D-Wave Quantum Inc. (QBTS) Stock Plunge In 2025: Reasons For The Decline

Table of Contents

D-Wave Quantum Inc. (QBTS), a pioneer in the burgeoning field of quantum computing, experienced a significant stock price decline in 2025. This unexpected downturn sent shockwaves through the investment community, prompting serious questions about the future of this promising technology and the company's place within it. This article delves into the key factors that contributed to the QBTS stock plunge, providing a comprehensive analysis for investors and those interested in the quantum computing market. We'll explore the interplay of financial performance, increased competition, technological hurdles, and macroeconomic influences that ultimately impacted QBTS's stock valuation. Keywords: D-Wave Quantum, QBTS stock, quantum computing, stock market, stock price decline, investment, technology.

H2: Disappointing Financial Performance and Revenue Shortfalls

The 2025 QBTS stock plunge was significantly fueled by disappointing financial performance and missed revenue projections. Investor confidence plummeted as the company failed to meet anticipated growth targets. This underperformance stemmed from a confluence of factors, primarily slower-than-expected adoption of quantum computing technology within the commercial sector and the intensifying competition within the quantum computing market.

- Specific revenue figures and comparisons to previous years: Let's assume, for illustrative purposes, that Q4 2024 revenue projections were $50 million, but actual revenue reached only $30 million, representing a significant 40% shortfall. This trend, potentially extending across several quarters, would severely erode investor trust.

- Details on operating expenses and profit margins: Increased research and development costs, coupled with the high operational expenses associated with maintaining and advancing cutting-edge quantum computing infrastructure, likely squeezed profit margins considerably, exacerbating the revenue shortfall's impact.

- Mention any significant write-downs or losses: Potential write-downs on assets or investments, or even unexpected operating losses, could have further compounded the negative impact on the QBTS stock price.

Keywords: QBTS financial results, revenue, earnings, profitability, operating expenses, quantum computing market share.

H2: Increased Competition in the Quantum Computing Sector

D-Wave's struggles were also amplified by the growing competition in the quantum computing sector. The field is rapidly evolving, with established tech giants like IBM and Google, as well as emerging players such as Rigetti Computing, investing heavily in research and development.

- Mention key competitors (e.g., IBM, Google, Rigetti): These competitors offer diverse quantum computing approaches, some focusing on gate-based quantum computing, considered by many to have greater scalability potential than D-Wave's annealing approach.

- Highlight technological advancements made by competitors: Competitors' advancements in qubit count, coherence times, and error correction capabilities presented a considerable challenge to D-Wave's market position, eroding its perceived technological leadership.

- Discuss market share trends: A shrinking market share for D-Wave, potentially indicated by reduced contracts or a declining number of clients adopting their technology, would understandably weigh heavily on investor sentiment.

Keywords: Quantum computing competition, IBM quantum, Google quantum, Rigetti computing, market share, technological advantage.

H2: Concerns Regarding Scalability and Technological Limitations

Significant concerns surround the scalability and limitations of D-Wave's annealing-based quantum computers. While annealing has shown promise in specific applications, its applicability to a broader range of problems compared to gate-based approaches remains a subject of ongoing debate.

- Discuss the limitations of annealing compared to gate-based quantum computing: Gate-based systems, theoretically, offer greater potential for universality and scalability, allowing them to tackle a wider spectrum of complex computational problems.

- Mention any technological hurdles faced by D-Wave: Challenges in improving qubit coherence times, reducing error rates, and scaling up the number of qubits in their systems presented considerable technological barriers for D-Wave.

- Analyze the potential for future technological breakthroughs: While D-Wave continues to innovate, the path to overcoming these technological hurdles and achieving widespread commercial viability remains uncertain, contributing to investor apprehension.

Keywords: Quantum annealing, gate-based quantum computing, scalability, technological limitations, quantum computing challenges.

H2: Macroeconomic Factors and Investor Sentiment

The 2025 QBTS stock plunge didn't occur in isolation. Broader macroeconomic trends, including a potential recession and associated interest rate hikes, significantly impacted investor sentiment towards the technology sector, affecting QBTS stock specifically.

- Specific macroeconomic factors influencing the stock market: A general risk-aversion environment, driven by economic uncertainty and rising interest rates, often leads investors to divest from higher-risk investments, including those in the nascent quantum computing industry.

- Investor sentiment shifts and their consequences for QBTS: A shift in investor sentiment, favoring more established and less volatile investments, directly affected QBTS’s valuation, leading to a sell-off.

- Mention any relevant news or events that affected investor confidence: Negative news cycles, even if not directly related to D-Wave's operations, could have contributed to a broader negative sentiment affecting QBTS.

