Analyzing Proxy Statements (Form DEF 14A): Tips And Strategies

Table of Contents

A proxy statement, also known as a Form DEF 14A, is a document that a publicly traded company sends to its shareholders before a shareholder meeting. It provides information about matters to be voted on, such as the election of directors, executive compensation, and shareholder proposals. Analyzing these statements is vital for investors seeking to understand a company's governance, financial health, and future prospects. The benefits of thoroughly analyzing proxy statements include making informed investment decisions, identifying potential risks and opportunities, and gaining a deeper understanding of a company's corporate governance practices.

Understanding the Structure and Key Sections of a Proxy Statement (DEF 14A)

A proxy statement is more than just a list of voting items; it’s a comprehensive snapshot of a company's operations and governance. Understanding its structure is key to effective analysis.

Identifying the Company's Background and Business Overview

This section provides a crucial foundation for your analysis. Pay close attention to:

- Company Description: Review the company's description, its products/services, and its market position. This sets the stage for understanding its business model and competitive landscape.

- Financial Highlights and KPIs: Analyze key performance indicators (KPIs) such as revenue, earnings per share (EPS), and debt-to-equity ratio. These figures offer insights into the company's financial health.

- Significant Risks and Uncertainties: Identify any significant risks or uncertainties facing the company, such as competition, regulatory changes, or economic downturns. These can significantly impact future performance.

Deciphering the Executive Compensation Section

Executive compensation is a crucial aspect of corporate governance and often a point of contention for shareholders. Analyze:

- Compensation Elements: Examine executive salaries, bonuses, stock options, and other compensation elements. Look for excessive or unjustified payouts.

- Performance Correlation: Compare executive pay to company performance and industry benchmarks. Does compensation align with company success?

- Potential Conflicts of Interest: Identify any potential conflicts of interest, such as related-party transactions or excessive stock option grants.

Analyzing Shareholder Proposals and Director Elections

This section offers insights into shareholder activism and the composition of the board of directors.

- Shareholder Proposals: Understand the shareholder proposals and their implications. Do they address important corporate governance issues or represent fringe viewpoints?

- Director Qualifications: Assess the qualifications and backgrounds of the proposed board of directors. Are they independent and experienced?

- Board Conflicts of Interest: Identify any potential conflicts of interest among board members. Look for interlocks between boards of different companies.

Scrutinizing Corporate Governance Practices

Strong corporate governance is essential for long-term value creation. Scrutinize:

- Committee Structures: Review the company's audit committee, compensation committee, and nominating committee structures. Are these committees adequately independent?

- Board Independence: Assess the independence of board members. A high percentage of independent directors is generally considered a positive sign.

- ESG (Environmental, Social, and Governance) Issues: Analyze the company's approach to environmental, social, and governance issues. Growing investor interest necessitates a careful review of these factors.

Utilizing Effective Analysis Techniques for Proxy Statements (DEF 14A)

Effective analysis goes beyond simply reading the document; it involves employing various techniques to extract meaningful insights.

Comparative Analysis: Benchmarking against Competitors and Industry Standards

- Industry Comparisons: Compare executive compensation and corporate governance practices to industry peers. This provides context and helps identify best practices.

- Identifying Areas for Improvement: Look for areas where the company lags behind its competitors in terms of governance or compensation practices.

Financial Statement Analysis in Conjunction with Proxy Statements

- Correlation of Data: Correlate information from the proxy statement with the company's financial statements (10-K, 10-Q). This helps identify potential inconsistencies or discrepancies.

- Understanding Financial Implications: Analyze how executive compensation and other corporate decisions impact the company's financial performance.

Utilizing Online Resources and Databases for Enhanced Analysis

- SEC EDGAR Database: Leverage the SEC EDGAR database for easy access to proxy statements and other company filings.

- Specialized Databases: Use specialized financial databases (e.g., Bloomberg Terminal, FactSet) for comprehensive company data and analysis tools.

- Proxy Statement Analysis Software: Access proxy statement analysis tools and software that can streamline the review process and provide insights.

Identifying Red Flags and Potential Risks in Proxy Statements (DEF 14A)

Certain indicators in a proxy statement can signal potential problems and risks.

Signs of Poor Corporate Governance

- High Executive Turnover: Frequent changes in senior management can indicate internal problems.

