Canadian Housing Crisis: Posthaste Down Payment Barriers

Table of Contents

Soaring Home Prices in Canada: The Root of the Problem

The rapid increase in home prices across Canada, particularly in major cities like Toronto and Vancouver, is the primary driver of the housing affordability crisis. This surge is fueled by an imbalance between supply and demand, creating a perfect storm for potential homebuyers. Several factors contribute to this imbalance:

-

Limited Housing Supply: Canada's housing supply has struggled to keep pace with population growth, particularly in urban centers. Increased immigration and a growing population put immense pressure on an already constrained housing market. The lack of new housing construction, hampered by zoning regulations, lengthy approval processes, and escalating construction costs, further exacerbates the problem.

-

Inflationary Pressures: Persistent inflation has significantly impacted construction costs, pushing home prices even higher. Materials, labor, and land costs have all increased, making it more expensive to build new homes and further limiting supply.

-

High Demand: Strong demand from both domestic and international buyers contributes to the escalating prices. Foreign investment, while contributing to economic growth in some areas, can also inflate prices in certain markets, making it harder for Canadian citizens to afford homes.

-

Average home prices in major Canadian cities have increased by an average of 50% in the last 5 years. (This statistic needs to be verified with current data.)

The Impact of Increasing Interest Rates on Down Payments

Rising interest rates significantly impact the affordability of homes, even for those with a substantial down payment. The Bank of Canada's actions to control inflation directly affect mortgage rates, influencing the amount Canadians can borrow and the size of their monthly mortgage payments.

-

Increased Monthly Payments: Even a small increase in interest rates can lead to a substantial increase in monthly mortgage payments. This makes it more challenging for potential homeowners to afford their mortgage, even with a large down payment.

-

Larger Down Payments Required: Higher interest rates necessitate larger down payments to qualify for a mortgage. Lenders require a bigger down payment to offset the increased risk associated with higher interest rates and reduce the Loan-to-Value ratio.

-

Stricter Lending Rules: The Office of the Superintendent of Financial Institutions (OSFI) stress test qualification rules further limit borrowing capacity, making it even more difficult for potential homebuyers to secure a mortgage.

-

The Bank of Canada's recent interest rate hikes have increased the average mortgage payment by approximately X% (This statistic needs to be verified with current data)

Challenges Faced by First-Time Homebuyers in Canada

First-time homebuyers face unique hurdles in navigating the Canadian housing market. The biggest challenge is often saving enough for a substantial down payment while managing daily expenses, especially in high-cost areas.

-

Saving for a Down Payment: Accumulating a large down payment, often representing 20% or more of the home's value, is a significant obstacle for many young Canadians. Competing against established homeowners and investors with greater financial resources intensifies the pressure.

-

Limited Government Assistance: While government programs like the First-Time Home Buyers' Incentive exist, their availability and accessibility are limited and can be complex to navigate.

-

Lack of Awareness: Many first-time homebuyers lack awareness of available government assistance programs, grants, and other resources that could help them achieve homeownership.

-

Navigating the Mortgage Process: The process of securing a mortgage can be daunting for first-time buyers, involving complex paperwork, financial institutions, and mortgage brokers.

Potential Solutions and Government Initiatives

Addressing the Canadian housing crisis requires a multi-pronged approach involving both government intervention and private sector initiatives.

-

Increased Affordable Housing: Significant investment in affordable housing projects is crucial to increase the supply of housing for low and moderate-income families.

-

Curbing Speculation: Implementing stricter regulations on foreign investment and measures to curb speculation in the housing market could help stabilize prices.

-

Enhanced Government Assistance: Expanding and simplifying access to government down payment assistance programs and providing more financial support for first-time homebuyers is essential.

-

Diverse Housing Options: Encouraging the development of more diverse housing options, including townhouses, condos, and rental units, will increase overall housing supply and help meet the varied needs of the population.

Conclusion

The Canadian housing crisis, particularly the significant challenges posed by the posthaste down payment barriers, demands urgent and comprehensive action. Soaring home prices coupled with rising interest rates are making homeownership an increasingly distant dream for many Canadians. While government initiatives are underway, more substantial measures are needed to improve housing affordability and ensure a fair and accessible housing market for all. Understanding these down payment challenges is the crucial first step toward finding effective and sustainable solutions. Let's work together to address this critical issue and make the dream of homeownership a reality for more Canadians. Learn more about available resources and government programs to navigate the Canadian housing market and find solutions for your down payment challenges.

