Kering's Q1 Results Send Shares Down 6%

Table of Contents

Declining Sales in Key Brands

Kering's Q1 results revealed underperformance across several of its flagship brands, significantly impacting the overall financial picture. This sluggish growth, compared to previous quarters and analyst expectations, is a major factor in the 6% share price drop. The most notable declines were observed in Gucci and Yves Saint Laurent, two powerhouses within Kering's portfolio.

-

Gucci: Sales figures for Gucci showed a [Insert Percentage]% decrease compared to Q1 2023 and fell short of the projected [Insert Percentage]% growth anticipated by analysts. Possible contributing factors include increased competition from other luxury brands offering similar styles, a potential need for a refreshed brand image to resonate with younger consumers, and perhaps supply chain issues impacting product availability.

-

Yves Saint Laurent (YSL): YSL also experienced a decline in sales, registering a [Insert Percentage]% drop compared to the same period last year. This underperformance could be attributed to [Insert specific reasons for YSL's underperformance, e.g., saturated market segment, less successful new product launches].

-

Other Brands: While other brands within the Kering portfolio may have shown some growth, the combined impact of the underperformance of Gucci and YSL was substantial enough to significantly drag down the overall Q1 results and contribute significantly to the share price drop.

The reasons for these declines are multifaceted and likely include intensified competition in the luxury market, evolving consumer spending patterns (perhaps a shift towards experiences over material goods), geopolitical instability affecting certain key regions, and potential supply chain disruptions.

Impact of Economic Headwinds

The disappointing Kering Q1 results cannot be viewed in isolation from the broader macroeconomic landscape. Several significant economic headwinds have impacted consumer spending and luxury purchases globally, directly influencing Kering's financial performance.