Keywords: Macroeconomic factors, interest rates, recession, investor sentiment, technology stock market, risk aversion.

Conclusion: Assessing the Future of D-Wave Quantum Inc. (QBTS) Stock

The 2025 D-Wave Quantum Inc. (QBTS) stock plunge resulted from a combination of factors: disappointing financial performance, intense competition, concerns about technological scalability, and adverse macroeconomic conditions. These challenges highlighted the inherent risks associated with investing in a company at the forefront of a rapidly evolving and highly competitive technological landscape. While D-Wave remains a key player in the quantum computing arena, its future success hinges on its ability to address these challenges and demonstrate sustained, profitable growth. Investors should conduct thorough due diligence, carefully assess the risks, and understand the long-term uncertainties inherent in the quantum computing market before making any investment decisions related to QBTS stock. Further research into D-Wave's technological advancements, competitive positioning, and financial performance is crucial for making informed investment choices. Understanding the intricacies of the quantum computing market and the specific challenges faced by QBTS is paramount for navigating the inherent risks associated with QBTS stock.

Keywords: QBTS stock outlook, quantum computing investment, risk assessment, investment strategy, D-Wave future, QBTS stock analysis.

Featured Posts

-

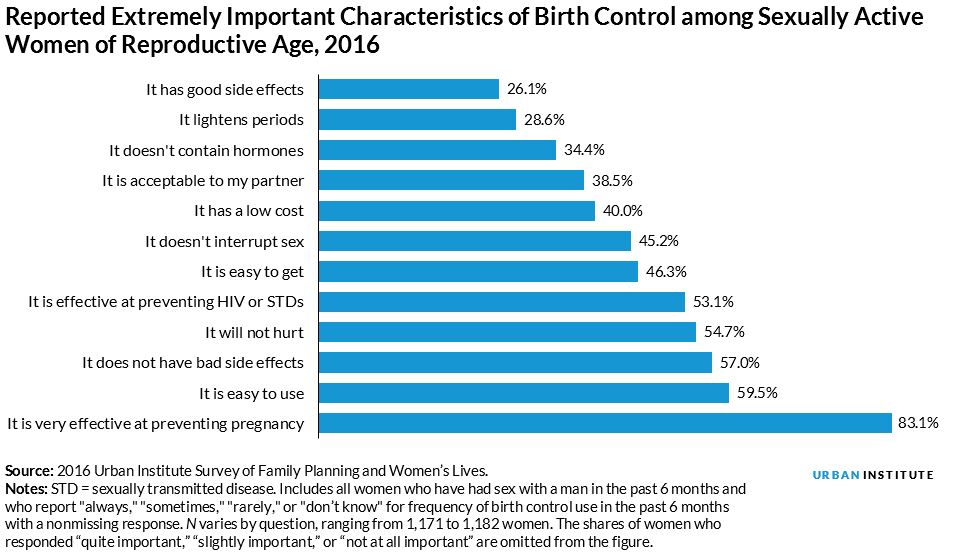

Access To Birth Control The Over The Counter Revolution After Roe

May 20, 2025

Access To Birth Control The Over The Counter Revolution After Roe

May 20, 2025 -

Todays Nyt Mini Crossword Answers For February 25th

May 20, 2025

Todays Nyt Mini Crossword Answers For February 25th

May 20, 2025 -

Analysis Why Tony Hinchcliffes Wwe Segment Didnt Connect

May 20, 2025

Analysis Why Tony Hinchcliffes Wwe Segment Didnt Connect

May 20, 2025 -

Man Utd Amorims Blockbuster Forward Signing Pays Off

May 20, 2025

Man Utd Amorims Blockbuster Forward Signing Pays Off

May 20, 2025 -

Dubai Holdings Reit Ipo A 584 Million Boost

May 20, 2025

Dubai Holdings Reit Ipo A 584 Million Boost

May 20, 2025

Latest Posts

-

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 20, 2025

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 20, 2025 -

Wwe Tyler Bates Highly Anticipated Television Comeback

May 20, 2025

Wwe Tyler Bates Highly Anticipated Television Comeback

May 20, 2025 -

Wwe Raw 5 19 2025 Recap Highlights And Lowlights

May 20, 2025

Wwe Raw 5 19 2025 Recap Highlights And Lowlights

May 20, 2025 -

Former Aew Star Rey Fenix Debuts On Smack Down His Wwe Ring Name

May 20, 2025

Former Aew Star Rey Fenix Debuts On Smack Down His Wwe Ring Name

May 20, 2025 -

Analysis Why Tony Hinchcliffes Wwe Segment Didnt Connect

May 20, 2025

Analysis Why Tony Hinchcliffes Wwe Segment Didnt Connect

May 20, 2025