CAC 40 Weekly Performance: Mixed Signals Amidst Market Fluctuations (March 7, 2025)

Table of Contents

Overall CAC 40 Performance for the Week Ending March 7, 2025

The CAC 40 experienced a relatively flat week, closing with a marginal 0.2% decrease for the period ending March 7, 2025. This follows a more robust 1.5% increase the previous week and contrasts with the year-to-date performance, which shows a modest 3% growth. This week's muted performance reflects a broader trend of cautious optimism in the global stock market.

- Weekly Change: -0.2%

- Previous Week Change: +1.5%

- Year-to-Date Change: +3%

[Insert a chart or graph visually representing the weekly performance of the CAC 40, clearly showing the opening and closing values, as well as the daily fluctuations.]

Sector-Specific Performance within the CAC 40

The performance across various CAC 40 sectors was far from uniform, highlighting the complexities of the current market environment.

- Top Performers: The Energy sector saw a notable 1% increase, driven by rising oil prices and positive industry news. The luxury goods sector also performed well, boosted by strong consumer spending in key markets.

- Underperformers: The Technology sector lagged behind, experiencing a 0.8% decline, reflecting concerns about rising interest rates and slowing global tech growth. Financial services also underperformed, with a 0.5% decrease, impacted by regulatory uncertainty.

The divergence in sector performance underscores the importance of sector-specific analysis in understanding the broader CAC 40 index performance. This disparity reflects global events, including ongoing geopolitical tensions and shifting economic policies.

Key Factors Influencing CAC 40 Fluctuations

Several macroeconomic and microeconomic factors contributed to the CAC 40's fluctuating performance this week.

-

Macroeconomic Factors: Persistent inflationary pressures continue to weigh on investor sentiment. The recent announcement of a potential further interest rate hike by the European Central Bank added to market uncertainty. Geopolitical tensions remain a significant source of volatility.

-

Specific News and Events: Several key company earnings reports fell short of analyst expectations, leading to sell-offs in specific sectors. Regulatory changes impacting the financial services industry also contributed to the negative sentiment in that sector.

-

Global Market Trends: The overall cautious global market mood, fueled by concerns about inflation and potential economic slowdown, significantly influenced the CAC 40's performance.

Investor Sentiment and Trading Activity

Investor sentiment towards the CAC 40 remains mixed. While long-term investors seem relatively unfazed by the short-term fluctuations, a degree of uncertainty is evident. Trading volume remained relatively moderate, indicating a lack of significant panic selling or aggressive buying. However, increased volatility during mid-week suggests underlying anxieties within the market.

Conclusion: Interpreting the Mixed Signals of the CAC 40 Weekly Performance

The CAC 40's weekly performance for the week ending March 7, 2025, presents a picture of mixed signals. A marginal decline, coupled with divergent sector performances and fluctuating investor sentiment, highlights the complexities of the current market environment. Macroeconomic factors, specific company news, and broader global market trends all contributed to this volatility. While the short-term outlook remains uncertain, the long-term prospects for the CAC 40 depend on addressing ongoing inflationary concerns and navigating geopolitical risks effectively. To stay informed about the dynamic CAC 40 weekly performance and make informed investment decisions, regularly consult our website for updated analyses and consider subscribing to our newsletter for timely updates. Keep a close watch on the CAC 40 index and its constituent stocks to stay ahead in this fluctuating market.

Featured Posts

-

Evrovidenie Pobediteli Poslednikh 10 Let Chto Oni Delayut Seychas

May 25, 2025

Evrovidenie Pobediteli Poslednikh 10 Let Chto Oni Delayut Seychas

May 25, 2025 -

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 25, 2025

Bbc Radio 1s Big Weekend Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 25, 2025 -

Joy Crookes Carmen A Deep Dive Into The New Single

May 25, 2025

Joy Crookes Carmen A Deep Dive Into The New Single

May 25, 2025 -

Solve Nyt Connections Puzzle 646 March 18 2025 Hints And Answers

May 25, 2025

Solve Nyt Connections Puzzle 646 March 18 2025 Hints And Answers

May 25, 2025 -

Wildfires Push Global Forest Loss To Unprecedented Levels

May 25, 2025

Wildfires Push Global Forest Loss To Unprecedented Levels

May 25, 2025

Latest Posts

-

Thames Waters Executive Pay Was It Justified

May 25, 2025

Thames Waters Executive Pay Was It Justified

May 25, 2025 -

Addressing Environmental Concerns Rio Tintos Response To Pilbara Criticism

May 25, 2025

Addressing Environmental Concerns Rio Tintos Response To Pilbara Criticism

May 25, 2025 -

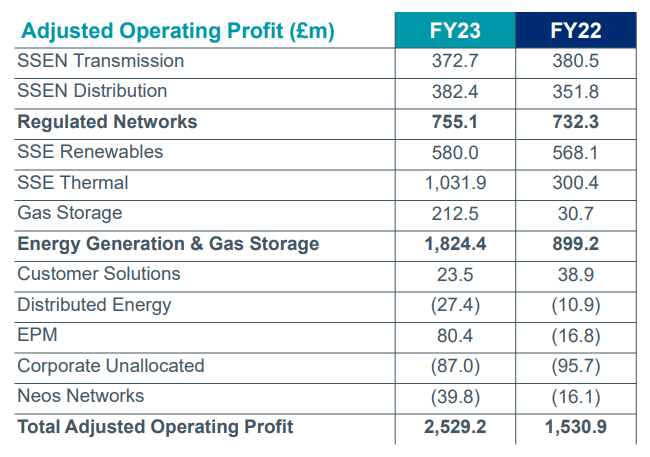

3 Billion Slash To Sse Spending Details Of The Revised Plan

May 25, 2025

3 Billion Slash To Sse Spending Details Of The Revised Plan

May 25, 2025 -

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025 -

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 25, 2025

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 25, 2025