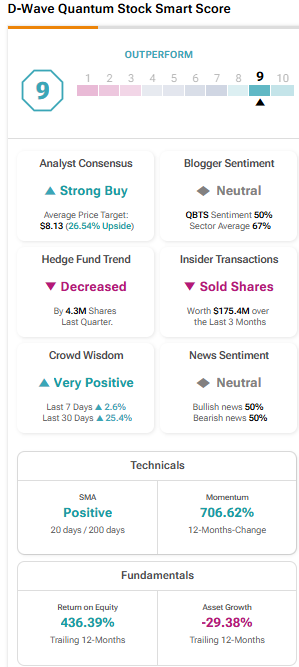

D-Wave Quantum Inc. (QBTS): Explaining The Recent Stock Market Volatility

Table of Contents

Impact of Recent Financial Results on QBTS Stock Price

D-Wave Quantum's recent financial performance has significantly impacted its stock price. Analyzing key financial metrics provides insights into the reasons behind QBTS's volatility.

-

Revenue growth (or lack thereof) compared to expectations: Investors closely scrutinize revenue growth. A shortfall in projected revenue can trigger sell-offs, increasing QBTS stock volatility. Conversely, exceeding expectations can lead to price increases. Analyzing year-over-year and quarter-over-quarter growth is vital for understanding the trend.

-

Profitability (or lack thereof) and its impact on investor sentiment: Profitability, or the lack thereof, is a major factor. While D-Wave Quantum operates in a high-growth, high-investment sector, consistent losses can negatively impact investor sentiment and contribute to QBTS stock volatility. Investors look for signs of a path to profitability.

-

Key financial metrics (e.g., operating expenses, R&D spending) and their implications: High research and development (R&D) spending is expected in the quantum computing sector. However, investors analyze the balance between R&D investment and operating expenses to assess efficiency and long-term viability. Understanding these metrics is critical for interpreting D-Wave Quantum's financial performance and its effect on QBTS earnings.

-

Comparison to competitor financial performance in the quantum computing sector: Benchmarking D-Wave Quantum against competitors like IBM, Google, and IonQ provides context. Analyzing relative performance can help determine if QBTS underperformance is sector-specific or unique to the company. This comparative analysis aids in gauging the impact of D-Wave Quantum's financial performance on its stock price relative to the overall quantum computing stock performance.

Market Sentiment and Investor Perception of D-Wave's Technology

Investor sentiment towards D-Wave Quantum and its technology is a powerful driver of QBTS stock volatility. Positive news and advancements can boost investor confidence, leading to price increases. Conversely, negative news can trigger sell-offs.

-

Discussion of investor confidence in the long-term prospects of quantum computing: The overall outlook for the quantum computing industry influences investor sentiment toward QBTS. Positive industry forecasts generally boost confidence, while doubts about the sector's potential can lead to decreased investment in D-Wave Quantum.

-

Assessment of D-Wave's competitive positioning within the quantum computing market: D-Wave's competitive landscape significantly influences investor perception. Successful technological breakthroughs and strong partnerships can enhance D-Wave Quantum's market standing, positively impacting QBTS stock. Conversely, falling behind competitors might negatively affect investor confidence.

-

Analysis of media coverage and its impact on investor perception: News articles, analyst reports, and social media discussions play a significant role in shaping investor sentiment and QBTS stock outlook. Positive media coverage often leads to increased interest and investment, while negative coverage might trigger sell-offs.

-

Mention of any significant partnerships or collaborations impacting market sentiment: Strategic partnerships and collaborations can significantly influence investor confidence. Announcing major collaborations with industry leaders often leads to a positive market response, potentially reducing QBTS stock volatility.

Broader Macroeconomic Factors Influencing QBTS Stock Price

Macroeconomic conditions significantly impact QBTS stock price. General market trends and economic uncertainties create volatility in all sectors, particularly for growth stocks like D-Wave Quantum.

-

Impact of interest rate hikes and inflation on technology stocks: Rising interest rates and inflation often negatively affect growth stocks like QBTS, as higher borrowing costs reduce investment and increase the discount rate used to value future earnings. This macroeconomic factor is a significant contributor to overall technology stock market volatility.

