Dax: Bundestag Elections And Business Figures – A Powerful Combination?

Table of Contents

H2: Historical Impact of Bundestag Elections on the DAX

H3: Election Uncertainty and Market Volatility

The period surrounding Bundestag elections often witnesses heightened market volatility. This uncertainty stems from the unknown policy directions of the next government. Investors react to the inherent risk, leading to fluctuations in the DAX index.

-

Bullet points:

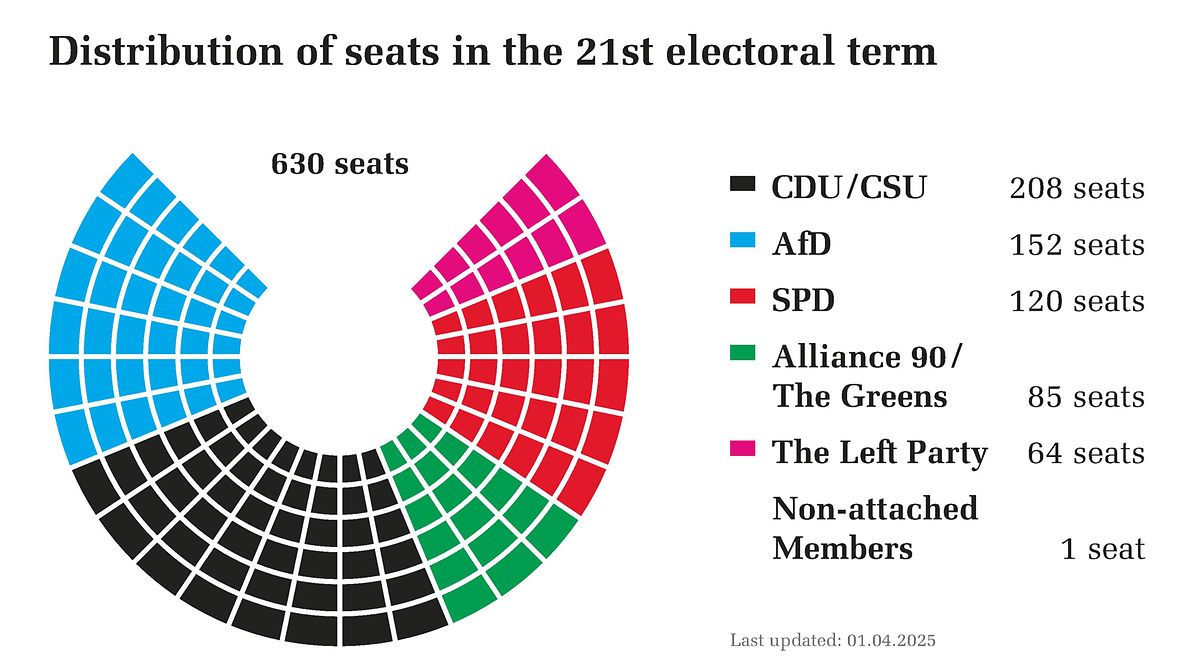

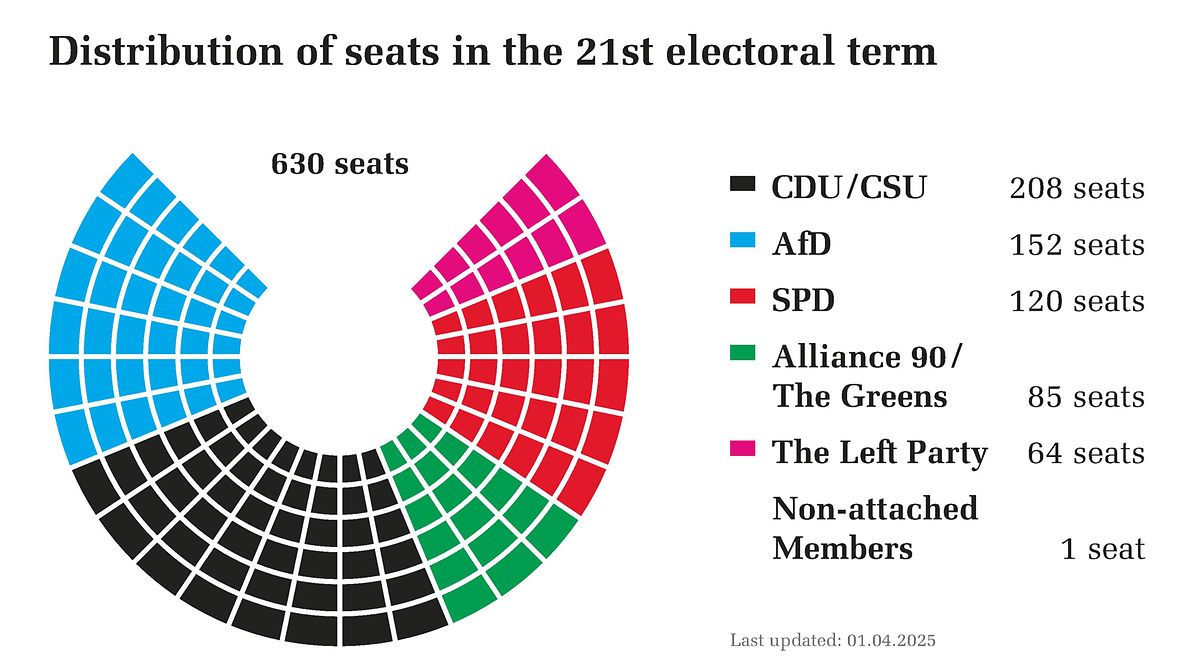

- The 2005 election, which saw a change from Schröder's SPD-Green coalition to Merkel's CDU-CSU-led government, initially caused a dip in the DAX followed by a period of relative stability.

- The 2017 election, resulting in a CDU/CSU-SPD grand coalition, saw relatively less market volatility compared to previous elections, potentially due to a degree of policy predictability.

- Specific policy proposals, like changes to corporate tax rates or environmental regulations, from different parties, significantly impact investor sentiment and consequently, the DAX. For example, proposals for stricter environmental regulations often lead to initial negative reactions from industry-related stocks.

-

Detail: Statistical analysis reveals a clear trend: the DAX typically experiences increased volatility in the months leading up to and immediately following a Bundestag election. Studies from the German Bundesbank and other financial institutions confirm this observation, showing statistically significant correlations between election cycles and DAX fluctuations.

H3: Long-Term Effects of Governing Coalitions on Economic Growth and the DAX

The composition of the governing coalition significantly impacts Germany's economic policies and, in turn, the long-term performance of the DAX.

-

Bullet points:

- Grand coalitions (e.g., CDU/CSU-SPD) historically demonstrated periods of stable, albeit sometimes slow, economic growth, reflected in a steady DAX performance.