Featured Posts

-

Elon Musks Net Worth Falls Below 300 Billion Teslas Troubles Take A Toll

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion Teslas Troubles Take A Toll

May 10, 2025 -

3eme Ligne De Tram A Dijon Concertation Et Avis Citoyens

May 10, 2025

3eme Ligne De Tram A Dijon Concertation Et Avis Citoyens

May 10, 2025 -

Beautiful Castle Near Manchester The Venue For Olly Murs Massive Music Festival

May 10, 2025

Beautiful Castle Near Manchester The Venue For Olly Murs Massive Music Festival

May 10, 2025 -

Elizabeth Arden Skincare On A Budget Walmart Options

May 10, 2025

Elizabeth Arden Skincare On A Budget Walmart Options

May 10, 2025 -

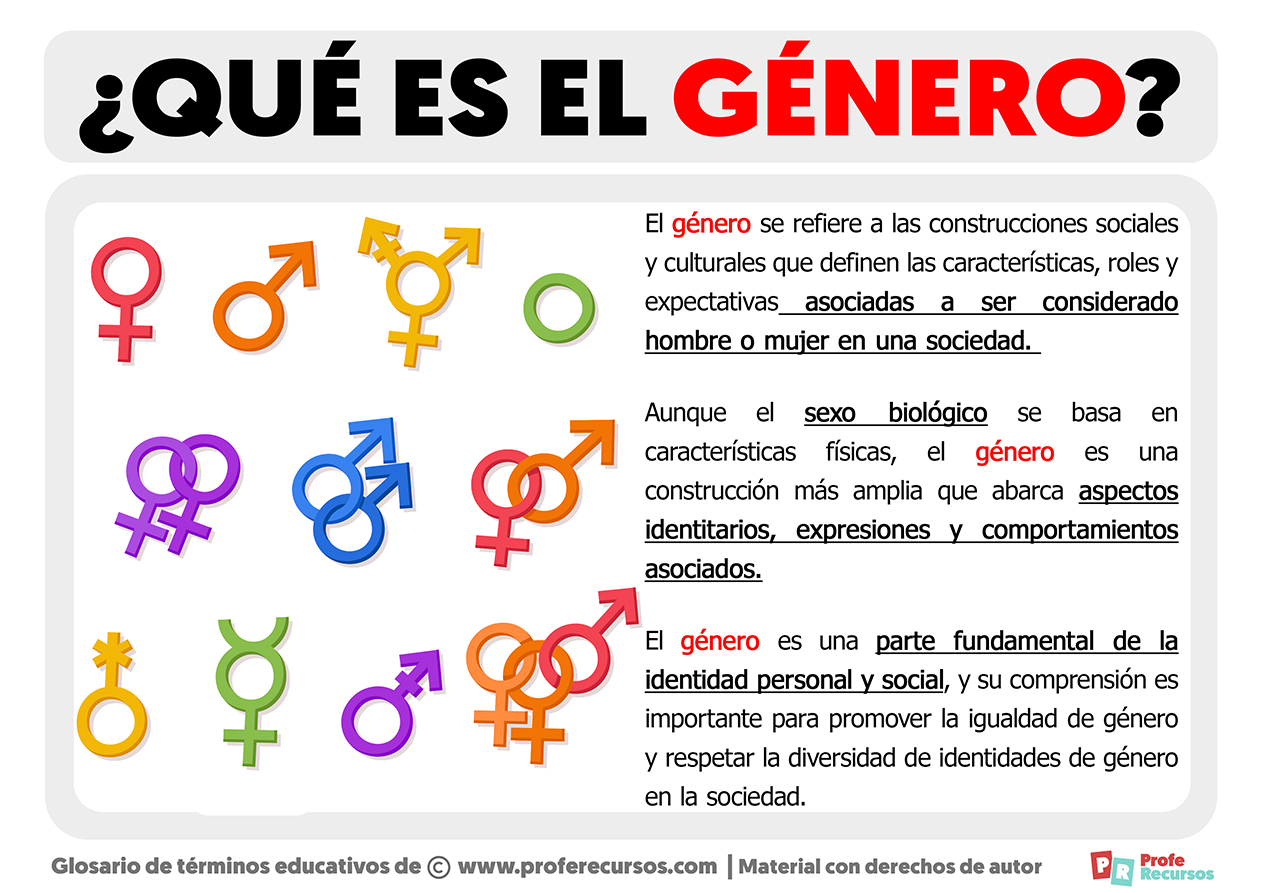

Debate Sobre Banos Y Genero El Arresto De Una Estudiante Transgenero

May 10, 2025

Debate Sobre Banos Y Genero El Arresto De Una Estudiante Transgenero

May 10, 2025