Canadian Dollar's Mixed Performance: Up Against USD, Down Elsewhere

Table of Contents

Strengthening Against the US Dollar

Reasons for CAD's Appreciation Against USD

The Canadian dollar's recent appreciation against the US dollar is attributable to several key factors. Increased demand for Canadian exports, particularly in the energy and resource sectors, has played a significant role. Canada's robust energy sector, with its significant oil and gas production, benefits when global demand is high, boosting the value of the Canadian dollar. Furthermore, Canada's relatively higher interest rates compared to the US have attracted foreign investment, increasing demand for the CAD. This interest rate differential makes Canadian assets more attractive to international investors seeking higher returns.

- Specific Export Data: Recent data shows a surge in Canadian oil exports to the US, directly impacting the CAD/USD exchange rate. This increased demand reflects growing global energy needs and strengthens the Canadian dollar.

- Interest Rate Differential: The Bank of Canada's interest rate decisions have played a crucial role. Higher interest rates compared to the US Federal Reserve's rates make the CAD more attractive to investors seeking higher yields.

- Economic Stability: Canada's comparatively stable economy, compared to some other global economies, adds to its appeal for investors seeking safe haven assets.

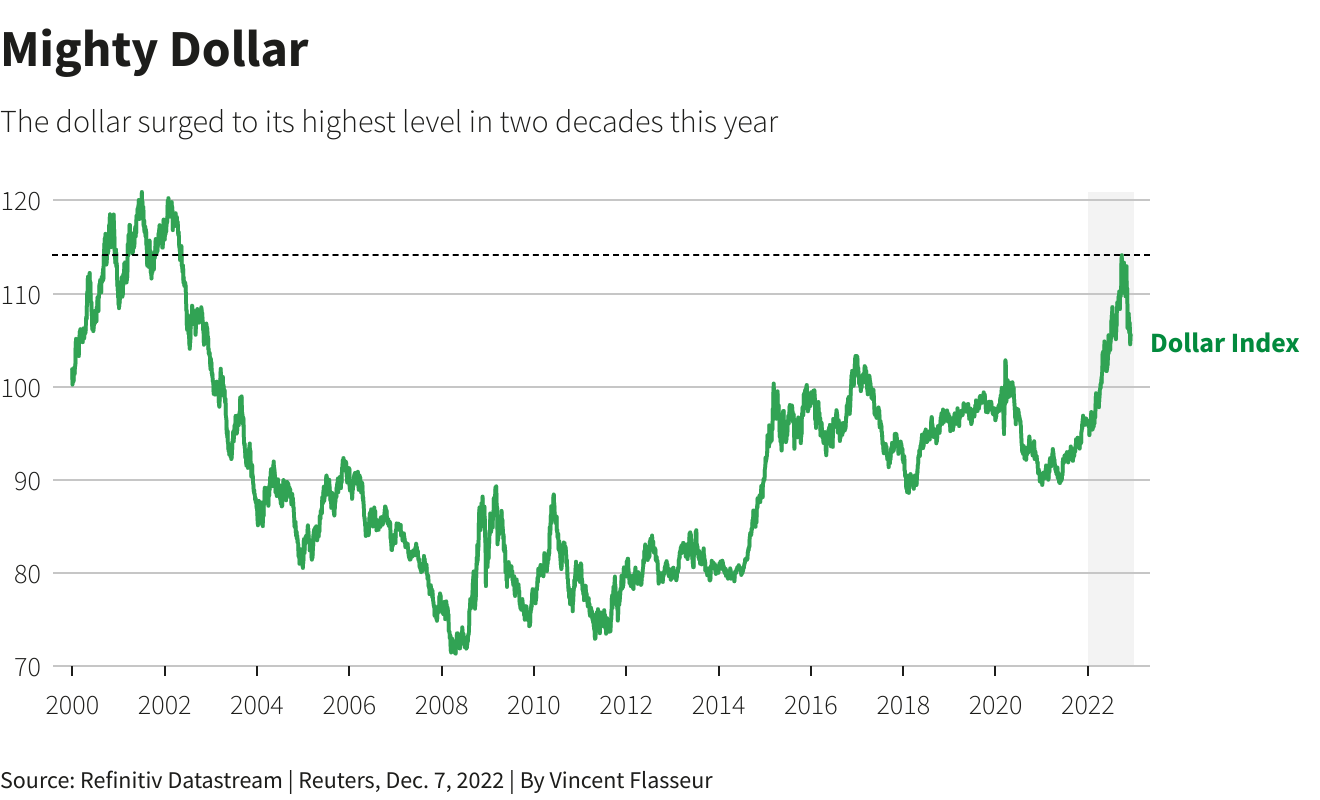

- US Dollar Weakness: Global economic uncertainty and concerns surrounding the US debt ceiling have contributed to a weaker US dollar, indirectly boosting the Canadian dollar.