- Minority governments often lead to periods of increased political uncertainty, potentially impacting investor confidence and the DAX trajectory.

- Different economic policy approaches – whether focused on austerity measures or stimulus packages – significantly influence the performance of specific sectors and consequently, the overall DAX index.

-

Detail: Charts comparing DAX performance over multiple election cycles, alongside corresponding economic growth figures, highlight the correlation between governing coalitions and long-term economic trends reflected in the DAX. These correlations are not always direct or immediate but reveal long-term patterns.

H2: The Role of Business Leaders and Lobbying in Shaping Election Outcomes and Policies

H3: Influence of Business Organizations and Associations

Powerful German business organizations, such as the Federation of German Industries (BDI) and the German Chambers of Commerce and Industry (DIHK), exert considerable influence on election campaigns and policy formation.

-

Bullet points:

- Lobbying activities by these organizations shape political party platforms and influence legislative agendas.

- Campaign donations, though regulated, contribute to political parties, creating an indirect link between business interests and political power.

- Articulation of business priorities by these organizations significantly shapes the economic policy debate during election campaigns.

-

Detail: Specific examples of successful lobbying efforts resulting in legislative changes favorable to specific industries are readily available through public records and news reports, illustrating the influence wielded by these powerful business organizations.

H3: CEOs and the Public Discourse

Public statements and actions by prominent DAX CEOs during election cycles can influence voter sentiment and shape the political narrative.

