Cost-Cutting Measures Surge As U.S. Companies Face Tariff Uncertainty

Table of Contents

Reduced Operational Expenditures

Companies are scrutinizing every aspect of their operational budgets to identify areas for savings. This involves a multi-pronged approach focusing on efficiency and smarter resource allocation. Effective cost-cutting measures in this area are crucial for long-term viability.

Supply Chain Optimization

Businesses are actively seeking alternative, more cost-effective suppliers, both domestically and internationally, to mitigate tariff impacts. This involves a strategic reassessment of the entire supply chain management process.

- Negotiating better deals with existing suppliers: Leveraging buying power and long-term relationships to secure more favorable pricing and payment terms.

- Exploring near-shoring and reshoring strategies: Bringing manufacturing and production closer to home to reduce transportation costs and tariff exposure. This involves careful consideration of factors like labor costs and infrastructure.

- Diversifying supply sources: Reducing reliance on single suppliers impacted by tariffs, creating a more resilient and flexible supply chain. This mitigates risks associated with geopolitical instability and supply chain disruptions. This strategy is a vital component of effective tariff mitigation.

Technology Implementation for Efficiency

Automation and technological advancements are being leveraged to streamline operations and reduce labor costs. Investing in the right technology can yield significant long-term savings and improve operational efficiency.

- Investing in automation software: Automating repetitive tasks to improve productivity and reduce the need for manual labor. This can range from simple software integrations to complex robotic systems.

- Implementing AI-powered solutions for process optimization: Utilizing artificial intelligence to analyze data, identify inefficiencies, and optimize processes for maximum output. AI can significantly improve decision-making and resource allocation.

- Exploring robotic process automation (RPA) to reduce manual tasks: RPA can handle a wide range of administrative and operational tasks, freeing up human employees for more strategic work. This boosts efficiency and reduces labor costs.

Energy Conservation Initiatives

Reducing energy consumption is a significant area for cost savings in many industries. Implementing energy-efficient practices is not only cost-effective but also environmentally responsible.

- Implementing energy-efficient equipment: Upgrading to newer, more energy-efficient machinery and technology can drastically reduce energy bills over time.

- Adopting renewable energy sources: Switching to solar, wind, or other renewable energy sources can significantly reduce energy costs and environmental impact. This can also improve a company's brand image and attract environmentally conscious customers.

- Optimizing building energy management systems: Implementing smart building technologies to monitor and control energy usage in real-time, reducing waste and optimizing energy consumption. This is a key element of sustainable business practices.

Strategic Workforce Adjustments

Managing labor costs is another critical aspect of cost-cutting strategies. This requires a careful balance between maintaining employee morale and controlling expenses.

Freezing Hiring and Reducing Overtime

Companies are implementing hiring freezes and minimizing overtime to control labor expenses. This is a short-term strategy to manage immediate costs.

- Prioritizing essential roles: Focusing on hiring and retaining employees in critical positions while minimizing recruitment in less essential areas.

- Optimizing staffing levels: Analyzing workforce needs and ensuring efficient staffing levels to avoid overstaffing.

- Implementing stricter overtime policies: Minimizing overtime hours by optimizing workflows and scheduling to control labor costs. This requires careful planning and efficient task allocation.

Employee Restructuring and Downsizing

In some cases, companies are resorting to layoffs or restructuring to reduce their workforce. This is often a last resort, but sometimes necessary to ensure the long-term viability of the business.

- Implementing voluntary severance packages: Offering incentives to employees willing to leave the company voluntarily, reducing the need for involuntary layoffs.

- Targeted layoffs in non-essential departments: Focusing layoff efforts on areas that are not critical to core business operations.

- Restructuring teams to improve efficiency: Reorganizing teams and departments to improve workflows and eliminate redundancies. This can increase overall productivity with fewer employees.

Increased Focus on Employee Productivity

Companies are emphasizing employee productivity and efficiency to maximize output with existing staff. Investing in employee development can lead to significant long-term gains in productivity.