- Lack of Independent Directors: A board dominated by insiders raises concerns about independence and oversight.

- Related-Party Transactions: Transactions with related parties can indicate potential conflicts of interest.

- Weak Internal Controls: Inadequate internal controls can lead to financial irregularities and fraud.

Excessive Executive Compensation

- Industry Outliers: Compensation significantly exceeding industry benchmarks warrants scrutiny.

- Lack of Performance-Based Incentives: Compensation not tied to company performance suggests a lack of accountability.

- Golden Parachutes: Excessive severance packages for executives can be a red flag.

Controversial Shareholder Proposals

- ESG Concerns: Proposals related to environmental concerns, social responsibility, and executive compensation often reflect shareholder dissatisfaction.

Conclusion: Mastering the Art of Analyzing Proxy Statements (DEF 14A)

Efficiently analyzing proxy statements (DEF 14A) requires a systematic approach encompassing understanding the document's structure, employing effective analysis techniques, and identifying potential red flags. Proficient analysis leads to informed investment decisions, effective risk mitigation, and a deeper understanding of corporate governance. Master the art of analyzing proxy statements (DEF 14A) to make more informed investment choices. Start analyzing today! Improve your investment strategy by regularly reviewing proxy statements (Form DEF 14A).

Featured Posts

-

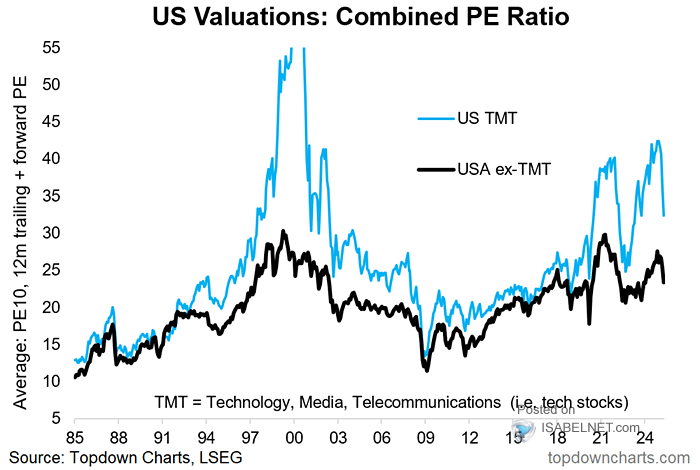

Why Current Stock Market Valuations Shouldnt Deter Investors Insights From Bof A

May 17, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors Insights From Bof A

May 17, 2025 -

Mlb Game Day Tigers Vs Mariners Prediction And Best Odds

May 17, 2025

Mlb Game Day Tigers Vs Mariners Prediction And Best Odds

May 17, 2025 -

Nba Prediction Celtics Vs Pistons Who Will Win

May 17, 2025

Nba Prediction Celtics Vs Pistons Who Will Win

May 17, 2025 -

Trumps Public Humiliation A Lawrence O Donnell Show Moment

May 17, 2025

Trumps Public Humiliation A Lawrence O Donnell Show Moment

May 17, 2025 -

Eid Al Fitr 2025 Dubais Dxb Airport Braces For Increased Passenger Traffic

May 17, 2025

Eid Al Fitr 2025 Dubais Dxb Airport Braces For Increased Passenger Traffic

May 17, 2025

Latest Posts

-

6 1 Billion Celtics Sale Impact On The Team And Its Future

May 17, 2025

6 1 Billion Celtics Sale Impact On The Team And Its Future

May 17, 2025 -

Boston Celtics Future Uncertain After 6 1 Billion Sale To Private Equity Firm

May 17, 2025

Boston Celtics Future Uncertain After 6 1 Billion Sale To Private Equity Firm

May 17, 2025 -

Boston Celtics Sold For 6 1 Billion Fans React To Private Equity Buyout

May 17, 2025

Boston Celtics Sold For 6 1 Billion Fans React To Private Equity Buyout

May 17, 2025 -

Celtics Vs Pistons A Detailed Game Preview And Prediction

May 17, 2025

Celtics Vs Pistons A Detailed Game Preview And Prediction

May 17, 2025 -

The Trump Family A Generational Overview And Family Dynamics

May 17, 2025

The Trump Family A Generational Overview And Family Dynamics

May 17, 2025