DAX Holds Steady: Frankfurt Stock Market Opens Following Record Run

Table of Contents

DAX Opening Performance and Initial Reactions

The DAX opened at 15,010 points, a mere 0.1% increase from the previous day's closing value of 15,000. This relatively stable opening reflects a cautious optimism among investors. While the index didn't experience a dramatic surge, the minimal drop suggests a degree of consolidation rather than a significant downturn. Early trading volume was slightly below average, suggesting some hesitation in the market. Market analysts interpreted this as a sign of investors taking a wait-and-see approach, monitoring global economic developments before committing to further investments.

- Opening Value: 15,010 points

- Percentage Change: +0.1% from the previous day's close

- Early Trading Volume: Moderately below average

- Analyst Quote: "The DAX's steady opening suggests a period of consolidation after its recent impressive run. Investors appear to be digesting recent global economic news before making significant moves," commented leading analyst, Dr. Klaus Richter, from Deutsche Bank Research.

Factors Influencing the DAX's Stability

Several factors contribute to the DAX's current stability. Global economic uncertainty, particularly regarding US interest rate decisions and ongoing geopolitical tensions, continues to impact investor sentiment. However, the relatively robust performance of certain DAX sectors is providing a degree of support.

The automotive sector showed slight growth, with Volkswagen and BMW reporting positive pre-orders. The technology sector remained relatively flat, while the banking sector experienced a minor dip due to concerns about potential interest rate hikes. Domestically, recent positive German economic data, including stronger-than-expected manufacturing output and consumer confidence, has helped to bolster investor sentiment.

- Key Global Economic Events: US interest rate hikes, geopolitical instability in Eastern Europe, global inflation concerns.

- Performance of Leading DAX Companies: Volkswagen experienced a modest increase, while Siemens and BASF showed minor fluctuations.

- Significant Economic Indicators: Positive German manufacturing output, increased consumer confidence.

Analyst Predictions and Future Outlook for the DAX

Analysts hold varying opinions on the DAX's short-term and long-term trajectory. Some predict continued, albeit moderate, growth, citing the resilience of the German economy and the positive performance of certain sectors. Others suggest a potential correction in the near term, highlighting the ongoing global economic uncertainties. The impact of upcoming economic data releases, such as the next inflation figures and German GDP growth, will be crucial in shaping the DAX's future performance. Furthermore, any significant shifts in geopolitical landscapes could also heavily influence investor confidence.

- Short-term DAX Forecast: Most analysts predict a range-bound market with potential for moderate growth, but caution against significant upward movement.

- Long-term DAX Forecast: Continued growth is projected, contingent on sustained economic recovery and positive global developments.

- Potential Risks: Global recession, increased inflation, geopolitical instability.

- Upcoming Events Affecting the DAX: Next German inflation report, EU economic summit.

Conclusion: DAX Holds Steady – What's Next for the Frankfurt Stock Market?

The DAX's steady opening at the Frankfurt Stock Market reflects a cautious optimism among investors. While the index hasn't experienced a dramatic shift, its relatively stable performance suggests a period of consolidation rather than a major correction. The stability is influenced by a mix of factors, including positive domestic economic indicators, the performance of certain sectors, and global economic uncertainty. The future trajectory of the DAX depends on numerous factors and remains subject to considerable market volatility. To stay informed about DAX performance and gain valuable insights into potential investment opportunities, follow market analysis closely. Consider subscribing to our regular updates on DAX trends and Frankfurt Stock Market analysis for informed DAX trading decisions.

