Canadian Mortgage Trends: The Case Against 10-Year Terms

Table of Contents

Higher Initial Interest Rates and Potential for Rate Drops

The Cost of Long-Term Predictability

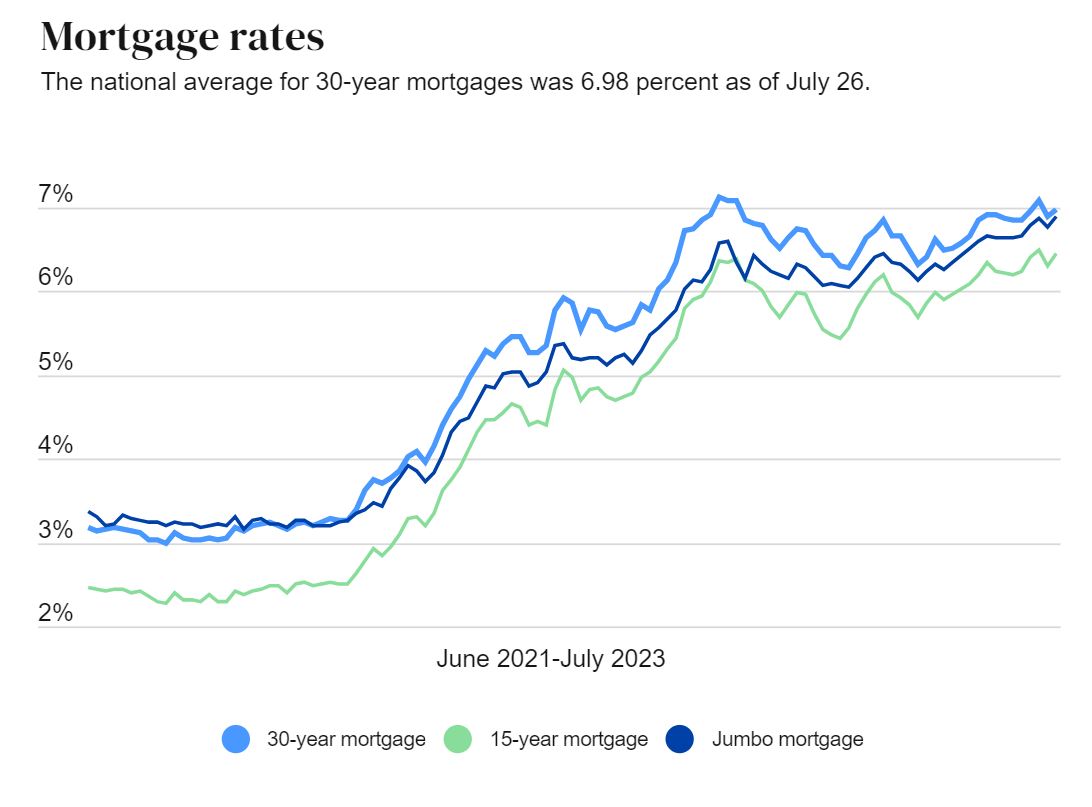

10-year mortgages often come with a higher initial interest rate compared to shorter-term options like 5-year or even 1-year mortgages. This higher rate is the price you pay for the perceived security of a fixed rate over a decade. Lenders build in a premium to account for the increased risk of lending money for such an extended period.

- Example: A 5-year fixed-rate mortgage might have an interest rate of 4.5%, while a comparable 10-year mortgage could be 5.5%. This seemingly small difference compounds significantly over the life of the loan, leading to a substantially higher total interest paid.

- Missed Opportunities: Interest rates are dynamic. If rates fall during your 10-year term, you're locked into a higher rate, missing out on potential savings through refinancing.

- Rate Lock-In Risk: The biggest risk is being locked into a higher rate for a prolonged period, especially if interest rates significantly decrease. This can leave you paying substantially more than necessary over the life of your mortgage.

Predicting Future Interest Rates – An Uncertain Game

Predicting interest rate trends over a 10-year period is virtually impossible. The Canadian economy is influenced by numerous factors, making long-term forecasts highly speculative.

- Influencing Factors: Economic growth, inflation, Bank of Canada policies, global events – these all impact interest rates. Accurately predicting their combined effect a decade out is unrealistic.

- Uncertainty and Commitment: Committing to a 10-year mortgage ties up your finances for a significant period, leaving you vulnerable to unexpected interest rate shifts.

- Alternative Strategies: Shorter-term mortgages, such as 5-year terms, or even rate-beating mortgages offer more flexibility to adapt to changing market conditions.

Penalty Costs for Breaking a 10-Year Mortgage

The High Cost of Flexibility

One of the most significant drawbacks of a 10-year mortgage is the substantial penalty for breaking the mortgage before its maturity date. These penalties can be extremely costly, eroding any potential savings from refinancing.

