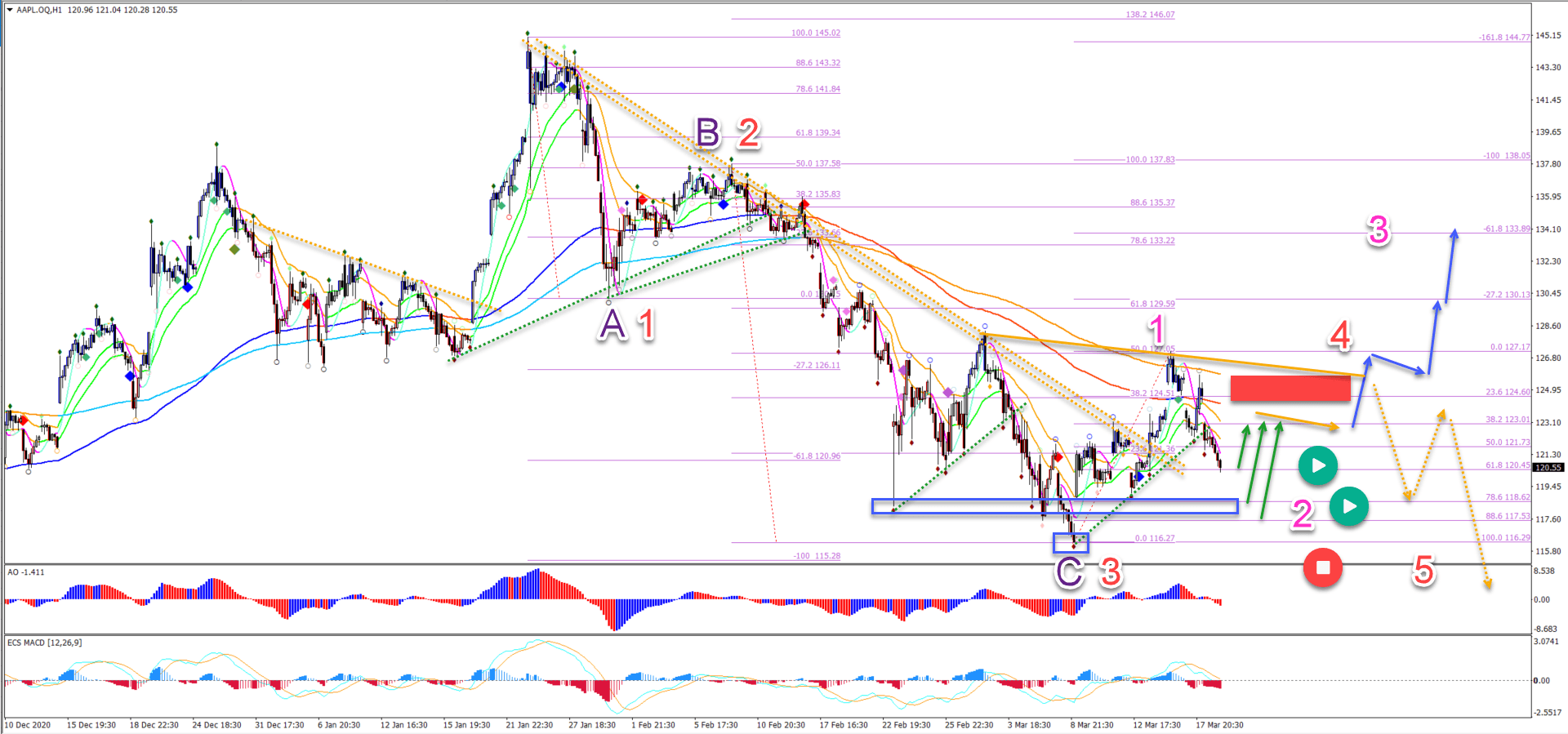

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025 -

New Initiatives Drive Bangladesh Europe Economic Growth

May 24, 2025

New Initiatives Drive Bangladesh Europe Economic Growth

May 24, 2025 -

Collaboration And Growth The Next Chapter For Bangladesh Europe Relations

May 24, 2025

Collaboration And Growth The Next Chapter For Bangladesh Europe Relations

May 24, 2025 -

Ai

May 24, 2025

Ai

May 24, 2025 -

Strengthening Ties Bangladesh And Europes Shared Future

May 24, 2025

Strengthening Ties Bangladesh And Europes Shared Future

May 24, 2025