Market Reaction: Deciphering The D-Wave Quantum (QBTS) Stock Crash On Monday

Table of Contents

Analyzing the Immediate Triggers of the QBTS Stock Drop

The sharp decline in QBTS stock price on Monday needs a multifaceted analysis to pinpoint the exact causes. Several factors likely contributed to this market reaction, creating a perfect storm for selling pressure.

News and Press Releases

Negative news or press releases often trigger immediate sell-offs. We need to scrutinize any information released before or on Monday that could have spooked investors.

- Analyst Downgrades: Did any significant financial analysts downgrade their outlook on QBTS, citing concerns about the company's performance or future prospects? Such downgrades often carry significant weight with institutional investors.

- Negative Media Coverage: Did any major financial news outlets publish articles expressing negative sentiment towards D-Wave Quantum, highlighting challenges or potential risks? Negative press can quickly influence public perception and lead to selling pressure.

- Overall Market Sentiment: It's crucial to assess the overall market conditions on Monday. Was there a broader market downturn that contributed to the QBTS decline, or was the stock's performance uniquely poor? A negative general market trend can amplify negative news for individual stocks.

Technical Factors

Technical analysis can offer valuable insights into price movements. Several technical indicators might explain the QBTS sell-off.

- Support Level Breach: Did the QBTS stock price breach a significant support level, triggering stop-loss orders and further selling pressure? Support levels represent psychological thresholds where investors are less likely to sell.

- High-Volume Trading: Was the Monday drop accompanied by unusually high trading volume? High volume often indicates significant buying or selling pressure, confirming a strong market reaction.

- Short Selling: The role of short selling needs investigation. An increase in short selling activity before or during the decline suggests that some investors anticipated a price drop.

The Broader Context: Quantum Computing Sector and Investor Sentiment

Understanding the broader context is vital to fully grasp the QBTS stock crash. The performance of the quantum computing sector as a whole and the overall investor sentiment towards the industry play a significant role.

Sector Performance

To understand if the QBTS crash was isolated or part of a broader trend, we need to compare its performance to other quantum computing companies.

- Industry-Wide Downturn: Did the entire quantum computing sector experience a downturn on Monday, indicating a broader loss of investor confidence in the industry? If so, external factors likely played a significant role in the QBTS drop.

- Investor Sentiment in Quantum Computing: Assessing the overall investor sentiment toward quantum computing stocks is crucial. Is there growing skepticism about the sector's potential or a general shift in investment priorities?

- Sector-Wide Events: Any significant announcements, regulatory changes, or technological setbacks affecting the quantum computing sector as a whole could have influenced the QBTS stock price.

Company-Specific Factors

Internal factors within D-Wave Quantum also need consideration.

- Financial Reports: Had D-Wave Quantum recently released financial reports that disappointed investors, perhaps revealing lower-than-expected revenue or increased losses?

- Product Delays: Were there any announcements regarding delays in product development or deployment that could have impacted investor confidence?

- Management Changes: Did any significant changes in management occur recently, leading to uncertainty or concerns about the company's future direction? Such changes can signal internal instability.

Potential Long-Term Implications for QBTS and Quantum Computing Investments

The QBTS stock crash carries potential long-term implications for both the company and the wider quantum computing investment landscape.

Investor Confidence

Monday's events could significantly impact investor confidence in D-Wave Quantum and the entire quantum computing sector.

- Future Funding: The crash might make it more challenging for D-Wave Quantum to secure future funding rounds. Investors may become more cautious about investing in quantum computing companies.

- Industry Reputation: The stock’s volatility could negatively affect the overall perception of the quantum computing industry, potentially hindering its growth and development.

Market Opportunities

While the situation appears challenging, opportunities might arise from the volatility.

