US Bond Yields Rise As Powell's Comments Dim Rate Cut Prospects

Table of Contents

Powell's Hawkish Stance and Its Impact on Yield Expectations

Powell's recent press conference and public statements adopted a decidedly hawkish tone, shifting away from the more dovish stance observed earlier this year. This shift in rhetoric profoundly impacted yield expectations. Market analysts interpreted his comments as a signal that the Fed is committed to combating inflation, even if it means maintaining higher interest rates for longer than previously anticipated.

- Emphasis on persistent inflation: Powell repeatedly stressed the persistence of inflation, highlighting that the Fed's goal of price stability remains paramount.

- Caution regarding premature rate cuts: He explicitly cautioned against prematurely cutting interest rates, emphasizing the need to see sustained progress in reducing inflation before considering any easing of monetary policy.

- Commitment to price stability: Powell reiterated the Fed's unwavering commitment to achieving its 2% inflation target, suggesting that rate hikes might continue if inflation remains stubbornly high.

This departure from a more lenient approach surprised some market participants who had anticipated earlier rate cuts. The shift to a hawkish stance signaled a higher risk-free rate, influencing investors' expectations and directly impacting bond yields. As Bloomberg reported, "[Quote from Bloomberg article regarding Powell's comments and market reaction]." This sentiment was echoed by several economic experts, who noted the increased uncertainty surrounding the Fed's future policy decisions. The impact of this shift on investor confidence is evident in decreased risk appetite and a move towards safer assets, which in turn bolsters demand for higher yields.

The Mechanics of Bond Yield Increases

Understanding the rise in US bond yields requires grasping the inverse relationship between bond prices and yields. When bond prices fall, yields rise, and vice versa. Reduced expectations for rate cuts, fueled by Powell's comments, led to a decrease in demand for US Treasury bonds. This decrease in demand resulted in lower bond prices and consequently, higher yields.

- Reduced expectations for rate cuts: The market's belief that interest rates will remain higher for longer reduces the attractiveness of lower-yielding bonds.

- Role of inflation expectations: High inflation erodes the purchasing power of fixed-income investments like bonds. Persistent inflationary pressures contribute to higher yields as investors demand a greater return to compensate for inflation's impact.

However, factors beyond Powell's comments contributed to the increase in yields:

- Stronger-than-expected economic data: Robust economic data releases often strengthen the case for higher interest rates, boosting bond yields.

- Increased government borrowing: Increased government borrowing to finance various programs can increase the supply of bonds, potentially putting downward pressure on prices and upward pressure on yields.

- Global economic uncertainty: Global economic uncertainties, such as geopolitical risks, often lead to increased demand for safe-haven assets like US Treasury bonds, which can temporarily impact yields.

Higher yields translate to increased borrowing costs for businesses and consumers, impacting investment decisions and overall economic activity.

Market Reactions and Investor Sentiment

The immediate market reaction to Powell's comments was swift and significant. US Treasury bond prices fell sharply, leading to a substantial increase in yields across various maturities. The 10-year Treasury yield, a key benchmark, saw a notable jump. This impacted other asset classes as well; stock markets experienced some volatility, and the US dollar strengthened slightly.

- Changes in bond prices: Sharp declines in bond prices across the maturity spectrum.

- Stock market fluctuations: Increased volatility and potential downward pressure on equity valuations.

- Currency movements: Strengthening of the US dollar against other major currencies.

Investor sentiment shifted towards increased risk aversion. The flight-to-safety phenomenon, typically observed during periods of uncertainty, was less pronounced due to the relatively strong economic indicators. However, the increased yields present both challenges and opportunities for investment strategies, requiring careful evaluation and adaptation. The potential future implications include re-evaluation of portfolio allocations and a greater focus on yield-sensitive investments.

Alternative Perspectives and Counterarguments

While the prevailing view attributes the rise in US bond yields primarily to Powell's hawkish comments, alternative perspectives exist. Some argue that the economic data itself, independent of Powell’s statements, was sufficient to drive yield increases. Others believe that the market overreacted to Powell's remarks, and that yields may eventually moderate. It's crucial to consider these diverse interpretations when forming investment strategies.

Conclusion: Understanding the Rise of US Bond Yields

The recent surge in US bond yields is multifaceted, but Powell's hawkish stance played a pivotal role. His comments, emphasizing the Fed's commitment to fighting inflation and cautioning against premature rate cuts, significantly altered investor expectations. This shift, combined with other economic factors, led to decreased demand for bonds, ultimately driving up yields. The implications of rising yields are far-reaching, impacting borrowing costs, investment strategies, and the broader economic landscape. Staying updated on the latest developments regarding US bond yields and their impact on your investments is crucial for making informed financial decisions. Understanding the factors influencing US bond yields is key to navigating the complexities of the current financial climate.