- Penalty Types: Penalties typically include an interest rate differential (the difference between your current rate and the prevailing rate) and a prepayment charge.

- Cost Examples: Breaking a 10-year mortgage several years early could result in penalties totaling tens of thousands of dollars.

- Financial Implications: Unexpected job loss, medical emergencies, or family changes might necessitate a move, forcing you to pay these steep penalties.

Life Changes and Mortgage Flexibility

Life is unpredictable. Circumstances change, and a 10-year mortgage offers little flexibility to adapt to these changes.

- Unforeseen Events: Job loss, unexpected medical expenses, family growth requiring a larger home, or a relocation for a better opportunity are all potential scenarios that could impact your ability to maintain a long-term mortgage.

- Personal Circumstances: It's crucial to consider your personal circumstances and risk tolerance before committing to a 10-year mortgage term. Flexibility is often worth the slightly higher initial interest rate on a shorter-term mortgage.

The Benefits of Shorter-Term Mortgages in the Current Canadian Mortgage Market

More Flexibility and Lower Initial Costs

Shorter-term mortgages, particularly 5-year terms, provide several advantages over 10-year options in the current Canadian mortgage market.

- Lower Initial Rates: Typically, shorter-term mortgages have lower initial interest rates.

- Refinancing Opportunities: They offer the flexibility to refinance at potentially lower rates when the term expires.

- Reduced Penalties: Penalties for breaking a shorter-term mortgage are generally lower than those for a 10-year mortgage.

Taking Advantage of Market Fluctuations

Regularly reassessing your mortgage strategy is crucial, especially in a dynamic market. Shorter-term mortgages enable you to do this effectively.

- Rate Drop Potential: If interest rates fall, you can refinance at a lower rate, saving money over the remaining mortgage term.

- Regular Mortgage Reviews: Regular reviews of your mortgage allow you to adjust your payments, explore different options, and ensure your mortgage aligns with your financial goals and circumstances.

Conclusion

While a 10-year mortgage in Canada offers the illusion of stability, current Canadian mortgage trends highlight significant drawbacks, including higher initial rates, hefty penalties for early breakage, and the risk of missing out on lower rates in the future. Shorter-term mortgages offer more flexibility and potentially better long-term value. Therefore, carefully consider all factors before committing to a 10-year term and explore the options available in the Canadian mortgage market to find the best solution for your individual financial circumstances. Are you ready to explore more flexible Canadian mortgage options? Contact a mortgage broker today to discuss alternatives to a 10-year mortgage.

