China Life Profit Rises: Investment Resilience Drives Growth

Table of Contents

Robust Investment Performance Fuels Profit Growth

China Life's remarkable profit increase is largely attributable to the exceptional performance of its investment portfolio. The company's strategic approach to asset allocation has yielded significant returns, outperforming market expectations. This success is not just a matter of luck; it's the result of a carefully crafted investment strategy and shrewd risk management.

- Successful Investment Strategies: China Life has demonstrated success across various asset classes. Their investments in real estate, particularly commercial properties in major Chinese cities, have yielded substantial returns. Equities, carefully selected based on rigorous analysis, have also contributed significantly to overall investment income. Furthermore, a diversified portfolio of government and corporate bonds provides stability and consistent returns.

- Quantifiable Data: While specific figures may be subject to official reporting periods, sources suggest a double-digit percentage increase in investment income compared to the previous year. This robust performance directly translates to higher profitability for the company.

- Portfolio Diversification: China Life’s proactive diversification strategy has played a crucial role in mitigating risk. By spreading investments across different asset classes and geographies, the company has successfully navigated periods of market volatility. This strategic approach minimizes exposure to any single sector’s performance fluctuations. This demonstrates the effectiveness of their China Life Investments strategy.

Strategic Asset Allocation Mitigates Market Volatility

China Life's proactive approach to asset allocation strategy has been instrumental in navigating market uncertainties. The company's experienced investment team consistently monitors global economic trends, geopolitical events, and potential risks. This allows them to adjust their investment portfolio accordingly, maximizing returns while minimizing exposure to potential downturns.

- Risk Management Strategies: China Life employs sophisticated risk management techniques, including stress testing and scenario analysis, to identify and mitigate potential risks. This forward-thinking approach ensures that the company can weather market storms and maintain its strong financial position.

- Addressing Market Fluctuations: Despite the global economic slowdown and geopolitical uncertainties that affected many companies, China Life’s sophisticated risk management and asset allocation expertise helped mitigate their impact, ensuring a steady growth trajectory.

- Investment Team Expertise: The success of China Life’s investment strategy is a testament to the experience and expertise of their investment professionals. Their deep understanding of market dynamics, coupled with their commitment to rigorous research and analysis, enables them to make informed decisions and generate substantial returns.

Growth in Core Insurance Businesses Contributes to Overall Profitability

While investment returns are a significant driver of China Life’s profit, the strong performance of its core insurance businesses also plays a crucial role. The company's traditional life insurance premiums have experienced steady growth, reflecting a rising demand for insurance products in China's expanding middle class.

- Life Insurance Premiums Growth: Consistent growth in life insurance premiums represents a significant portion of China Life’s overall revenue. This demonstrates the company’s success in offering attractive and relevant products to meet the evolving needs of its customer base.

- Expansion in Other Insurance Segments: China Life has also seen significant expansion in its health insurance and other related insurance segments, further diversifying its revenue streams and strengthening its market position. This demonstrates the company’s adaptability and forward-thinking approach.

- Market Share Increase: China Life’s performance has led to an increase in their insurance market share, solidifying their position as a leading player in the Chinese insurance market. This reinforces their strong brand recognition and customer loyalty.

Future Outlook and Implications for the Insurance Sector

China Life's impressive performance has significant implications for the broader Chinese insurance sector. Its success underscores the importance of strategic investment management and diversified revenue streams.

- Predictions for Future Growth: Based on the current trends, analysts predict continued growth for China Life, fueled by both its robust investment performance and the expanding Chinese insurance market.

- Impact on Competitors: China Life’s success will likely increase competition within the Chinese insurance industry. Competitors will need to adopt innovative strategies and refine their investment approaches to stay competitive.

- Overall Outlook for the Chinese Insurance Market: China Life's success contributes to a positive insurance sector outlook for the Chinese market, indicating strong growth potential and investor confidence. The Chinese insurance market is expected to continue its expansion.

Conclusion: China Life Profit Rises: A Testament to Strategic Investment

China Life's significant profit increase is a testament to its robust investment performance and the strength of its core insurance businesses. The company’s strategic asset allocation, risk management practices, and diversified investment portfolio have proven highly effective in generating substantial returns, even amid market volatility. This success underscores the importance of strategic China Life investments and showcases the potential of the Chinese insurance market. Discover how China Life's investment resilience is shaping the industry by visiting [link to China Life's investor relations page]. Learn more about the factors driving China Life profit rises and the future of the Chinese insurance market.

Featured Posts

-

Giai Bong Da Sinh Vien Tran Dau Soi Noi Mo Man Vong Chung Ket

May 01, 2025

Giai Bong Da Sinh Vien Tran Dau Soi Noi Mo Man Vong Chung Ket

May 01, 2025 -

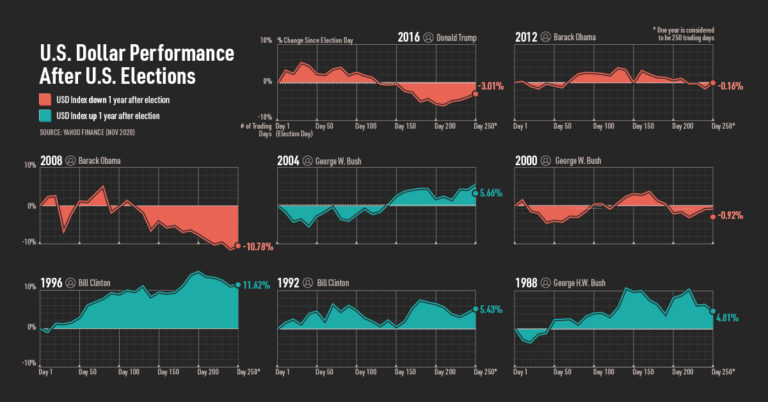

Election Uncertainty Impact On The Canadian Dollars Value

May 01, 2025

Election Uncertainty Impact On The Canadian Dollars Value

May 01, 2025 -

Dai Hoc Ton Duc Thang Chien Thang Ngoan Muc Tai Giai Bong Da Sinh Vien Quoc Te 2025

May 01, 2025

Dai Hoc Ton Duc Thang Chien Thang Ngoan Muc Tai Giai Bong Da Sinh Vien Quoc Te 2025

May 01, 2025 -

Pasifika Sipoti Quick Look At April 4th

May 01, 2025

Pasifika Sipoti Quick Look At April 4th

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Latest Posts

-

10 Game Winning Streak For Cavaliers De Andre Hunters Key Role In Victory Against Portland

May 01, 2025

10 Game Winning Streak For Cavaliers De Andre Hunters Key Role In Victory Against Portland

May 01, 2025 -

4 Takeaways How Derrick White Carried The Celtics Past The Cavaliers

May 01, 2025

4 Takeaways How Derrick White Carried The Celtics Past The Cavaliers

May 01, 2025 -

Derrick White Leads Celtics To Victory Over Cavaliers 4 Crucial Takeaways

May 01, 2025

Derrick White Leads Celtics To Victory Over Cavaliers 4 Crucial Takeaways

May 01, 2025 -

Hunters Stellar Game Propels Cavaliers Past Trail Blazers For 10th Consecutive Victory

May 01, 2025

Hunters Stellar Game Propels Cavaliers Past Trail Blazers For 10th Consecutive Victory

May 01, 2025 -

Rekord Ovechkina Kinopoisk Darit Soski S Izobrazheniem Khokkeista Novorozhdennym

May 01, 2025

Rekord Ovechkina Kinopoisk Darit Soski S Izobrazheniem Khokkeista Novorozhdennym

May 01, 2025