Find Your Missing HMRC Refund: Check Your Savings Account Now

Table of Contents

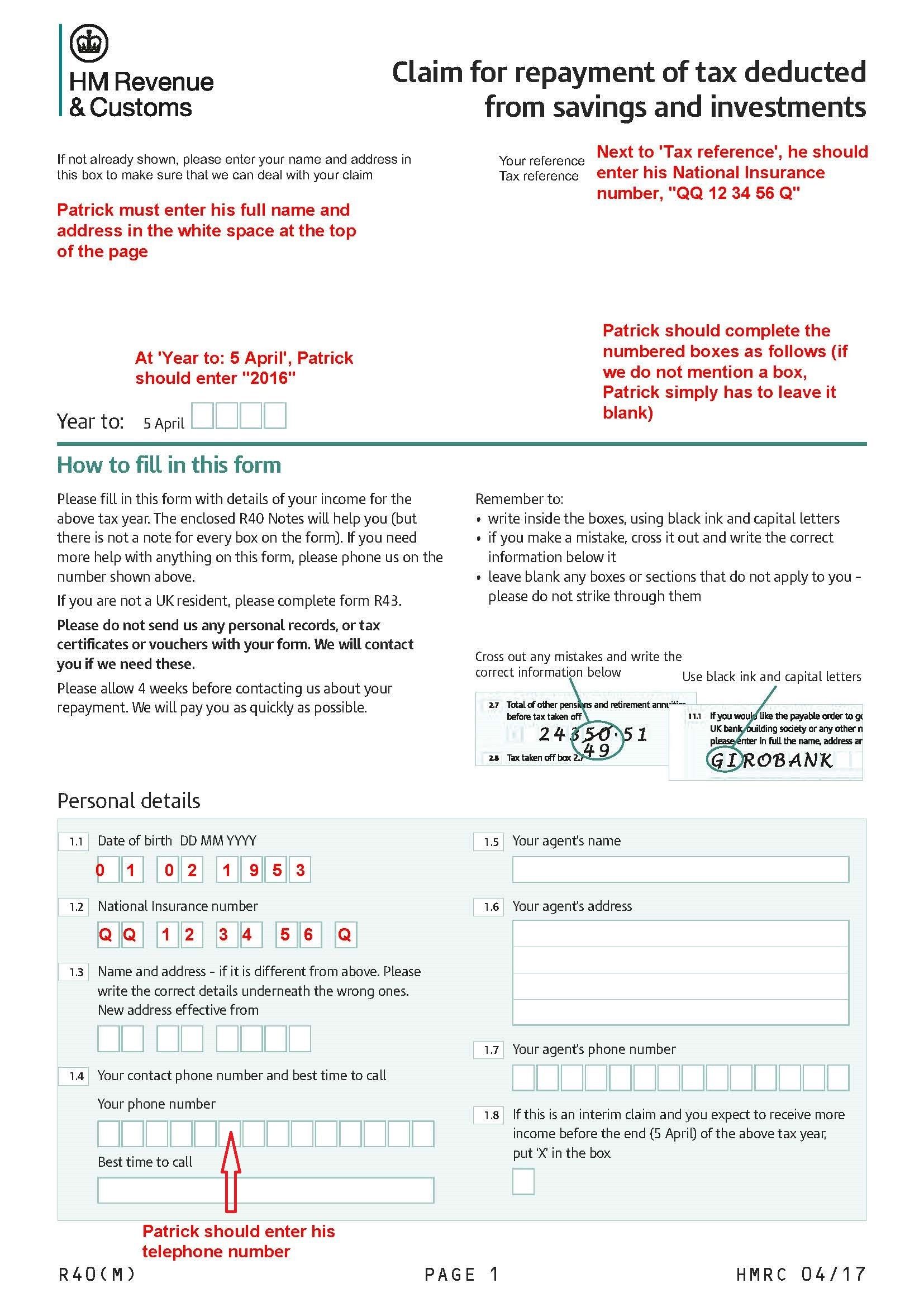

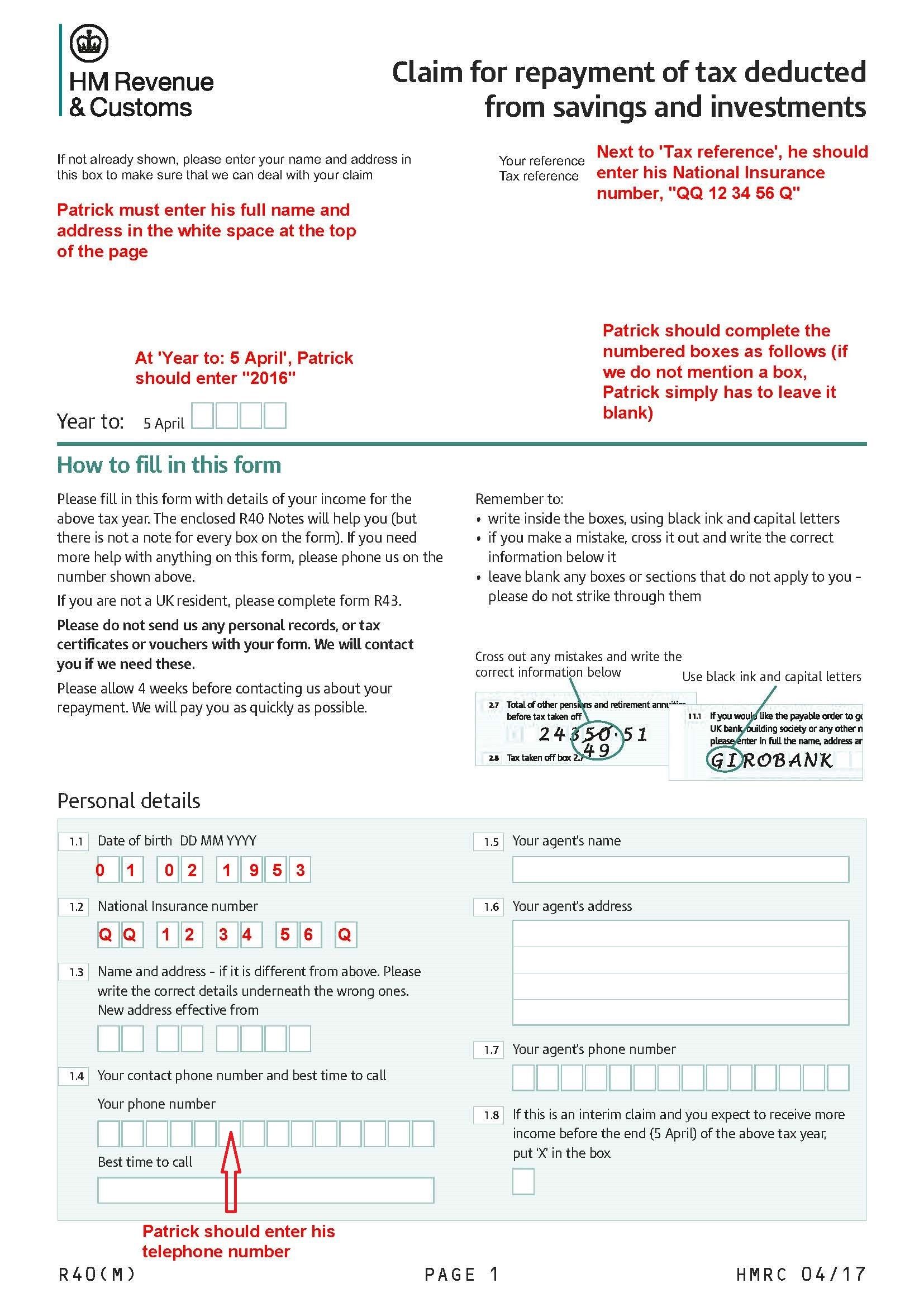

Why Your HMRC Refund Might Be in Your Savings Account

Sometimes, your HMRC refund might end up in an unexpected place – your savings account! There are several reasons why this might happen. Understanding these reasons is the first step to locating your missing money.