Featured Posts

-

Glastonbury 2025 Charli Xcx Neil Young And The Lineups Top Contenders

May 24, 2025

Glastonbury 2025 Charli Xcx Neil Young And The Lineups Top Contenders

May 24, 2025 -

Borsa Europa Cauta Attesa Per La Fed Banche Deboli A Piazza Affari

May 24, 2025

Borsa Europa Cauta Attesa Per La Fed Banche Deboli A Piazza Affari

May 24, 2025 -

Learn From Nicki Chapman 700 000 Property Investment On Escape To The Country

May 24, 2025

Learn From Nicki Chapman 700 000 Property Investment On Escape To The Country

May 24, 2025 -

Crisi Dazi Ue Impatto Sulle Borse E Possibili Contromisure

May 24, 2025

Crisi Dazi Ue Impatto Sulle Borse E Possibili Contromisure

May 24, 2025 -

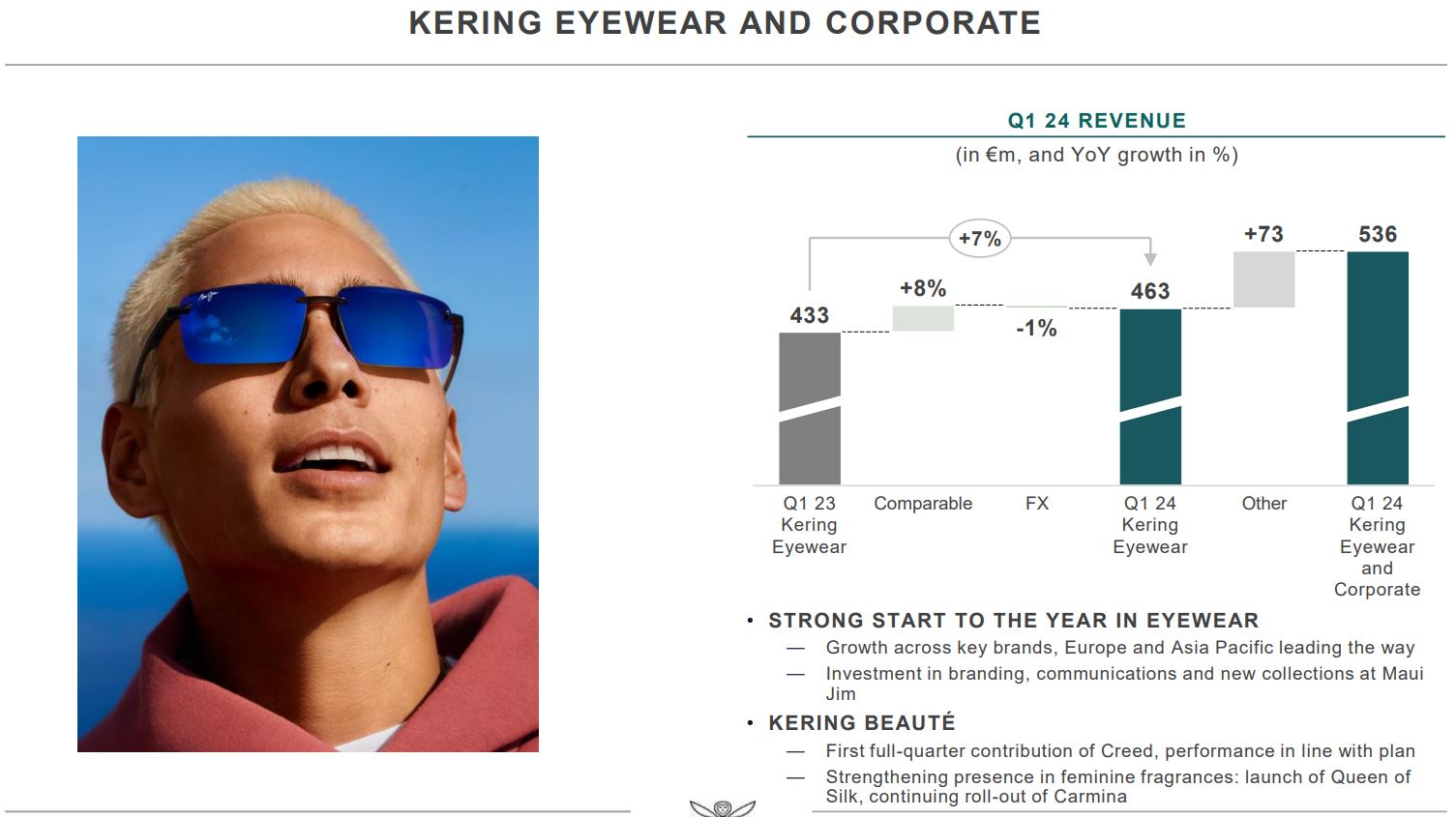

6 Kering Share Slump After First Quarter Earnings Miss

May 24, 2025

6 Kering Share Slump After First Quarter Earnings Miss

May 24, 2025

Latest Posts

-

Royal Philips Shareholders Key Details On The 2025 Agm

May 24, 2025

Royal Philips Shareholders Key Details On The 2025 Agm

May 24, 2025 -

Euro Vs Dollar Live Analyse Van Kapitaalmarktrentes

May 24, 2025

Euro Vs Dollar Live Analyse Van Kapitaalmarktrentes

May 24, 2025 -

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025 -

Kapitaalmarkt Live Update Over Rentes En Eurokoers

May 24, 2025

Kapitaalmarkt Live Update Over Rentes En Eurokoers

May 24, 2025 -

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025