-

Overall performance of the Nasdaq and its influence on QBTS: As QBTS is listed on the Nasdaq, its performance is closely tied to the overall Nasdaq index. A decline in the Nasdaq generally leads to a decrease in QBTS stock price, while an upward trend often provides support. Understanding Nasdaq trends is crucial for predicting QBTS stock market trends.

-

Effect of broader investor risk aversion on growth stocks like D-Wave Quantum: During periods of increased risk aversion, investors tend to move away from growth stocks and towards safer investments. This shift can lead to significant price declines for companies like D-Wave Quantum, increasing QBTS stock volatility.

Technological Developments and Their Effect on QBTS Stock

Technological advancements (or setbacks) directly influence D-Wave Quantum's stock price. Positive developments boost investor confidence, while setbacks can trigger sell-offs.

-

Announcements of new quantum computing technologies or advancements: Successful milestones and technological breakthroughs often lead to a positive market response, increasing investor confidence in D-Wave Quantum's long-term potential and reducing QBTS stock volatility.

-

Competition from other quantum computing companies and its market impact: The competitive landscape in quantum computing significantly impacts D-Wave Quantum's market position. Announcements of significant advances by competitors can negatively impact QBTS stock price.

-

Success (or failure) of D-Wave's technological milestones: Meeting or exceeding technological milestones signals progress and reinforces investor confidence, potentially leading to reduced QBTS stock volatility. Conversely, failure to meet milestones can negatively affect investor sentiment.

Conclusion

This analysis highlights the multifaceted nature of the recent volatility in D-Wave Quantum (QBTS) stock. Factors such as financial results, investor sentiment, macroeconomic conditions, and technological developments all play a significant role in shaping its price fluctuations. Understanding these interwoven elements is key to navigating the complexities of investing in this emerging technology sector.

Call to Action: For a more comprehensive understanding of D-Wave Quantum (QBTS) and its future prospects, continue researching the company's financial reports, technological breakthroughs, and industry trends. Stay informed about the latest developments to make well-informed decisions regarding D-Wave Quantum (QBTS) stock volatility and investment strategies.

