Understanding The 2025 Decline Of D-Wave Quantum Inc. (QBTS) Stock

Table of Contents

D-Wave Quantum Inc. (QBTS) once captured the imagination of investors with its pioneering work in quantum computing. The promise of revolutionary computational power fueled significant initial interest. However, the current market landscape paints a less optimistic picture, raising serious questions about the future of QBTS stock. This article aims to analyze the potential decline of D-Wave Quantum Inc. (QBTS) stock by 2025, examining key factors contributing to this concerning outlook, including competitive pressures, technological limitations, and financial performance.

2. Main Points:

2.1. Competitive Landscape and Technological Advancements:

H3: Emerging Quantum Computing Competitors: The quantum computing field is rapidly evolving, with numerous players vying for market dominance. D-Wave faces stiff competition from companies like IBM, Google, and IonQ, each making significant strides in developing powerful quantum computers. These competitors are not only attracting substantial funding but also achieving breakthroughs in areas where D-Wave's technology lags.

- IBM: Continuously improving its gate-based quantum computers with higher qubit counts and improved coherence times.

- Google: Demonstrating "quantum supremacy" with its Sycamore processor, achieving computational feats beyond the capabilities of classical computers.

- IonQ: Focusing on trapped ion technology, which offers potential advantages in terms of scalability and qubit quality.

These advancements in alternative technologies like gate-based quantum computing and trapped-ion systems pose a significant threat to D-Wave's market share and future prospects. The race for quantum supremacy is heating up, and D-Wave's position in this competitive landscape is becoming increasingly precarious. Keywords: Quantum computing competitors, quantum supremacy, market share, technological disruption.

H3: Technological Limitations of D-Wave's Annealing Approach: D-Wave's technology relies on quantum annealing, a specialized approach to quantum computing that differs significantly from the more widely pursued gate-based models. While annealing offers advantages in specific problem domains, it faces inherent limitations compared to its competitors.

- Scalability Challenges: Increasing the number of qubits in an annealing system while maintaining coherence presents substantial engineering difficulties.

- Application Limitations: Quantum annealing is particularly well-suited for optimization problems, but its applicability to a broader range of quantum algorithms remains limited.

- Gate-Based Superiority: Gate-based quantum computers offer greater versatility and are considered by many to have a clearer path towards solving complex problems beyond the scope of annealing.

These technological hurdles raise questions about the long-term viability of D-Wave's approach, potentially limiting its ability to compete effectively in the future. Keywords: Quantum annealing, gate-based quantum computing, scalability, application limitations, technological hurdles.