- Implementing performance management systems: Tracking employee performance and providing regular feedback to improve efficiency and productivity.

- Providing training and development opportunities: Investing in employee skills and knowledge to improve performance and engagement.

- Improving employee engagement: Creating a positive and supportive work environment to improve employee morale and productivity. Engaged employees are more productive and less likely to leave the company.

Financial Strategies to Weather the Storm

Beyond operational changes, companies are adopting financial strategies to navigate the uncertainty. Strong financial management is crucial for survival during periods of economic instability.

Negotiating Better Credit Terms

Businesses are negotiating improved payment terms with suppliers to improve cash flow. This is a critical aspect of short-term financial management.

- Extending payment terms: Negotiating longer payment periods with suppliers to improve cash flow and reduce immediate financial pressure.

- Securing lines of credit: Obtaining lines of credit from banks or other financial institutions to provide access to capital when needed.

- Exploring invoice financing options: Utilizing invoice financing to receive immediate payment for invoices, improving cash flow and reducing reliance on traditional financing.

Investment Diversification and Risk Management

Reducing reliance on single markets and diversifying investments is crucial. This involves reducing exposure to specific economic risks.

- Investing in new markets and product lines: Expanding into new markets and developing new products to reduce reliance on single revenue streams.

- Hedging against currency fluctuations: Implementing strategies to mitigate risks associated with currency fluctuations and exchange rate volatility.

- Implementing robust risk management strategies: Developing comprehensive risk management plans to identify, assess, and mitigate potential risks to the business.

Conclusion

The impact of tariff uncertainty is forcing U.S. companies to adopt aggressive cost-cutting measures across various operational and financial aspects. From optimizing supply chains and implementing automation to adjusting workforce strategies and managing finances more effectively, businesses are taking proactive steps to ensure survival and maintain profitability. Understanding these strategies and adapting accordingly is critical for navigating the complexities of the current economic environment. Implementing effective cost-cutting measures will be essential for businesses to not only survive but thrive in this period of tariff uncertainty. Don't wait until it's too late—begin evaluating your own cost-cutting measures today.

