Case Study: How Trump's Tariffs Bankrupted Small Businesses

Table of Contents

Increased Input Costs and Reduced Profit Margins

Trump's tariffs dramatically increased the cost of imported goods, impacting businesses reliant on global supply chains. These increased costs, often passed down the supply chain, directly affected the profitability of many small businesses, severely impacting their bottom line. The ripple effect was devastating, ultimately contributing to many businesses’ failures.

-

Example 1: A small furniture manufacturer in North Carolina, relying heavily on imported hardwoods from Southeast Asia, saw its raw material costs increase by 30% almost overnight. This dramatic surge in manufacturing costs, coupled with the inability to raise prices proportionally without losing market share, led to significantly reduced profits and ultimately contributed to the company’s closure. This illustrates the devastating impact of tariff-induced inflation on small businesses.

-

Example 2: A clothing retailer in California, sourcing fabrics from China, faced a 25% increase in import costs. To maintain profit margins, they were forced to raise their prices, but this alienated price-sensitive customers and led to a dramatic drop in sales. The increased competition from larger retailers who could better absorb the cost increases further exacerbated the problem, ultimately leading to bankruptcy.

The increased supply chain disruption and inflation caused by tariffs created a perfect storm, squeezing profit margins and leaving many small businesses vulnerable. These increased raw material costs and manufacturing costs were simply unsustainable for many.

Loss of Market Share and International Competition

Trump's tariffs ignited retaliatory tariffs from other countries, creating a global trade war that disproportionately impacted export-oriented small businesses. The increased costs of American goods in foreign markets led to a significant loss of market share and further financial hardship.

-

Example 1: A small agricultural business in Iowa, exporting soybeans to China, faced crippling losses when China imposed retaliatory tariffs, rendering their product uncompetitive in the Chinese market. This loss of a major export market severely damaged the business's financial viability, contributing to eventual closure.

-

Example 2: A technology company in Silicon Valley, exporting software, saw international sales plummet as their clients in other countries faced increased import costs due to tariffs. This loss of revenue significantly impacted their ability to maintain operations, highlighting the global interconnectedness of modern business and the vulnerability of small businesses to trade wars.

The retaliatory tariffs created a vicious cycle, reducing export opportunities and severely limiting the growth potential of many American small businesses. The disruption to global trade caused by this trade war was nothing short of catastrophic for many.

Access to Credit and Financial Strain

The economic uncertainty generated by Trump's tariffs made it exceptionally difficult for small businesses to secure loans and credit. Lenders, facing increased risk aversion, became less willing to extend credit, even to previously successful businesses.

-

Increased Risk Aversion of Lenders: Banks and other financial institutions became more cautious in their lending practices, perceiving increased risk in the volatile economic climate created by the tariffs. Many small businesses, even those with strong track records, found it nearly impossible to secure the loans they needed to stay afloat.

-

Impact of Reduced Cash Flow: The reduced sales and increased costs associated with the tariffs severely impacted many small businesses' cash flow. This lack of liquidity made it incredibly challenging to meet loan obligations, further exacerbating their financial difficulties.

-

Difficulty in Accessing Government Aid: While some government aid programs existed, navigating the bureaucracy and obtaining the necessary funds often proved challenging for already-struggling small businesses. The process was often cumbersome and ineffective in providing timely relief.

The combination of restricted credit access and economic uncertainty created a perfect storm, pushing many small businesses towards bankruptcy. This financial hardship was often the final blow to businesses already struggling with the direct impacts of the tariffs.

Specific Case Studies of Bankruptcies

Several small businesses directly attributed their bankruptcies to the negative impacts of Trump's tariffs. While specific details and attributions can be difficult to definitively isolate, numerous news reports and economic analyses documented significant increases in small business closures during this period. Further research into specific industry sectors most impacted by imported materials would reveal even more compelling case studies. For instance, research into the impact of tariffs on the furniture industry in North Carolina, or the agricultural sector in the Midwest, would uncover specific businesses whose failures can be directly correlated to the policy's devastating economic impact.

