Can Tax Credits Revitalize Minnesota's Film And Television Industry?

Table of Contents

The Current State of Minnesota's Film Industry

Minnesota's film production industry, while showing signs of life, faces significant hurdles. While productions like the Coen brothers' films and episodes of "Fargo" have showcased the state's capabilities, the industry's overall size remains relatively small compared to other states. The number of Minnesota film jobs fluctuates, often dependent on larger productions choosing the state. The economic impact, while positive, is limited by the current level of activity. Key challenges include:

- Limited Production Volume: The number of productions filming in Minnesota remains considerably lower than in states with more robust incentive programs.

- Minnesota Film Production Employment: While skilled professionals exist, a lack of consistent work leads to out-migration of talent.

Competition from Neighboring States

States like Illinois, Iowa, Wisconsin, and even further afield such as Georgia and New Mexico offer significantly more lucrative film tax credits. This "film tax credits comparison" reveals a stark disparity: Minnesota's incentives often pale in comparison, making it a less attractive location for large-scale productions. These states actively court productions with generous packages, directly impacting Minnesota's ability to compete for "attract film productions Minnesota" projects.

Infrastructure Deficiencies

Minnesota lacks the extensive studio space, soundstages, and readily available equipment found in other major film hubs. This “Minnesota film studios” deficiency hinders productions requiring significant infrastructure. A shortage of specialized equipment and crew often necessitates bringing resources from elsewhere, increasing production costs and reducing the economic benefits for Minnesota. Finding readily available “film production equipment Minnesota” can also prove problematic for smaller productions.

The Role of Film Tax Credits in Economic Development

Film tax credits are financial incentives offered by governments to attract film and television productions. They work by reducing a production company’s tax liability, effectively lowering the cost of filming in a specific location. The intended effect is multifaceted:

- Boosting Job Creation: A "Minnesota film industry jobs" increase occurs across various roles, from actors and directors to crew members, caterers, and transportation services.

- Generating Revenue: Increased production spending translates into revenue for local businesses – hotels, restaurants, rental companies, and more. This contributes to overall economic growth and “economic impact of film production” in the state.

- Infrastructure Investment: The influx of productions can spur investment in much-needed studio space, equipment rental facilities, and other infrastructure improvements, ultimately benefiting future projects. The "Minnesota film tax credit program" should explicitly incentivize such improvements.

Job Creation and Economic Impact

The ripple effect of film productions is substantial. A single major production can create hundreds, if not thousands, of "Minnesota film industry jobs." This extends beyond the core production team to include hospitality, transportation, and numerous ancillary services. The "economic impact of film production" includes direct spending by the production, as well as indirect spending within the local economy.

Attracting Major Productions

Competitive "film tax credits comparison" data shows that states with generous incentive programs successfully "attract film productions Minnesota" competitors away. By offering compelling incentives, Minnesota can attract large-scale productions, bringing substantial investment and international exposure to the state. This translates into more jobs, increased tourism, and a broader recognition of Minnesota as a leading film destination.

Analyzing Minnesota's Existing Film Tax Credit Program

Minnesota currently has a film tax credit program, but its effectiveness is debatable. The "Minnesota film tax credit application" process and eligibility criteria need careful scrutiny. The program's limitations hinder its ability to compete with more generous offers from other states.

Strengths and Weaknesses of the Current Program

While the current "Minnesota film incentive program" has successfully attracted some productions, its overall effectiveness is limited. Its strengths might include a relatively straightforward application process. However, weaknesses stem from a relatively low credit percentage, restrictive eligibility requirements, and limited funding. Analyzing the "Minnesota film tax credit effectiveness" requires a comprehensive review of its impact and cost-benefit analysis.

Potential Improvements and Recommendations

To enhance its competitiveness, the "Minnesota film tax credit program" requires significant improvements:

- Increase the Credit Percentage: A higher credit percentage would make Minnesota more attractive to larger productions.

- Broaden Eligibility Criteria: Expanding eligibility to include a wider range of productions could increase participation.

- Improve Program Administration: Streamlining the application process and providing clearer guidelines would improve efficiency. Investing in marketing the enhanced “enhance Minnesota film tax credits” will also be beneficial.

- Invest in Infrastructure: Direct investment in studio space and equipment would create a more attractive environment for productions. Investing in training programs to help develop a skilled "Minnesota film jobs" workforce will also assist.

Conclusion

Tax credits can be a powerful tool for revitalizing Minnesota's film and television industry. While the current "Minnesota film tax credit program" offers some benefits, increasing its competitiveness through strategic improvements is crucial. By making the program more attractive, Minnesota can "attract film productions Minnesota," fostering a sustainable and thriving industry, boosting local economies, and establishing Minnesota as a premier film destination. Consider expanding the tax credit program, investing in infrastructure, and actively marketing Minnesota's unique potential. By investing in a robust and competitive Minnesota film tax credit program, the state can unlock significant economic opportunities and establish itself as a major player in the North American film and television landscape.