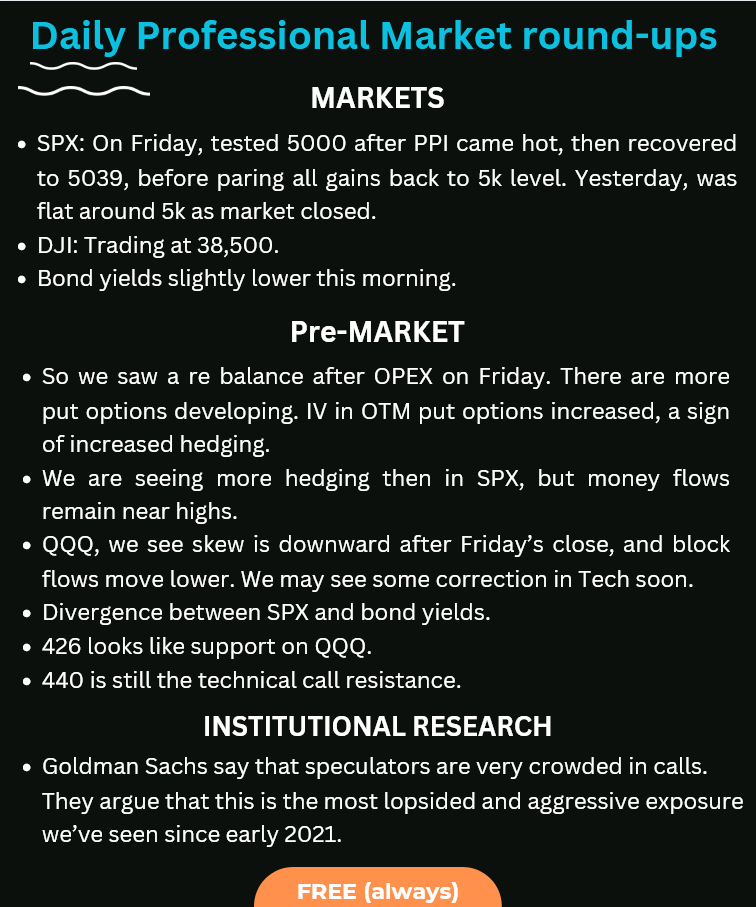

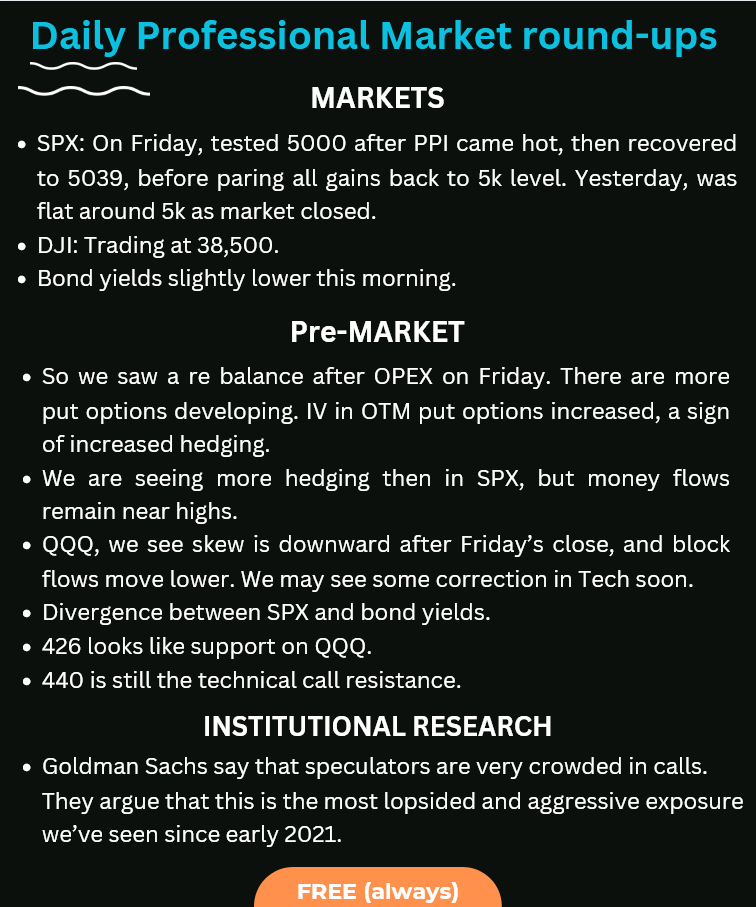

2.2. Financial Performance and Market Valuation:

H3: Analyzing D-Wave's Financial Statements: A thorough examination of D-Wave's financial statements reveals a picture of persistent losses and limited revenue growth. While specific financial details vary over time, the company's financial health needs careful assessment. Analyzing key metrics like revenue growth, operating expenses, and debt levels is crucial for investors attempting to gauge the company's long-term sustainability.

- Revenue Growth: Historically, D-Wave's revenue growth has not kept pace with the expectations of a rapidly growing technology sector.

- Operating Expenses: High research and development costs have significantly impacted profitability.

- Debt Levels: The company's debt burden could pose further challenges to its financial stability.

These financial realities raise concerns about D-Wave's ability to sustain its operations and compete effectively without substantial future funding. Keywords: Financial performance, revenue growth, market capitalization, profitability, debt levels, financial stability.

H3: Investor Sentiment and Stock Price Volatility: Investor sentiment toward QBTS stock has been highly volatile, reflecting the inherent risks and uncertainties associated with investing in a young, loss-making quantum computing company. News events, technological breakthroughs by competitors, and shifts in market trends significantly impact the stock price.

- News Events: Positive announcements regarding technological advances or partnerships can lead to temporary price spikes, while negative news can trigger sharp declines.

- Market Trends: Overall trends in the technology sector and the broader market significantly influence investor appetite for high-risk investments.

- Analyst Predictions: Analyst ratings and predictions about the future of QBTS stock can also sway investor sentiment and drive price fluctuations.

The inherent volatility of QBTS stock makes it a high-risk investment, requiring careful consideration of potential losses. Keywords: Investor sentiment, stock price volatility, market trends, analyst predictions, risk assessment, QBTS stock price forecast.

2.3. Business Model and Future Projections:

H3: D-Wave's Business Strategy and Market Penetration: D-Wave's business model focuses on providing quantum computing solutions to specific industries, primarily those dealing with optimization problems. However, achieving significant market penetration presents considerable challenges.

