Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Table of Contents

Declining Consumer Spending and its Impact

Reduced consumer spending directly translates to fewer credit card transactions and lower transaction fees for issuers, creating a significant challenge for the credit card industry's profitability. This decline is impacting various sectors, creating a ripple effect across the financial ecosystem.

Reduced Purchase Volumes

Lower consumer spending is evident across numerous sectors. The decrease in discretionary spending is particularly noticeable.

- Reduced spending on non-essential goods: Consumers are cutting back on purchases like entertainment, dining out, and new clothing.

- Decline in travel and tourism spending: Increased airfare and accommodation costs are deterring travel, impacting the travel-related credit card transactions.

- Lower retail sales: Overall retail sales figures reflect a decline in consumer confidence and reduced purchasing power.

Data from leading financial institutions show a year-on-year decline of approximately X% in credit card transactions in Q[Quarter] [Year], indicating a substantial drop in consumer spending. Financial analysts predict a further decline in the coming quarters unless economic conditions improve significantly. As one leading financial analyst, [Analyst Name], stated, "[Quote about the severity of the decline in consumer spending and its impact on the credit card industry]".

Rising Delinquency Rates

The economic slowdown is leading to increased financial strain on many credit card holders, resulting in a rise in delinquency rates. More consumers are struggling to meet their minimum monthly payments.

- Job losses and reduced income: Economic uncertainty has led to job losses and salary reductions, impacting consumers’ ability to repay their credit card balances.

- Rising interest rates: Higher interest rates on credit cards increase the cost of borrowing, making it harder for consumers to manage their debt.

- Inflationary pressures: Increased prices for essential goods and services reduce disposable income and increase the likelihood of credit card defaults.

Credit rating agencies are reporting a significant increase in credit card delinquency rates. For instance, [Credit Rating Agency] reported a Y% increase in delinquencies in [Time Period]. [Expert Quote from credit rating agency on the potential impact on credit card defaults and the broader economy].

The Impact of Rising Interest Rates

The Federal Reserve's interest rate hikes, intended to combat inflation, are having a profound impact on the credit card industry. These rate increases make borrowing more expensive and significantly impact consumer spending and repayment ability.

Increased Cost of Borrowing

Higher interest rates directly translate into increased annual percentage rates (APRs) on credit cards.

- Higher APRs: Credit card APRs have increased substantially, making it more costly for consumers to carry a balance.

- Increased minimum payments: Higher interest rates result in higher minimum payments, further straining consumers' budgets.

- Difficulty in debt repayment: The combined effect of higher interest rates and reduced income makes debt repayment increasingly challenging for many consumers.

The average credit card interest rate is currently at Z%, a significant increase compared to [Historical comparison]. This increase is making it harder for consumers to manage their credit card debt, leading to a higher default rate. [Expert quote from an economist on the effects of interest rates on consumer debt].

Profitability Challenges for Issuers

While higher interest rates can increase revenue for credit card issuers on outstanding balances, they also decrease consumer spending and increase the risk of defaults.

- Reduced net interest margins: Higher default rates reduce the net interest margin earned by credit card companies.

- Increased loan loss provisions: Credit card issuers are forced to set aside larger amounts to cover potential loan losses.

- Reduced lending activity: Credit card companies may become more cautious in their lending, potentially reducing overall profitability.

The financial performance indicators of major credit card issuers are reflecting these challenges. [Data on financial performance indicators, such as decreased net income or profitability ratios for major credit card issuers]. [Expert Quote from a financial analyst concerning the long-term effects on the industry's business model].

Strategic Responses from Credit Card Companies

Facing these headwinds, credit card companies are implementing various strategies to mitigate risks and maintain profitability.

Adjusting Credit Limits and Approval Standards

To reduce risk, credit card companies are tightening their lending criteria.

- Stricter credit scoring models: Credit card companies are using more stringent credit scoring models to assess risk.

- Reduced credit limit approvals: New credit applications are facing lower approval rates and smaller credit limits.

- Increased rejection rates: The number of credit card applications being rejected has increased significantly.

Data show a significant decrease in average credit limit approvals and a rise in application rejection rates. For example, [Data point on changes in credit limit approvals]. [Expert Quote from a credit risk management specialist on the effectiveness of the new strategies].

Emphasis on Customer Retention and Loyalty Programs

Retaining existing customers and encouraging responsible spending are becoming increasingly important.

- Enhanced rewards programs: Credit card companies are improving their reward programs to incentivize customer loyalty.

- Improved customer service initiatives: Credit card companies are focusing on providing better customer service to enhance customer retention.

- Financial literacy programs: Some companies are implementing financial literacy programs to help customers manage their finances better.

[Data on customer churn rates and the success of loyalty programs]. [Expert quote on effective strategies to improve customer retention during economic downturns].