Conclusion: The Long-Term Consequences of Protectionist Policies on Small Businesses

Trump's tariffs had a significantly negative impact on small businesses across various sectors. Increased input costs, loss of market share, and severely restricted access to credit created a perfect storm that led to widespread bankruptcies and long-term economic damage. The ripple effects of these protectionist policies extended far beyond the businesses directly impacted, affecting entire communities and the broader economy. Understanding the devastating effects of Trump's tariffs on small businesses is crucial to preventing similar economic crises in the future. Learn more about the long-term consequences of protectionist trade policies and advocate for policies that support small business growth and a more balanced approach to international trade. Analyzing the impact of tariffs on specific industries and developing effective policies to mitigate the negative consequences on small businesses is essential for a healthy and robust economy.

Featured Posts

-

Division Title Secured Celtics Impressive Victory

May 12, 2025

Division Title Secured Celtics Impressive Victory

May 12, 2025 -

Your Guide To Montego Bay Activities And Attractions

May 12, 2025

Your Guide To Montego Bay Activities And Attractions

May 12, 2025 -

Us Bond Yields Rise As Powells Comments Dim Rate Cut Prospects

May 12, 2025

Us Bond Yields Rise As Powells Comments Dim Rate Cut Prospects

May 12, 2025 -

Bayern Munich Legend Thomas Mueller A Look At His Most Common Teammates

May 12, 2025

Bayern Munich Legend Thomas Mueller A Look At His Most Common Teammates

May 12, 2025 -

Virginia Giuffres Shocking Statement Four Days To Live

May 12, 2025

Virginia Giuffres Shocking Statement Four Days To Live

May 12, 2025

Latest Posts

-

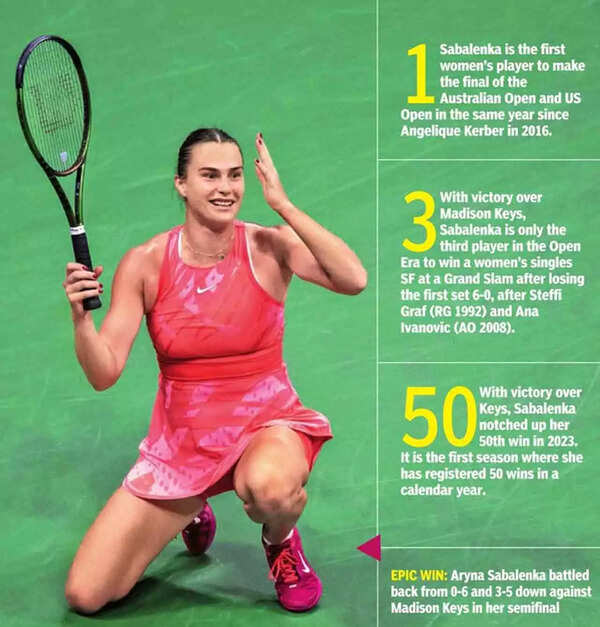

Sabalenkas Dominant Performance Secures Madrid Open Win Against Gauff

May 13, 2025

Sabalenkas Dominant Performance Secures Madrid Open Win Against Gauff

May 13, 2025 -

Gauff Falls To Sabalenka In Madrid Open Championship Match

May 13, 2025

Gauff Falls To Sabalenka In Madrid Open Championship Match

May 13, 2025 -

Madrid Open Sabalenka Triumphs Over Gauff

May 13, 2025

Madrid Open Sabalenka Triumphs Over Gauff

May 13, 2025 -

Sabalenka Claims Madrid Open Title With Victory Over Gauff

May 13, 2025

Sabalenka Claims Madrid Open Title With Victory Over Gauff

May 13, 2025 -

Sabalenkas Miami Open Win 19th Wta Title Secured

May 13, 2025

Sabalenkas Miami Open Win 19th Wta Title Secured

May 13, 2025