- Incorrect bank details previously provided: If you previously provided incorrect bank details to HMRC, the refund might have been sent to an older, inactive account, possibly a savings account.

- Automatic repayment into a linked savings account: Some individuals have linked savings accounts with their primary current account. HMRC might automatically deposit the refund into the linked savings account as a default setting.

- HMRC system error directing the payment: Although rare, system errors can sometimes lead to an HMRC refund being deposited into the wrong account, including a savings account.

- Changes in personal banking information not updated with HMRC: If you've changed banks or updated your account details recently, there's a chance HMRC might not have the most up-to-date information, leading to the refund being sent to an older savings account.

How to Check Your Savings Accounts for an HMRC Refund

Checking your savings accounts for a missing HMRC refund is straightforward. Follow these steps to ensure you don't miss out on your money:

- Log in to your online banking securely: Access your online banking portal through the official website or app of your bank. Ensure you're using a secure connection.

- Check transaction history for the past 12 months (or longer): Most online banking platforms allow you to filter your transaction history by date. Check for at least the past year, extending further back if you suspect the refund might be older.

- Search for payments from "HMRC," "HM Revenue & Customs," or similar keywords: Use the search function within your online banking to quickly locate payments from HMRC. Be sure to check for variations of the name.

- Look for unusual or unexpected payments around tax return filing dates: Focus your search around the times you typically file your tax return. This will narrow down your search significantly.

- Contact your bank if you have difficulty identifying the payment: If you're having trouble finding the payment, contact your bank's customer service for assistance. They may be able to help you identify the transaction.

What to Do if You Find Your HMRC Refund

Discovering your missing HMRC refund in your savings account is fantastic news! Here's what you should do next:

- Ensure the amount matches your expected refund: Carefully compare the amount received with the amount you expected based on your tax return.

- Review your tax return filing status to confirm the payment: Check your HMRC online account to confirm that the refund has been processed and that the payment matches your records.

- Contact HMRC if there's any discrepancy: If the amount is incorrect or you have any questions, contact HMRC immediately to clarify the situation.

What to Do if You Can't Find Your HMRC Refund

If you've diligently checked your savings accounts and still haven't found your HMRC refund, don't panic. Here are some further steps you can take:

- Check your main current account and other bank accounts: Ensure you've checked all your bank accounts, including any joint accounts or less frequently used accounts.

- Contact HMRC directly using their online portal or phone: Use the official HMRC website or phone number to contact them directly. Be prepared to provide your Unique Taxpayer Reference (UTR) number and other relevant details.

- Provide your Unique Taxpayer Reference (UTR) number and relevant details: Having this information readily available will speed up the process of resolving the issue.

- Be prepared to answer questions about your tax return: HMRC may ask for details about your tax return to verify your identity and the refund amount.

- Keep records of all communication with HMRC: Maintain a record of all correspondence, including email confirmations and phone call notes, for your reference.

Conclusion

Finding your missing HMRC refund can be simpler than you think! By diligently checking your savings accounts and following the steps outlined above, you can increase your chances of locating any unexpected payments. Remember to check all your accounts, not just the one you primarily use. Don't underestimate the power of a thorough search – even small amounts can add up!

Call to Action: Don't wait any longer! Check your savings account today to see if your missing HMRC refund is waiting for you. Start searching for your missing HMRC refund now and ensure you receive all the money you're owed! If you still haven't found it, contact HMRC directly.