Conclusion

Reduced consumer spending and rising interest rates present significant headwinds for the credit card industry. Increased delinquency rates and profitability challenges are forcing credit card companies to adapt their strategies, focusing on risk management and customer retention. Understanding these dynamics is crucial for navigating the evolving credit card landscape. Stay informed about changes in consumer credit and the impact of reduced consumer spending on the credit card industry to make informed financial decisions. Follow us for regular updates on this evolving situation and how it impacts the consumer credit market.

Featured Posts

-

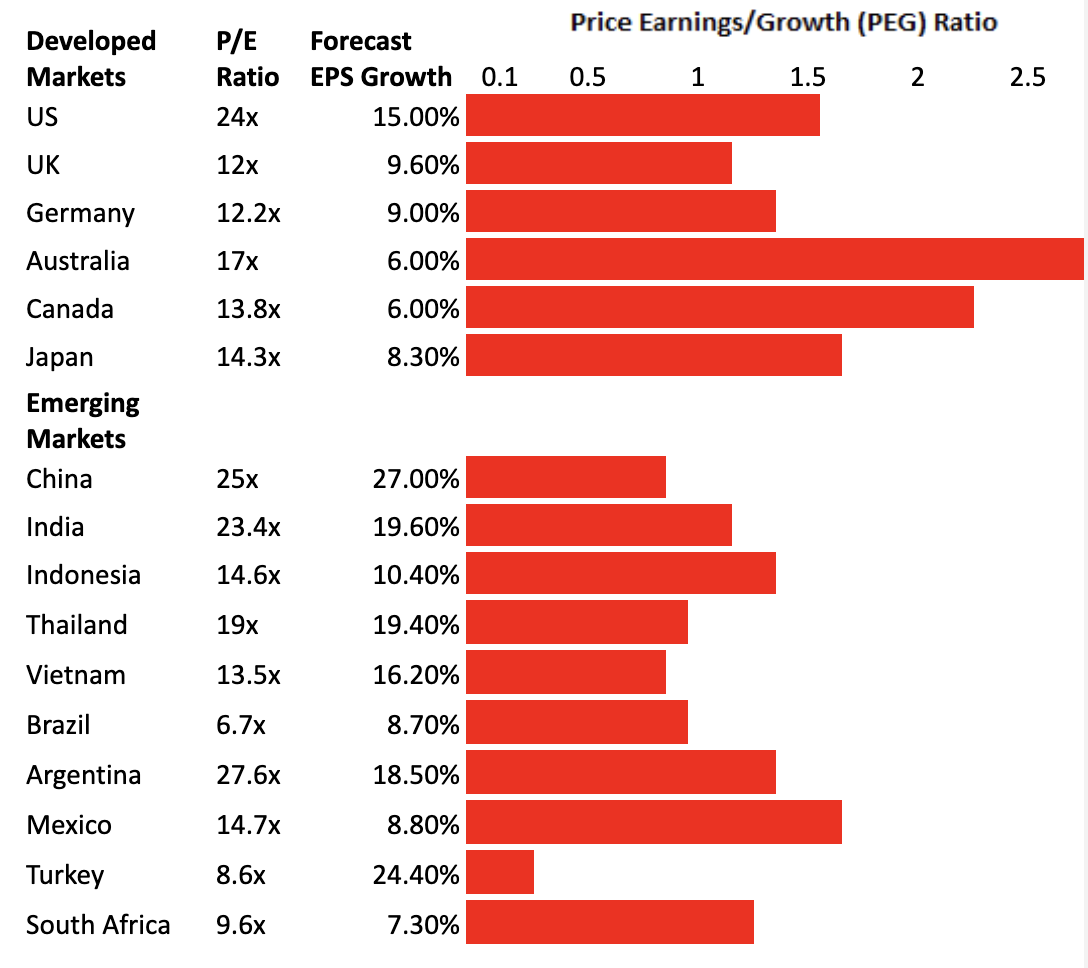

Emerging Market Stock Rally A Contrarian Investment Strategy For 2023

Apr 24, 2025

Emerging Market Stock Rally A Contrarian Investment Strategy For 2023

Apr 24, 2025 -

Loss Of Independence 60 Minutes Executive Producer Steps Down Following Trump Lawsuit

Apr 24, 2025

Loss Of Independence 60 Minutes Executive Producer Steps Down Following Trump Lawsuit

Apr 24, 2025 -

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience Video

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience Video

Apr 24, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Issue Delays Mission

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Subsystem Issue Delays Mission

Apr 24, 2025 -

Nba 3 Point Contest 2024 Herros Victory Over Hield

Apr 24, 2025

Nba 3 Point Contest 2024 Herros Victory Over Hield

Apr 24, 2025