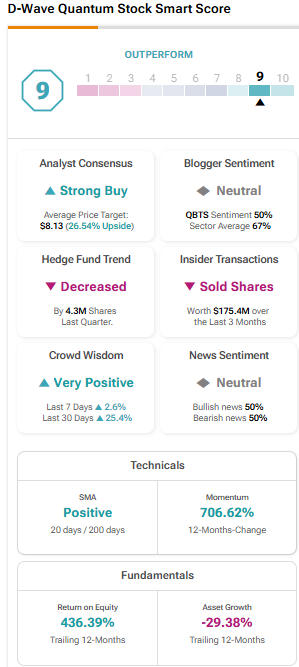

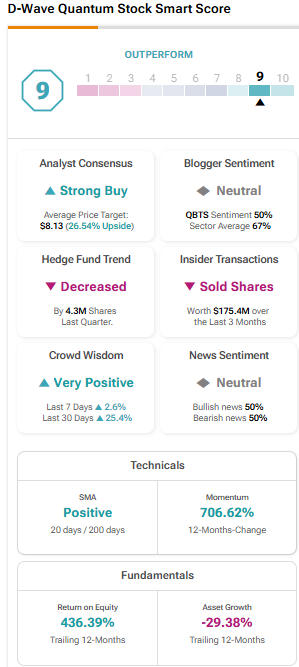

- Buy-the-Dip Strategy: Some investors might view the crash as a buying opportunity, believing the stock is undervalued and poised for a rebound.

- Risk Management: It’s vital for investors to develop strategies for managing risk in the volatile quantum computing market. Diversification and careful analysis are key.

- Long-Term Potential: Despite the short-term setback, the long-term potential of quantum computing remains significant. The crash should not overshadow the transformative potential of this technology.

Conclusion:

The D-Wave Quantum (QBTS) stock crash on Monday is a complex event with various contributing factors. Understanding the interplay between immediate triggers, the broader market sentiment, and company-specific issues is vital for navigating the volatile quantum computing investment landscape. While the short-term outlook is uncertain, the long-term potential of quantum computing remains significant. Careful analysis and risk management are essential for investors making decisions concerning QBTS and other quantum computing stocks. To stay informed about future developments and market reactions surrounding D-Wave Quantum (QBTS) and the quantum computing sector, continue researching and monitoring reputable financial news sources. Further investigation into the QBTS stock crash and the broader quantum computing market is highly recommended before making any investment decisions.