Featured Posts

-

El Viaje De Schumacher De Mallorca A Suiza En Helicoptero

May 20, 2025

El Viaje De Schumacher De Mallorca A Suiza En Helicoptero

May 20, 2025 -

Aldhkae Alastnaey Yeyd Ihyae Ajatha Krysty Thlyl Jdyd Laemalha

May 20, 2025

Aldhkae Alastnaey Yeyd Ihyae Ajatha Krysty Thlyl Jdyd Laemalha

May 20, 2025 -

Ofitsialno Dzhenifr Lorns Otnovo E Mayka

May 20, 2025

Ofitsialno Dzhenifr Lorns Otnovo E Mayka

May 20, 2025 -

Nou Membru In Familia Schumacher Pilotul Legendar Devine Bunic

May 20, 2025

Nou Membru In Familia Schumacher Pilotul Legendar Devine Bunic

May 20, 2025 -

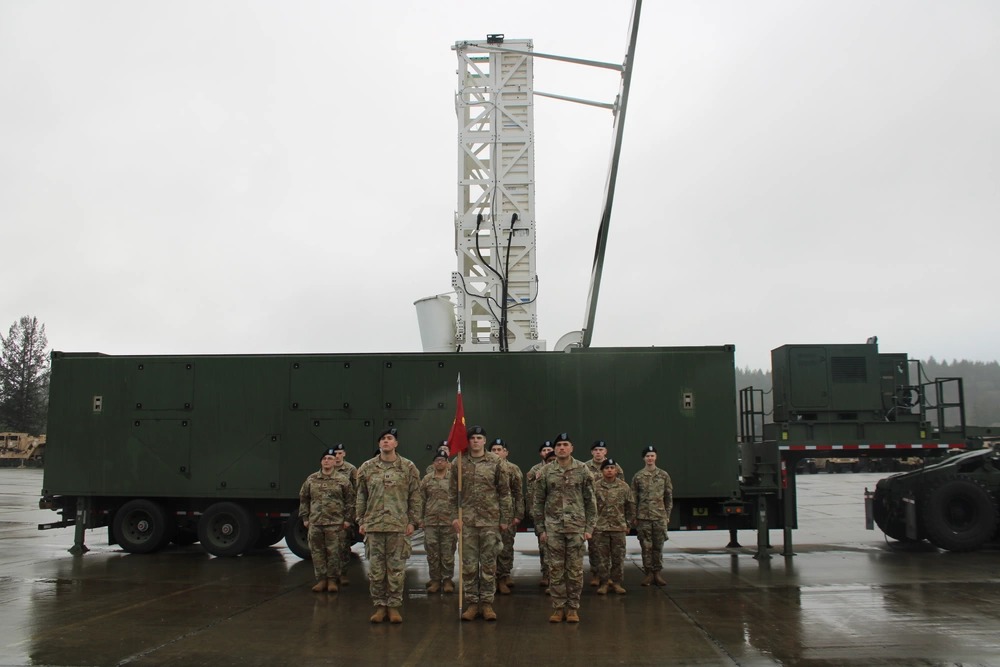

The Strategic Implications Of The Us Typhon Missile System In The Philippines A Case Study Of Chinas Growing Influence

May 20, 2025

The Strategic Implications Of The Us Typhon Missile System In The Philippines A Case Study Of Chinas Growing Influence

May 20, 2025

Latest Posts

-

Jennifer Lawrences New Film Critical Analysis And Reviews

May 20, 2025

Jennifer Lawrences New Film Critical Analysis And Reviews

May 20, 2025 -

What Critics Are Saying About Jennifer Lawrences New Film

May 20, 2025

What Critics Are Saying About Jennifer Lawrences New Film

May 20, 2025 -

Film Critics Weigh In Jennifer Lawrences New Release

May 20, 2025

Film Critics Weigh In Jennifer Lawrences New Release

May 20, 2025 -

Early Critic Response Jennifer Lawrences New Project

May 20, 2025

Early Critic Response Jennifer Lawrences New Project

May 20, 2025 -

Novinata E Fakt Dzhenifr Lorns E Mayka Za Vtori Pt

May 20, 2025

Novinata E Fakt Dzhenifr Lorns E Mayka Za Vtori Pt

May 20, 2025