-

Bullet points:

- CEOs occasionally publicly endorse specific political parties or policies, impacting the perception of those parties amongst voters.

- Public criticism of potential policies can create pressure on political parties to modify their platforms.

-

Detail: While public endorsements carry inherent risks, including potential backlash from certain segments of the population, they can also help to shape public opinion and influence policy decisions. This illustrates the broader impact of business leaders beyond their direct involvement in corporate affairs.

H2: Investment Strategies in Light of Bundestag Elections

H3: Managing Election-Related Risk

The volatility surrounding Bundestag elections necessitates robust risk management strategies for investors.

-

Bullet points:

- Diversification across different asset classes minimizes exposure to election-related risks within the DAX.

- Hedging techniques, like options trading, can mitigate potential losses stemming from market fluctuations.

- Sophisticated risk assessment tools help investors evaluate the potential impact of different election outcomes on their portfolios.

-

Detail: A long-term investment horizon is crucial; avoiding impulsive decisions based on short-term market reactions is vital. A well-diversified portfolio, coupled with a comprehensive risk assessment strategy, allows investors to navigate the turbulent period of elections.

H3: Opportunities During and After Elections

Political shifts following elections create potential investment opportunities.

-

Bullet points:

- Sectors expected to benefit from specific policy changes (e.g., renewable energy under a Green-leaning government) present attractive investment opportunities.

- Companies undervalued due to election-related market corrections may offer attractive entry points for long-term investors.

-

Detail: Careful analysis of party platforms and their likely policy consequences enables investors to identify sectors and individual companies that might benefit from the incoming government's agenda. This requires thorough research and an understanding of the interplay between politics and market dynamics.

3. Conclusion:

The relationship between the Dax, Bundestag elections, and the actions of business figures is multifaceted. Election uncertainty generates short-term market volatility, but the long-term DAX performance hinges on the governing coalition's economic policies. Understanding this intricate connection is crucial for devising effective investment strategies. By analyzing historical data, the political landscape, and potential policy impacts, investors can navigate Bundestag election uncertainties and potentially capitalize on emerging opportunities. Stay informed about the next Bundestag elections and their potential impact on the Dax – mastering the interplay between politics and the market is key to successful investing.

Featured Posts

-

Patrick Schwarzeneggers Unseen Appearance In Ariana Grandes Video A White Lotus Connection

Apr 27, 2025

Patrick Schwarzeneggers Unseen Appearance In Ariana Grandes Video A White Lotus Connection

Apr 27, 2025 -

The Trump Factor How Alberta Differs From The Rest Of Canada

Apr 27, 2025

The Trump Factor How Alberta Differs From The Rest Of Canada

Apr 27, 2025 -

Charleston Tennis Pegula Claims Victory Against Collins

Apr 27, 2025

Charleston Tennis Pegula Claims Victory Against Collins

Apr 27, 2025 -

Vancouver Whitecaps Stadium Future Negotiations At Pne Fairgrounds

Apr 27, 2025

Vancouver Whitecaps Stadium Future Negotiations At Pne Fairgrounds

Apr 27, 2025 -

Bencic Campeona Nueve Meses Despues Del Parto

Apr 27, 2025

Bencic Campeona Nueve Meses Despues Del Parto

Apr 27, 2025

Latest Posts

-

Revolutionizing Voice Assistant Development Open Ais 2024 Showcase

Apr 28, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Showcase

Apr 28, 2025 -

16 Million Penalty T Mobiles Three Year Data Breach History

Apr 28, 2025

16 Million Penalty T Mobiles Three Year Data Breach History

Apr 28, 2025 -

T Mobile Fined 16 Million For Repeated Data Breaches

Apr 28, 2025

T Mobile Fined 16 Million For Repeated Data Breaches

Apr 28, 2025 -

Ai Digest Creating A Podcast From Repetitive Scatological Documents

Apr 28, 2025

Ai Digest Creating A Podcast From Repetitive Scatological Documents

Apr 28, 2025 -

Using Ai To Transform Repetitive Scatological Data Into A Poop Podcast

Apr 28, 2025

Using Ai To Transform Repetitive Scatological Data Into A Poop Podcast

Apr 28, 2025