Featured Posts

-

Baggelis Giakoymakis Mia Analysi Tis Diavrosis Tis Anthropinis Aksias

May 21, 2025

Baggelis Giakoymakis Mia Analysi Tis Diavrosis Tis Anthropinis Aksias

May 21, 2025 -

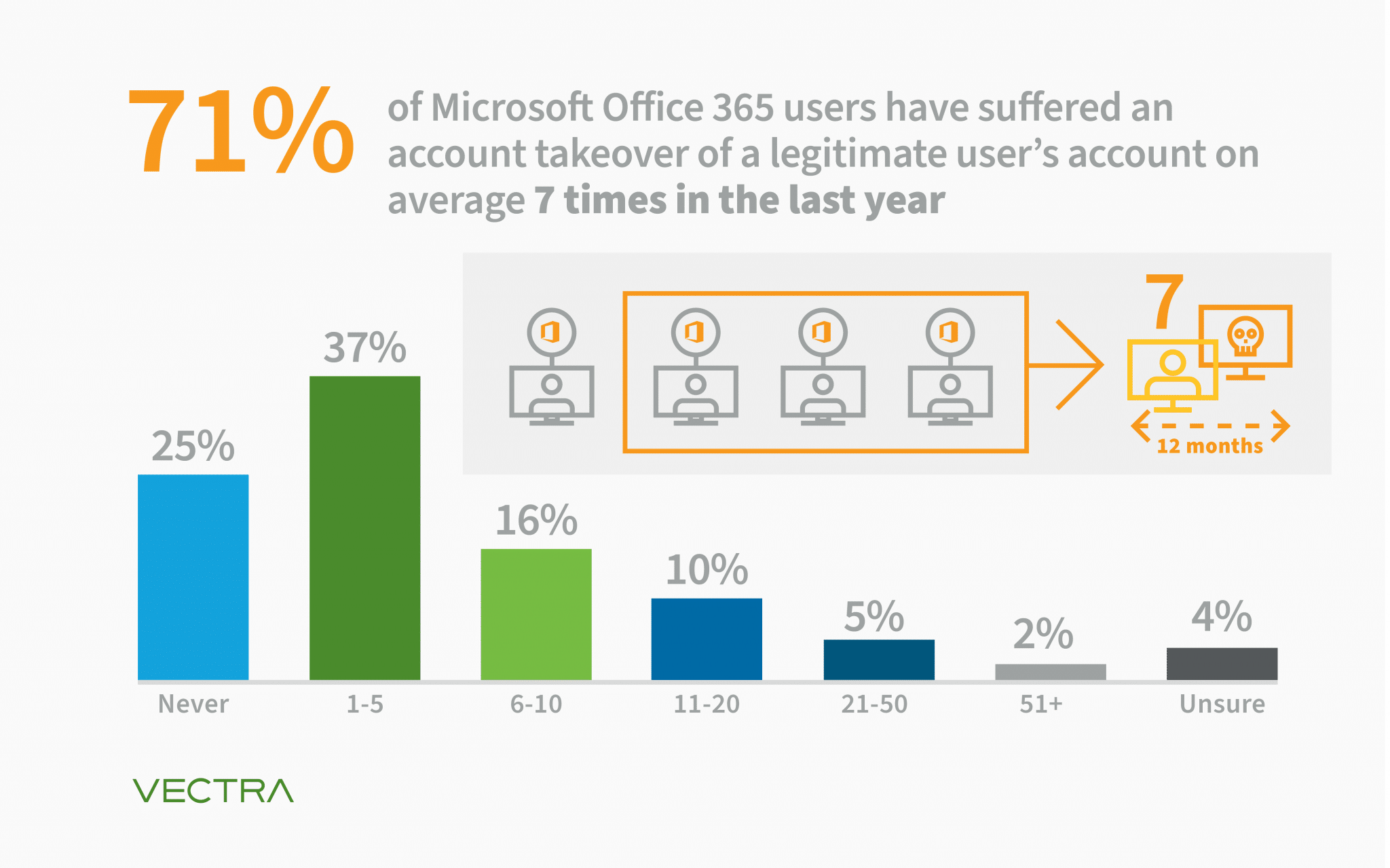

Crook Accused Of Millions In Office 365 Executive Account Theft

May 21, 2025

Crook Accused Of Millions In Office 365 Executive Account Theft

May 21, 2025 -

Bp Chiefs Strategy Doubling Valuation Maintaining Uk Listing

May 21, 2025

Bp Chiefs Strategy Doubling Valuation Maintaining Uk Listing

May 21, 2025 -

John Lithgow Und Jimmy Smits In Dexter Resurrection Ein Kult Comeback

May 21, 2025

John Lithgow Und Jimmy Smits In Dexter Resurrection Ein Kult Comeback

May 21, 2025 -

Celebrating The Premier League 2024 25 Champions An Image Gallery

May 21, 2025

Celebrating The Premier League 2024 25 Champions An Image Gallery

May 21, 2025

Latest Posts

-

Southport Racial Hate Crime Tory Councillors Wife Sentenced

May 22, 2025

Southport Racial Hate Crime Tory Councillors Wife Sentenced

May 22, 2025 -

Wife Of Tory Councillor To Fight 31 Month Prison Term For Online Hate Speech

May 22, 2025

Wife Of Tory Councillor To Fight 31 Month Prison Term For Online Hate Speech

May 22, 2025 -

Appeal Hearing For Tory Councillors Wife After Migrant Rant Conviction

May 22, 2025

Appeal Hearing For Tory Councillors Wife After Migrant Rant Conviction

May 22, 2025 -

Ex Tory Councillors Wife Appeals Racial Hatred Tweet Sentence

May 22, 2025

Ex Tory Councillors Wife Appeals Racial Hatred Tweet Sentence

May 22, 2025 -

Rockies Fall To Tigers 8 6 Upset

May 22, 2025

Rockies Fall To Tigers 8 6 Upset

May 22, 2025