Weakening Against Other Major Currencies

Factors Contributing to CAD's Depreciation Against Other Currencies

While the Canadian dollar has strengthened against the US dollar, it has weakened against other major currencies like the Euro and the British Pound. Several factors contribute to this depreciation. The global economic slowdown has dampened demand for Canadian goods and commodities, putting downward pressure on the Loonie. The strength of the Euro and the Pound, driven by regional economic factors, has also contributed to the CAD's relative weakness.

- Global Economic Slowdown: Reduced global demand, particularly from the European Union and the United Kingdom, impacts the demand for Canadian exports, leading to a weaker CAD. Data on Canadian export volumes to these regions reflects this trend.

- Commodity Price Fluctuations: Fluctuations in commodity prices, particularly oil and natural gas, significantly influence the Canadian economy and its currency. Decreases in these prices weaken the CAD.

- Geopolitical Instability: Geopolitical events, such as the ongoing war in Ukraine, contribute to uncertainty in global markets and reduce investor confidence, impacting the Canadian dollar.

- Investor Sentiment: Speculation and shifts in investor sentiment play a crucial role in currency markets. Negative sentiment towards the Canadian economy can drive down the value of the CAD.

Outlook for the Canadian Dollar

Predicting Future Trends for the Canadian Dollar

Predicting the future trajectory of the Canadian dollar is inherently challenging, due to the numerous interacting economic and geopolitical factors at play. However, by analyzing current economic forecasts and considering potential policy changes, we can offer some potential scenarios.

- Economic Forecasts: Reputable financial institutions' forecasts for Canadian economic growth and inflation will play a crucial role in determining future CAD performance. These forecasts often consider factors such as interest rate projections and global economic growth.

- Policy Changes: Upcoming policy decisions by the Bank of Canada and the Canadian government will undoubtedly influence the value of the Canadian dollar.

- Global Uncertainty: Geopolitical risks and unexpected global events could introduce considerable volatility into the CAD's exchange rate.

- Potential Scenarios: The CAD could experience further appreciation against the USD if Canadian interest rates remain higher and commodity prices rise. Conversely, a global recession or a significant drop in commodity prices could lead to a depreciation.

Conclusion:

The Canadian dollar's recent performance reflects a complex interplay of global and domestic economic forces. While it has strengthened against the US dollar, it has weakened against other major currencies. This mixed performance underscores the need for careful monitoring of economic indicators and geopolitical events. Understanding these factors is key to navigating the complexities of currency exchange and making informed decisions regarding your investments and business strategies related to the Canadian Dollar. Continuously monitor the fluctuations of the Canadian dollar to optimize your financial strategies. Stay informed on the latest developments affecting the Canadian dollar and its value in relation to other major currencies.

Featured Posts

-

The Bold And The Beautiful Recap April 3 Liam Collapses Following Major Fight With Bill

Apr 24, 2025

The Bold And The Beautiful Recap April 3 Liam Collapses Following Major Fight With Bill

Apr 24, 2025 -

Pope Francis Legacy A More Global Yet Divided Church

Apr 24, 2025

Pope Francis Legacy A More Global Yet Divided Church

Apr 24, 2025 -

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025 -

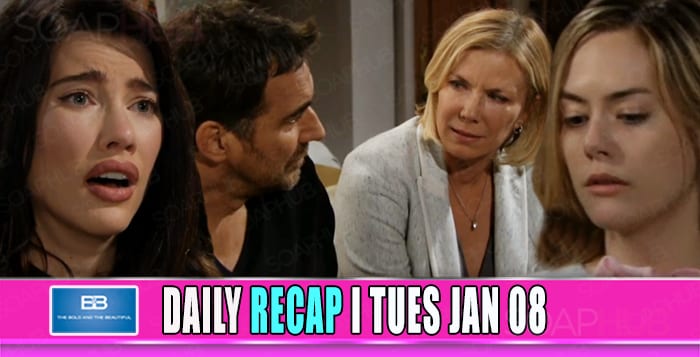

Stock Market Data Dow S And P 500 And Nasdaq April 23rd 2024

Apr 24, 2025

Stock Market Data Dow S And P 500 And Nasdaq April 23rd 2024

Apr 24, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

Apr 24, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

Apr 24, 2025