CFP Board CEO Announces 2026 Retirement

Table of Contents

The CEO's Legacy and Contributions to the CFP Board

The current CEO's tenure has been marked by significant achievements that have strengthened the CFP Board and the financial planning profession. Their leadership has been instrumental in elevating the standards and reputation of certified financial planners.

-

Strengthening the CFP Certification: Under the CEO's leadership, the CFP certification process has undergone significant improvements, enhancing its rigor and ensuring that CFP professionals meet the highest standards of competence and ethics. This has included updates to the curriculum, stricter examination processes, and a greater emphasis on ongoing professional development for certified financial planners.

-

Promoting Ethical Standards: The CEO has championed a strong ethical framework for financial advisors, leading initiatives that emphasize fiduciary duty and client best interests. This commitment to ethical standards has helped build public trust in the financial planning profession and reinforces the value of the CFP certification.

-

Expanding Public Awareness: The CEO has overseen initiatives to raise public awareness of the importance of financial planning and the value of working with a certified financial planner. These campaigns have increased public understanding of the CFP designation and its significance in navigating complex financial matters. The increased visibility has likely contributed to a rise in the demand for CFP professionals.

-

Quantifiable Successes: While precise figures may not be publicly available, the CEO’s leadership has demonstrably contributed to a significant growth in the number of CFP professionals and a marked increase in public trust and confidence in the financial planning industry. This success is evidenced by the CFP Board's increased influence and the growing recognition of the CFP designation as the gold standard in financial planning.

The Search for a New CEO and the Future of the CFP Board

The upcoming CEO search will be a crucial moment for the CFP Board. The selection of the next leader will shape the organization's direction and its impact on the financial planning industry for years to come.

-

The Selection Process: The CFP Board will likely employ a rigorous search process, potentially engaging an executive search firm specializing in non-profit leadership recruitment. This process is likely to involve a thorough evaluation of candidates, considering their experience in financial services, leadership capabilities, and commitment to the CFP Board's mission.

-

Desired Qualities: The Board will likely seek a candidate with a deep understanding of the financial planning industry, a proven track record of leadership, strong communication skills, and a dedication to upholding the highest ethical standards. Experience in managing large organizations and navigating regulatory complexities will also be highly valued.

-

Challenges and Opportunities: The next CEO will face both challenges and opportunities. Challenges include adapting to evolving technological advancements in the financial services sector, navigating regulatory changes, and continuing to enhance the CFP certification's relevance and value. Opportunities include expanding access to financial planning services, fostering greater diversity within the profession, and leveraging technology to enhance service delivery.

-

Impact on CFP Certification: The transition should ideally be seamless, minimizing disruption to the CFP certification process and ongoing initiatives. However, minor adjustments in policy or emphasis may occur depending on the new CEO’s priorities and vision.

Implications for CFP Professionals and the Financial Planning Industry

The change in leadership at the CFP Board will inevitably have implications for CFP professionals and the broader financial planning industry.

-

Career Outlook for CFP Professionals: While a leadership change rarely causes immediate upheaval, the new CEO's priorities and strategies might indirectly impact career opportunities. A focus on technology, for example, could lead to increased demand for CFP professionals with specific technological skills.

-

Potential Regulatory Changes: Although significant regulatory changes are not expected immediately, the new CEO may bring a different approach to advocating for policies that benefit CFP professionals and the industry as a whole.

-

Demand for Certified Financial Planners: The ongoing growth of the financial planning industry suggests a continuing high demand for certified financial planners. The CFP Board's actions under the new CEO will likely influence how this demand is met and the overall career trajectory for CFP professionals.

-

Industry Growth and Evolution: The financial planning industry is constantly evolving. The next CEO will play a vital role in shaping the industry's future, navigating technological advancements, addressing regulatory changes, and ensuring that the CFP designation remains the gold standard in the field.

Conclusion

The announcement of the CFP Board CEO's retirement in 2026 marks a significant moment for the organization and the financial planning profession. The incoming CEO will inherit a robust organization but will also face challenges in navigating the ever-evolving financial landscape. The transition period presents both opportunities and uncertainties for CFP professionals.

Call to Action: Stay informed about developments regarding the CFP Board CEO search and the future direction of the organization. Follow industry news and resources to stay updated on the latest information impacting CFP professionals and the broader financial planning field. Learn more about the importance of CFP certification and how it can benefit your career in financial planning. Understanding these changes is crucial for all individuals pursuing a career as a certified financial planner or currently working as a financial advisor in this dynamic sector.