Featured Posts

-

Where To Invest The Countrys Hottest New Business Markets

Apr 29, 2025

Where To Invest The Countrys Hottest New Business Markets

Apr 29, 2025 -

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025 -

Blue Origin Rocket Launch Abruptly Halted By Technical Glitch

Apr 29, 2025

Blue Origin Rocket Launch Abruptly Halted By Technical Glitch

Apr 29, 2025 -

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025 -

North Korea Confirms Troop Deployment To Russia Ukraine War Escalation

Apr 29, 2025

North Korea Confirms Troop Deployment To Russia Ukraine War Escalation

Apr 29, 2025

Latest Posts

-

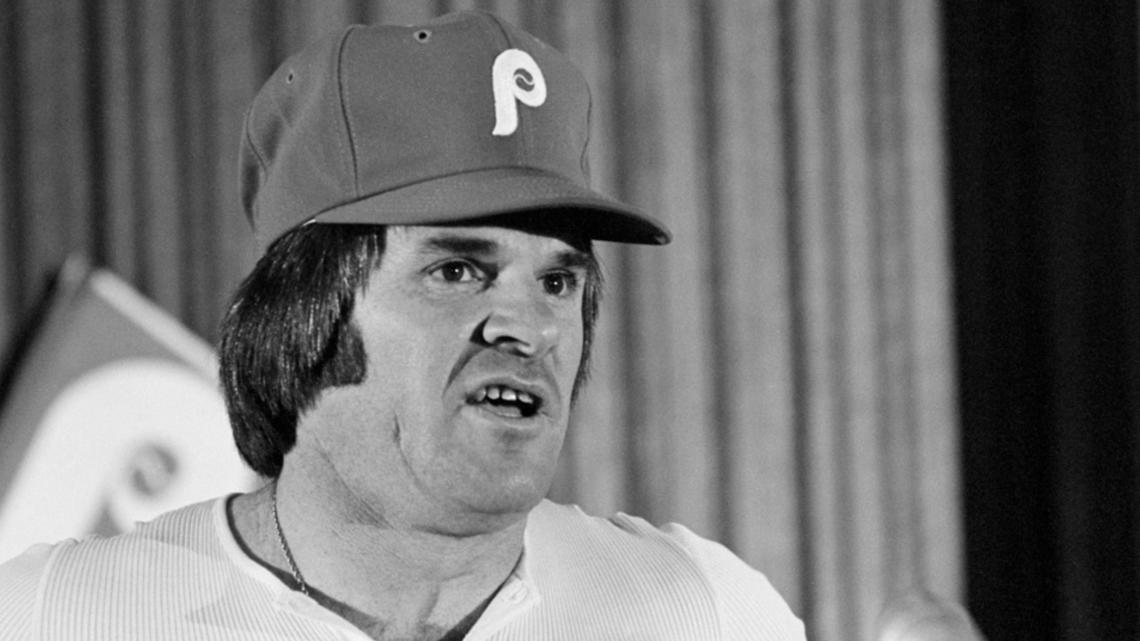

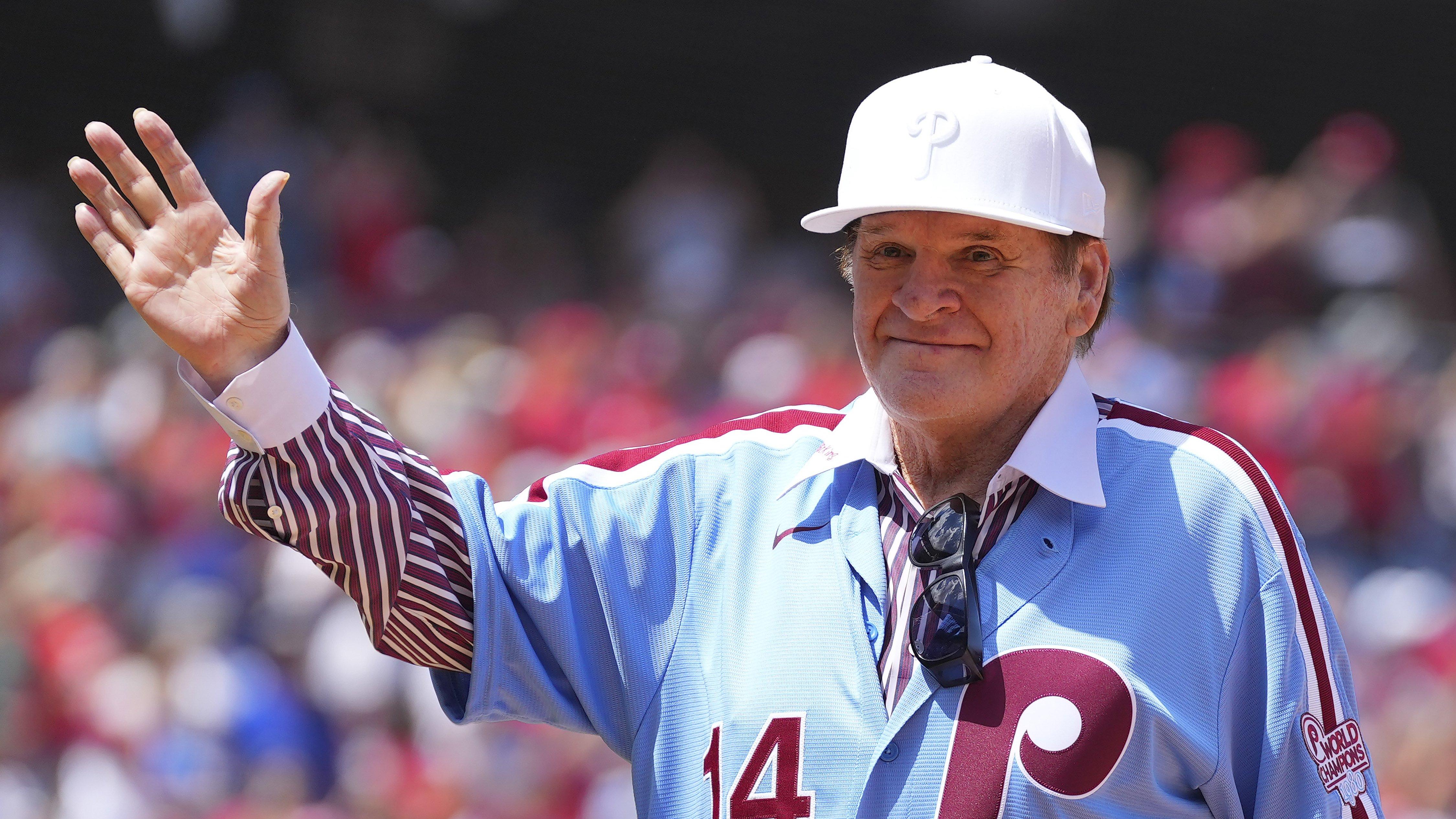

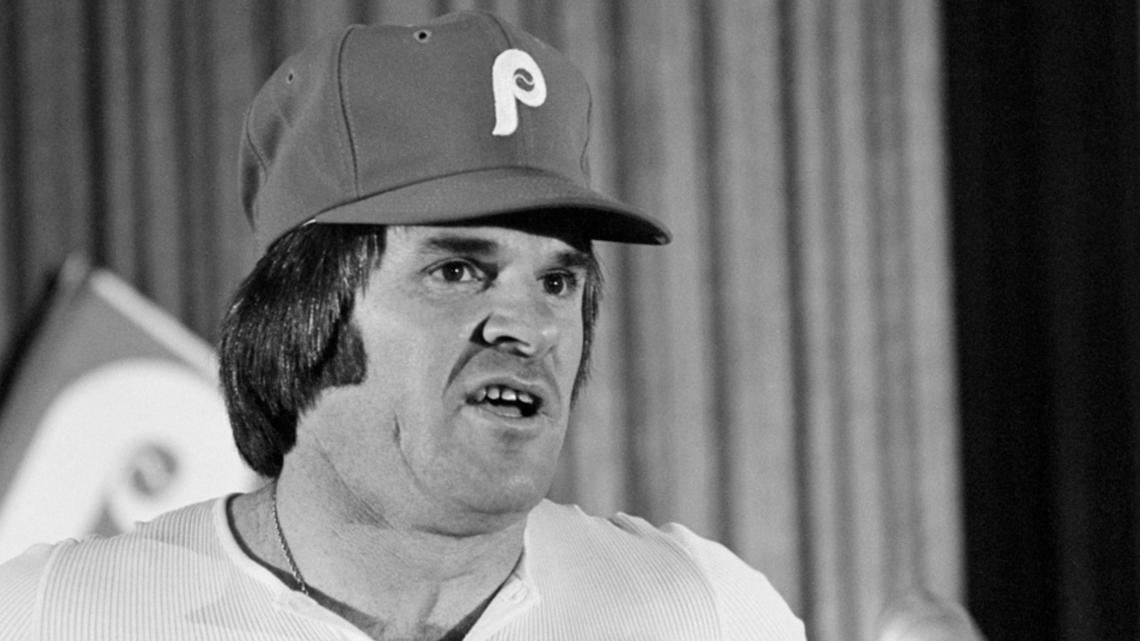

The Pete Rose Pardon Trumps Consideration And The Future Of Baseballs Betting Rules

Apr 29, 2025

The Pete Rose Pardon Trumps Consideration And The Future Of Baseballs Betting Rules

Apr 29, 2025 -

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025 -

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025 -

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025