Featured Posts

-

Crazy Rich Asians Sequel Tv Series Adaptation Announced With Jon M Chu

May 12, 2025

Crazy Rich Asians Sequel Tv Series Adaptation Announced With Jon M Chu

May 12, 2025 -

Smith Mountain Lake Hosts B And W Trailer Hitches Heavy Hitters Tournament 100 K Prize

May 12, 2025

Smith Mountain Lake Hosts B And W Trailer Hitches Heavy Hitters Tournament 100 K Prize

May 12, 2025 -

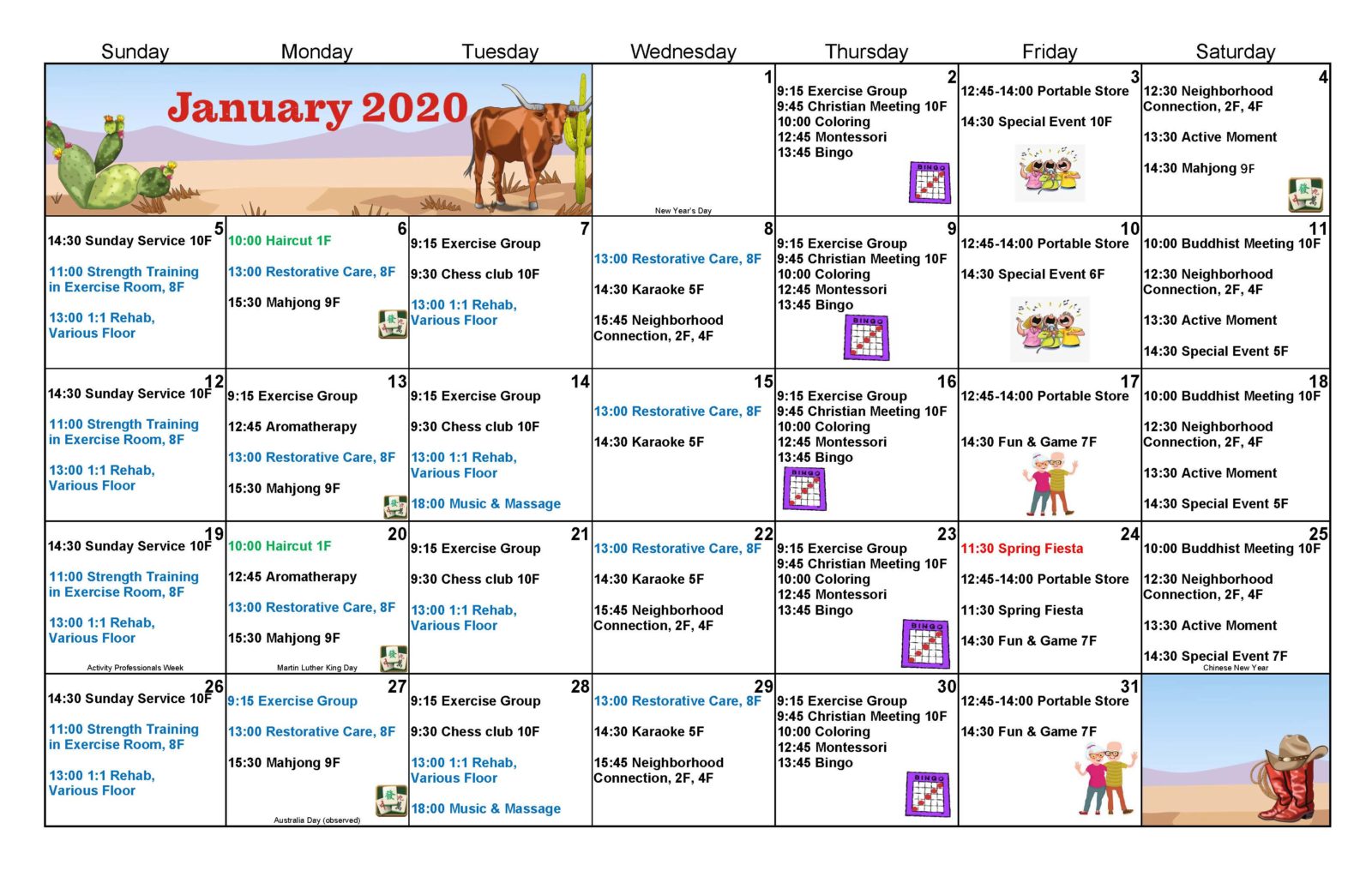

The Ultimate Senior Calendar Trips Activities And Events

May 12, 2025

The Ultimate Senior Calendar Trips Activities And Events

May 12, 2025 -

The Paradox Of Trumps Cheap Oil Policy Boosting Prices While Praising Producers

May 12, 2025

The Paradox Of Trumps Cheap Oil Policy Boosting Prices While Praising Producers

May 12, 2025 -

Oscars 2025 Adam Sandlers Unexpected Cameo His Outfit The Joke And The Chalamet Hug

May 12, 2025

Oscars 2025 Adam Sandlers Unexpected Cameo His Outfit The Joke And The Chalamet Hug

May 12, 2025

Latest Posts

-

Pl Retro Watch Sky Sports Premier League Hd Classics

May 13, 2025

Pl Retro Watch Sky Sports Premier League Hd Classics

May 13, 2025 -

Lids Una Ted I Barnli Nov Zhivot Vo Premier Ligata

May 13, 2025

Lids Una Ted I Barnli Nov Zhivot Vo Premier Ligata

May 13, 2025 -

Barnli I Lids Una Ted Promotsi A Vo Premier Ligata

May 13, 2025

Barnli I Lids Una Ted Promotsi A Vo Premier Ligata

May 13, 2025 -

Lids I Barnli Obezbedi A Mesto Vo Premier Ligata

May 13, 2025

Lids I Barnli Obezbedi A Mesto Vo Premier Ligata

May 13, 2025 -

Derbito Go Odnese Barnli Vozvrakjanje Vo Premier Ligata

May 13, 2025

Derbito Go Odnese Barnli Vozvrakjanje Vo Premier Ligata

May 13, 2025