Featured Posts

-

Market Reaction Deciphering The D Wave Quantum Qbts Stock Crash On Monday

May 21, 2025

Market Reaction Deciphering The D Wave Quantum Qbts Stock Crash On Monday

May 21, 2025 -

The Goldbergs Behind The Scenes And Production Details

May 21, 2025

The Goldbergs Behind The Scenes And Production Details

May 21, 2025 -

Ings 2024 Form 20 F A Comprehensive Analysis Of Financial Performance

May 21, 2025

Ings 2024 Form 20 F A Comprehensive Analysis Of Financial Performance

May 21, 2025 -

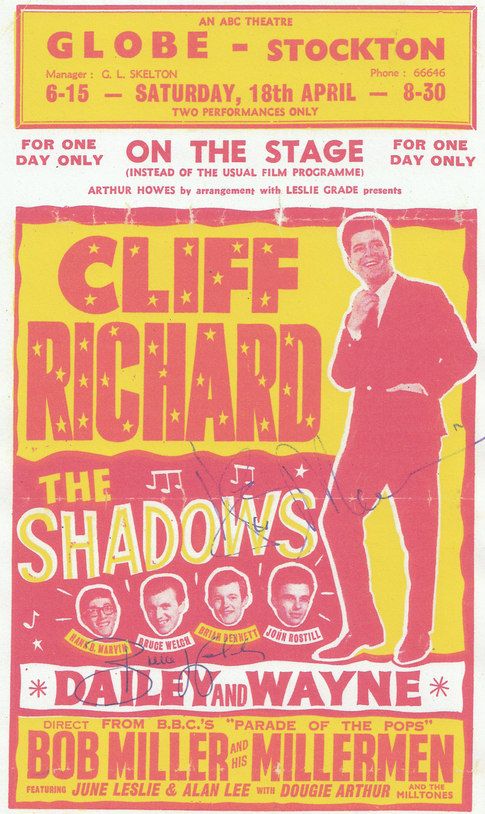

Cliff Richard Musical By Matt Lucas And David Walliams Faces A Setback

May 21, 2025

Cliff Richard Musical By Matt Lucas And David Walliams Faces A Setback

May 21, 2025 -

Good Morning America Robin Roberts Shares Family News

May 21, 2025

Good Morning America Robin Roberts Shares Family News

May 21, 2025

Latest Posts

-

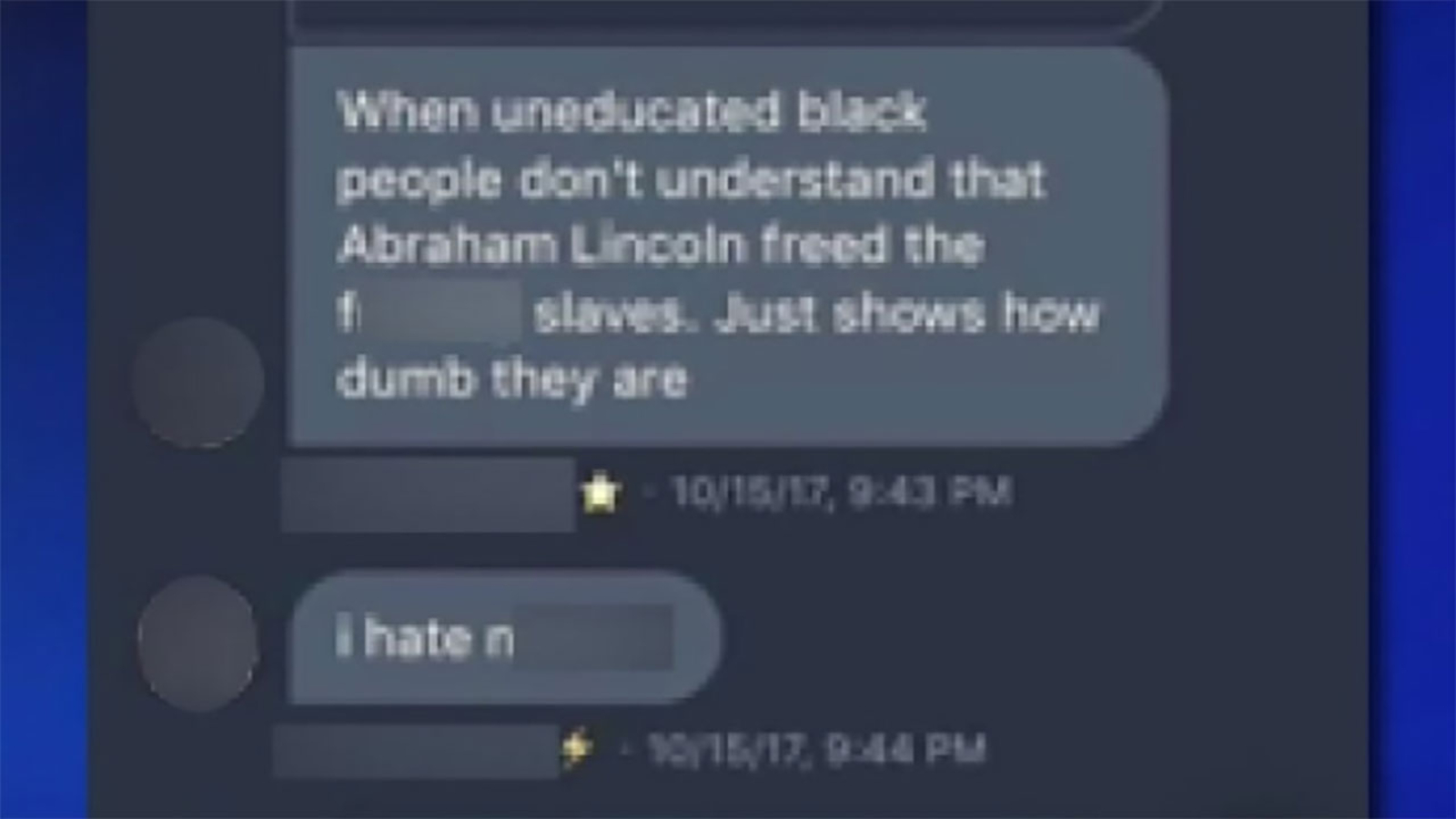

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025 -

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025 -

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025 -

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025