Featured Posts

-

Lady Gaga To Converse Unpacking Social Medias Recession Indicators

May 06, 2025

Lady Gaga To Converse Unpacking Social Medias Recession Indicators

May 06, 2025 -

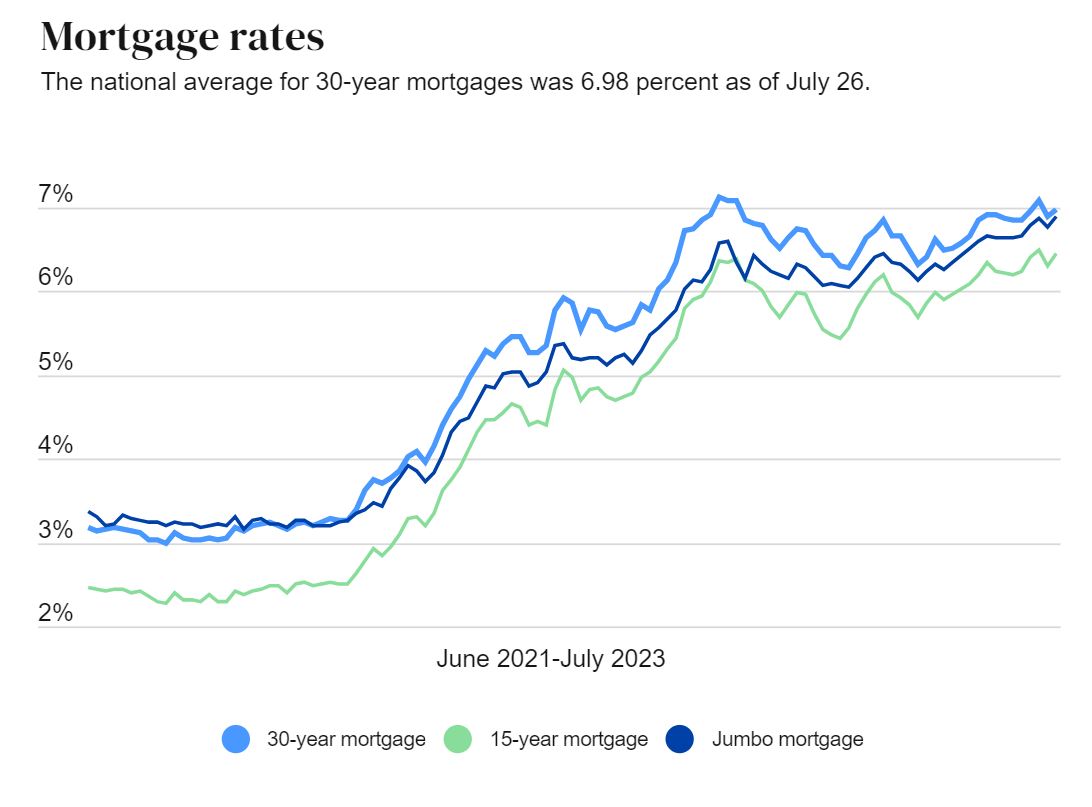

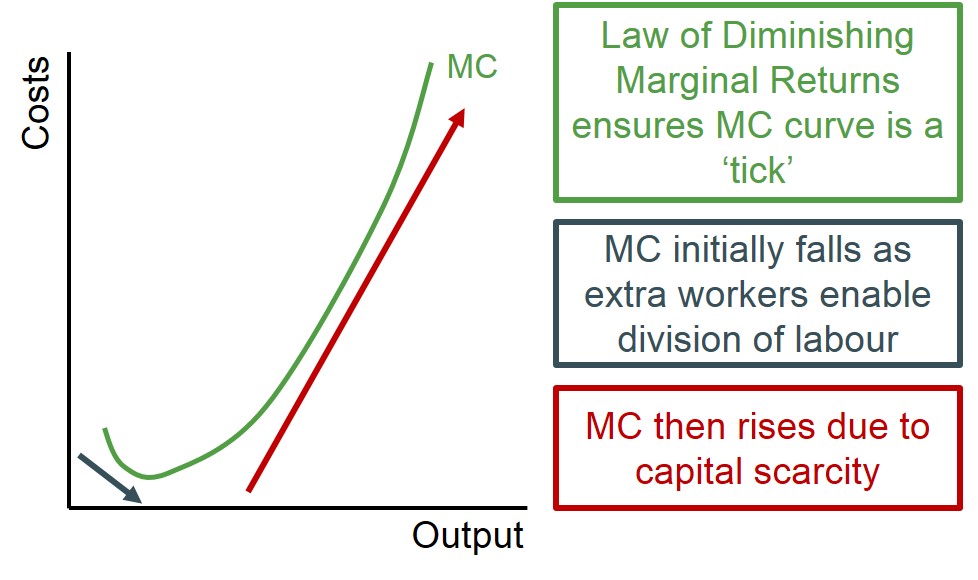

Diminishing Returns For Westpac Wbc The Impact Of Shrinking Margins

May 06, 2025

Diminishing Returns For Westpac Wbc The Impact Of Shrinking Margins

May 06, 2025 -

Cord Cutters Guide Watching March Madness Online

May 06, 2025

Cord Cutters Guide Watching March Madness Online

May 06, 2025 -

Dont Take My Son Ddgs New Diss Track Against Halle Bailey Explained

May 06, 2025

Dont Take My Son Ddgs New Diss Track Against Halle Bailey Explained

May 06, 2025 -

New Ddg Song Dont Take My Son Ignites Controversy Is Halle Bailey The Target

May 06, 2025

New Ddg Song Dont Take My Son Ignites Controversy Is Halle Bailey The Target

May 06, 2025

Latest Posts

-

Dont Take My Son Ddgs New Diss Track Against Halle Bailey Explained

May 06, 2025

Dont Take My Son Ddgs New Diss Track Against Halle Bailey Explained

May 06, 2025 -

Jeff Goldblum And The Fly A Masterclass In Acting Underrated And Unrecognized

May 06, 2025

Jeff Goldblum And The Fly A Masterclass In Acting Underrated And Unrecognized

May 06, 2025 -

Ddgs New Song Takes Aim At Halle Bailey The Dont Take My Son Controversy

May 06, 2025

Ddgs New Song Takes Aim At Halle Bailey The Dont Take My Son Controversy

May 06, 2025 -

Halle Bailey Targeted In Ddgs Dont Take My Son

May 06, 2025

Halle Bailey Targeted In Ddgs Dont Take My Son

May 06, 2025 -

Ddg Diss Track Targets Halle Bailey Dont Take My Son

May 06, 2025

Ddg Diss Track Targets Halle Bailey Dont Take My Son

May 06, 2025