Featured Posts

-

Fortnite Offline Update 34 40 Brings Planned Server Maintenance

May 02, 2025

Fortnite Offline Update 34 40 Brings Planned Server Maintenance

May 02, 2025 -

Daily Lotto Tuesday April 15 2025 Results

May 02, 2025

Daily Lotto Tuesday April 15 2025 Results

May 02, 2025 -

Rust Movie Review Examining The Fallout Of The On Set Accident

May 02, 2025

Rust Movie Review Examining The Fallout Of The On Set Accident

May 02, 2025 -

Michael Sheens 1 Million Debt Relief Initiative Impacting 900 Lives

May 02, 2025

Michael Sheens 1 Million Debt Relief Initiative Impacting 900 Lives

May 02, 2025 -

Fans React To Christina Aguileras Heavily Edited Photos

May 02, 2025

Fans React To Christina Aguileras Heavily Edited Photos

May 02, 2025

Latest Posts

-

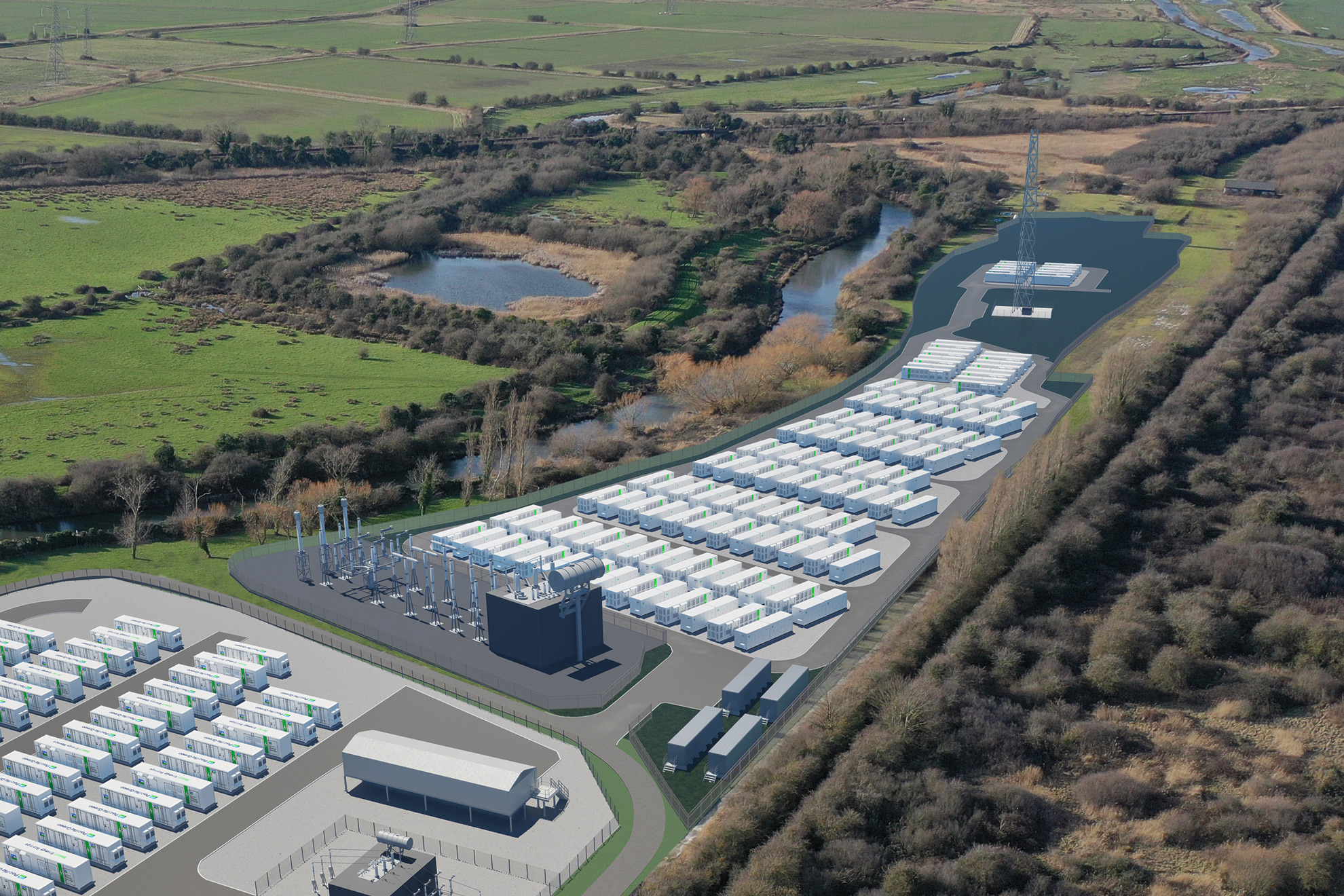

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025 -

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025 -

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025 -

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025