- Target Markets: While D-Wave targets various industries, achieving widespread adoption of its technology across different sectors remains a significant hurdle.

- Go-to-Market Strategy: The company's strategy for reaching its target markets needs continued evaluation to ensure its effectiveness in a competitive landscape.

- Business Challenges: The complexities of integrating quantum computing into existing workflows and the relatively high cost of access represent significant challenges to market adoption.

The success of D-Wave’s business model hinges on its ability to overcome these challenges and demonstrate clear value propositions to its target customers. Keywords: Business model, market penetration, target market, go-to-market strategy, business challenges, market adoption.

H3: Long-Term Sustainability and Potential for Growth: The long-term sustainability of D-Wave's business and its potential for future growth are subject to considerable uncertainty. Several factors could either contribute to or hinder its future success.

- Technological Breakthroughs: A major technological breakthrough could significantly improve D-Wave's competitiveness, but the likelihood and timing of such advancements are uncertain.

- Strategic Partnerships: Successful strategic partnerships could provide access to new markets and resources, enhancing the company's prospects.

- Funding Rounds: Securing further funding rounds will be crucial for continued operations and further research and development.

The future of QBTS depends on navigating these uncertainties successfully, making a cautious approach to investing essential. Keywords: Long-term sustainability, future growth potential, risk factors, future scenarios, long-term investment outlook.

3. Conclusion: Navigating the Uncertain Future of D-Wave Quantum (QBTS) Stock

This analysis suggests a potential decline in D-Wave Quantum Inc. (QBTS) stock by 2025, driven by a combination of intense competition from more advanced quantum computing technologies, inherent limitations in D-Wave's annealing approach, and financial challenges. The company faces significant hurdles in achieving market penetration and ensuring long-term sustainability. Investors considering investing in QBTS stock should carefully assess the inherent risks and uncertainties involved. Understanding D-Wave stock requires a thorough evaluation of its financial performance, its competitive landscape, and the technological limitations of its core technology. Analyzing QBTS stock necessitates a comprehensive understanding of the quantum computing industry and the various technological approaches being pursued by competitors. Before committing to a D-Wave Quantum investment, conduct thorough due diligence and stay informed about the ever-evolving landscape of the quantum computing market. The inherent risks associated with D-Wave Quantum investment warrant a cautious approach.

Featured Posts

-

Resilience Overcoming Challenges And Protecting Your Mental Health

May 20, 2025

Resilience Overcoming Challenges And Protecting Your Mental Health

May 20, 2025 -

Crack The Code 5 Dos And Don Ts To Secure A Private Credit Role

May 20, 2025

Crack The Code 5 Dos And Don Ts To Secure A Private Credit Role

May 20, 2025 -

Germanys Thrilling 5 4 Aggregate Victory Over Italy Secures Nations League Final Four Spot

May 20, 2025

Germanys Thrilling 5 4 Aggregate Victory Over Italy Secures Nations League Final Four Spot

May 20, 2025 -

Railroad Bridge Accident Two Adults Killed Children Injured And Missing

May 20, 2025

Railroad Bridge Accident Two Adults Killed Children Injured And Missing

May 20, 2025 -

Colomiers Oyonnax Et Montauban Brive Le Programme Complet De Pro D2

May 20, 2025

Colomiers Oyonnax Et Montauban Brive Le Programme Complet De Pro D2

May 20, 2025

Latest Posts

-

Jalkapallo Huuhkajien Avauskokoonpanossa Merkittaeviae Muutoksia

May 20, 2025

Jalkapallo Huuhkajien Avauskokoonpanossa Merkittaeviae Muutoksia

May 20, 2025 -

Yllaetys Huuhkajissa Avauskokoonpanoon Kolme Muutosta

May 20, 2025

Yllaetys Huuhkajissa Avauskokoonpanoon Kolme Muutosta

May 20, 2025 -

Huuhkajien Avauskokoonpano Naein Se Muuttuu Kaellman Sivussa

May 20, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttuu Kaellman Sivussa

May 20, 2025 -

Huuhkajat Kolme Muutosta Avauskokoonpanossa Kaellman Penkille

May 20, 2025

Huuhkajat Kolme Muutosta Avauskokoonpanossa Kaellman Penkille

May 20, 2025 -

Kaksi Suomalaista Jalkapalloilijaa Jaettaevaet Puolalaisseuran

May 20, 2025

Kaksi Suomalaista Jalkapalloilijaa Jaettaevaet Puolalaisseuran

May 20, 2025