Featured Posts

-

Akesos Disappointing Trial Results Lead To Significant Stock Decline

Apr 29, 2025

Akesos Disappointing Trial Results Lead To Significant Stock Decline

Apr 29, 2025 -

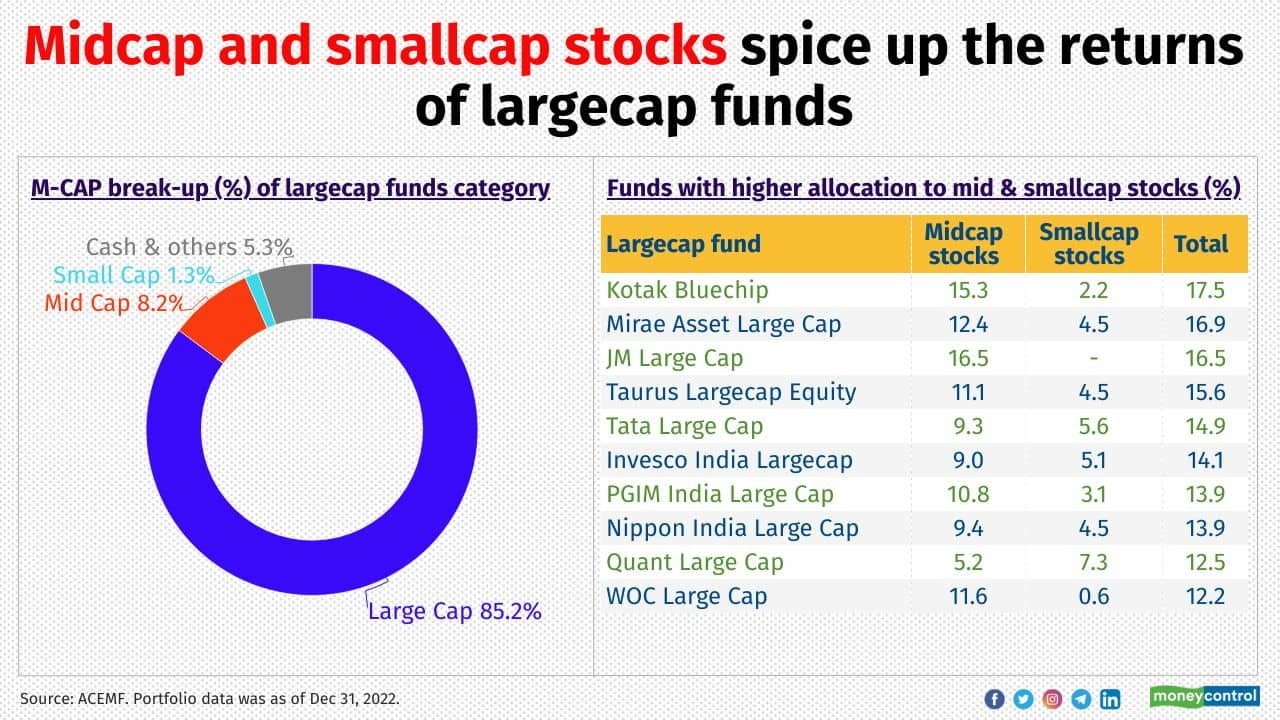

Reliance Earnings Surprise Boost For Indian Large Cap Stocks

Apr 29, 2025

Reliance Earnings Surprise Boost For Indian Large Cap Stocks

Apr 29, 2025 -

Ais Limited Thinking What The Latest Research Reveals

Apr 29, 2025

Ais Limited Thinking What The Latest Research Reveals

Apr 29, 2025 -

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025 -

North Korea Confirms Troop Deployment To Russia Ukraine War Escalation

Apr 29, 2025

North Korea Confirms Troop Deployment To Russia Ukraine War Escalation

Apr 29, 2025

Latest Posts

-

The Legacy Of Murder An Ohio Doctors Parole Hearing And A Sons Journey

Apr 29, 2025

The Legacy Of Murder An Ohio Doctors Parole Hearing And A Sons Journey

Apr 29, 2025 -

Sons Anguish Ohio Doctor Seeks Parole After 36 Years In Prison For Wifes Death

Apr 29, 2025

Sons Anguish Ohio Doctor Seeks Parole After 36 Years In Prison For Wifes Death

Apr 29, 2025 -

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder 36 Years Ago

Apr 29, 2025

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder 36 Years Ago

Apr 29, 2025 -

Ohio Doctors Parole Hearing Sons Struggle 36 Years After Wifes Murder

Apr 29, 2025

Ohio Doctors Parole Hearing Sons Struggle 36 Years After Wifes Murder

Apr 29, 2025 -

The Wrexham Story Ryan Reynolds And A Historic Promotion

Apr 29, 2025

The Wrexham Story Ryan Reynolds And A Historic Promotion

Apr 29, 2025