-

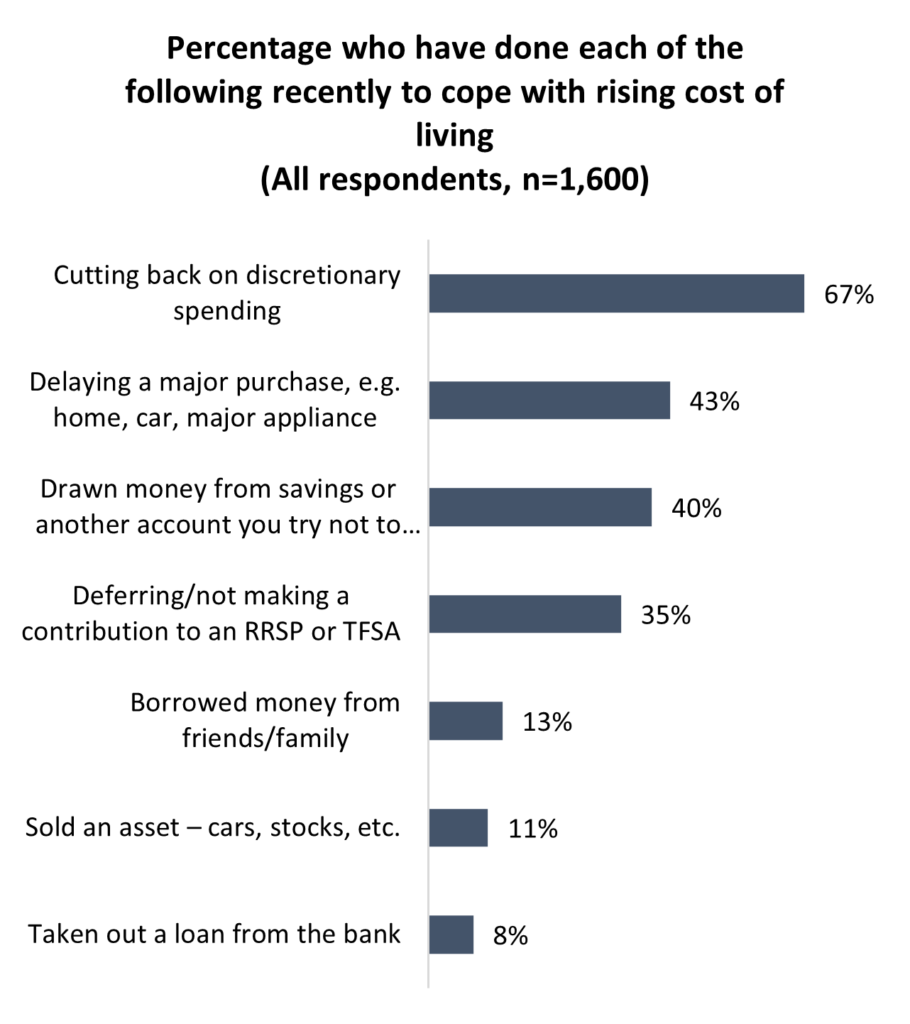

Inflation: Persistent inflation has eroded purchasing power, making luxury goods—which are typically discretionary purchases—less accessible for many consumers. The impact of rising prices on consumer confidence has likely played a role in the slowdown of sales.

-

Rising Interest Rates: Higher interest rates increase the cost of borrowing, impacting consumer spending and potentially reducing the willingness to make large luxury purchases.

-

Geopolitical Instability: Geopolitical uncertainty, including the ongoing war in Ukraine and other global conflicts, creates economic instability that affects consumer confidence and can significantly impact sales in specific regions.

These factors combined created a perfect storm, dampening demand for Kering's luxury products and consequently affecting Kering's Q1 results, contributing to the negative market reaction and the share price drop.

Management Response and Future Outlook

In response to the disappointing Q1 results, Kering's management [Insert details of Kering's response, e.g., announced cost-cutting measures, revised their outlook for the year, outlined new strategies to boost sales]. Specific details about these strategies are crucial for understanding the company's plan to navigate these challenges. [Insert quotes from Kering's management, if available, to provide further insight into their plans and outlook]. The success of these initiatives will be a key factor in determining whether Kering can recover its lost momentum and regain investor confidence. Changes in brand positioning or marketing strategies might also be discussed here.

Analyst Reactions and Market Predictions

The release of Kering's Q1 results prompted a range of reactions from financial analysts. Many adjusted their price targets for Kering's stock downwards, reflecting the concerns raised by the disappointing performance. [Insert details about specific analyst reactions, including price target adjustments and stock rating changes from major investment banks]. The overall market sentiment towards Kering shifted from positive to cautious following the report, emphasizing the gravity of the situation.

Conclusion: Analyzing Kering's Q1 Results and Future Implications

Kering's Q1 results painted a concerning picture, revealing a significant decline in sales for key brands like Gucci and YSL, largely attributed to a combination of declining brand performance, intensified competition, and a challenging macroeconomic environment characterized by inflation, rising interest rates, and geopolitical instability. The subsequent 6% share price drop reflects the market's reaction to these disappointing results. The management's response and the effectiveness of their strategies will be critical in determining Kering's future trajectory. This situation highlights the vulnerability of even the most established luxury brands to changing economic conditions and competitive pressures. Keep an eye on future Kering financial reports for further updates on their recovery strategy and overall performance. Stay informed about Kering's upcoming quarterly results to gauge the impact of their implemented strategies.

Featured Posts

-

Prepustanie V Nemecku Ake Firmy Rusia Pracovne Miesta A Co To Znamena Pre Ekonomiku

May 24, 2025

Prepustanie V Nemecku Ake Firmy Rusia Pracovne Miesta A Co To Znamena Pre Ekonomiku

May 24, 2025 -

Ihanet Edildiginde Intikami Geciktirmeyen Burclar

May 24, 2025

Ihanet Edildiginde Intikami Geciktirmeyen Burclar

May 24, 2025 -

Millions Made From Executive Office365 Account Hacks Fbi Investigation

May 24, 2025

Millions Made From Executive Office365 Account Hacks Fbi Investigation

May 24, 2025 -

Znaete Li Vy Roli Olega Basilashvili Test Na Znanie Sovetskogo Kino

May 24, 2025

Znaete Li Vy Roli Olega Basilashvili Test Na Znanie Sovetskogo Kino

May 24, 2025 -

Glastonbury 2024 Unofficial Band Announcement Sparks Online Frenzy

May 24, 2025

Glastonbury 2024 Unofficial Band Announcement Sparks Online Frenzy

May 24, 2025

Latest Posts

-

Iste En Tasarruflu 3 Burc Ve Harcama Aliskanliklari

May 24, 2025

Iste En Tasarruflu 3 Burc Ve Harcama Aliskanliklari

May 24, 2025 -

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025 -

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025 -

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025 -

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025